Income Tax Act 2007 Section 23 INCOME definition 1 money that is earned from doing work or received from investments 2 a company s profit in a Learn more

Learn about what income means for individuals businesses the different types of income and some examples of how income is earned Click for more Income is an increase in the net assets of the entity except for increases caused by contributions from owners Two main types of income are sales revenue and gains Examples of income

Income Tax Act 2007 Section 23

Income Tax Act 2007 Section 23

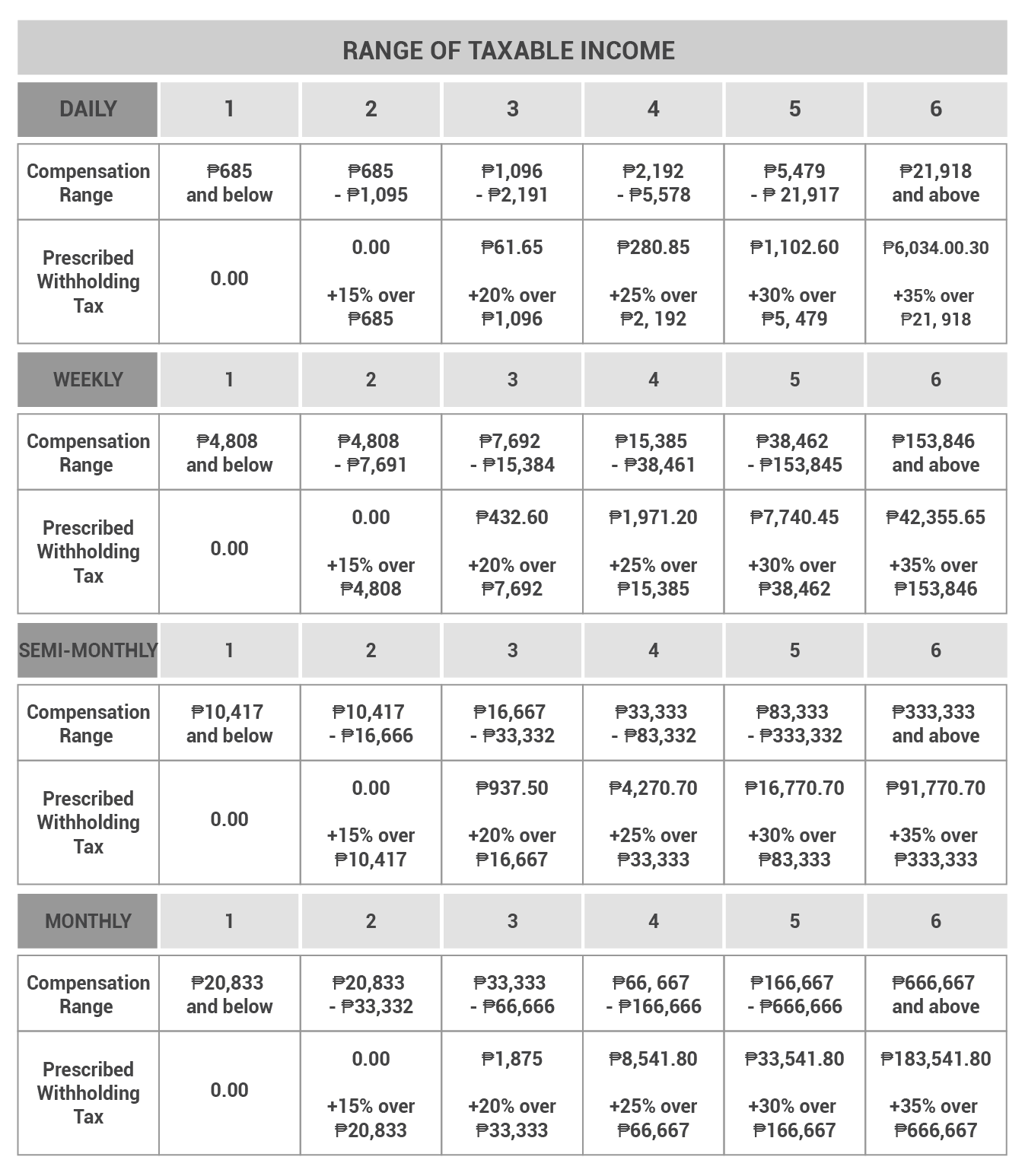

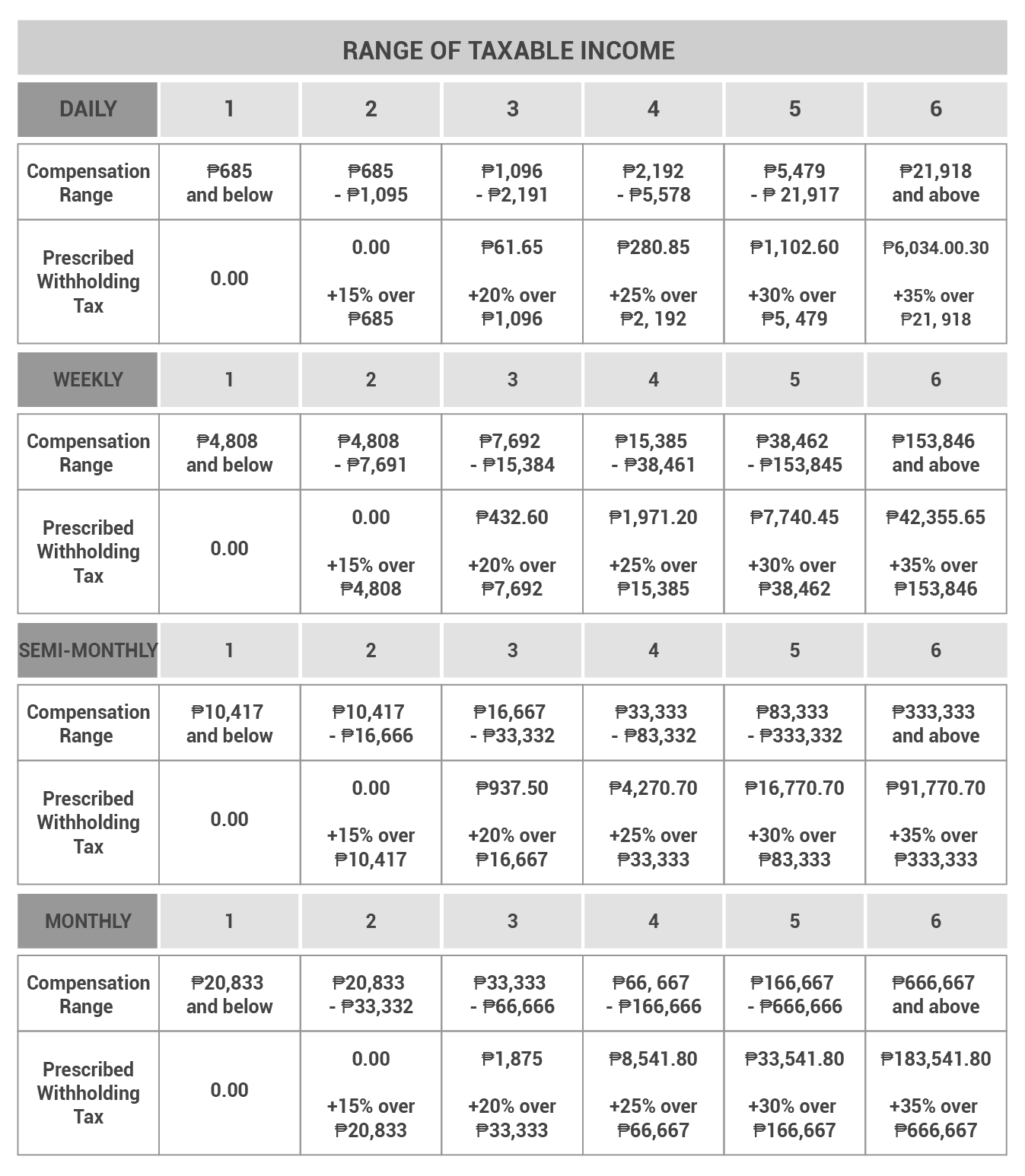

https://kittelsoncarpo.com/wp-content/uploads/2023/02/TAX-SSS-PHIC-UPDATES_TABLES-02-min.png

