12 Percent Gst Items List 48 rowsList of 12 GST rate items as per schedule II approved in the Goods

Goods and materialas with 12 Goods and Services Tax in India Central Government employees those who want to avail the LTC Special cash Package need to purchase the items which carry GST rate 12

12 Percent Gst Items List

12 Percent Gst Items List

https://i.ytimg.com/vi/7LlfYE45QmU/maxresdefault.jpg

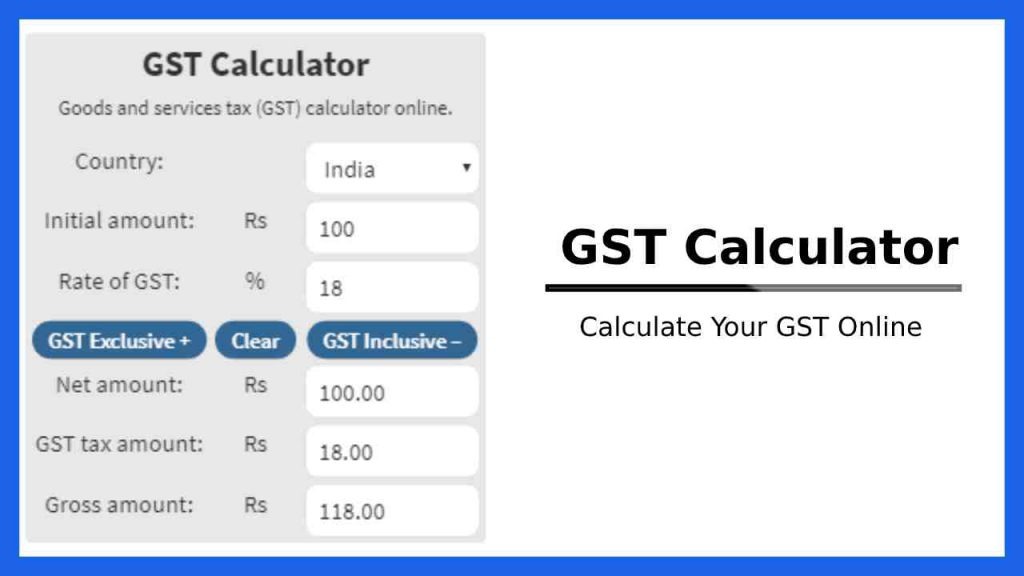

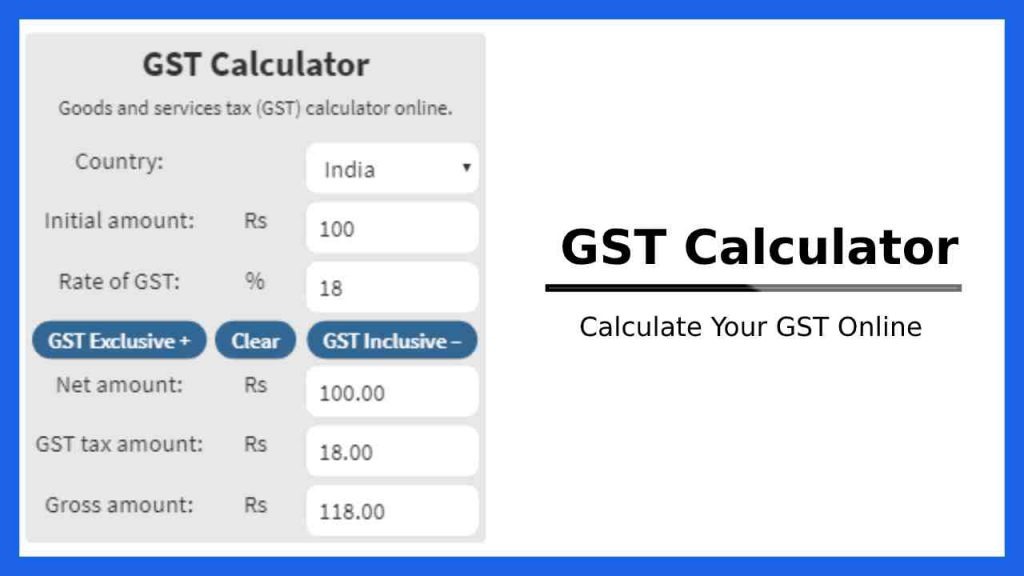

GST Calculate Online GST Calculate Online TamilGuru

https://www.tamilguru.in/wp-content/uploads/2022/07/GSTCalculator.jpg

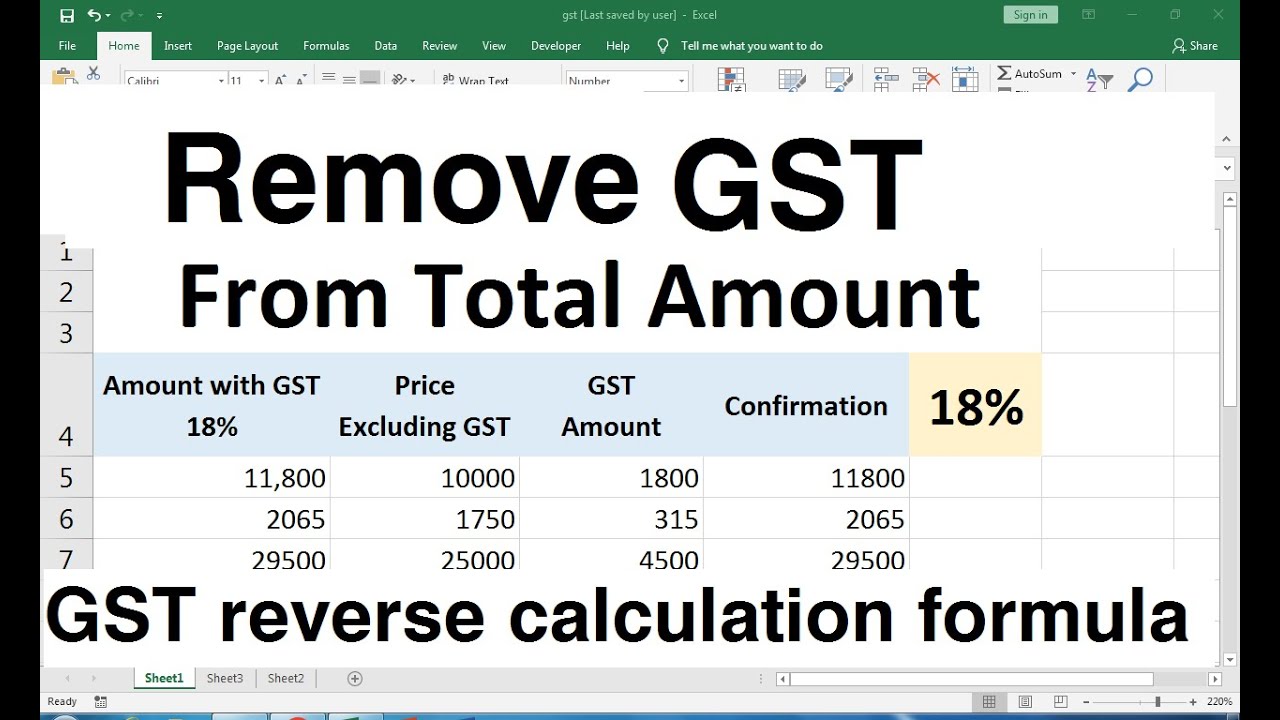

