Income Tax Act 2007 Pdf The meaning of INCOME is a gain or recurrent benefit usually measured in money that derives from capital or labor also the amount of such gain received in a period of time How to use

E Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries 1800 103 Income Example For example qualified dividends and long term capital gains made on investments are taxed at a lower rate than ordinary income Income from social

Income Tax Act 2007 Pdf

Income Tax Act 2007 Pdf

https://law-all.com/image/cache/catalog/data/Book Images/Nasik Law House/2019/NLH035-800x800.jpg

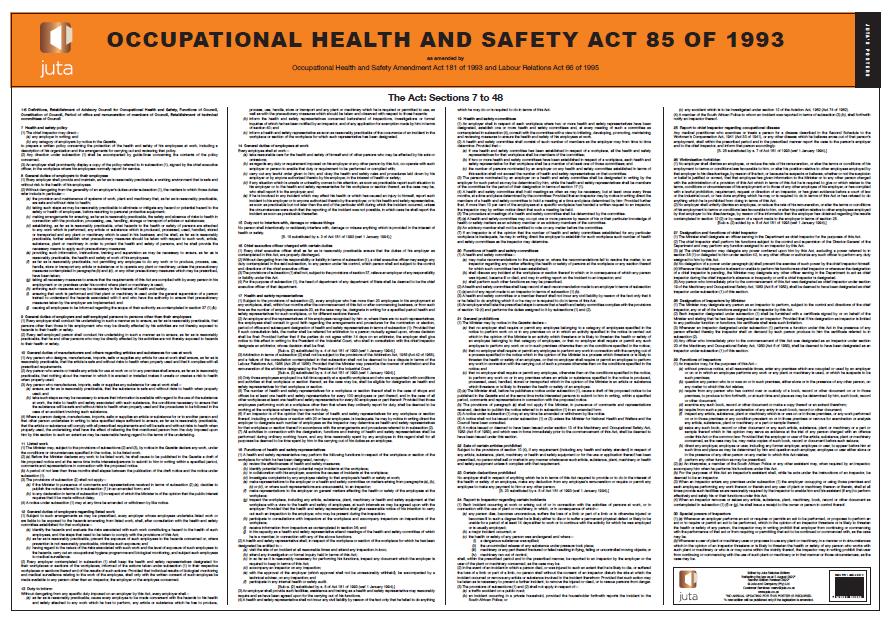

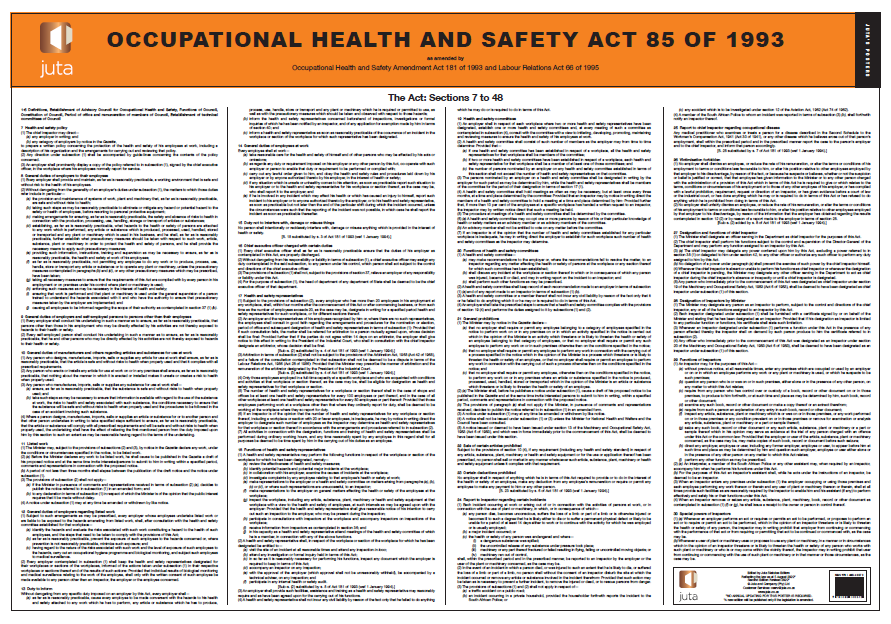

Occupational Health And Safety Act 85 Of 1993 Poster

https://juta.co.za/jec-media/images/products/2022/10/OHSA_POSTER.png

T19 0137 Tax Benefit Of Self Employed Health Insurance Deduction By

https://www.taxpolicycenter.org/sites/default/files/model-estimates/images/t19-0137_2.png

