How Much Tax To Pay On 4000 You can use the tax rate calculator to estimate whether the tax rate indicated in your tax card needs to be changed This may be necessary if you have started or stopped working for

Full salary after tax calculation for Finland based on 4 000 00 annual salary and the 2025 income tax rates in Finland Useful for Finland expats and Finland residents You can calculate how much tax you would pay using Vero s calculator https www vero fi en individuals tax cards and tax returns tax card tax percentage

How Much Tax To Pay On 4000

How Much Tax To Pay On 4000

https://i.ytimg.com/vi/Gjr8aYsysgA/maxresdefault.jpg

How Much Tax Do Landlords Pay On Rental Income Answer

https://smallbusinessowneradvice.co.uk/wp-content/uploads/2022/09/How-Much-Tax-Do-Landlords-Pay.jpg

How To Pay Your Taxes YouTube

https://i.ytimg.com/vi/bZjTIHPyY94/maxresdefault.jpg

With gross pay of 2 000 euros your take home pay is 1 661 euros or 83 per cent of your gross pay for gross pay of 4 000 euros you take home 2 762 euros or 69 per cent Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2025 to 5 April 2026

Use our Bonus Tax Calculator to see the amount of tax paid on a bonus on top of regular salary How much of the bonus do you take home more options Adjust your details above and the calculation will automatically refresh Free online income tax calculator to estimate U S federal tax refund or owed amount for both salary earners and independent contractors

More picture related to How Much Tax To Pay On 4000

How To Deal With Employee Taxes

https://www.payrollpartners.com/wp-content/uploads/2023/04/April-21-2023.jpg

How To Calculate Income Tax On Salary With Example

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-16-1024x538.png

How Much Tax Will Shohei Ohtani Have To Pay On His 700 Million Mega

https://phantom-marca.unidadeditorial.es/01b1b106b9361db4d1d0a3cc6a30c7f8/crop/0x0/2044x1363/resize/1200/f/webp/assets/multimedia/imagenes/2023/12/11/17023205221950.jpg

On a 4 000 salary your take home pay will be 4 000 after tax and National Insurance This equates to 333 33 per month and 76 92 per week If you work 5 days per week this is Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This

An individual who receives 3 694 00 net salary after taxes is paid 4 000 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security Let s look at how to Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income Student loan pension contributions bonuses company

How Much Tax You Pay On A 250k Salary In Australia YouTube

https://i.ytimg.com/vi/8Ih8NFrPFok/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYZSBXKEkwDw==&rs=AOn4CLD1-7GyCEsE23qlOYak6niXoj8B_A

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

https://www.vero.fi › en › individuals › tax-cards-and...

You can use the tax rate calculator to estimate whether the tax rate indicated in your tax card needs to be changed This may be necessary if you have started or stopped working for

https://fi.icalculator.com › salary-example

Full salary after tax calculation for Finland based on 4 000 00 annual salary and the 2025 income tax rates in Finland Useful for Finland expats and Finland residents

What Percentage Of Taxes Needs To Pay On Winning Lottery The Lottery

How Much Tax You Pay On A 250k Salary In Australia YouTube

How Much Tax Will You Have To Pay On The Sale Of Your Rental Property

How Much Tax Will I Pay

Federal Income Tax Brackets 2021 Vs 2022 Orangerilo

Weekly Payroll Deduction Chart

Weekly Payroll Deduction Chart

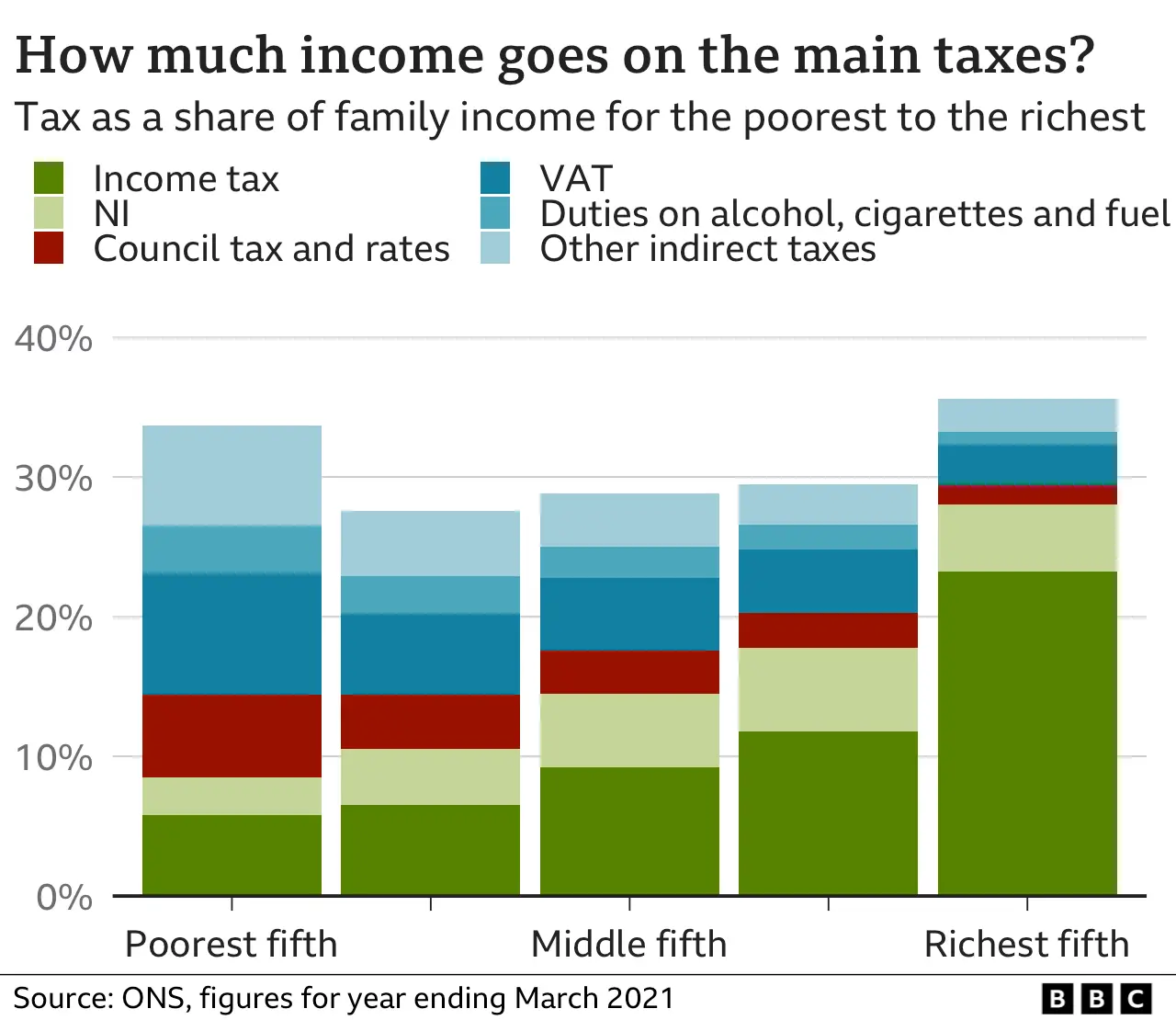

National Insurance What Are NI And Income Tax And What Do I Pay

How Much Tax Do I Have To Pay On Rental Income

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

How Much Tax To Pay On 4000 - Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income