Income Tax Act 2007 Uk For amounts based on your specific income use the Old Age Security OAS estimator If you lived in Canada for at least 10 years but less than 40 years after age 18 you will receive a

The Canada Disability Benefit is a monthly payment for working age persons with disabilities who have low income The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was

Income Tax Act 2007 Uk

Income Tax Act 2007 Uk

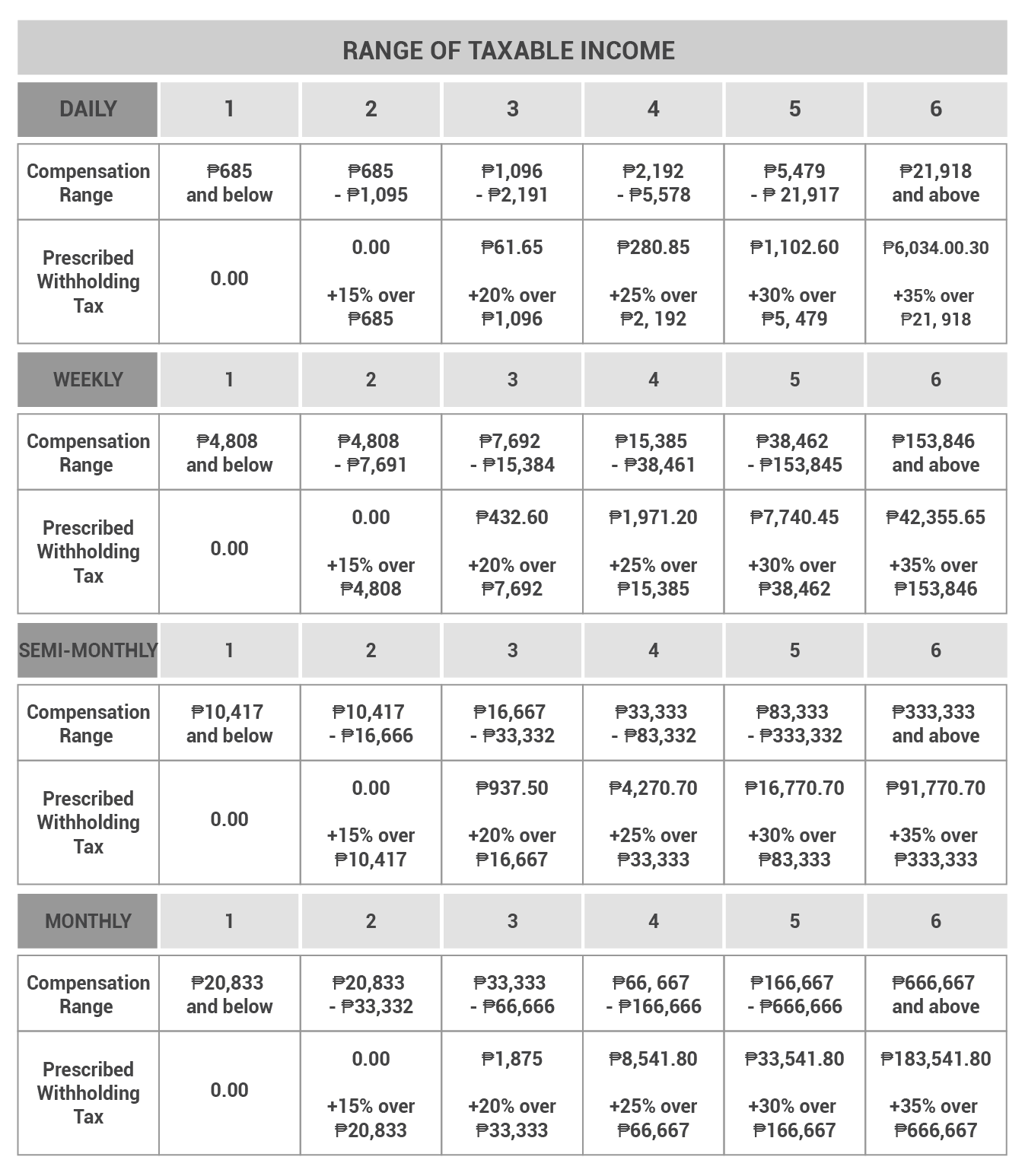

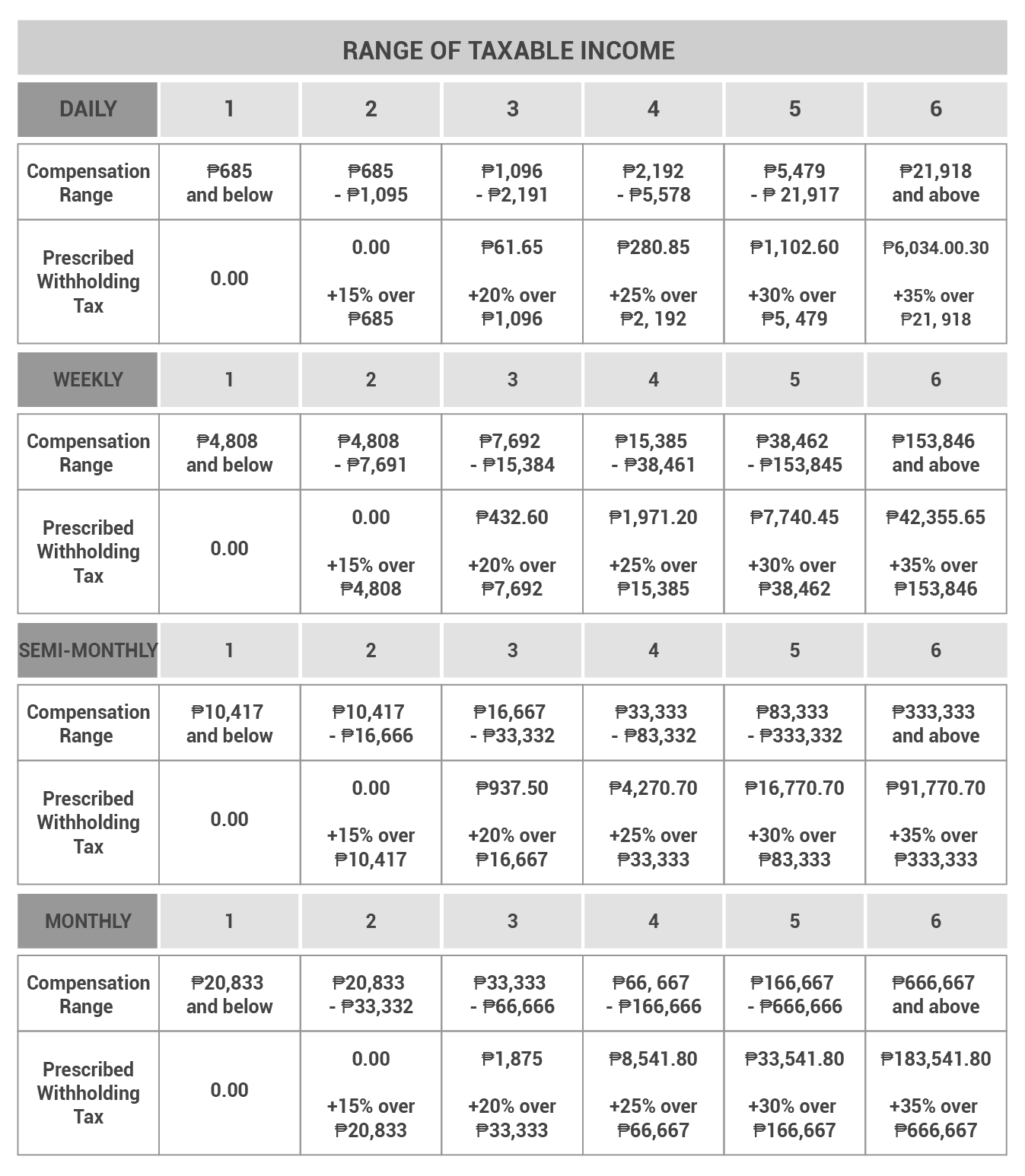

https://kittelsoncarpo.com/wp-content/uploads/2023/02/TAX-SSS-PHIC-UPDATES_TABLES-02-min.png

Capital Gains Rates 2025 Daniel Harris

http://www.taxpolicycenter.org/sites/default/files/4.2.1-figure1.png

Future Of Charities And Tax Ppt Download

https://slideplayer.com/slide/16613036/96/images/3/Income+Tax+Exemptions+Country+All+income+exempt.jpg

