Do You Get Taxed On Food In Texas For example flour sugar bread milk eggs fruits vegetables and similar groceries food products are not subject to Texas sales and use tax Tax is due however on many non food

In Texas food and food ingredients are generally exempt from sales tax However there are some exceptions to this rule The following food items are subject to sales tax in Texas 1 Although most food products are exempt from sales tax in Texas there are a few exceptions In this article we will explore what food is taxed in Texas and provide answers to some

Do You Get Taxed On Food In Texas

Do You Get Taxed On Food In Texas

https://i.ytimg.com/vi/YjxNxxwJM2w/maxresdefault.jpg

Do You Get Taxed On Lottery Winnings YouTube

https://i.ytimg.com/vi/26XTtjHwJXo/maxresdefault.jpg

Why Did I Get Taxed So Much On My Bonus YouTube

https://i.ytimg.com/vi/Nceq-h9q5Ew/maxresdefault.jpg

Taxes on food can be complicated and Texas has its own unique set of rules This article aims to clarify what food is taxed in Texas shedding light on exemptions special Meals are generally taxable in Texas whether eaten dine in or to go However as in many states Texas doesn t consider bakery food to be taxable as long as that food is sold without eating utensils

The tax on food in Texas is generally 6 25 but certain groceries are exempted from this tax Texas Sales Tax Code Section 151 314 specifically outlines the exemption for food products Ready to eat food is typically taxable even when it is sold to go Tax is not due however on bakery items regardless of size whether whole pies for example or individual portions when

More picture related to Do You Get Taxed On Food In Texas

How Much Do Lottery Winners Pay In Taxes In The United States YouTube

https://i.ytimg.com/vi/ElnWckBoAYQ/maxresdefault.jpg

Social Security 2023 How Are Social Security Benefits Taxed When You

https://i.ytimg.com/vi/0FFLvqQiDOI/maxresdefault.jpg

How Much TAX Do You PAY On A Buy To Let UK YouTube

https://i.ytimg.com/vi/8YMt0C59Ch4/maxresdefault.jpg

Food purchased for consumption at home is generally exempt from sales tax in Texas This includes groceries prepared meals and non alcoholic beverages intended for Some states like Texas exempt grocery items completely while others partially or fully charge sales tax at either full or reduced rates As selling food online has rapidly grown in the US you must know the answer to Is

Texas has a 6 25 sales and use tax on all retail sales but there are some tax exemptions when it comes to food Cities counties transit authorities and special purpose The tax on food in Texas is complex and it depends on several factors including the type of food location and the retailer To better understand the tax laws let us break it

HOW TO GET TAXED LESS ON BONUSES YouTube

https://i.ytimg.com/vi/KORgq_kpqmU/maxresdefault.jpg

Payroll Taxes Here s A Breakdown Of What Gets Taken Out Of Your Pay

https://i.ytimg.com/vi/v-SVCB6g-6o/maxresdefault.jpg

https://comptroller.texas.gov › taxes › publications

For example flour sugar bread milk eggs fruits vegetables and similar groceries food products are not subject to Texas sales and use tax Tax is due however on many non food

https://www.chefsresource.com › what-food-items-are-taxed-in-texas

In Texas food and food ingredients are generally exempt from sales tax However there are some exceptions to this rule The following food items are subject to sales tax in Texas 1

Video Memes TYRFkXUaA By Nezudoge 3 Comments IFunny

HOW TO GET TAXED LESS ON BONUSES YouTube

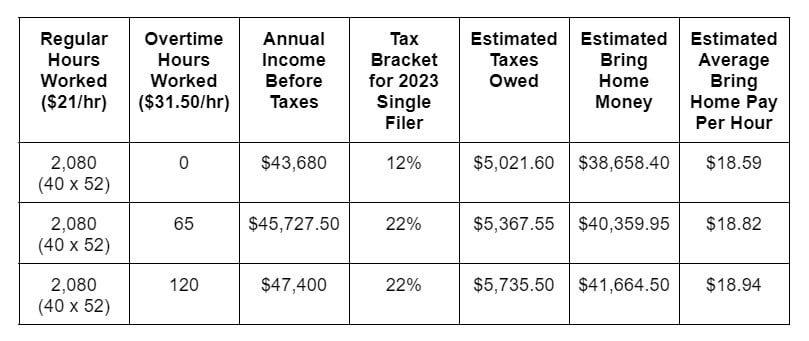

Is Overtime Taxed More Than Regular Time

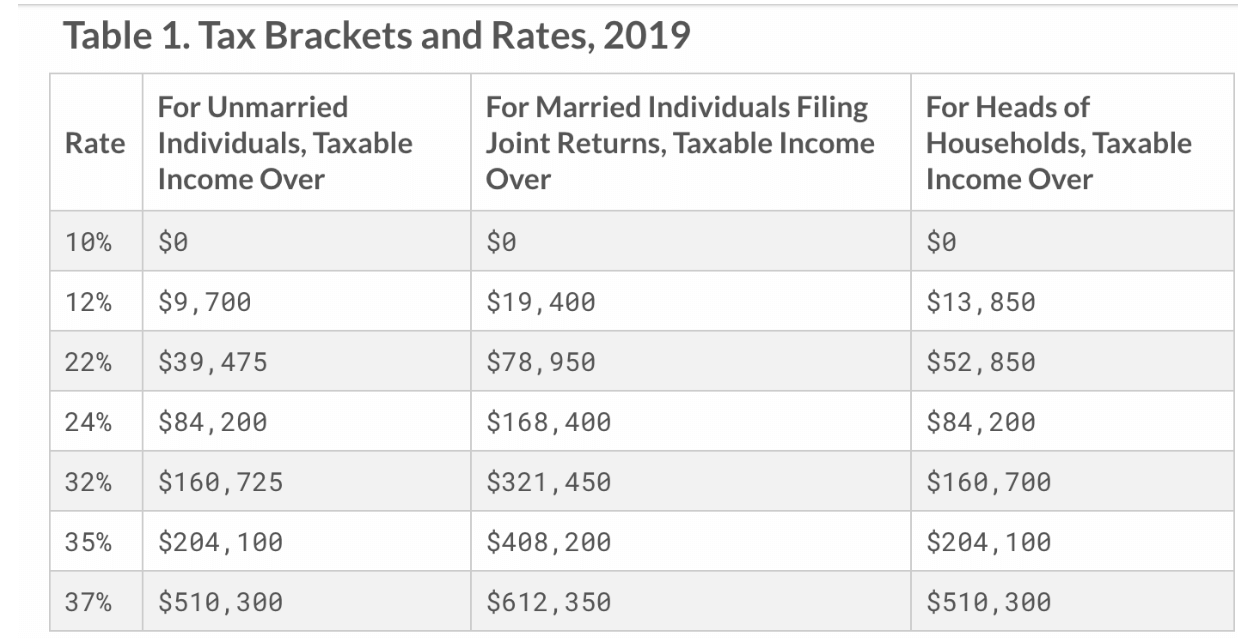

2017 Colorado Income Tax Tables Cabinets Matttroy

How Much Money You Take Home From A 100 000 Salary After Taxes

2025 Max Social Security Deduction Tyne Alethea

2025 Max Social Security Deduction Tyne Alethea

How Much Does 7brew Pay

Social Security Taxability Worksheet

Capital Gains Tax Rate 2025 Calculator App Wren Salsabil

Do You Get Taxed On Food In Texas - Meals are generally taxable in Texas whether eaten dine in or to go However as in many states Texas doesn t consider bakery food to be taxable as long as that food is sold without eating utensils