Free Fillable And Printable 1099 Forms IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more There are 20 active types of

This form may show only the last four digits of your TIN social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees The paying party must issue a 1099 NEC if payments during a calendar year exceed 600 and the recipient must use the form to report their income when filing taxes

Free Fillable And Printable 1099 Forms

Free Fillable And Printable 1099 Forms

https://legaltemplates.net/wp-content/uploads/free-1099-MISC-form.png

1099 Interest Fillable Form Printable Forms Free Online

https://secureservercdn.net/104.238.68.196/793.969.myftpupload.com/wp-content/uploads/2021/01/1099.png

Free Printable 1099 Tax Form Printable Forms Free Online

https://www.pdffiller.com/preview/421/116/421116584/big.png

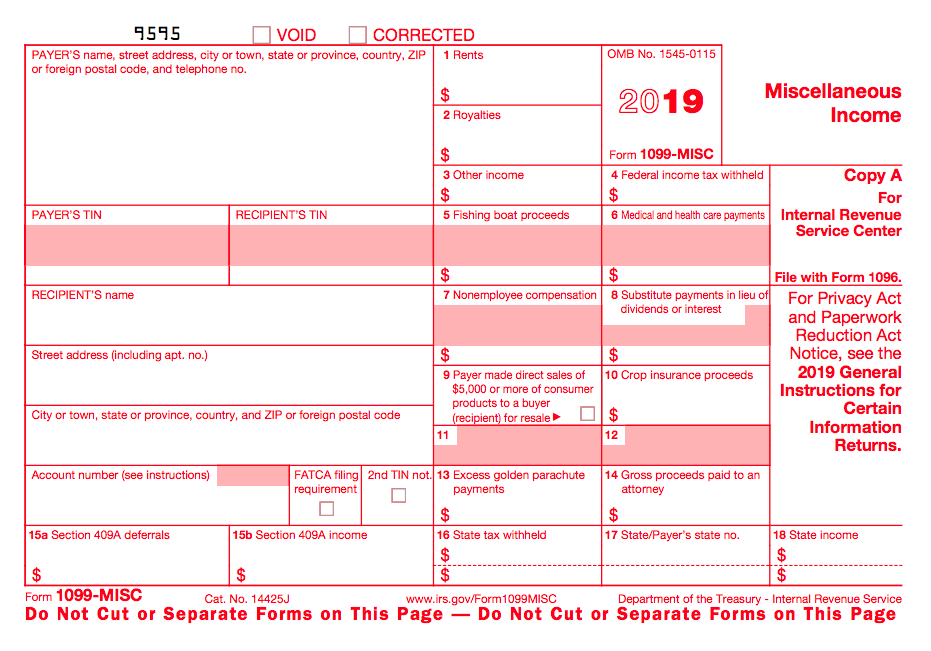

A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a certain dollar threshold for rent royalties prizes awards medical and legal exchanges and other specific transactions must be reported to the IRS using this form Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099 MISC form is featured below

Use Form 1099 MISC to report non salary payments your business made in 2023 Form 1099 MISC is a government form businesses use to show miscellaneous payments they distribute and taxpayers report them on their annual tax returns Form 1099 NEC is your go to tool for reporting nonemployee payments to the IRS and the workers you hire If your organization paid over 600 for services this year or withheld federal income tax from any payment regardless of amount it s time to file a 1099 NEC

More picture related to Free Fillable And Printable 1099 Forms

1099s Fillable Form Printable Forms Free Online

http://www.contrapositionmagazine.com/wp-content/uploads/2019/01/1099-s-fillable-form.jpg

1099 Form Printable 2023 Free

http://www.contrapositionmagazine.com/wp-content/uploads/2019/12/free-fillable-1099-form.jpg

Blank 1099 Form Blank 1099 Form 2021 ESign Genie

https://www.esigngenie.com/wp-content/uploads/2019/06/1099-Form_Page-1.jpg

Jotform is a reliable and intuitive tool for your 1099 tax form needs Users can fill out their 1099 forms for free with our drag and drop no code builder Jotform can also turn your completed form data into polished PDFs ready to be downloaded for your records Create Fillable Printable Form 1099 MISC online for 2021 tax year Fill Generate Download or print copies for free e File with IRS for 2 75 per Form Meet Your Mandated BOI Reporting

