Does Milk Have Tax In Ontario What grocery items are not taxed in Ontario You are not required to pay the Ontario portion 8 of the HST on items such as books children s clothing and footwear

Food is often taxed based on dietary and health guidelines Certain snacks tend to be unhealthy and are therefore subject to tax whereas essential nutrients like milk and bread are not GST is short for Goods and Services Tax This tax applies to most goods and services sold or provided throughout Canada The GST has also been combined with the

Does Milk Have Tax In Ontario

Does Milk Have Tax In Ontario

https://healthbas.com/wp-content/uploads/2020/11/Dairy-Products-Milk.jpg

Ontario Estate Administration Tax Reduce The Burden

https://ontario-probate.ca/wp-content/uploads/2023/10/oleg-ivanov-QsRf_m8RFe4-unsplash.jpg

Why Do Alcoholics Crave Milk Banyan Chicago

https://www.banyantreatmentcenter.com/wp-content/uploads/2023/07/milk.jpg

In Ontario some goods and services are not quite HST exempt but follow different tax rules than most types of taxable goods Instead of these items being taxed the 13 HST rate they are An overview for business owners of goods and services that are subject to or exempt from sales tax in Ontario

Non carbonated beverages that are otherwise zero rated may be taxable when sold in single servings This does not include unflavoured milk Explore the details Generally basic groceries are exempt from Ontario s sales tax Items like fruits vegetables dairy and bread fall under this exemption allowing you to

More picture related to Does Milk Have Tax In Ontario

Which Milk Is The Highest In Fat The Coconut Mama

https://thecoconutmama.com/wp-content/uploads/2023/09/Which-Milk-Is-the-Highest-in-Fat-jpg.webp

Does Almond Milk Have Estrogen The FACTS Milk Pick

https://milkpick.com/wp-content/uploads/2022/12/Does-Almond-Milk-Have-Estrogen-thumbnail.png

Does Milk Have Gluten In It YouTube

https://i.ytimg.com/vi/d91lhCrz_vM/maxresdefault.jpg

Is there sales tax on ice cream in Ontario While milk based drinks and milk aren t taxable ice cream sherbet and frozen pudding are taxable when sold in single servings And Groceries that are exempt from tax include dairy products eggs cereals vegetables poultry meat fish coffee tea and more Certain farm livestock is non taxable if it s used for

Zero rated items are technically taxable but the Goods and Services Tax GST or Harmonized Sales Tax HST applied to them is zero percent Exempt items on the other hand are These items generally considered basic necessities are exempt from both the Goods and Services Tax GST and the Provincial Sales Tax PST This is designed to make

How Much Does Milk Cost Exploring Price Variations Saving Strategies

https://www.tffn.net/wp-content/uploads/2023/01/how-much-does-milk-cost.jpg

Estate Administration Tax In Ontario A Comprehensive Guide

https://ontario-probate.ca/wp-content/uploads/2023/10/andy-quezada-2TwDxERvzaI-unsplash-2.jpg

https://ontario-bakery.com › ontario › what-groceries...

What grocery items are not taxed in Ontario You are not required to pay the Ontario portion 8 of the HST on items such as books children s clothing and footwear

https://www.torontopho.com › blogs › what-food-is-taxed-in-canada.html

Food is often taxed based on dietary and health guidelines Certain snacks tend to be unhealthy and are therefore subject to tax whereas essential nutrients like milk and bread are not

