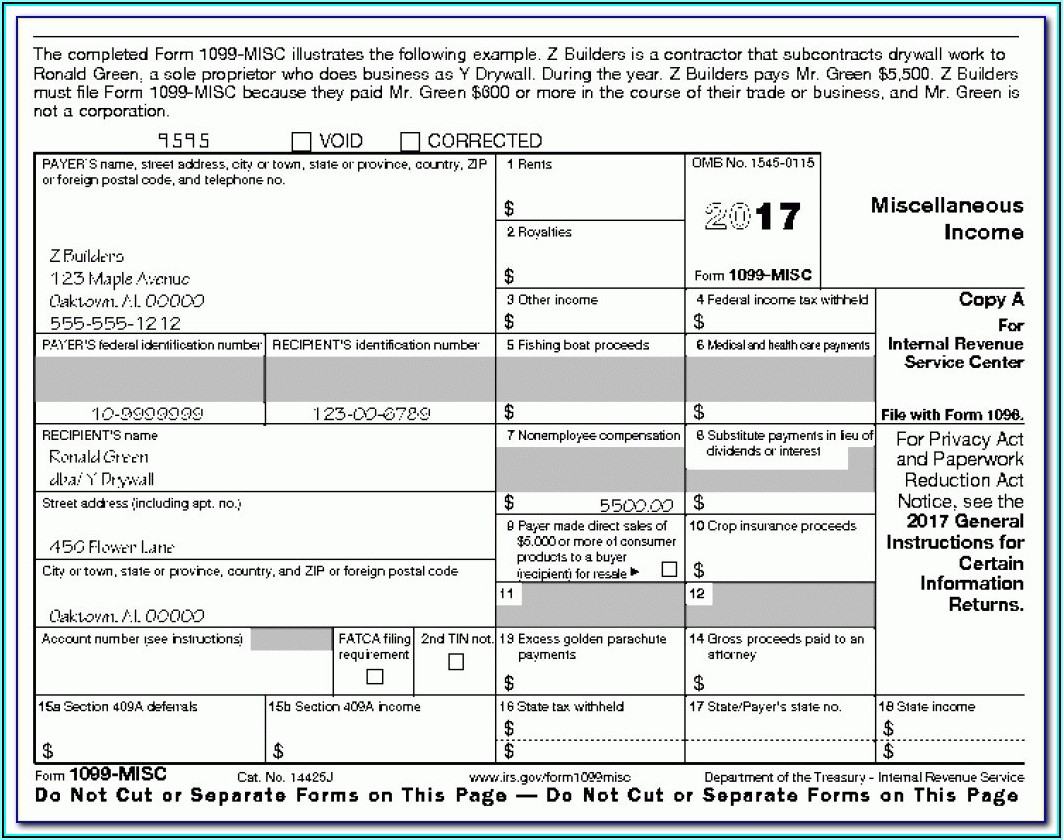

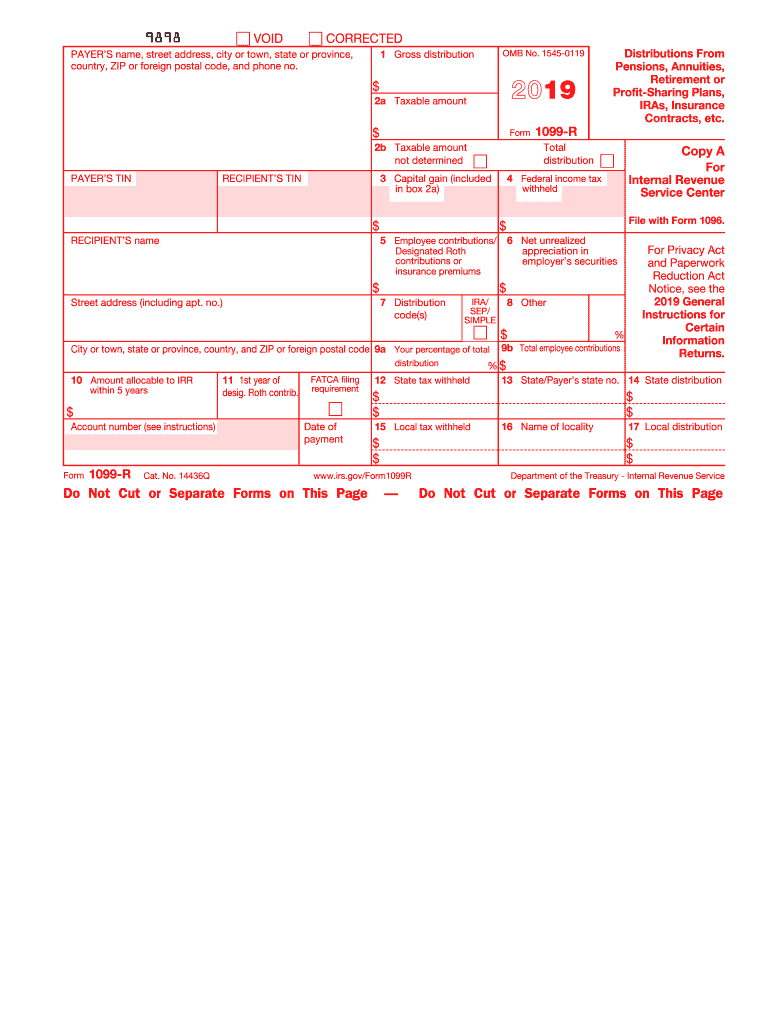

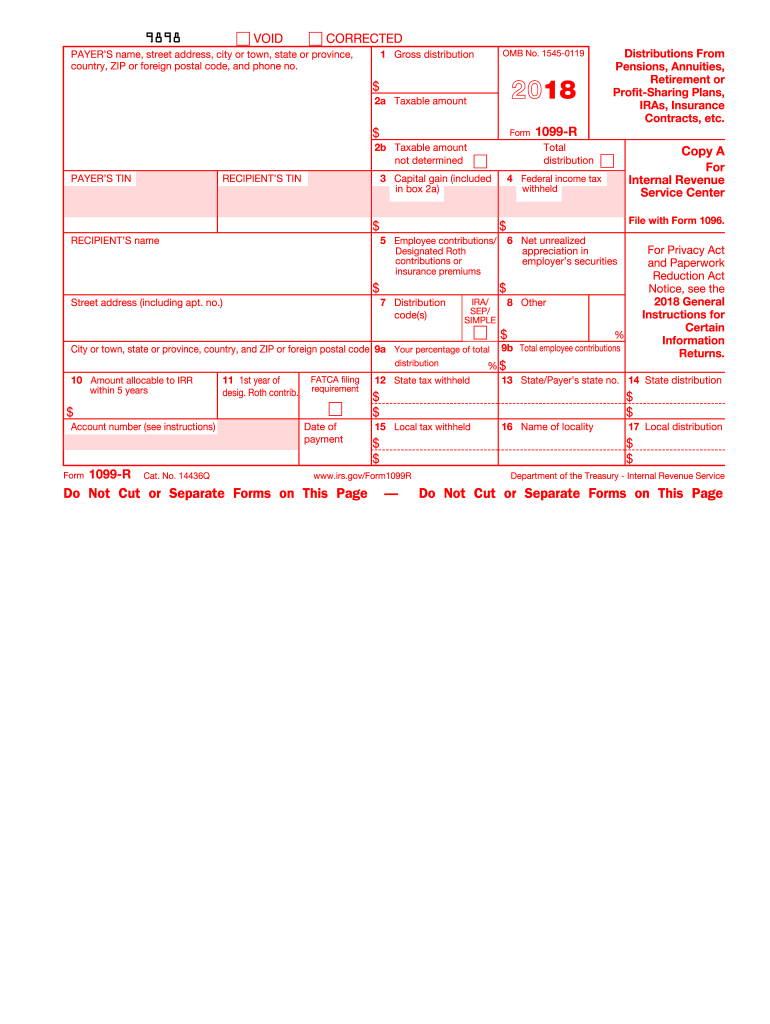

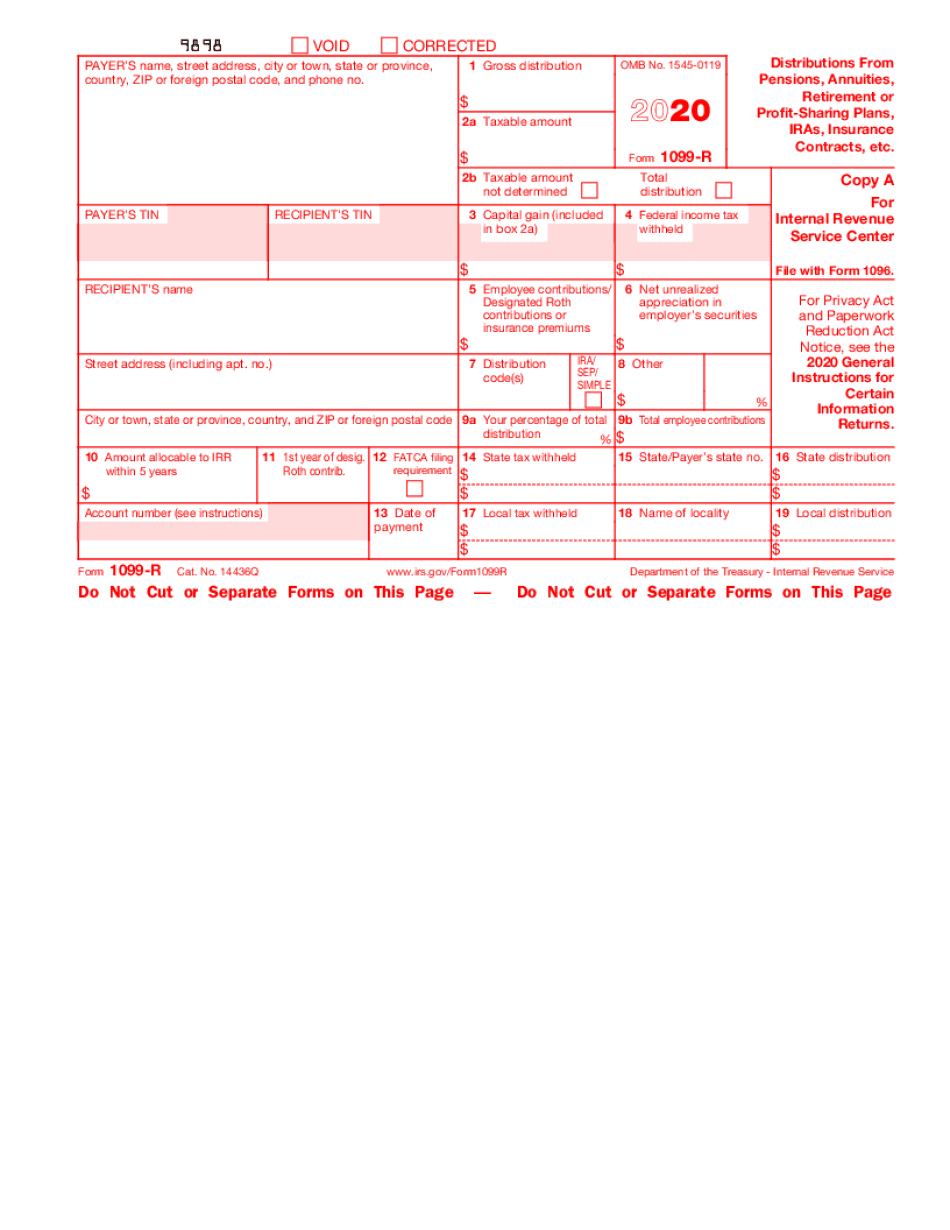

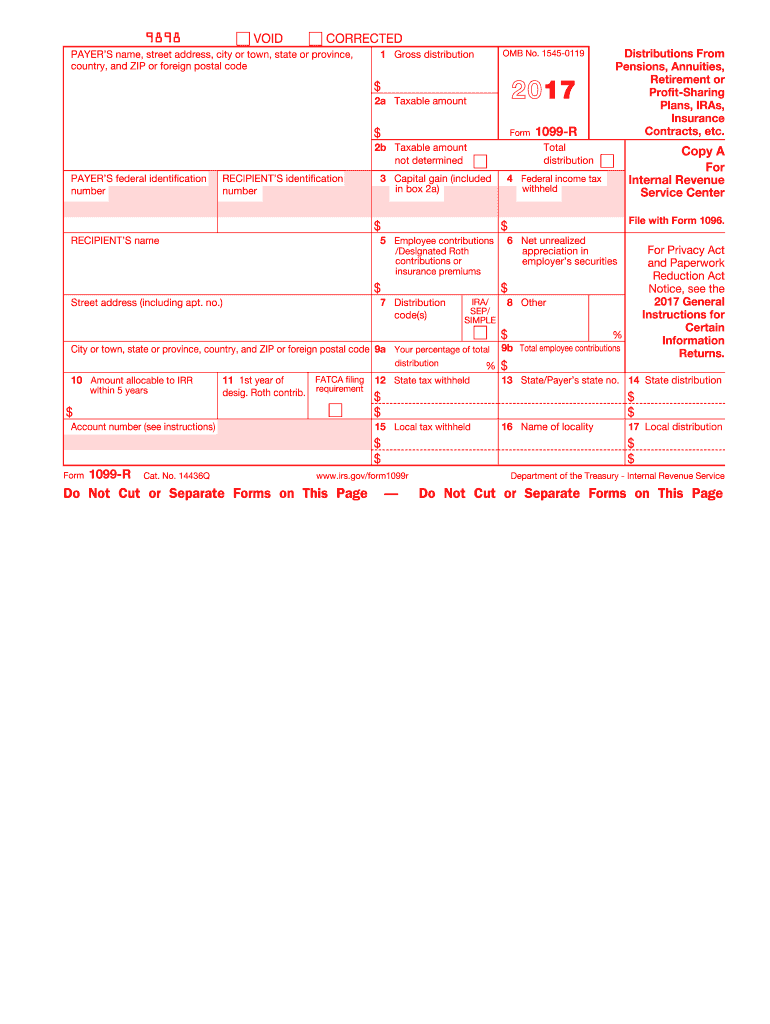

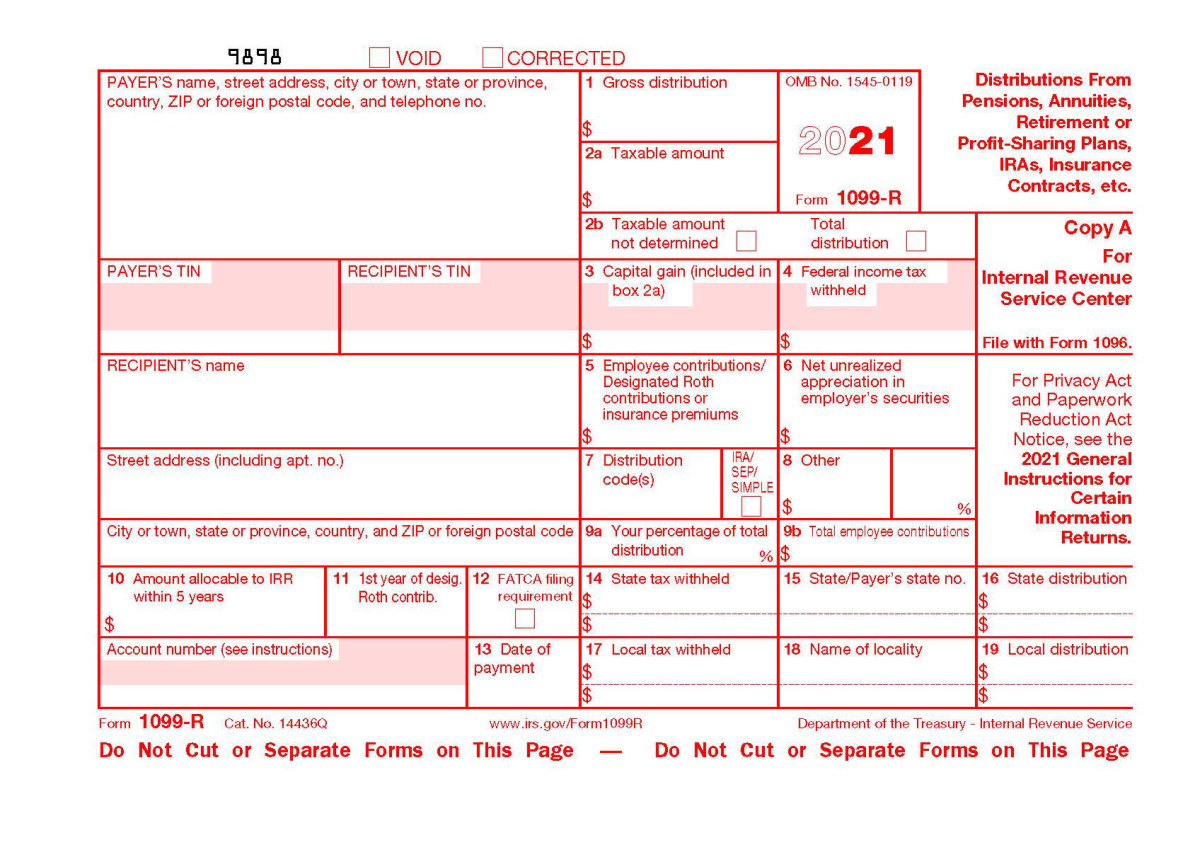

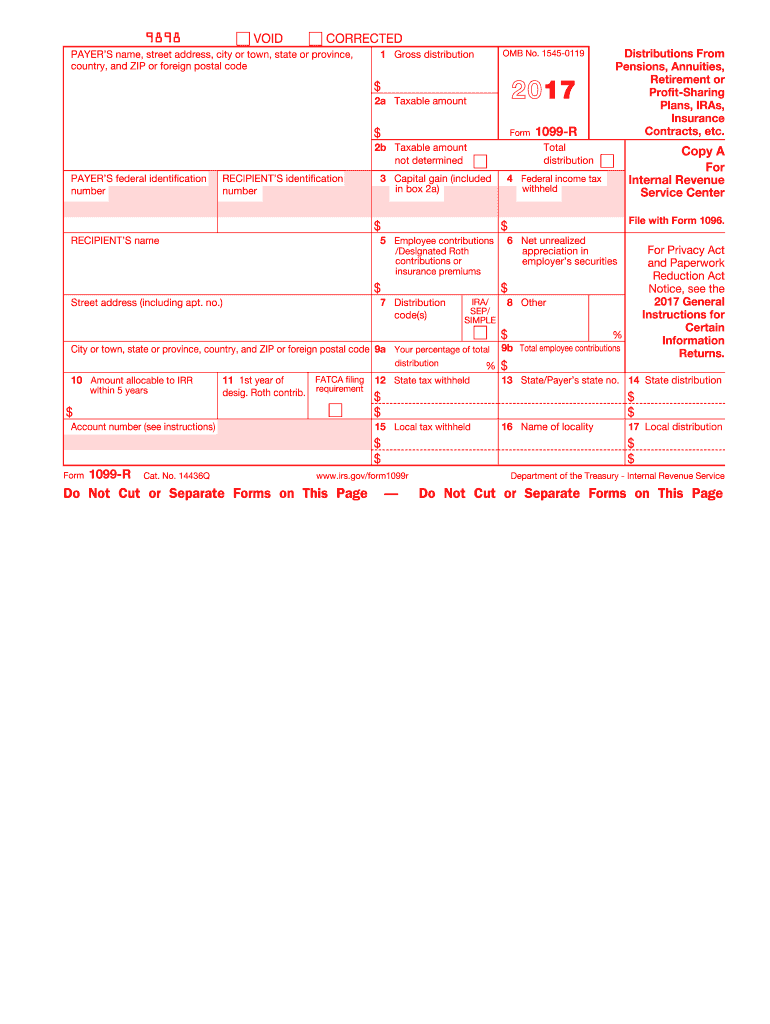

Free Printable 1099 R Form File Form 1099 R for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from Profit sharing or retirement plans Any individual retirement arrangements IRAs Annuities pensions insurance contracts survivor income benefit plans

A 1099 R form is used by payers trustees and plan administrators to report designated distributions from profit sharing and retirement plans when the distribution has a value of 10 or more Distributions are reported by filing this form with the Internal Revenue Service IRS and providing a copy to the recipient of the distribution Get your 1099 R tax form Learn how to view download print or request by mail your annual 1099 R tax form that reports how much income you earned from your annuity

Free Printable 1099 R Form

Free Printable 1099 R Form

https://www.contrapositionmagazine.com/wp-content/uploads/2020/10/printable-form-1099.jpg

Free Printable 1099 R Form Printable Forms Free Online

https://www.thestreet.com/.image/t_share/MTc4MzI2MDE1OTAxMTgxNTQ5/f1099r_page_02-web.jpg

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png)

Printable 1099 R Form Printable Forms Free Online

https://www.investopedia.com/thmb/Bb0JpMtsCdiZ1trpMCb-YJNjtns=/1663x1100/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png