How To Calculate Gst Amount From Total Amount In Excel YouTube

https://i.ytimg.com/vi/ptTea5xLrXY/maxresdefault.jpg

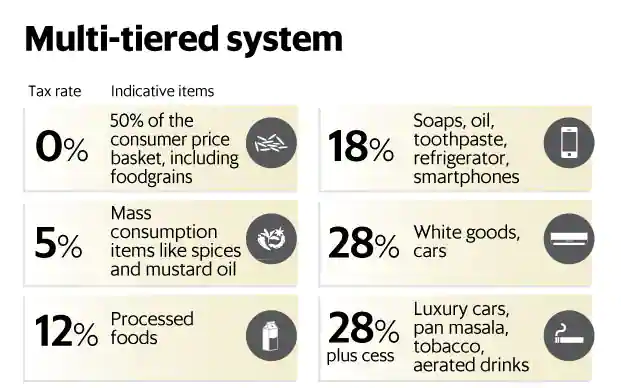

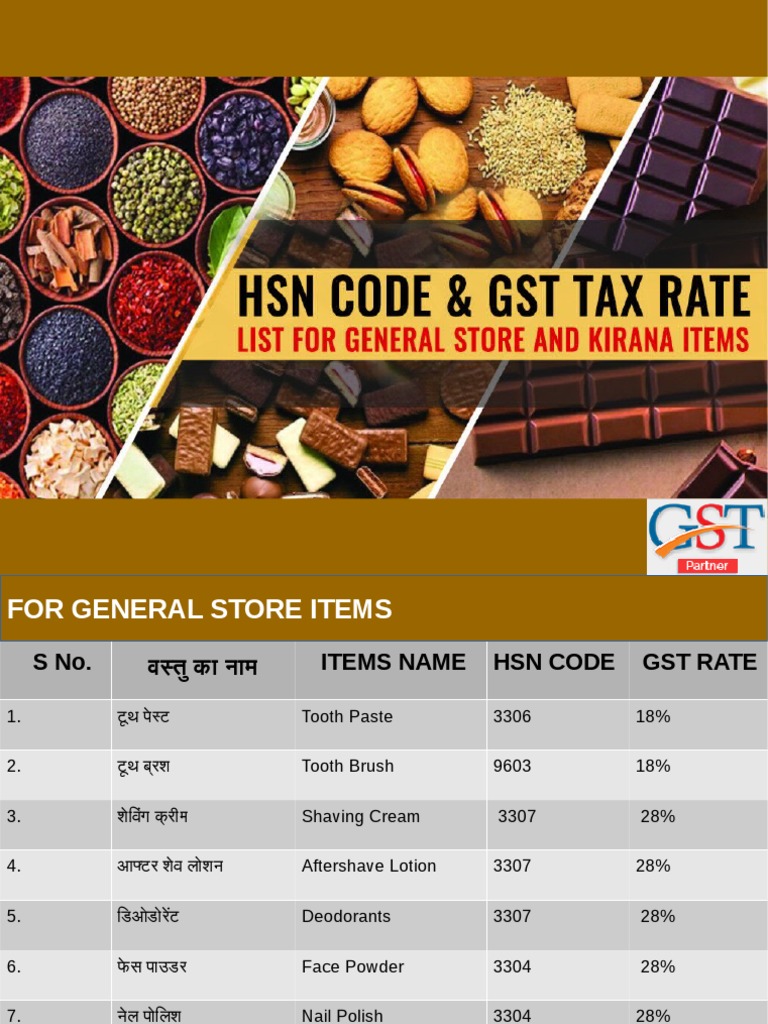

44 rowsYou can search GST tax rate for all products in this search box You have to only type name or few words or products and our server will search details for you Tax rates are A business registered under the GST law must issue invoices with GST amounts charged on the value of supply The Council has broadly approved the GST rates for goods at nil rate 5 12 18 and 28 to be levied on certain goods

