3678 Divided By 7 I understand that money paid into an ISA is free of income tax up to an annual limit When I come to withdraw money from the account is the withdrawn amount

Discover if you pay tax on ISA withdrawals in the UK Learn about tax free benefits taxable elements and strategies for optimizing tax efficiency People may have ISA withdrawal questions such as can I take money out of my ISA how much can I take out and do I pay ISA withdrawal tax Moneyfarm will answer all

3678 Divided By 7

3678 Divided By 7

https://i.ytimg.com/vi/RymBhNF7A9Y/maxresdefault.jpg

3 Divided By 7 3 7 YouTube

https://i.ytimg.com/vi/D96gWBITAHc/maxresdefault.jpg

File 22 Divided By 7 Circle png Wikipedia

https://upload.wikimedia.org/wikipedia/commons/9/92/22_Divided_by_7_Circle.png

An ISA is a special type of account that lets you keep more of your money because you don t pay UK Income Tax and Capital Gains Tax on what you earn from it It s a great way Unless you undertake a transfer out to another provider when you take money out of an ISA you stop earning tax free interest on the withdrawn amount Every tax year you have an Annual

Read more about how long it takes to withdraw funds from a Stocks and shares ISA or Dealing account The difference between withdrawing and transferring When you make withdrawals This means unless you have a flexible cash ISA if you reach the ISA limit and then take money out you can t put the money back in within that tax year So what does this look like in

More picture related to 3678 Divided By 7

T Rone On Twitter 300 120 Divided By 6 476 7 Times 16 Divided By 2

https://pbs.twimg.com/amplify_video_thumb/1657553119771869186/img/jJ7VQGpqBOcrHH0d.jpg

![]()