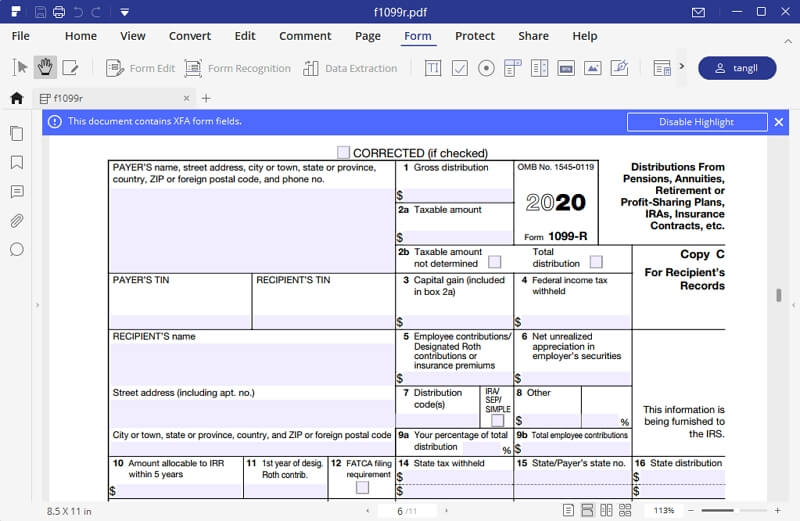

Form CSA 1099 R Civil Service Retirement Benefits The Ofice of Personnel Management issues Form CSA 1099 R for annuities paid or Form CSF 1099 R for survivor annuities paid The CSA Form 1099 R box numbers reflect the standard numbering on a Form 1099 R If the taxable amount isn t calculated in Box 2 the Simplified Method must be used Form 1099 R is prepared and submitted by entities that manage retirement plans for every recipient of the distribution from the retirement plan This document outlines various distributions from annuities pensions insurance agreements and retirement accounts

Download or print the 2023 Federal Form 1099 R Distributions From Pensions Annuities Retirement or Profit Sharing Plans IRAs Insurance Contracts etc for FREE from the Federal Internal Revenue Service IRS Form 1099 R reports income received from IRAs pensions retirement plans profit sharing plans insurance contracts and annuities Whether you re required to pay taxes on this income depends on the source

More picture related to Free Printable 1099 R Form

2019 Form IRS 1099 R Fill Online Printable Fillable Blank PDFfiller

https://www.pdffiller.com/preview/460/0/460000729/large.png

IRS 1099 R 2018 Fill And Sign Printable Template Online US Legal Forms

https://www.pdffiller.com/preview/445/681/445681868/large.png

1099 R Fillable Form Printable Forms Free Online

https://www.pdffiller.com/preview/496/222/496222006/big.png

Form 1099 R is used to report the distribution of retirement benefits such as pensions and annuities You should receive a copy of Form 1099 R or some variation if you received a distribution of 10 or more from your retirement plan Increase in required minimum distribution RMD age The age for RMDs was increased to 73 by the SECURE 2 0 Act of 2022 For more information see RMDs later In addition see the current General Instructions for Certain Information Returns for information on the following topics

