9990 Divided By 2 Older homeowners needing funds for cost of living expenses or retirement can access cash through a reverse mortgage This type of loan can be a helpful tool for seniors

A reverse mortgage allows homeowners further up in age to borrow against a portion of their home equity Figure out if this loan option is right for you The reverse mortgage becomes due when the borrower moves out sells the home or dies Like any loan a reverse mortgage comes with costs like origination fees closing

9990 Divided By 2

9990 Divided By 2

https://i.ytimg.com/vi/MpYOFNvuBbo/maxresdefault.jpg

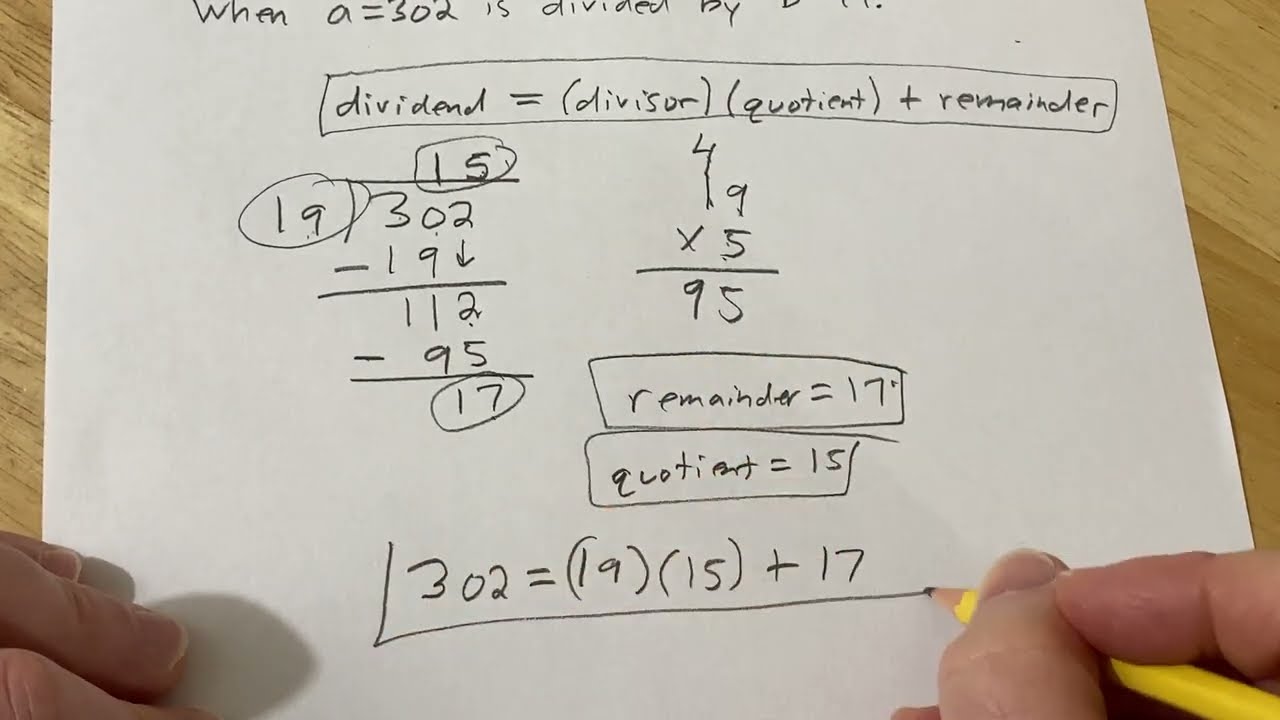

5 150 Divided By 2 With Solution Brainly ph

https://ph-static.z-dn.net/files/dcc/b67cba6730740c6562f1e48c96e0e2b6.jpg

Find The Quotient And Remainder When Dividing Numbers YouTube

https://i.ytimg.com/vi/CWlafJsZJRk/maxresdefault.jpg

A reverse mortgage is a type of loan reserved for those 62 and older Here s how it works how you can get one and what to be wary of A reverse mortgage is a type of loan against your house But unlike with a traditional mortgage you don t make monthly payments to a lender Instead the lender pays

A reverse mortgage allows you to access the equity in your home Understand the pros an cons to determine whether a reverse mortgage makes sense for you A reverse mortgage is a financial product designed for homeowners aged 62 and older Unlike a traditional mortgage where you make monthly payments to the lender with a

More picture related to 9990 Divided By 2

2 Divided By 12 2 12 YouTube

https://i.ytimg.com/vi/ocvCARqBD2s/maxresdefault.jpg

3 Divided By 6 3 6 YouTube

https://i.ytimg.com/vi/y4k_8rGu_Us/maxresdefault.jpg

5 Divided By 10 5 10 YouTube

https://i.ytimg.com/vi/QTGNbkUH9FA/maxresdefault.jpg

The reverse mortgage loan becomes due when the borrower dies sells the home or moves out of the home The lender may also require repayment if you fail to pay your property taxes fail to Home equity is typically an older homeowner s biggest asset and they can access it through a reverse mortgage to pay for almost any type of expense To find the best reverse

Whether seeking money to finance a home improvement pay off a current mortgage supplement their retirement income or pay for healthcare expenses many older Americans are turning to Considering a reverse mortgage loan Already have one Learn more about Home Equity Conversion Mortgages HECMs the most common type of reverse mortgage loan