If you receive federal benefits including some provincial territorial benefits you will receive payment on these dates If you set up direct deposit payments will be deposited in your How does the recovery tax deduction work Once your Old Age Security Return of Income form is received the net world income you report is used to estimate your Old Age Security OAS

This Chapter discusses the tax implications of receiving a taxable dividend from a corporation resident in Canada focusing on dividends received by individuals and corporations who are Personal income tax Manitoba tax information for 2024 Use the information on this page to help you complete your provincial tax and credits form

More picture related to Income Tax Act 2007 Uk

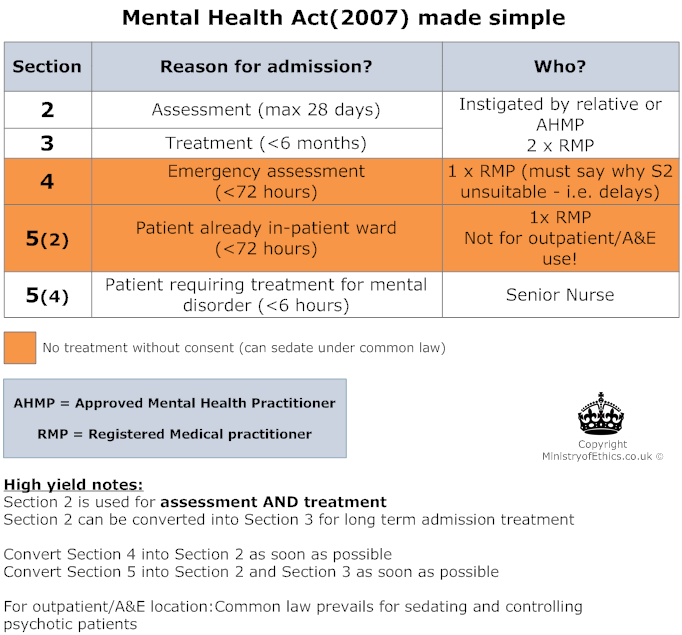

Mental Health Act MHA 1983 2007 Ministry Of Ethics co uk

https://ministryofethics.co.uk/images/note/mha.png

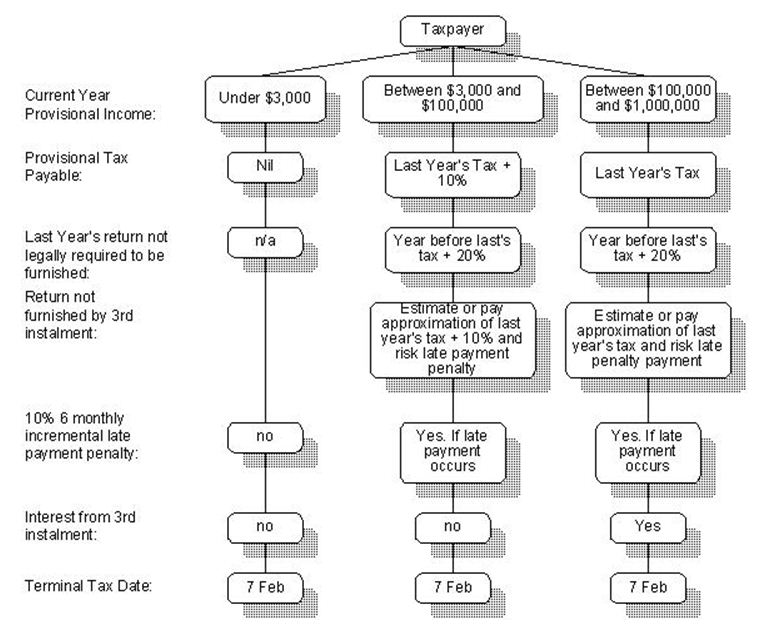

Tax Flow Chart Nz Flowchart Examples

https://www.taxtechnical.ird.govt.nz/-/media/project/ir/tt/resources/9/0/90e21c00404c3a48b7b8bf558bf61937/flowchart-07.jpg

Income Tax Act 2007 No 97 as At 02 February 2025 Public Act Subpart

https://www.legislation.govt.nz/act/public/2007/0097/latest/images/IncomefB2.JPG

General information for corporations on how to complete page 3 of the T2 Corporation Income Tax Return The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income

[desc-10] [desc-11]