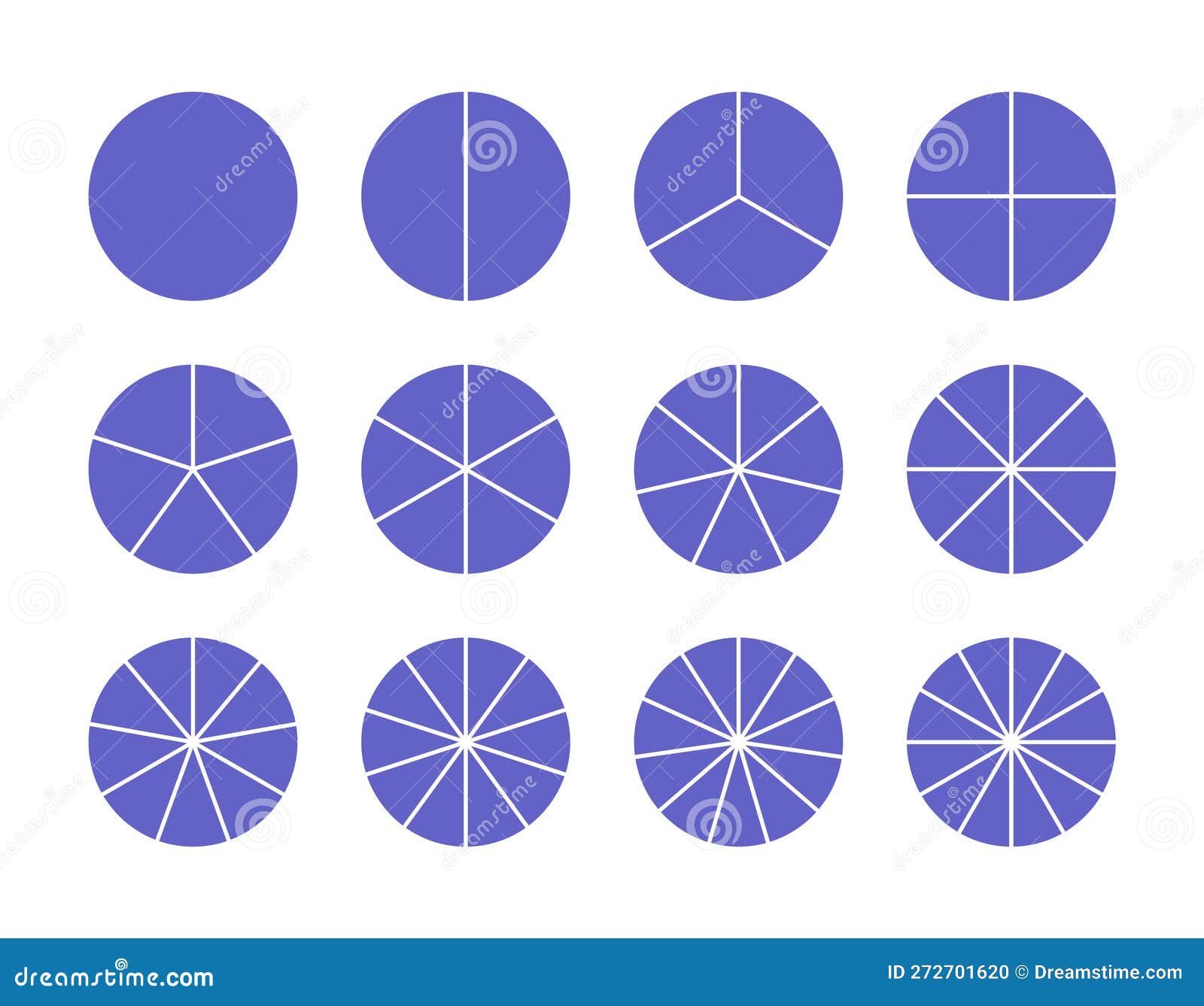

Donut Chart Divided In 7 Sections Colorful Circle Diagram Infographic

https://static.vecteezy.com/system/resources/previews/020/455/594/original/donut-chart-divided-in-7-sections-colorful-circle-diagram-infographic-wheel-icon-round-shape-cut-in-seven-equal-segments-vector.jpg

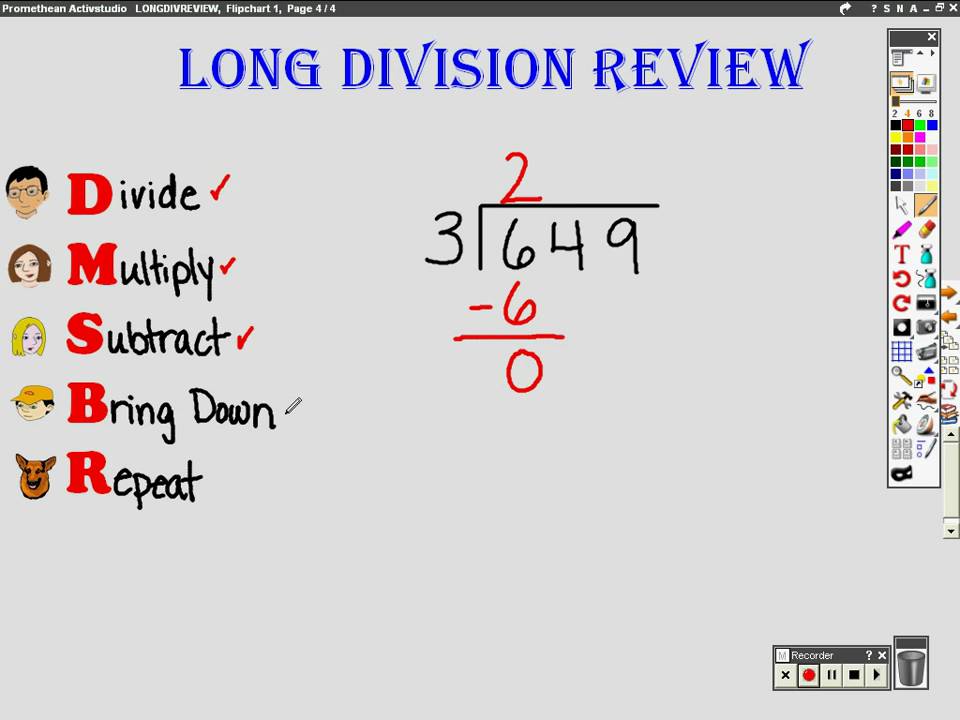

How To Division On Paper

https://corbettmathsprimary.com/wp-content/uploads/2020/05/Long-Division-Video.png