Find The Quotient 1 4 Divided By 2 2 3 Brainly in

https://hi-static.z-dn.net/files/dc9/80ec14df787359abc9c4927f71e8d264.png

5 500 Divided By 9 YouTube

https://i.ytimg.com/vi/5v7NAHeQhFM/maxresdefault.jpg

https://www.forbes.com › advisor › mortgages › reverse-mortgages

Older homeowners needing funds for cost of living expenses or retirement can access cash through a reverse mortgage This type of loan can be a helpful tool for seniors

https://www.rocketmortgage.com › learn › reverse-mortgage

A reverse mortgage allows homeowners further up in age to borrow against a portion of their home equity Figure out if this loan option is right for you

Division For Grade 2 Definition Facts Examples

Find The Quotient 1 4 Divided By 2 2 3 Brainly in

X Divided By 5 3 X Divided By 15 9 X Divided By 3 Is Equals To 1

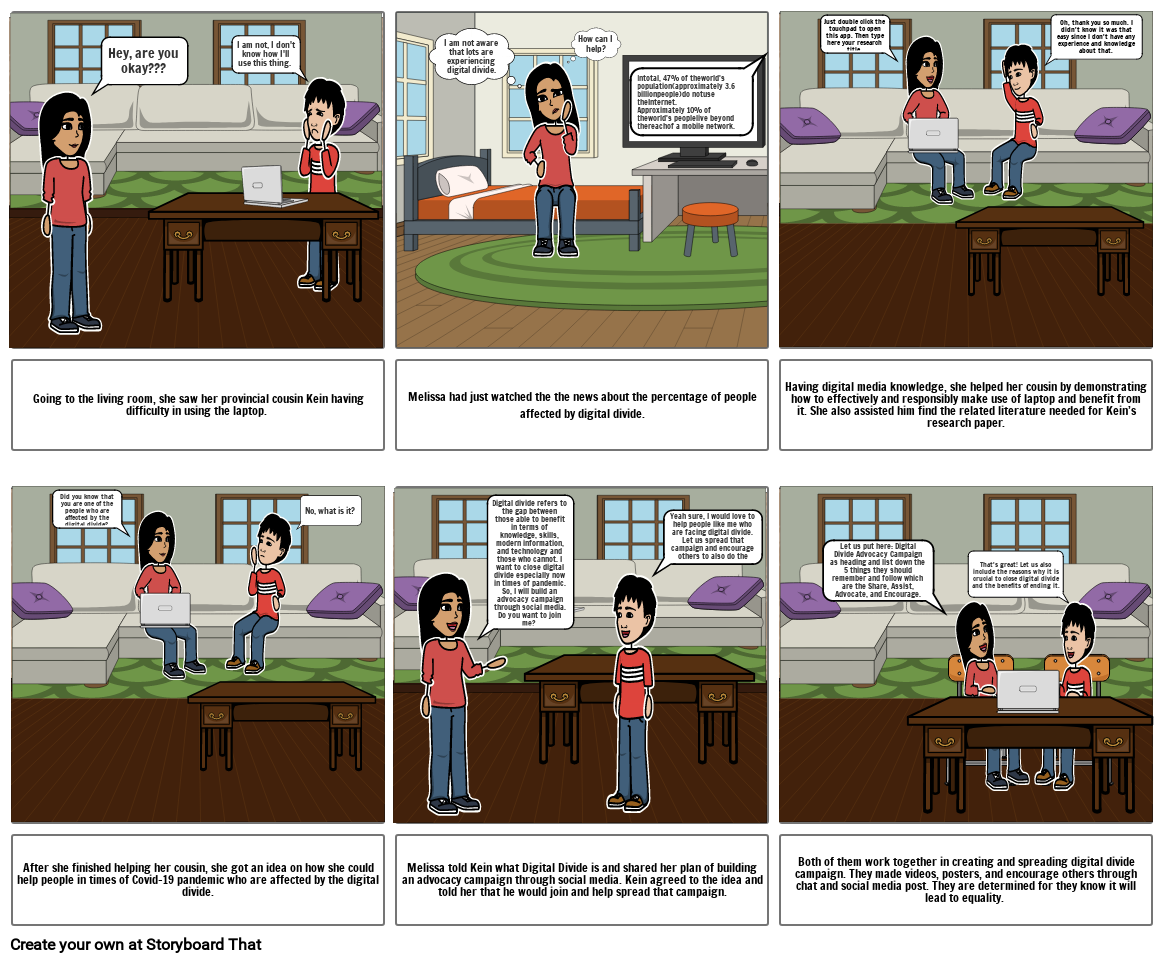

Digital Divided Storyboard By 93c79a54

What Will Be The Remainder When 2 256 Is Divided By 17 Solved By Two

18 8 Divided By 2 8 Divided By 4x2 Brainly in

18 8 Divided By 2 8 Divided By 4x2 Brainly in

What Is The Square Root Of 36 Divided By 5 Times 12 Divided By The Cube

814 Math Blog 2012 Josh s Fraction Scribepost

What Is The Value Of 10 1 2 Divided By 2 5 8 Explain On How You Got The

9990 Divided By 2 - A Reverse Mortgage is a special type of loan for homeowners age 62 and older allowing them to convert part of their home equity into cash