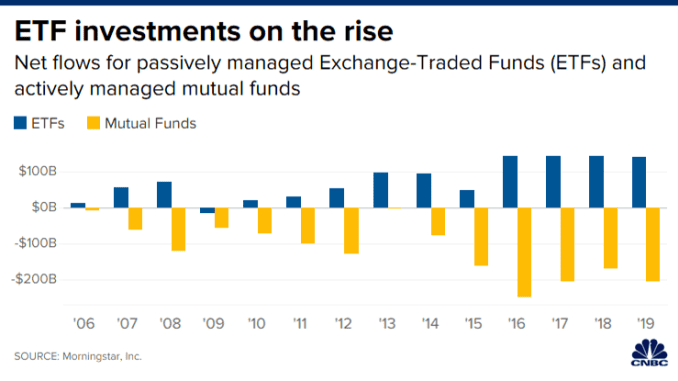

Etf Vs Mutual Fund Tax Learn about the tax differences including the treatment of capital gains and dividends between ETFS and mutual funds

ETFs have a tax advantage over mutual funds but the size of their advantage depends on the investment strategy and asset class of the fund Both ETFs and mutual funds are considered strong potential investments but carry different tax implications Here s what to know

Etf Vs Mutual Fund Tax

Etf Vs Mutual Fund Tax

https://i.ytimg.com/vi/cHjpPRLPhLo/maxresdefault.jpg

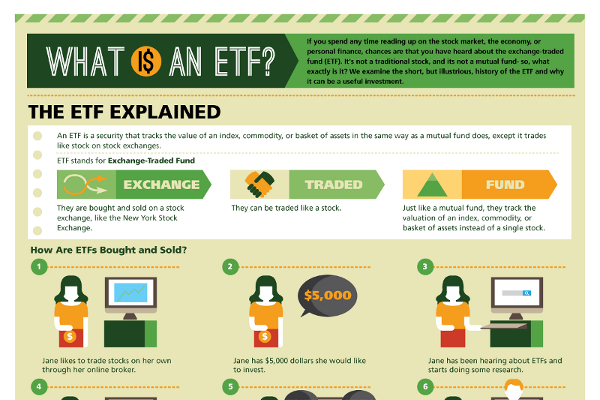

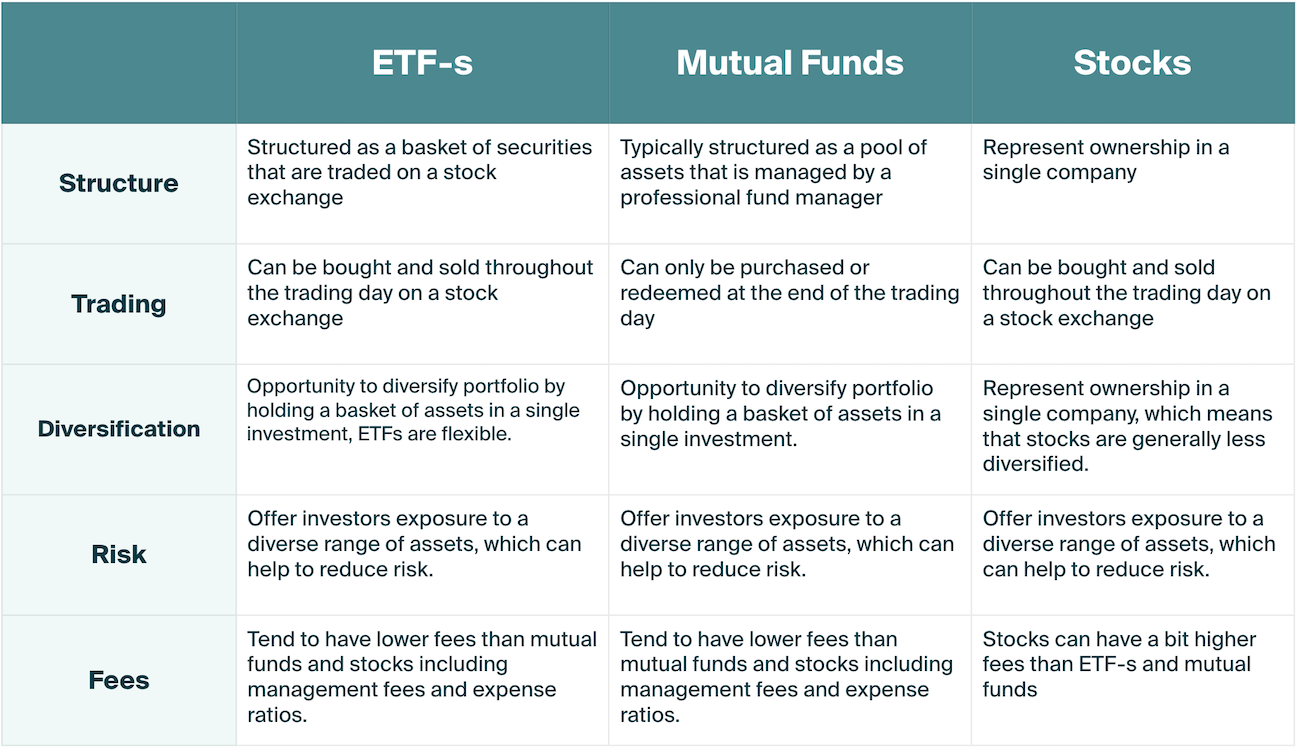

What Is ETFs ETF Vs Mutual Fund Key Differences Mutual Funds

https://i.ytimg.com/vi/JRClVRJNq7s/maxresdefault.jpg

Index Funds Vs Mutual Funds Vs ETFs Differences Similarities YouTube

https://i.ytimg.com/vi/HXj7ZnTWPSI/maxresdefault.jpg

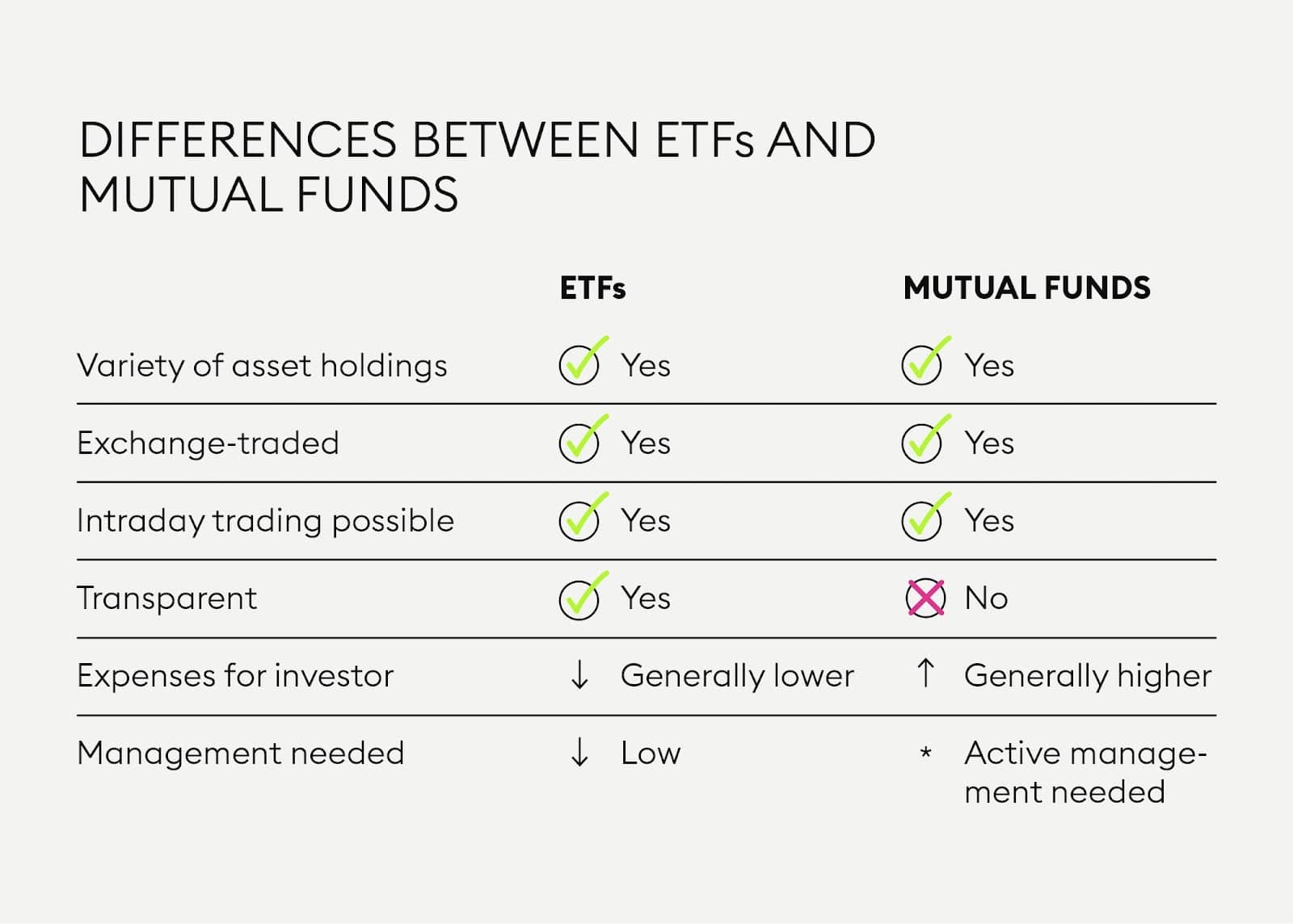

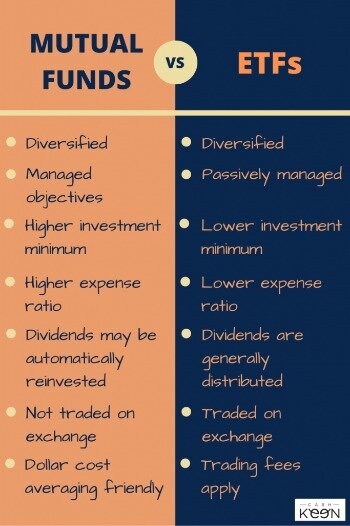

ETFs are more tax efficient with investors generally only paying capital gains tax after they sell their shares Meanwhile buying or selling by mutual fund managers can trigger capital gains ETFs and mutual funds are both popular investment options that hold underlying securities ETFs are often used for passive investing and can charge different expenses for asset management while mutual funds can also include 12b 1 fees for sales promotion

