Free 1099 Tax Forms Printable IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more There are 20 active types of

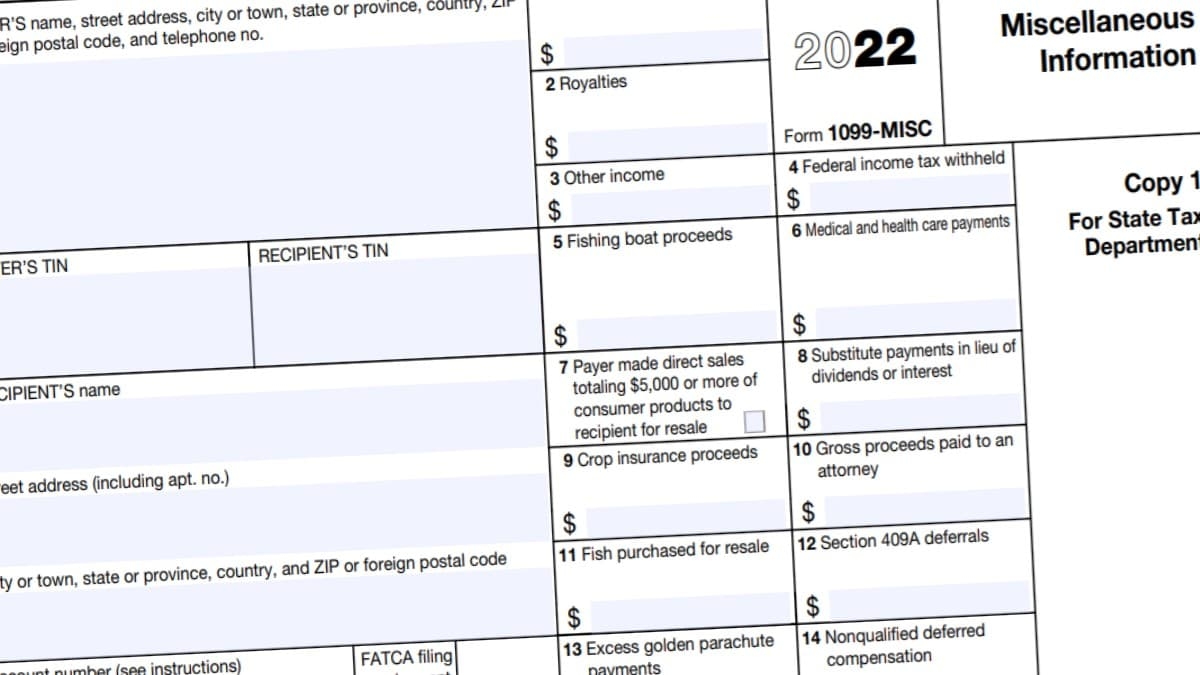

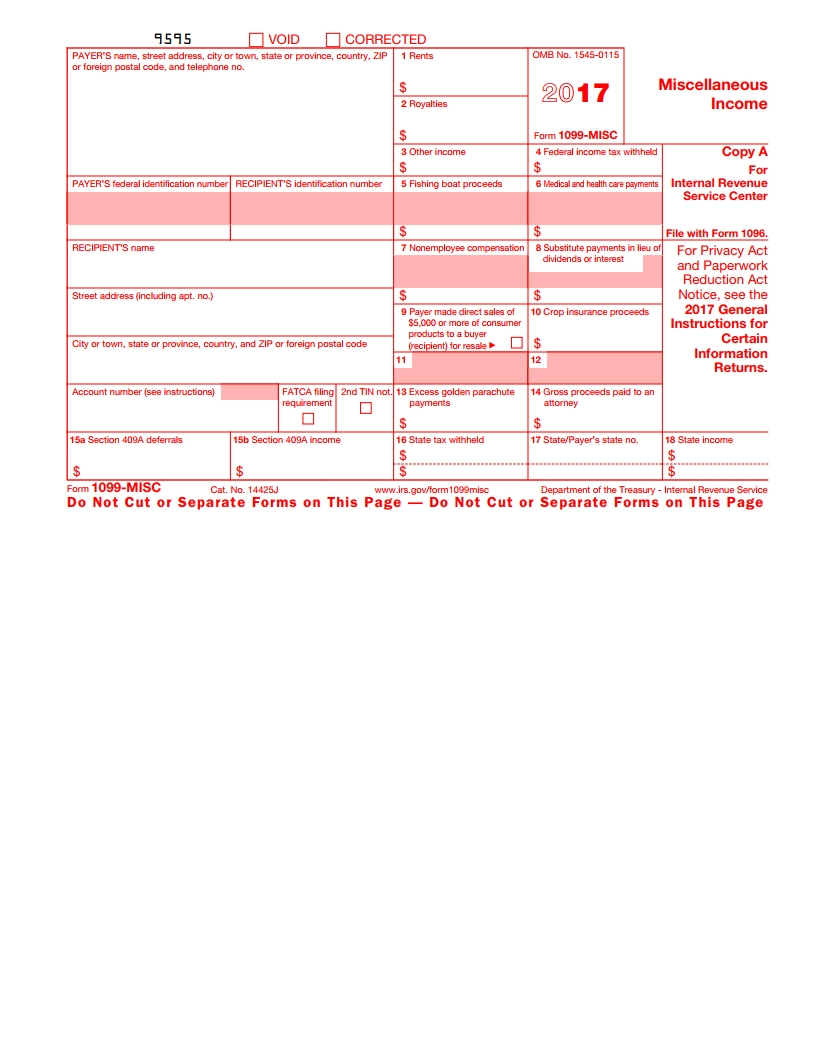

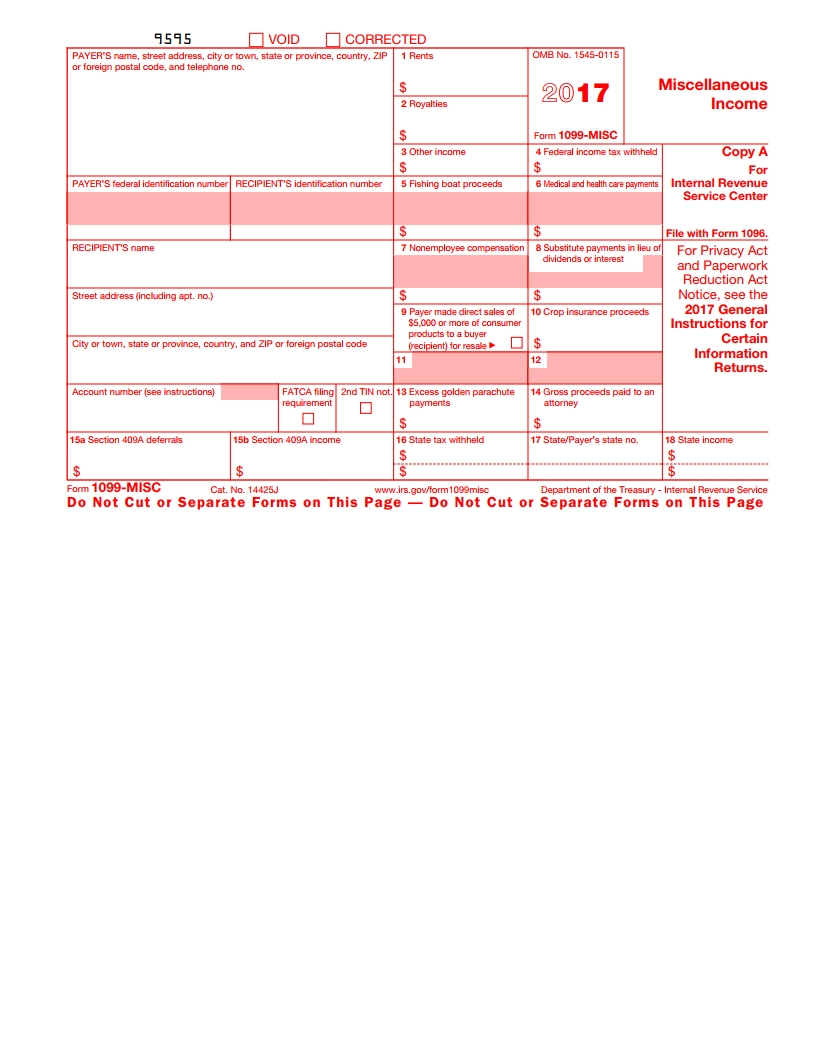

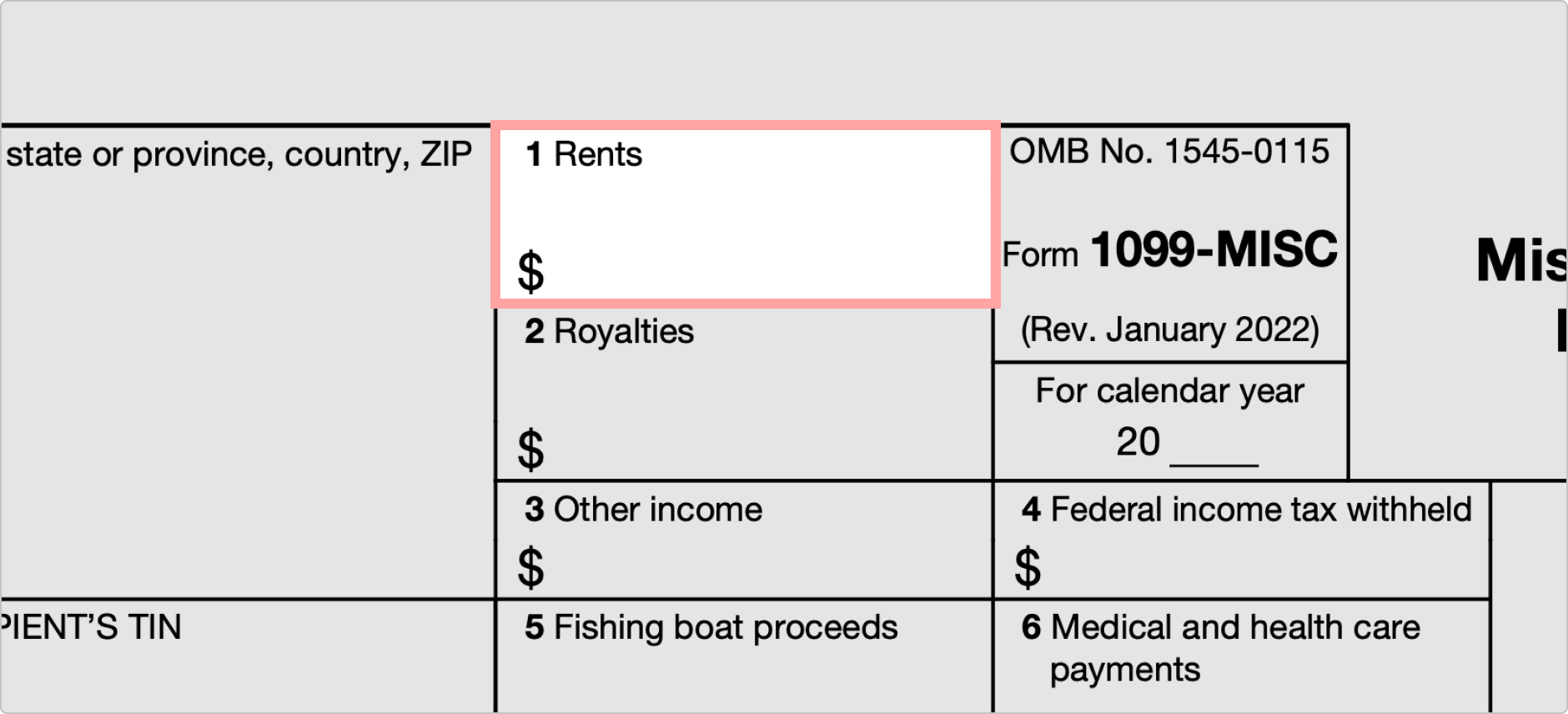

A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a certain dollar threshold for rent royalties prizes awards medical and legal exchanges and other specific transactions must be reported to the IRS using this form Use Form 1099 MISC to report non salary payments your business made in 2023 Form 1099 MISC is a government form businesses use to show miscellaneous payments they distribute and taxpayers report them on their annual tax returns

Free 1099 Tax Forms Printable

Free 1099 Tax Forms Printable

https://i.pinimg.com/originals/84/39/25/8439251aed2f493ff6de85d44058d911.gif

Irs Printable 1099 Form Printable Form 2024

https://www.printableform.net/wp-content/uploads/2021/06/what-is-irs-form-1099-q-turbotax-tax-tips-videos.jpg

1099 Form 2024 Download Ambur Bettine

https://legaltemplates.net/wp-content/uploads/Form-1099-screenshot.png

Those who need to send out a 1099 MISC can acquire a free fillable form by navigating the website of the IRS which is located at www irs gov Once you ve received your copy of the form you ll want to familiarize yourself with the various boxes that must be completed A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees The paying party must issue a 1099 NEC if payments during a calendar year exceed 600 and the recipient must use the form to report their income when filing taxes

Jotform is a reliable and intuitive tool for your 1099 tax form needs Users can fill out their 1099 forms for free with our drag and drop no code builder Jotform can also turn your completed form data into polished PDFs ready to be downloaded for your records This form may show only the last four digits of your TIN social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number