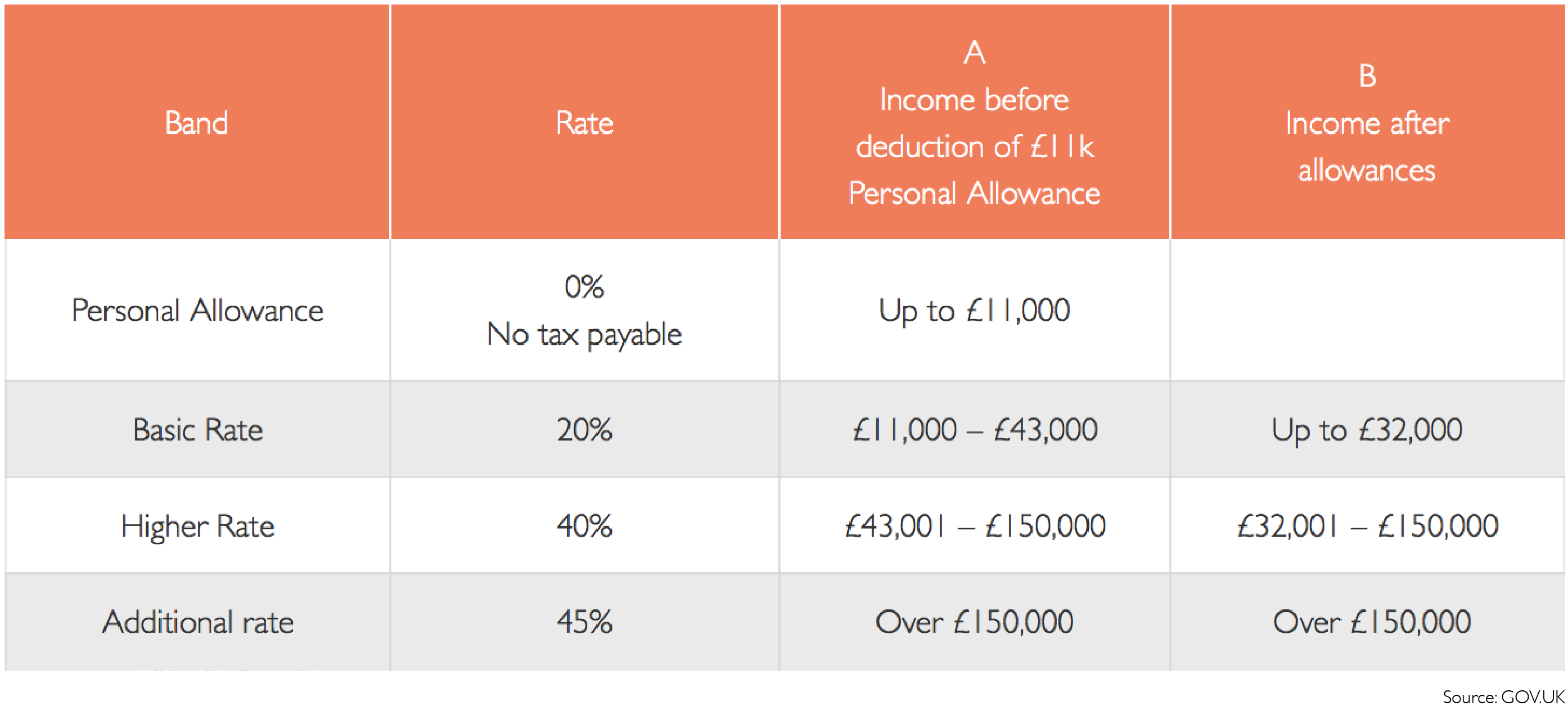

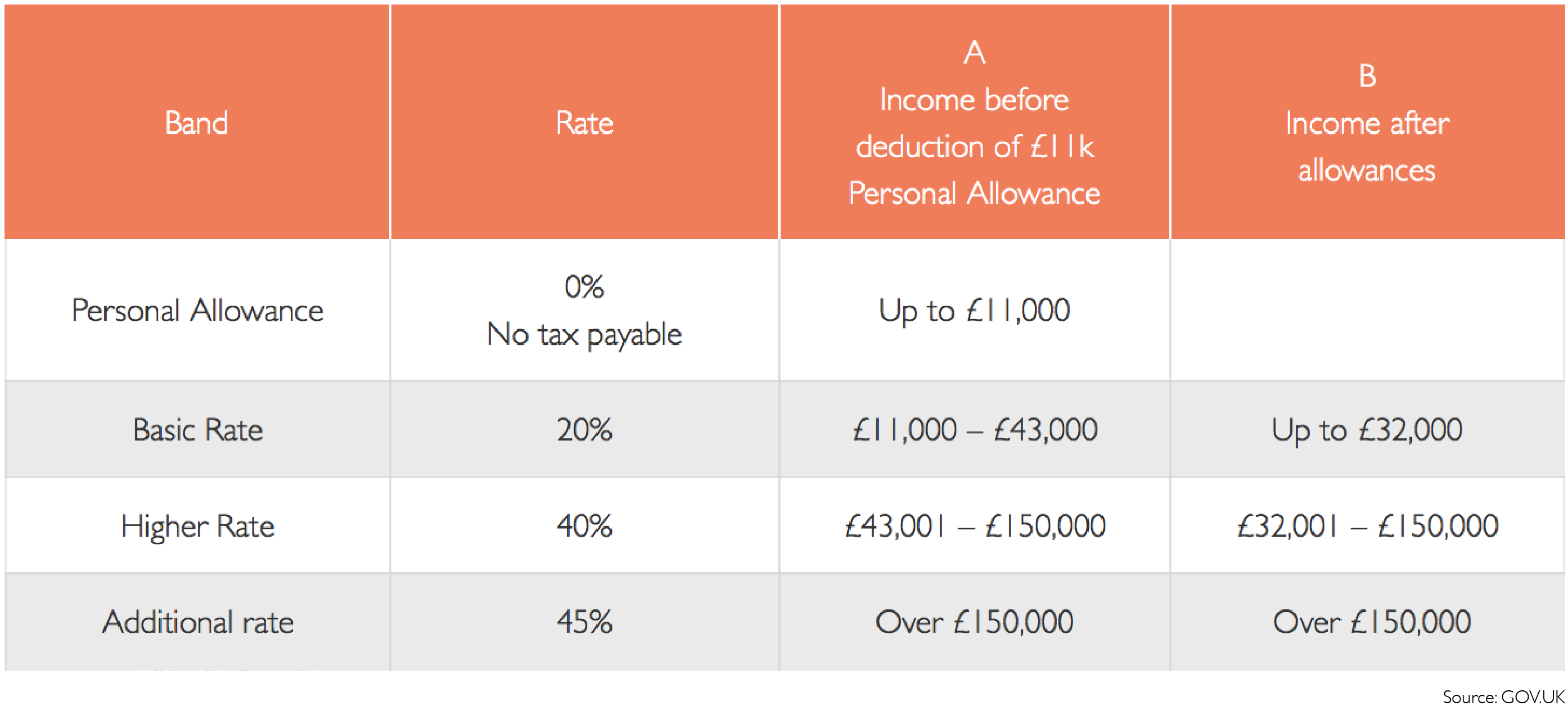

Income Tax Hello Grads

https://hellograds.com/wp-content/uploads/2016/07/Income-Tax-Bands-Ratesno-heading.png

Tax Act 2024 Update Teddy Gennifer

https://ebizfiling.com/wp-content/uploads/2023/03/Section-43-B-of-income-tax-act.png

https://www.canada.ca › en › services › benefits › publicpensions › old-a…

For amounts based on your specific income use the Old Age Security OAS estimator If you lived in Canada for at least 10 years but less than 40 years after age 18 you will receive a

https://www.canada.ca › en › services › benefits › disability › canada-dis…

The Canada Disability Benefit is a monthly payment for working age persons with disabilities who have low income

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Income Tax Hello Grads

New York State Supplemental Tax Rate 2025 Dyani Star

What Is Tax Avoidance Generate Accounting

Income Tax Act 2007 No 97 Public Act BC 8 Satisfaction Of Income Tax

Wolters Kluwer NZ CCH Books New Zealand Income Tax Act 2007 2023

Wolters Kluwer NZ CCH Books New Zealand Income Tax Act 2007 2023

Section 139 4a Of Income Tax Act

Medical Expenses Deduction Under Income Tax Act 2023 Update

New Clause H Of Section 43B With Applicable Date Effect

Income Tax Act 2007 Uk - Personal income tax Manitoba tax information for 2024 Use the information on this page to help you complete your provincial tax and credits form