In the new reimbursement scheme employees could get reimbursement on any expenses of buying 12 percent and above GST goods and services Here we present a new GST Rates Find out the Latest Revised Goods and Service Tax Rates in India Check Complete List of GST Slabs on 0 5 12 18 28 Visit now

More picture related to 12 Percent Gst Items List

GST Rates On Essential Goods For Common Man A Detailed List

https://i.ndtvimg.com/i/2017-06/gst-for-common-man_650x400_51496832569.jpg

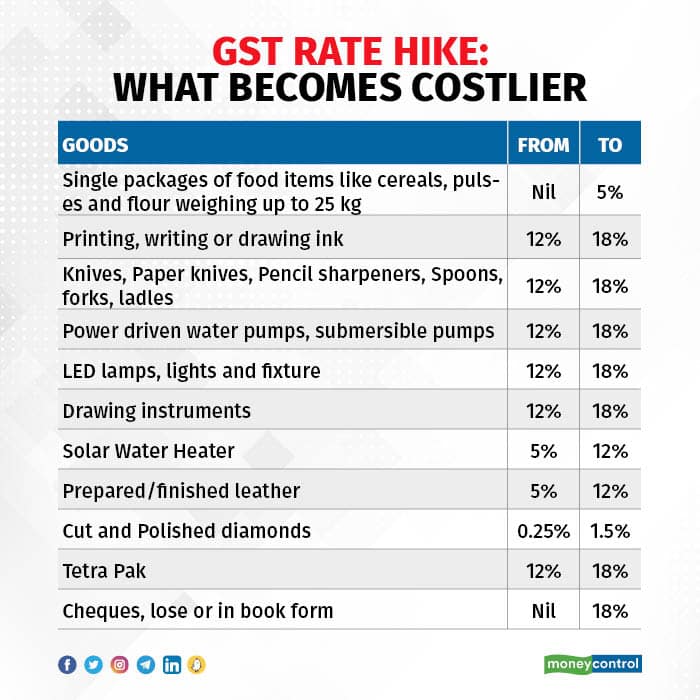

New GST Rates These Items Will Be Costlier

https://images.moneycontrol.com/static-mcnews/2022/07/GST-Rate-Hike-What-Becomes-Costlier.jpg