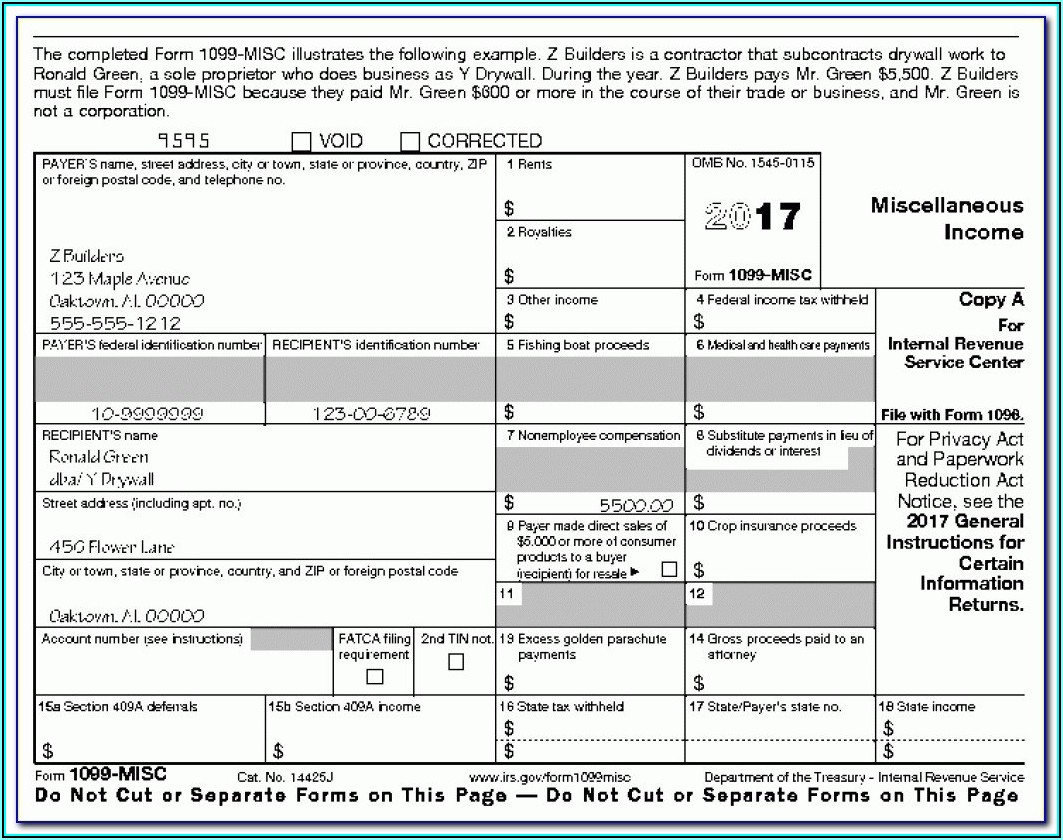

IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more There are 20 active types of Knowing what to do with a 1099 R can help you accurately report the income you received and that you may have to pay tax on Let s answer the question What is a 1099 R and talk about what to do if you receive one What is a 1099 R When might I receive a 1099 R What information is on a 1099 R What should I do with Form 1099 R

