Income Tax Act 80c To 80u Filing an income tax and benefit return can help you access benefit and credit payments like the GST HST credit up to 533 for an eligible individual the Canada child

The Canada Disability Benefit provides direct financial support to people with disabilities who are between 18 and 64 years old The program is administered by Service Canada The first If your net world income exceeds the threshold amount 86 912 for 2023 you have to repay part or your entire OAS pension Part or your entire OAS pension is reduced as a monthly recovery

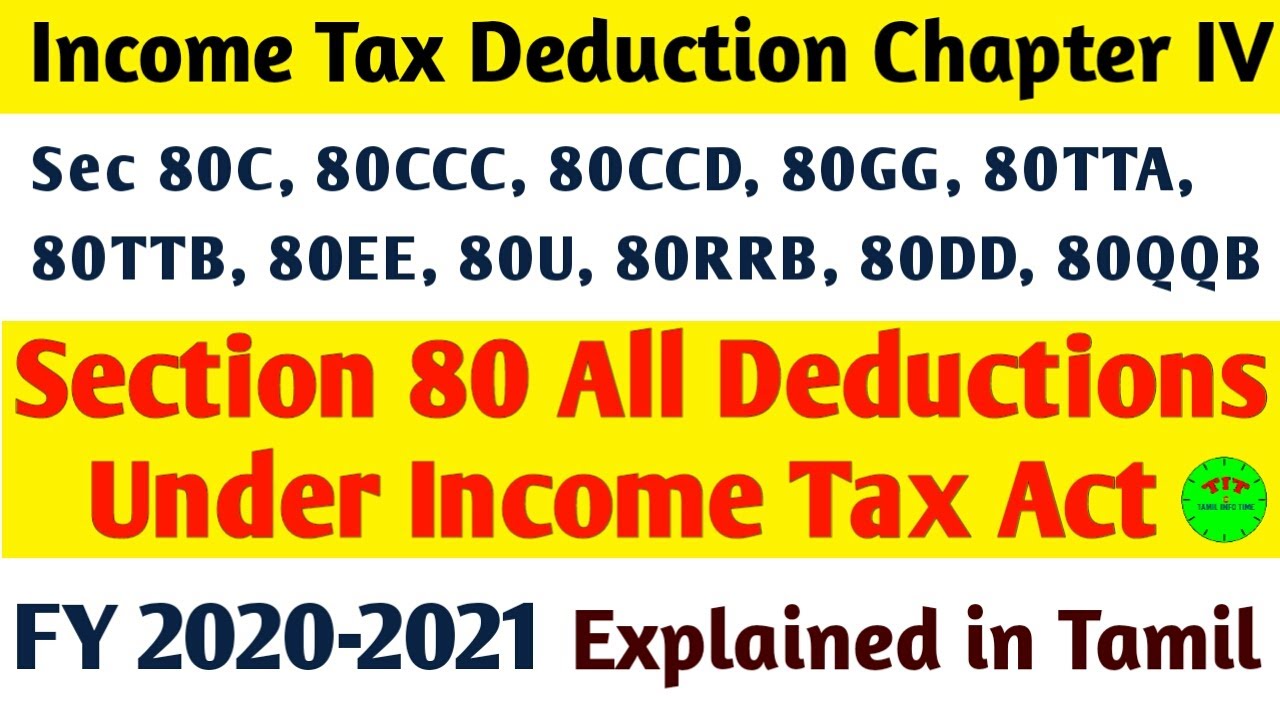

Income Tax Act 80c To 80u

Income Tax Act 80c To 80u

https://i.ytimg.com/vi/BKNZQLzty0Q/maxresdefault.jpg