More picture related to Free 1099 Tax Forms Printable

1099 Form Fillable Pdf Printable Forms Free Online

https://fundsnetservices.com/wp-content/uploads/Lost-your-1099-Form.png

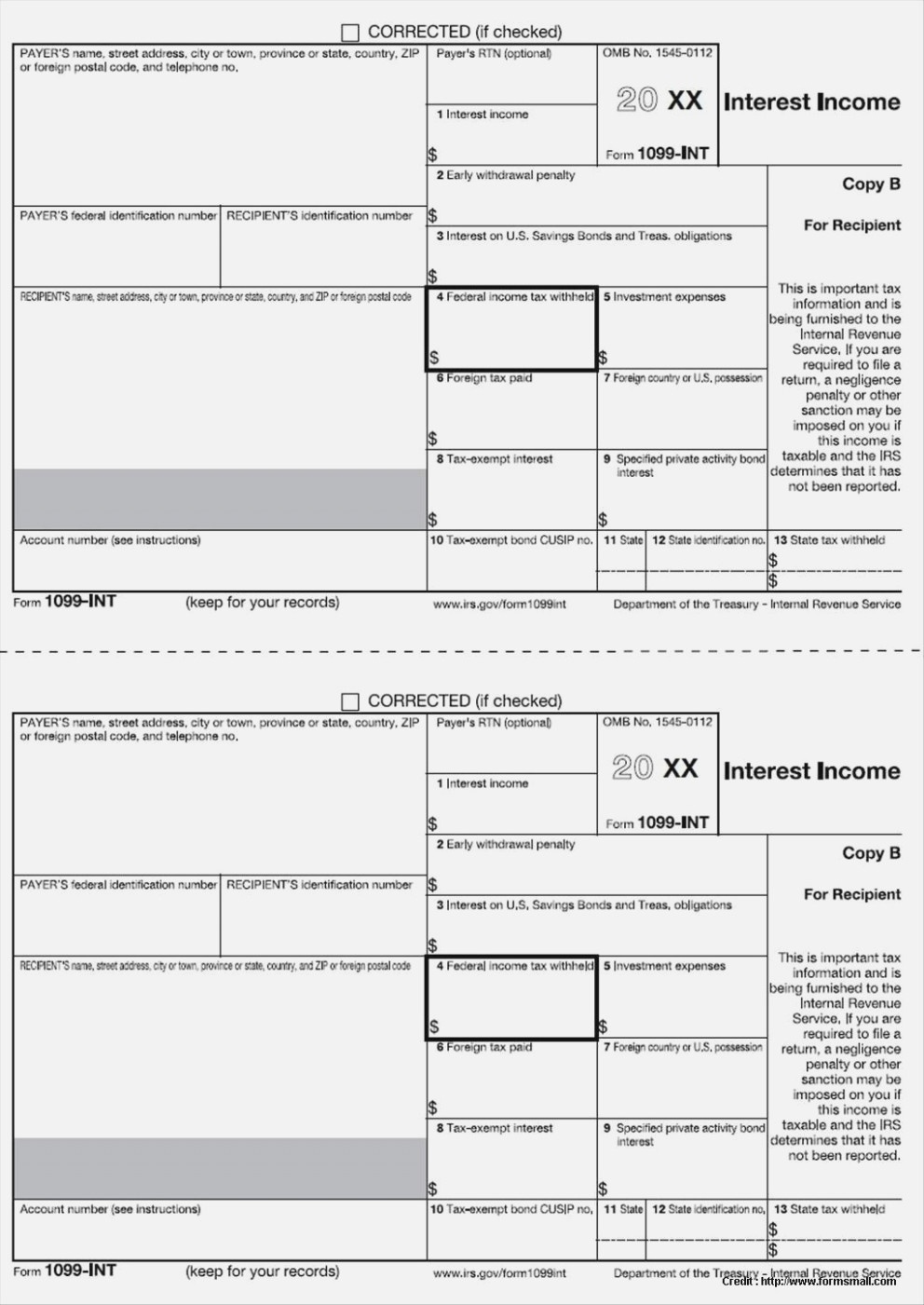

1099 Interest Fillable Form Printable Forms Free Online

https://secureservercdn.net/104.238.68.196/793.969.myftpupload.com/wp-content/uploads/2021/01/1099.png

96 Best Ideas For Coloring Print Your Own 1099

https://i.pinimg.com/originals/c9/c1/37/c9c13790a3fa5525a6837a05994f2175.jpg

Form 1099 is a collection of forms used to report payments that typically aren t from an employer 1099 forms can report different types of incomes These can include payments to independent contractors gambling winnings rents royalties and more Here s how to figure out whether you need to file a 1099 MISC for a payee when it s due and how to fill and file one properly Who exactly is a nonemployee Businesses normally use IRS Form W 2 to report wages collected by employees on their payroll

File your 1099 with the IRS for free Free support for self employed income independent contractor freelance and other small business income Can You Print 1099 Forms From a Regular Printer Everything You Need to Know If you paid a contractor or freelancer over 600 in a year you need to send them a 1099 NEC You can t print the IRS copy Copy A on plain paper it must be on special red inked paper Copies B C and 1 can be printed on regular paper

Tax Forms 1099 Printable Printable Forms Free Online

https://www.american-equity.com/filesimages/Tax Forms PDFs/1099 R 2018.JPG

1099 Tax Relief Instant Tax Solutions

https://instanttaxsolutions.com/wp-content/uploads/2020/10/1099-top-level-page-scaled.jpg

https://eforms.com/irs/form-1099

IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more There are 20 active types of

https://eforms.com/irs/form-1099/misc

A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a certain dollar threshold for rent royalties prizes awards medical and legal exchanges and other specific transactions must be reported to the IRS using this form

1099 Misc Form Printable Fillable

Tax Forms 1099 Printable Printable Forms Free Online

Free Printable 1099 Form Free Printable

Free 1099 Tax Forms Printable - You may either file Form 1099 MISC or Form 1099 NEC to report sales totaling 5 000 or more of consumer products to a person on a buy sell a deposit commission or other commission basis for resale