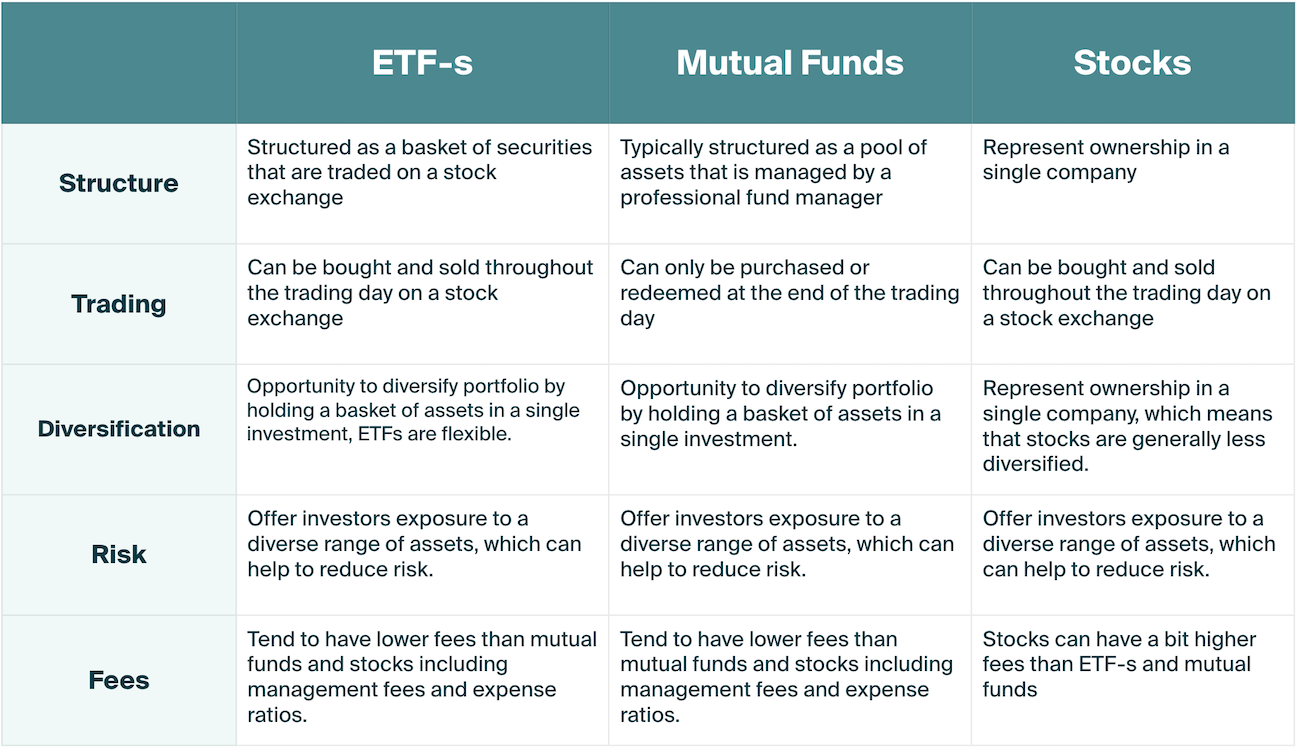

Tax Efficiency Differences ETFs vs Mutual Funds ETFs are generally considered more tax efficient than mutual funds owing to the fact that they typically have fewer capital gains distributions However they still have tax implications you must consider both when creating your portfolio as well as when timing the sale of an ETF you hold Understand the key ETFs vs Mutual Funds tax distinctions to make more informed decisions aligned with your investment strategy Each offers unique benefits worth considering

More picture related to Etf Vs Mutual Fund Tax

Mutual Funds

https://m.foolcdn.com/media/dubs/images/etfs-vs-mutual-funds-infographic.width-880.png