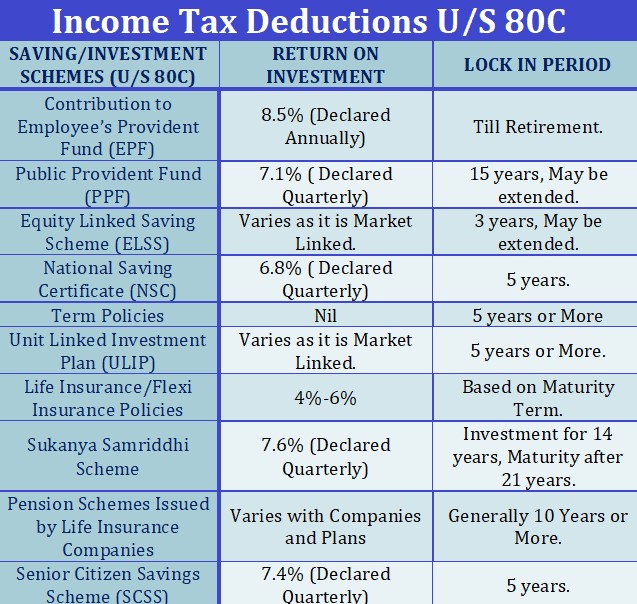

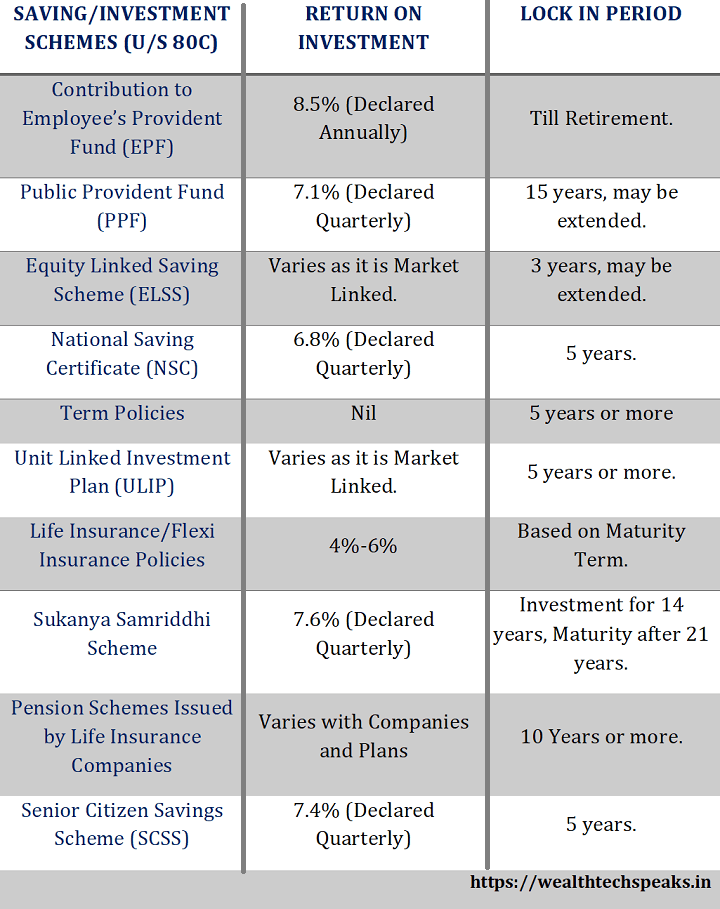

Tax Saving Investments Section 80C Income Tax Filing Section 80C

https://i.ytimg.com/vi/hRLYX9TOqK0/maxresdefault.jpg

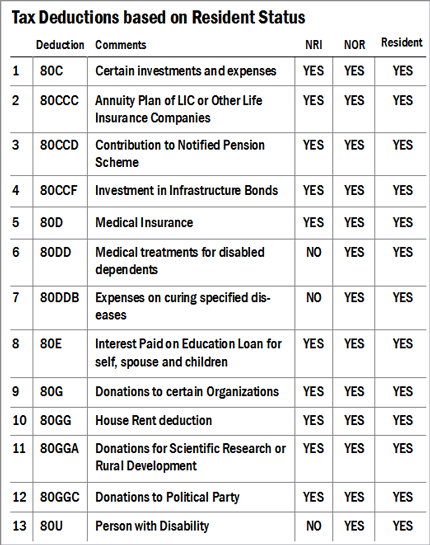

Deductions 80C To 80U Income Tax Deductions Chart Deduction 80C To

https://i.ytimg.com/vi/SwweNwxtx3M/maxresdefault.jpg

How to determine your income When applying for the Guaranteed Income Supplement and the Allowance you or in the case of a couple you and your spouse or common law partner must NETFILE is a fast and convenient option for filing your income tax and benefit return online You ll be asked to enter an access code when using NETFILE certified tax software Your eight