The money you take out must be put back in the same tax year Your ISA must be flexible Let s take a look at an example You have an allowance of 20 000 for the year and If the interest from your savings goes above a set amount you may need to pay tax But not with an ISA Find out how tax and ISAs work

[desc-10] [desc-11]

Division Chart 1 100 Printable Printable Templates

https://cdn.shoplightspeed.com/shops/611783/files/13573863/ashley-productions-learning-mat-division.jpg

Circular Chart Round Structure Graph Circle Section Template In Grey

https://thumbs.dreamstime.com/z/circular-chart-round-structure-graph-circle-section-template-grey-color-pie-diagram-divided-pieces-set-schemes-272701620.jpg

https://forums.moneysavingexpert.com › ... › paying-tax-on-isa-withd…

I understand that money paid into an ISA is free of income tax up to an annual limit When I come to withdraw money from the account is the withdrawn amount

https://www.simplysavingsaccounts.co.uk › guides › do-i-pay-tax-on-isa...

Discover if you pay tax on ISA withdrawals in the UK Learn about tax free benefits taxable elements and strategies for optimizing tax efficiency

Long Division Review YouTube

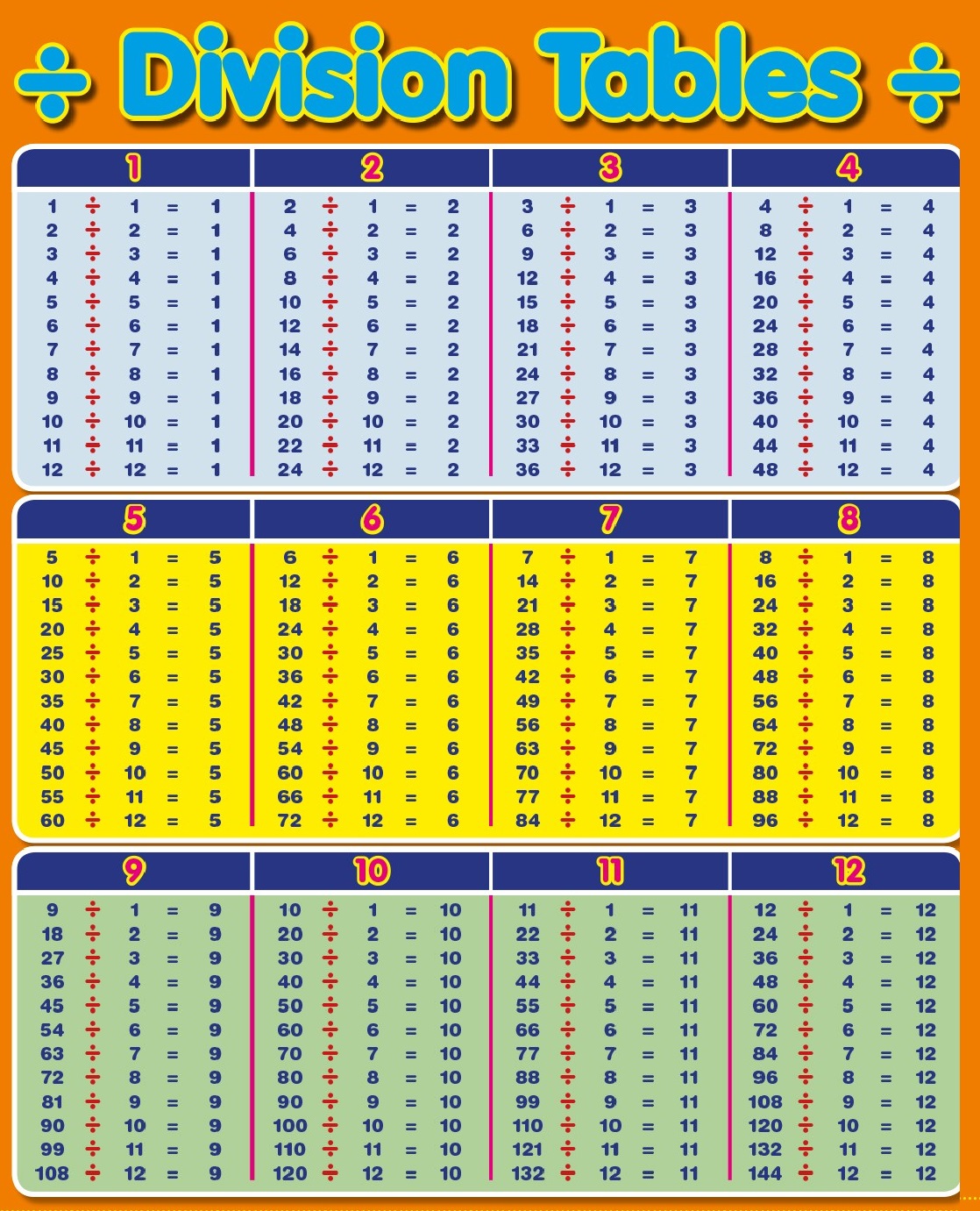

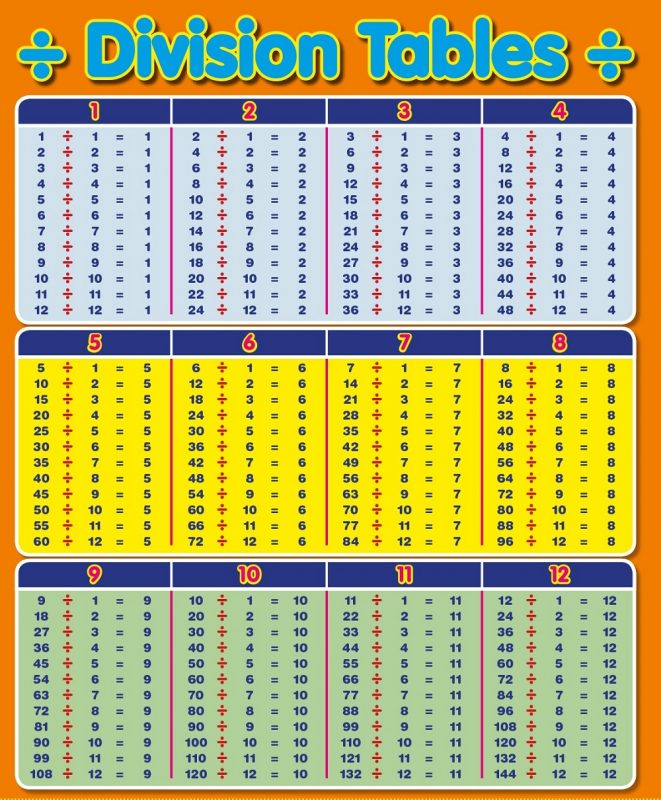

Division Chart 1 100 Printable Printable Templates

Which Is The Largest Three Digit Number That Can Be Exactly Divided By 7

Times Table And Division Sheet

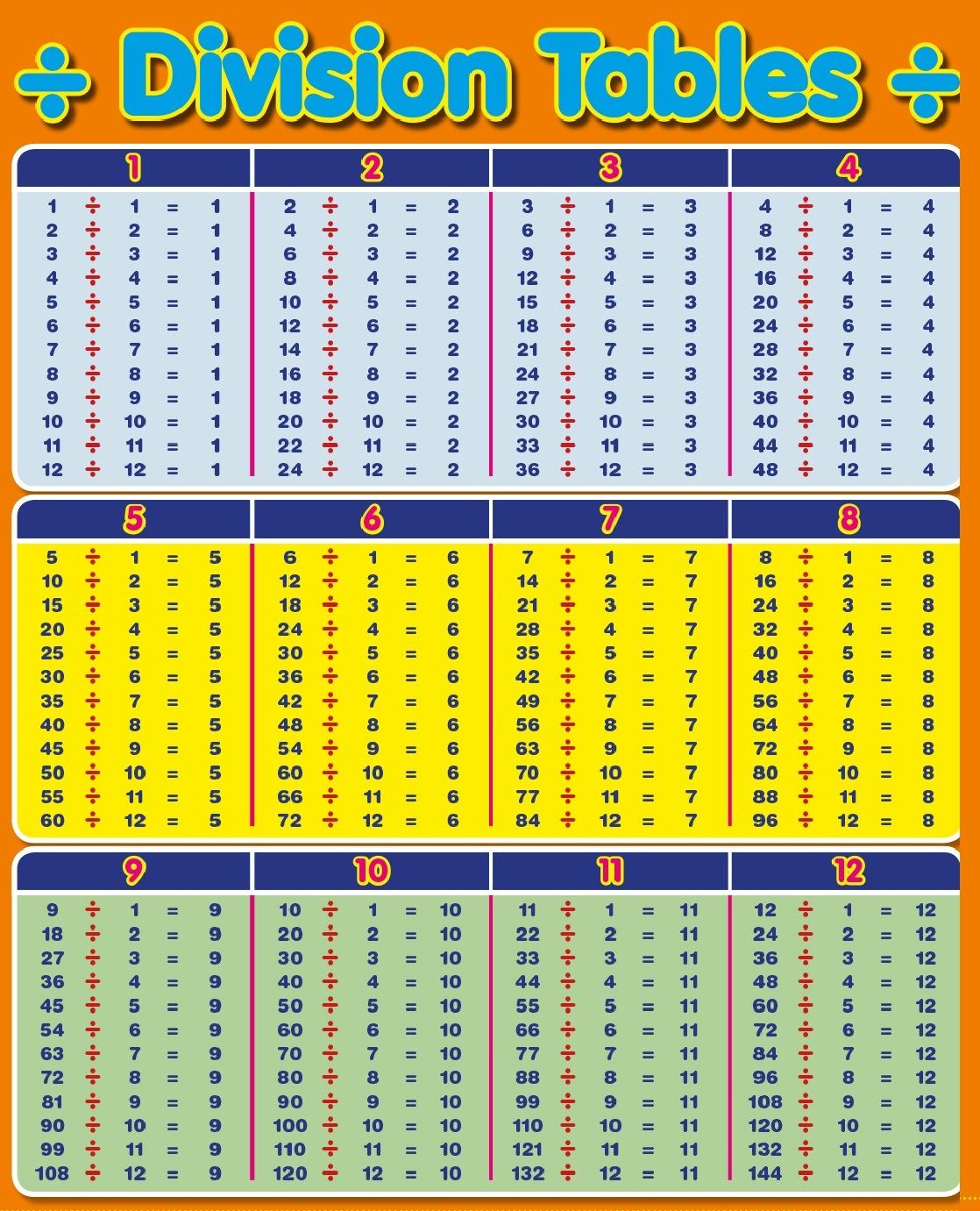

Division Table 1 12 Learning Printable

Divided By 7 8

Divided By 7 8

Divide Table Chart

[img_title-15]

[img_title-16]

3678 Divided By 7 - This means unless you have a flexible cash ISA if you reach the ISA limit and then take money out you can t put the money back in within that tax year So what does this look like in