Single GST Rate

http://drishtiias.com/images/uploads/1667982482_Multi_tiered_Sysytem_Drishti_IAS_English.png

12 items like processed foods computers printers frozen meat products business class air travel non AC hotels etc fall under this category 28 Luxury items and services are taxed at this rate This includes items List of 12 GST rate items as per schedule II approved in the Goods and Services Tax Council meeting IGST 12 CGST 6 SGST UTGST 6

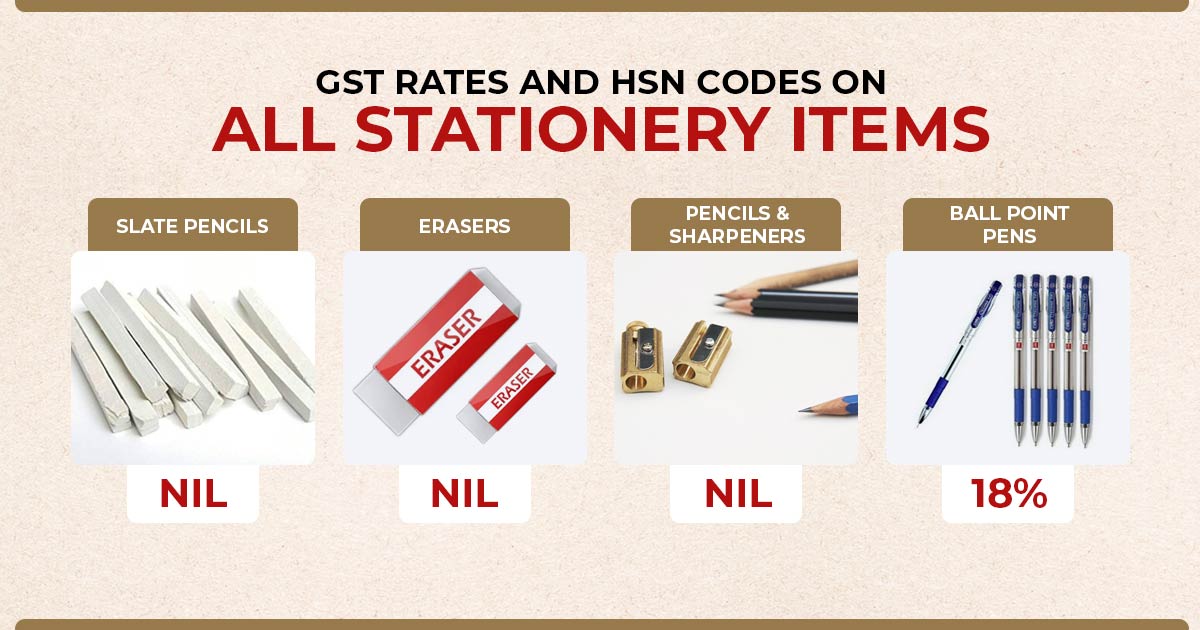

What are GST Slab Rates Learn more about the GST Percentage slab rates list of items under 5 12 18 28 slabs GST exemptions and other details Check out the following tables to know the list of goods and services that fall under the 12 slab rate It generally applies to non essential goods and services affecting the food electronics

Nil Rated Exempted Zero rated And Non GST Supplies

https://mybillbook.in/blog/wp-content/uploads/2022/09/type-of-supplies.jpg

GST Rates In 2023 List Of Goods Service Tax Rates Slabs

https://razorpay.com/learn-content/uploads/2021/07/Screenshot-2021-07-26-at-2.18.36-PM-1024x595.png

https://www.aubsp.com › gst-tax-rates-goods-twelve-percent

48 rowsList of 12 GST rate items as per schedule II approved in the Goods

https://www.lawdadi.in › gst

Goods and materialas with 12 Goods and Services Tax in India

New List Of GST Rates HSN Codes On All Stationery Items

Nil Rated Exempted Zero rated And Non GST Supplies

List Of Services With 12 Percent GST Rate ExcelDataPro

GST Rates For All Items 0 5 12 18 28 GST Tax Items YouTube

28 GST Items List Of GST Slab Rates In India PW Skills

GST Rate Hikes List Of Goods And Services Which Are Expensive Now

GST Rate Hikes List Of Goods And Services Which Are Expensive Now

Understanding GST Slab Rates GST Percentage Rate List In India

GST Impact What s Cheaper What s Not Sourajit Saha

HSN Code GST Tax Rate List For General Store And Kirana Items PDF

12 Percent Gst Items List - In the new reimbursement scheme employees could get reimbursement on any expenses of buying 12 percent and above GST goods and services Here we present a new