2555 Divided By 2 If you qualify you can use Form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction You cannot exclude or deduct more than the amount of your

You can contact by phone using number 021 5590 2555 is located at Tehran Tehran Province Iran What is Form 2555 used for Form 2555 is the form you file to claim the Foreign Earned Income Exclusion which allows you to exclude up to 126 500 of foreign earned

2555 Divided By 2

2555 Divided By 2

https://ph-static.z-dn.net/files/dcc/b67cba6730740c6562f1e48c96e0e2b6.jpg

Fantasy Life

https://dfw06mp24knrz.cloudfront.net/logos/top_bar_presentedby2.png

6 Divided By 10 6 10 YouTube

https://i.ytimg.com/vi/BPJDrsKCsa8/maxresdefault.jpg

Form 2555 is a tax form that can be filed by US citizens and Green Card Holders who have earned income from outside the United States and Puerto Rico It is used to claim As a US citizen working abroad you will need the IRS Form 2555 to claim the Foreign Earned Income Exclusion and exclude up to 130 000 of foreign earned income from

Form 2555 known as the Foreign Earned Income form is designed to help U S citizens and resident aliens who meet certain qualifications exclude foreign earned income and housing To use Form 2555 taxpayers must meet specific income qualifications The form is designed for U S citizens and resident aliens earning income abroad enabling them to

More picture related to 2555 Divided By 2

Ronald Lacey

https://m.media-amazon.com/images/M/MV5BY2FiNGVmODUtOTMxMi00ZGQzLWJjYWEtZDE5OTE1OTc3Yjc1XkEyXkFqcGdeQXVyMTUzMTg2ODkz._V1_FMjpg_UX2160_.jpg

No 5653 8 2555

https://image-gallery.dmc.tv/uploads/550108_Dhutanga_03_3267424d44.JPG

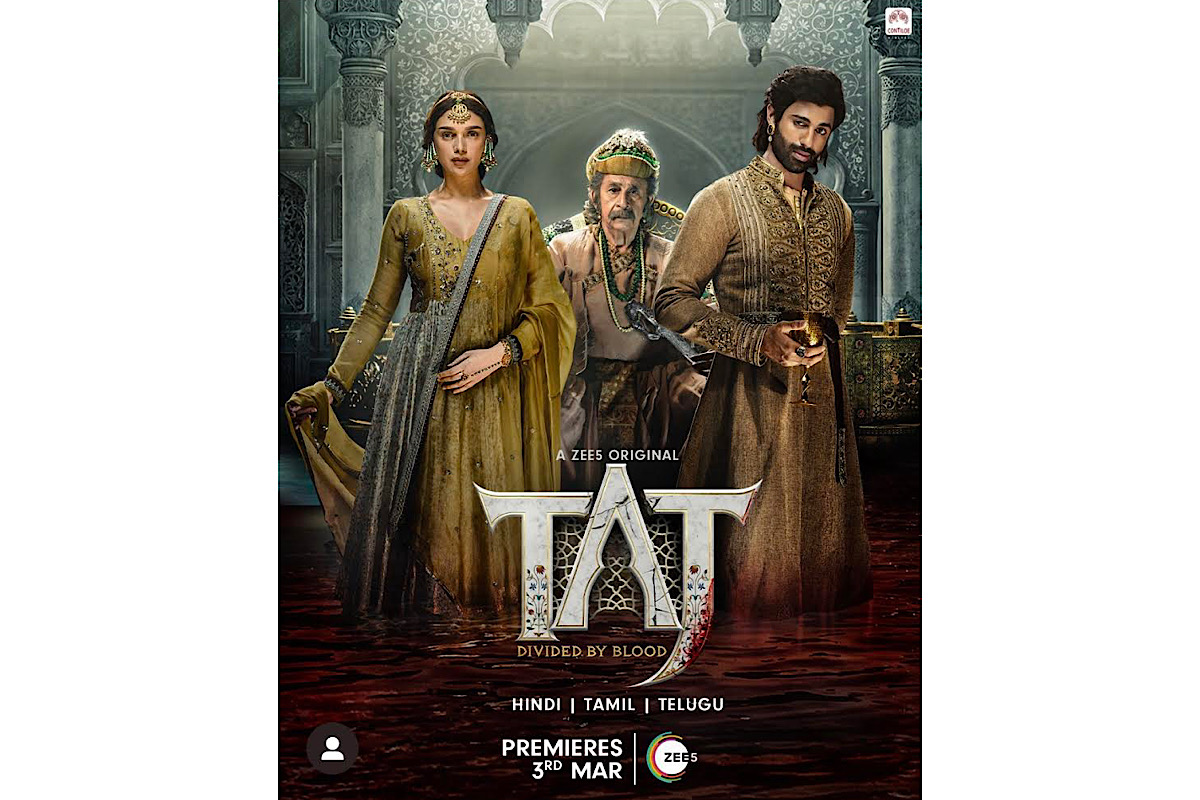

Taj Divided By Blood Trailer Out The Statesman

https://www.thestatesman.com/wp-content/uploads/2023/02/CFE8F580-6350-4B50-AA41-1CA942F71DE0.jpeg

If you re a U S expat you may be able to exclude foreign earned income from U S taxable income using IRS Form 2555 This form allows eligible taxpayers to claim the What Is IRS Form 2555 Form 2555 officially titled Foreign Earned Income is used by U S citizens and resident aliens to exclude income earned outside the U S from their taxable

[desc-10] [desc-11]

Division For Grade 2 Definition Facts Examples

https://www.vedantu.com/seo/content-images/c775ba8e-e542-4d1e-9d48-08ee79229389.jpg

Taylor Swift s Eras Tour Outfits See All The Looks She s

https://assets.teenvogue.com/photos/641b2a23912ddccbabf80f80/4:3/w_6000,h_4500,c_limit/GettyImages-1474459622.jpg

https://www.irs.gov › instructions

If you qualify you can use Form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction You cannot exclude or deduct more than the amount of your

https://www.bizsouthasia.com › IR

You can contact by phone using number 021 5590 2555 is located at Tehran Tehran Province Iran

Dark Magician By Aftershock Studio SOLD OUT

Division For Grade 2 Definition Facts Examples

Frida 2024

103366187 20160204 2 2022 2 jpg v 1664133593 w 1920 h 1080

Download Divided Fame SVG FreePNGImg

Solving 1 Divided By Infinity The Story Of Mathematics A History Of

Solving 1 Divided By Infinity The Story Of Mathematics A History Of

Global Outlook May Be Less Bad But We re Still Not In A Good Place

Jim Jordan No Longer GOP Speaker Nominee After Third Loss

Most Influential Database Papers Ryan Marcus

2555 Divided By 2 - [desc-13]