Before understanding how to fill out a 1099 form you ll need to identify workers who are contractors understand the process for completing a 1099 NEC form and submit the forms properly If you ve provided Form 1099 MISC to Want to print 1099 forms at home Here s how to do it right and avoid costly mistakes with the IRS See tips tips for PDFs Excel sheets QuickBooks Sage 50 and Patriot

Free Printable 1099 Tax Form Printable Forms Free Online

https://i.pinimg.com/originals/84/39/25/8439251aed2f493ff6de85d44058d911.gif

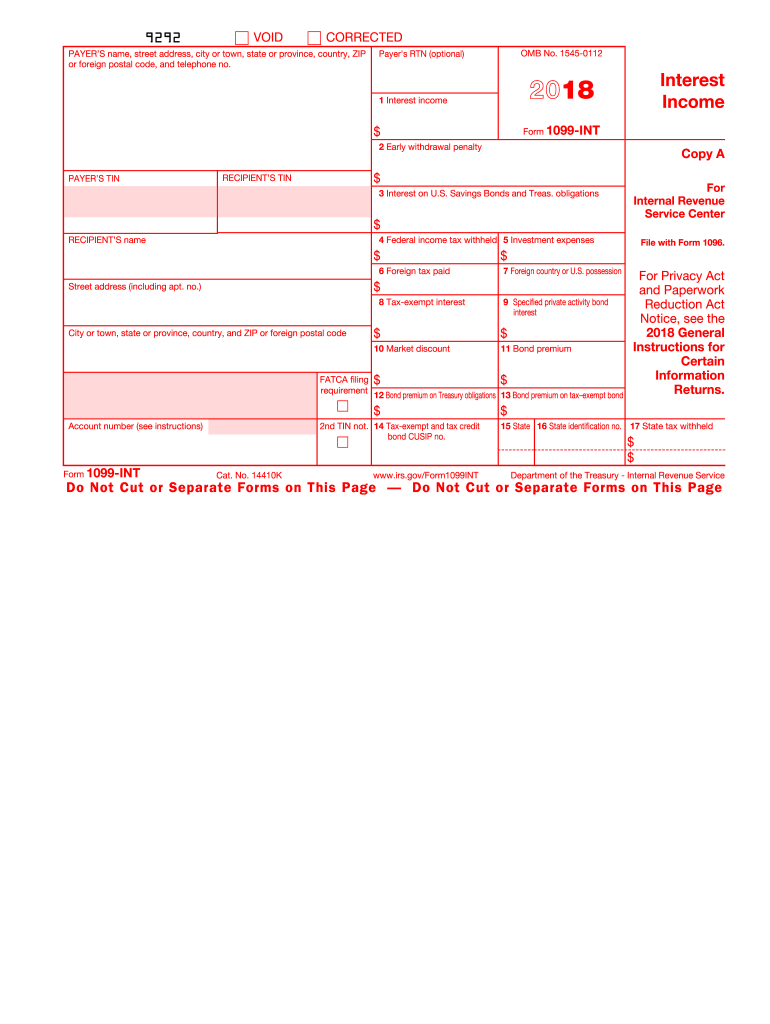

2018 Form IRS 1099 INT Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/445/723/445723799/large.png

https://eforms.com/irs/form-1099

IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more There are 20 active types of

https://www.irs.gov/pub/irs-pdf/f1099nec.pdf

This form may show only the last four digits of your TIN social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number

Free Fillable 1099 Tax Form Printable Forms Free Online

Free Printable 1099 Tax Form Printable Forms Free Online

1099 Misc Form Printable Fillable

How To File 1099 S Fill Online Printable Fillable Blank PdfFiller

:max_bytes(150000):strip_icc()/1099-R2022-2372bb9e77514c4a8af4bcc393b6cd36.jpeg)

1099 Form 2023 Pdf Printable Forms Free Online

:max_bytes(150000):strip_icc()/1099-R2022-2372bb9e77514c4a8af4bcc393b6cd36.jpeg)

Free Fillable And Printable 1099 Forms - Use Form 1099 MISC to report non salary payments your business made in 2023 Form 1099 MISC is a government form businesses use to show miscellaneous payments they distribute and taxpayers report them on their annual tax returns