ETF Versus Mutual Funds BrandonGaille

https://brandongaille.com/wp-content/uploads/2014/04/ETF-Versus-Mutual-Funds.jpg

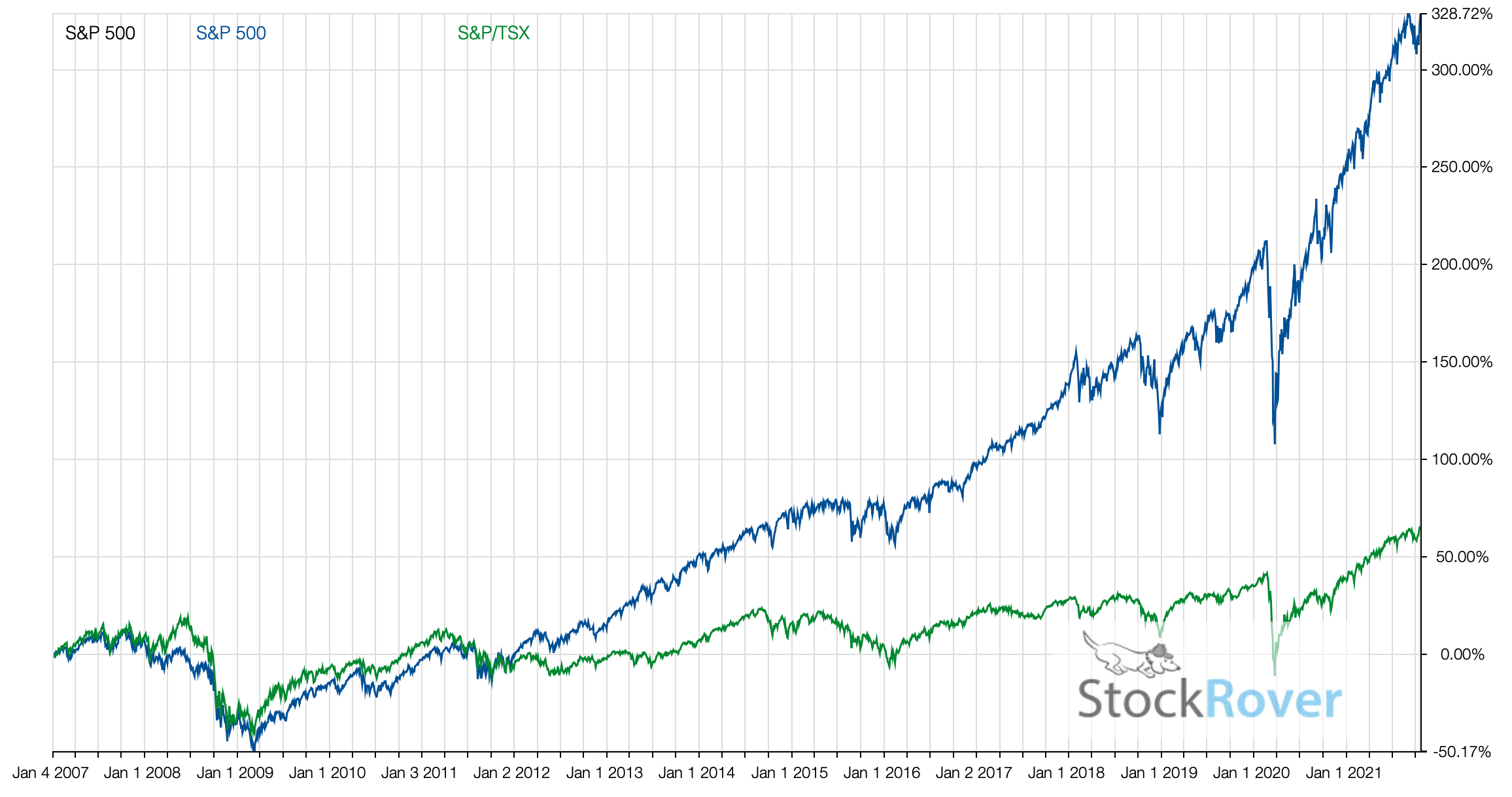

The Best S P 500 ETFs In Canada For 2023

https://dividendearner.com/wp-content/uploads/SP500-vs-TSX.png

ETFs and mutual funds can hold very similar investments such as stocks bonds U S Treasuries commodities and other securities And both are taxed in a similar way Dividends paid out by a mutual fund or ETF are taxed at your ordinary income tax rate Because of how they re managed ETFs are usually more tax efficient than mutual funds This can be important if the ETF is held within a taxable account and not within a tax advantaged

[desc-10] [desc-11]

Gr nfin Financial Blog Full ETF Guide All You Need To Know About ETF s

https://www.grunfin.com/blog-images/etf-mutual-funds-stocks-comparision-2.png

ETF Vs Mutual Fund Which Is Better To Invest In Investing Mutuals

https://i.pinimg.com/originals/15/84/0f/15840f392bfaf2217db4129d5dc665e0.png

https://www.fidelity.com › learning-center › investment-products › etf...

Learn about the tax differences including the treatment of capital gains and dividends between ETFS and mutual funds

https://www.morningstar.com › funds › etfs-vs-mutual-funds-benefits...