Do not report tax exempt employment income you paid to your employee who is registered or entitled to be registered under the Indian Act using box 14 use code 71 or for a 2 49 In broad terms the enhanced dividend gross up and dividend tax credit apply to dividends distributed to an individual from corporate income taxed at the general corporate income tax

More picture related to Income Tax Act 80c To 80u

Income Tax Deductions 1 Section 80D 80DD 80DDB 80E 80G 80GG 80U 80CCD1B

https://i.ytimg.com/vi/qT4UE82nHEs/maxresdefault.jpg

Income Tax Deductions Under Sec 80C To 80U Chapter IV Deduction

https://i.ytimg.com/vi/sK-voVH8L7w/maxresdefault.jpg

Section 80C Deductions List Save Income Tax With Section 80C Options

https://i.ytimg.com/vi/6nlYwNEIo48/maxresdefault.jpg

The Government of Canada has tabled legislation proposing to reduce the lowest income tax rate effective July 1 2025 For more information Government tables a Motion to Enter net income or loss after income tax and extraordinary items at amount A page 1 of Schedule 1 Add the taxable items and the non allowable expenses listed on lines 101 to 199

[desc-10] [desc-11]

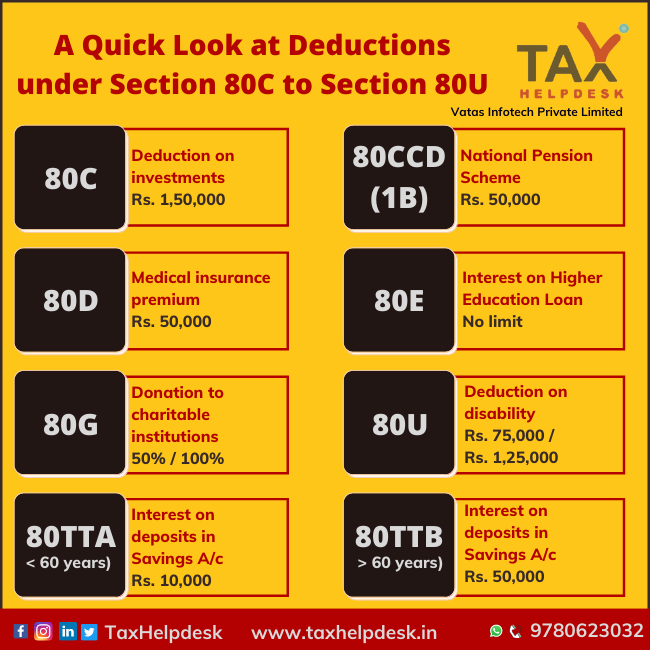

How To Save Tax Under Section 80C Deduction Under Section 80C

https://i.ytimg.com/vi/y5Sat6TcJHs/maxresdefault.jpg

Section 80C To 80U List 2024 Income Tax Act Chapter VIA Deductions

https://i.ytimg.com/vi/qMMN1qt6qI8/oar2.jpg?sqp=-oaymwEkCJUDENAFSFqQAgHyq4qpAxMIARUAAAAAJQAAyEI9AICiQ3gB&rs=AOn4CLDyuYpl7GUKwvPebqR1oHnLBwsrQA

https://www.canada.ca › en › revenue-agency › news › tax-season-start…

Filing an income tax and benefit return can help you access benefit and credit payments like the GST HST credit up to 533 for an eligible individual the Canada child

https://www.canada.ca › en › services › benefits › disability › canada-dis…

The Canada Disability Benefit provides direct financial support to people with disabilities who are between 18 and 64 years old The program is administered by Service Canada The first

80c Deductions

How To Save Tax Under Section 80C Deduction Under Section 80C

80c Deductions

80c Deductions

80c Deductions

80c Deductions

80c Deductions

80c Deductions

2022 Deductions List Name List 2022

2022 Deductions List Name List 2022

Income Tax Act 80c To 80u - [desc-14]