Milk Run Delivery Service Has Been Bought By Woolworths Food Files

How Much Does Milk Cost Exploring Price Variations Saving Strategies

Which Milk Has The Most Carbs The Coconut Mama

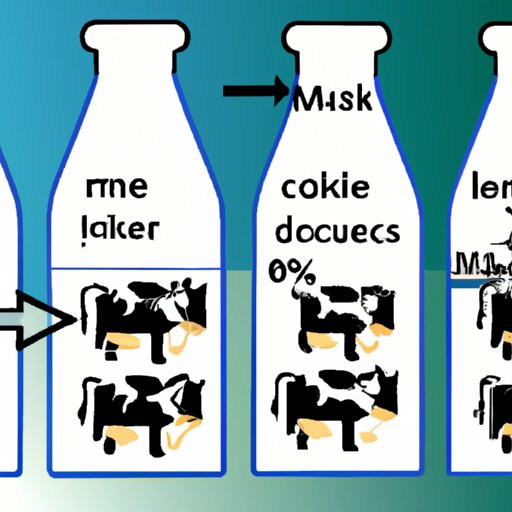

Ontario Just Changed Its Electricity Prices And Here s What That Means

With The Participation Of Canada The Canadian Film Of Video Production

COOKED AUSSIE SMARTER MILK EXPANSION Fast Free Shipping Good Store Good

COOKED AUSSIE SMARTER MILK EXPANSION Fast Free Shipping Good Store Good

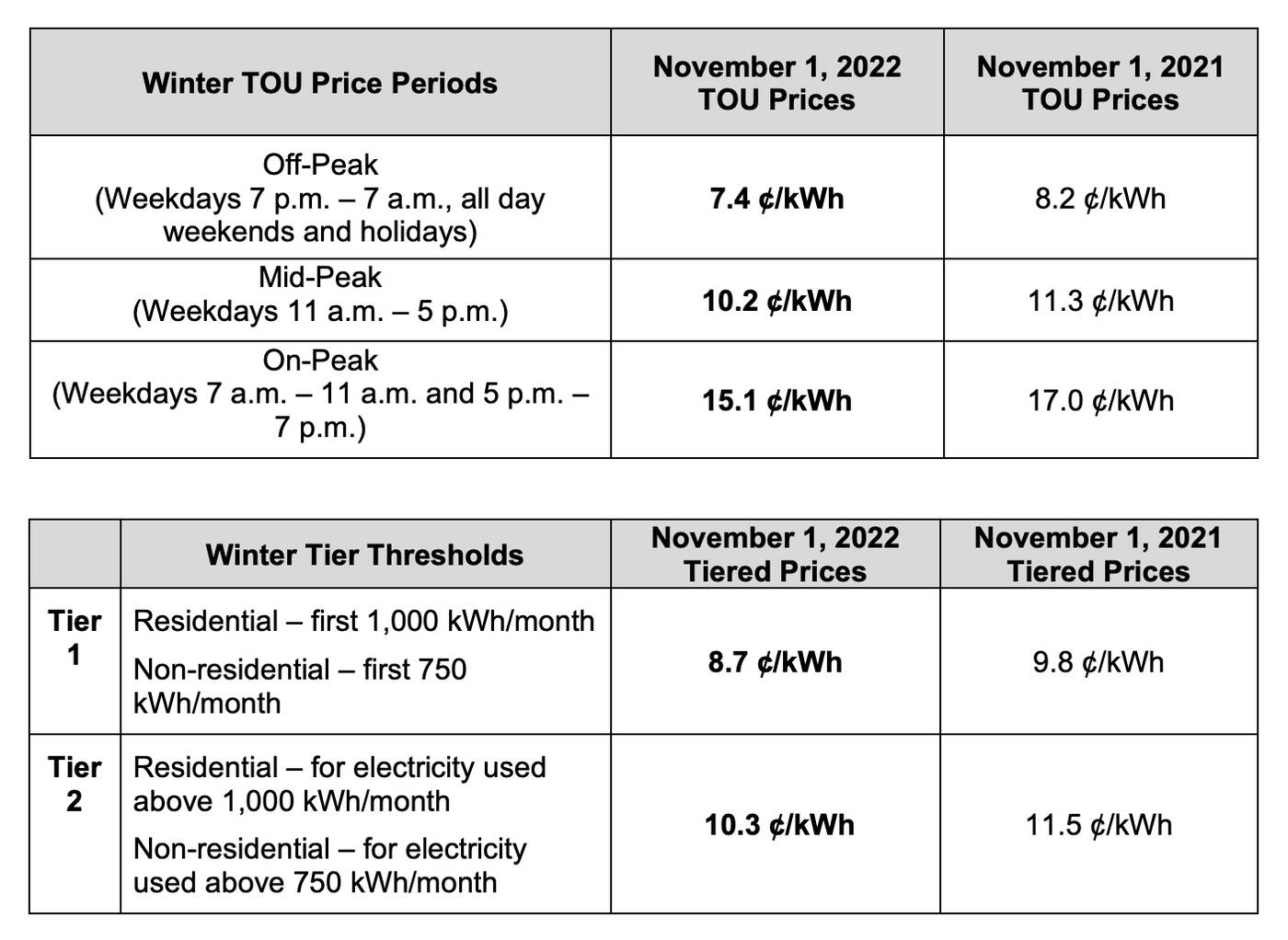

Provincial marginal tax rates middle income canada infographic jpg

Infographic Milk The Science Of Milk In One Page Food Crumbles

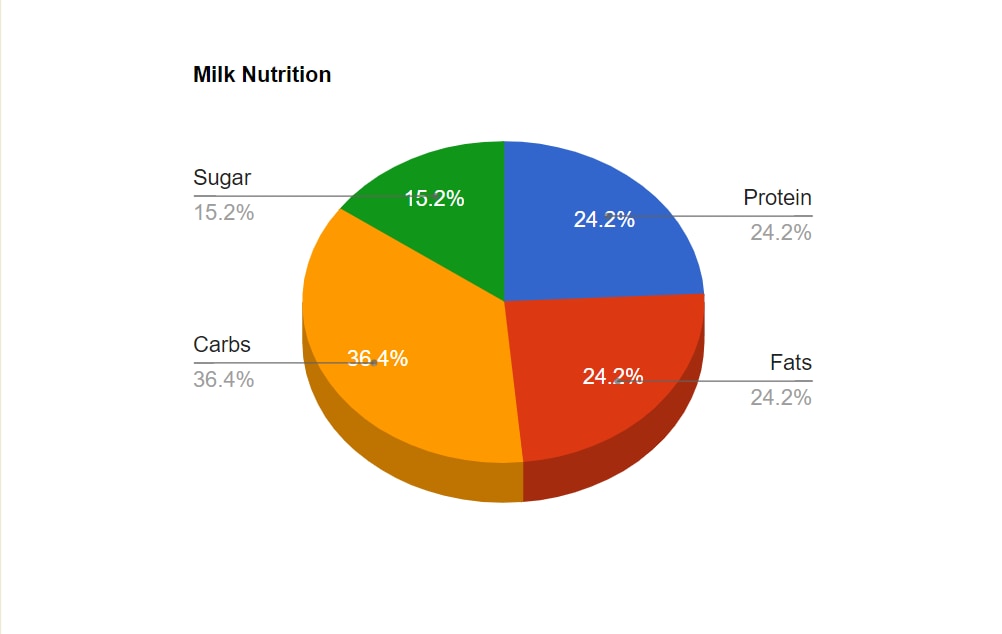

Calories In Milk Nutritional Facts Health Benefits

Does Milk Have Tax In Ontario - The Harmonized Sales Tax HST in Ontario is a combined tax rate of 13 consisting of 5 federal GST and 8 provincial PST While it applies to most goods and services there are