ETFs have a tax advantage over mutual funds but the size of their advantage depends on the investment strategy and asset class of the fund

ETF Vs Mutual Fund An Overview

Gr nfin Financial Blog Full ETF Guide All You Need To Know About ETF s

ETF Vs Mutual Fund An Overview

Etf Vs Mutual Fund Turbo Tax

ETF Vs Mutual Funds Review Difference Performance Fintrakk

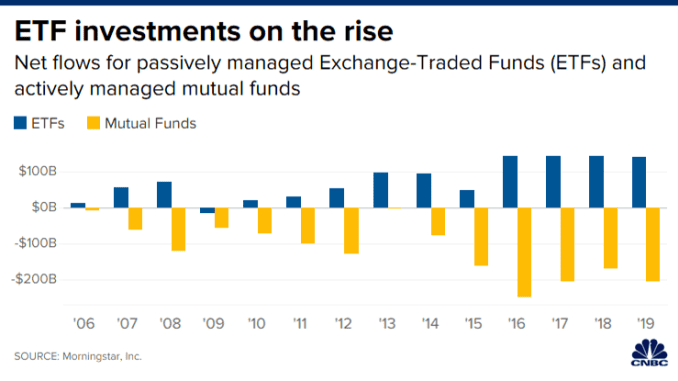

The Next Big Thing In ETFs Nottingham

The Next Big Thing In ETFs Nottingham

ETF Vs Mutual Fund Which One Is Right For You

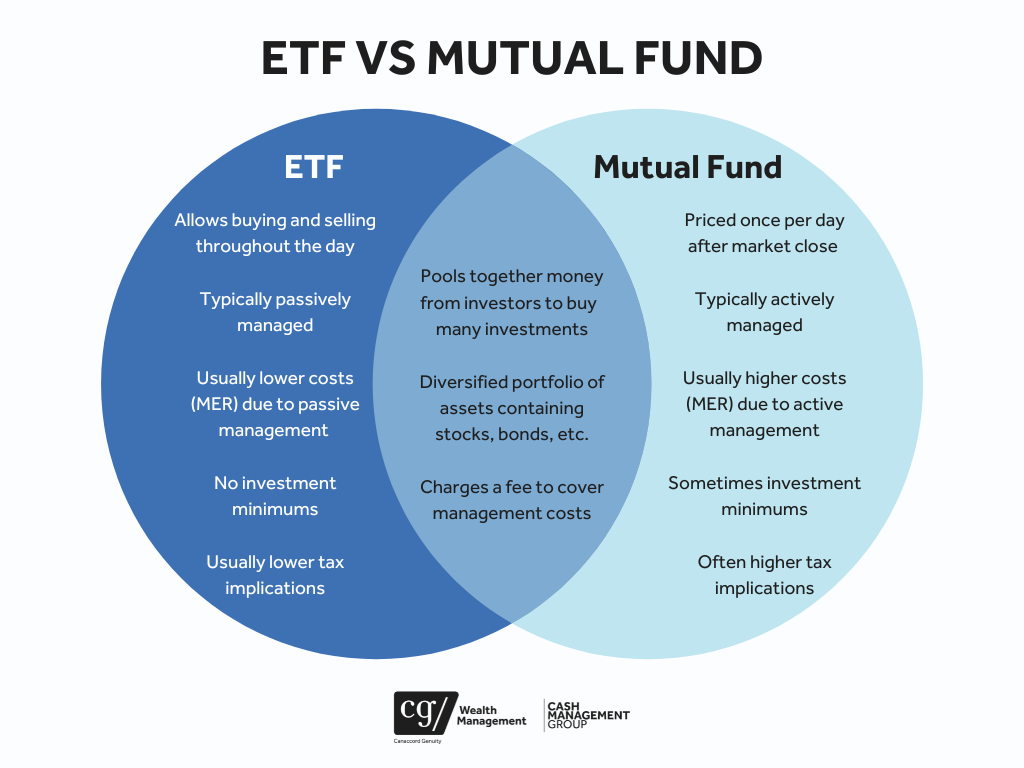

ETFs Vs Mutual Funds Which Is Right For You CG Cash Management Group

ETF Vs Index Funds Top 8 Differences You Must Know

Etf Vs Mutual Fund Tax - ETFs and mutual funds are both popular investment options that hold underlying securities ETFs are often used for passive investing and can charge different expenses for asset management while mutual funds can also include 12b 1 fees for sales promotion