IRS 1099 R 2017 Fill And Sign Printable Template Online US Legal Forms

https://www.pdffiller.com/preview/392/932/392932417/large.png

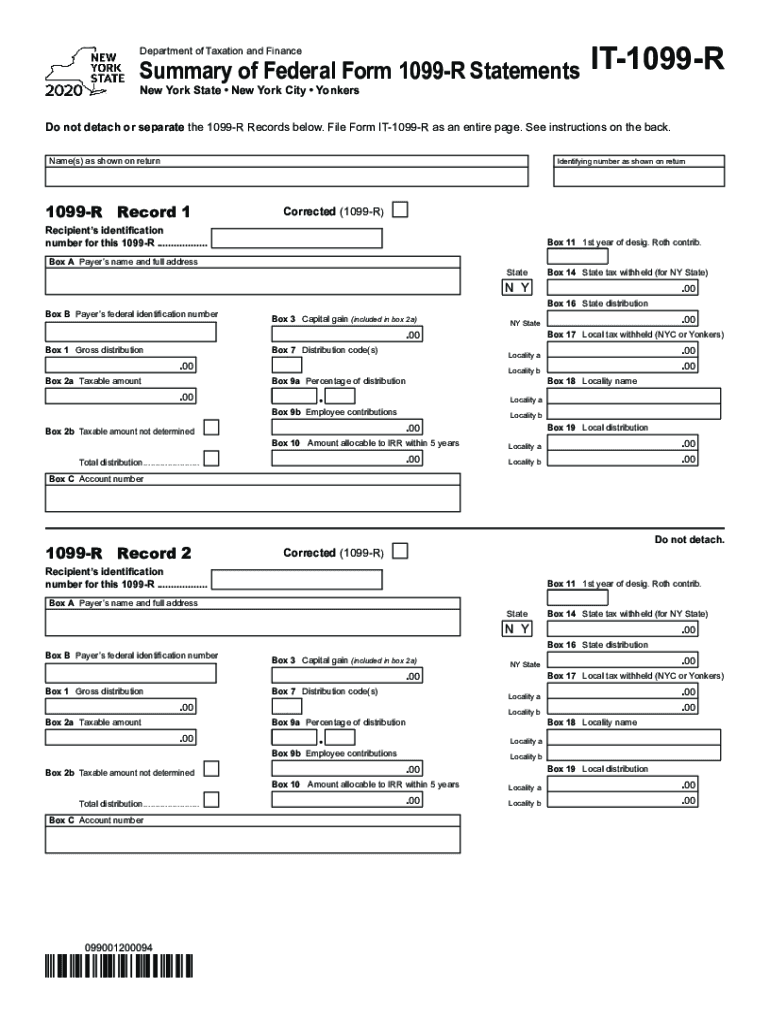

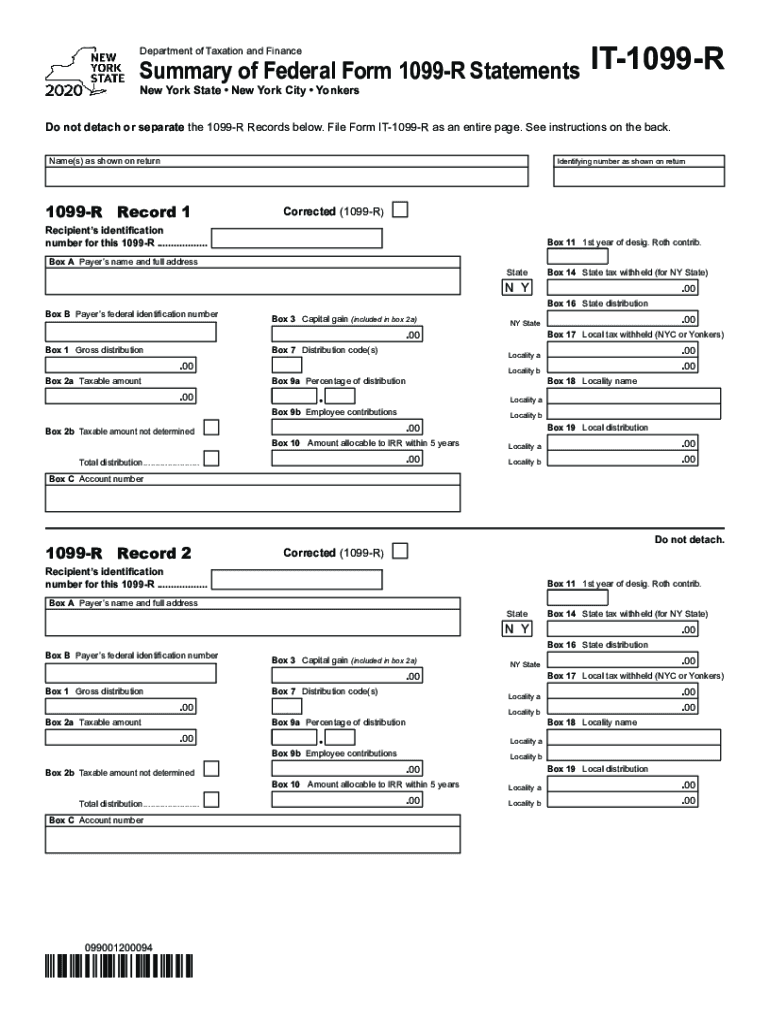

Printable Form It 1099 R Printable Forms Free Online

https://www.taxbandits.com/content/images/form/form1099r-1.png

https://www.irs.gov/forms-pubs/about-form-1099-r

File Form 1099 R for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from Profit sharing or retirement plans Any individual retirement arrangements IRAs Annuities pensions insurance contracts survivor income benefit plans

https://eforms.com/irs/form-1099/r

A 1099 R form is used by payers trustees and plan administrators to report designated distributions from profit sharing and retirement plans when the distribution has a value of 10 or more Distributions are reported by filing this form with the Internal Revenue Service IRS and providing a copy to the recipient of the distribution

1099 Form 2023 Printable Free Pdf One Page

IRS 1099 R 2017 Fill And Sign Printable Template Online US Legal Forms

E file 2022 Form 1099 R Report The Distributions From Pensions

2023 Form 1099 R Printable Forms Free Online

1099 Form Free Printable Printable Forms Free Online

It 1099 R 2020 2024 Form Fill Out And Sign Printable PDF Template AirSlate SignNow

It 1099 R 2020 2024 Form Fill Out And Sign Printable PDF Template AirSlate SignNow

IRS Form 1099 R How To Fill It Right And Easily

SDCERS Form 1099 R Explained

Free Printable 1099 Int Form Form Resume Examples

Free Printable 1099 R Form - Report the amount on Form 1040 1040 SR or 1040 NR on the line for IRAs pensions and annuities or the line for Taxable amount and on Form 8606 as applicable