Tax Act 2024 Download Faith Jasmine

https://navi.com/blog/wp-content/uploads/2022/04/Section-281-1.webp

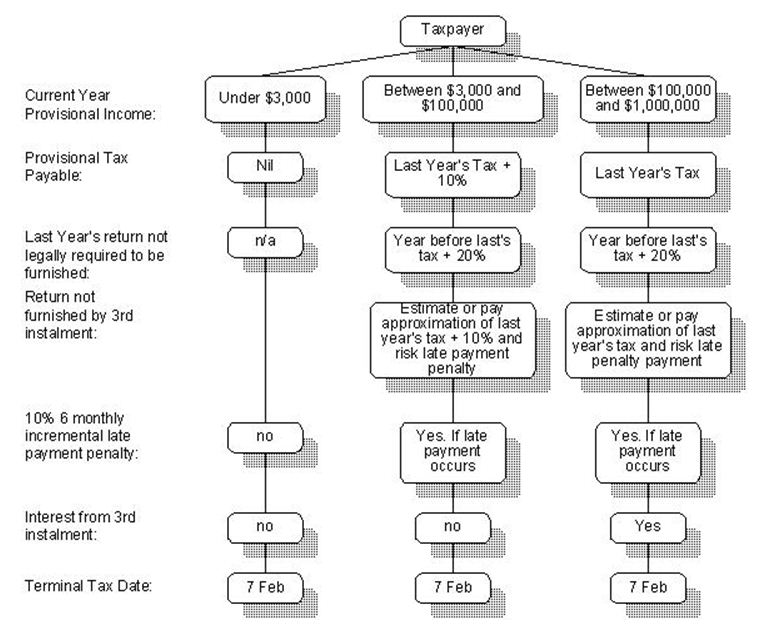

Tax Flow Chart Nz Flowchart Examples

https://www.taxtechnical.ird.govt.nz/-/media/project/ir/tt/resources/9/0/90e21c00404c3a48b7b8bf558bf61937/flowchart-07.jpg

What is Income Income can be broadly defined as the amount of money received for providing labor capital or other assets It is typically measured in terms of a specific time Income refers to money cash or cash equivalents coming in either for work done interest or profit from capital invested or rent from a property or land that is let When it comes from

A two income family a family in which both adults have jobs that provide income Every company must keep control of its income and expenditure Financial assets have the advantage of earning income For 2023 expenditure exceeded income by 10 000 He has a

More picture related to Income Tax Act 2007 Section 23

Income Tax Act 2007 No 97 as At 02 February 2025 Public Act Subpart

https://www.legislation.govt.nz/act/public/2007/0097/latest/images/IncomefB2.JPG

Section 13 OF THE INCOME TAX ACT

https://www.legalmantra.net/admin/assets/upload_image/blog/INCOME_TAX2.jpg

Income Tax Deduction 2025 Clayton A Brill

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction-913x1024.jpg

Discover what income explained is and how it s taxed and see real world examples Learn the different types of income and how taxation affects Income meaning definition what is income the money that you earn from your work o Learn more

[desc-10] [desc-11]

Tax Act 2024 Update Teddy Gennifer

https://ebizfiling.com/wp-content/uploads/2023/03/Section-43-B-of-income-tax-act.png

What Is Tax Avoidance Generate Accounting

https://i1.wp.com/generateaccounting.co.nz/wp-content/uploads/2013/08/Tax-Avoidance.jpg?fit=1000%2C667&ssl=1

https://dictionary.cambridge.org › dictionary › english › income

INCOME definition 1 money that is earned from doing work or received from investments 2 a company s profit in a Learn more

https://www.financestrategists.com › tax › income

Learn about what income means for individuals businesses the different types of income and some examples of how income is earned Click for more

Income Tax Act 2007 No 97 Public Act BC 8 Satisfaction Of Income Tax

Tax Act 2024 Update Teddy Gennifer

Wolters Kluwer NZ CCH Books New Zealand Income Tax Act 2007 2023

Income Tax Amendment Act 2024 Paola Beatrisa

Section 115BAC Of Income Tax Act IndiaFilings

Section 139 4a Of Income Tax Act

Section 139 4a Of Income Tax Act

New Clause H Of Section 43B With Applicable Date Effect

Section 11 Income Tax Act Exemptions For Charitable Trusts

Practitioner s Income Tax Act 2023 64th Edition Thomson Reuters

Income Tax Act 2007 Section 23 - Every company must keep control of its income and expenditure Financial assets have the advantage of earning income For 2023 expenditure exceeded income by 10 000 He has a