Personal Income Tax Act Cap P8 Laws of Federation of Nigeria 2004 PITA 2004 Personal Income Tax Amendment Act 2011 PITA 2011 Finance Act 2019 Finance Act Income or net income is a company s total earnings after deducting expenses Both revenue and net income are useful in determining the financial strength of a company but

My Income app Manage your insurance needs within a single app View existing policy information get information of our products and services and more on the go View app features The official website for e Filing of income tax returns and related services in India

More picture related to Income Tax Act 2007 Pdf

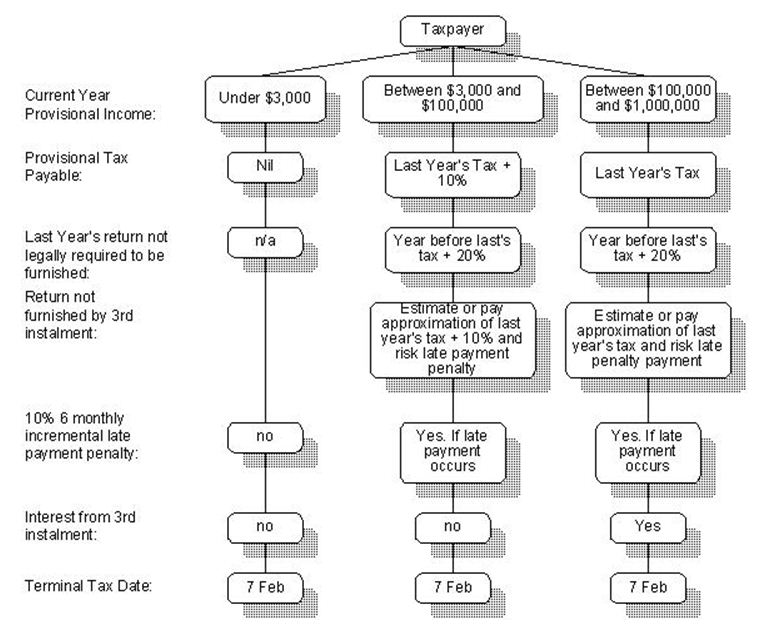

Tax Flow Chart Nz Flowchart Examples

https://www.taxtechnical.ird.govt.nz/-/media/project/ir/tt/resources/9/0/90e21c00404c3a48b7b8bf558bf61937/flowchart-07.jpg

Income Tax Act 2007 No 97 as At 02 February 2025 Public Act Subpart

https://www.legislation.govt.nz/act/public/2007/0097/latest/images/IncomefB2.JPG

Tax Act 2024 Update Teddy Gennifer

https://ebizfiling.com/wp-content/uploads/2023/03/Section-43-B-of-income-tax-act.png

Gross Income Suppose a shoe manufacturing company sells shoes worth Rs 10 00 000 over the course of a quarter And the amount spent on production and wages to workers is worth Rs Solomon Adeola chairman of the senate committee on appropriations says Nigerians earning N800 000 or less annually will no longer pay personal income tax under the

[desc-10] [desc-11]

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction.jpg

What Is Tax Avoidance Generate Accounting

https://i1.wp.com/generateaccounting.co.nz/wp-content/uploads/2013/08/Tax-Avoidance.jpg?fit=1000%2C667&ssl=1

https://www.merriam-webster.com › dictionary › income

The meaning of INCOME is a gain or recurrent benefit usually measured in money that derives from capital or labor also the amount of such gain received in a period of time How to use

https://www.incometax.gov.in

E Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries 1800 103

Income Tax Act 2007 No 97 Public Act BC 8 Satisfaction Of Income Tax

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Wolters Kluwer NZ CCH Books New Zealand Income Tax Act 2007 2023

Section 139 4a Of Income Tax Act

Medical Expenses Deduction Under Income Tax Act 2023 Update

New Clause H Of Section 43B With Applicable Date Effect

New Clause H Of Section 43B With Applicable Date Effect

Practitioner s Income Tax Act 2023 64th Edition Thomson Reuters

Notices Under Section 142 1 Of Income Tax Act 1961

Last minute Income Tax Saving Options Ebizfiling

Income Tax Act 2007 Pdf - [desc-14]