Income Tax Act 80ccd 1 How to determine your income When applying for the Guaranteed Income Supplement and the Allowance you or in the case of a couple you and your spouse or common law partner must

The Government of Canada has tabled legislation proposing to reduce the lowest income tax rate effective July 1 2025 For more information Government tables a Motion to The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was

Income Tax Act 80ccd 1

Income Tax Act 80ccd 1

https://static.wixstatic.com/media/f120be_ba8a35fd2a504d28b38767ca1717437c~mv2.png/v1/fill/w_1000,h_668,al_c,q_90,usm_0.66_1.00_0.01/f120be_ba8a35fd2a504d28b38767ca1717437c~mv2.png

80CCD 1B 52000 National Pension Scheme NPS PDF Government

https://imgv2-2-f.scribdassets.com/img/document/701349685/original/a7895b7837/1720321858?v=1

NPS Additional Deduction Under Section 80CCD 1B Scenario 2 ERP

https://imgv2-1-f.scribdassets.com/img/document/682309209/original/ac6115a7fd/1716292372?v=1

If your net world income exceeds the threshold amount 86 912 for 2023 you have to repay part or your entire OAS pension Part or your entire OAS pension is reduced as a monthly recovery Formerly known as Climate action incentive payment Basic amount and rural supplement for residents of Alberta Manitoba New Brunswick Newfoundland and Labrador Nova Scotia

2 49 In broad terms the enhanced dividend gross up and dividend tax credit apply to dividends distributed to an individual from corporate income taxed at the general corporate income tax Your income It is considered taxable income and is subject to a recovery tax if your individual net annual income is higher than the net world income threshold set for the year 86 912 for

More picture related to Income Tax Act 80ccd 1

Deductions Under Section 80CCD Of Income Tax Act YouTube

https://i.ytimg.com/vi/4Tk5KtruVEc/maxresdefault.jpg

Section 80CCC 80CCD 1 80CCD 1B Of Income Tax Act YouTube

https://i.ytimg.com/vi/HEMAGpKbI-Y/maxresdefault.jpg

Section 80CCD Of Income Tax Act latest Updates YouTube

https://i.ytimg.com/vi/vM4BA8MKiaA/maxresdefault.jpg

If you are reporting only Canadian source income from taxable scholarships fellowships bursaries research grants capital gains from disposing of taxable Canadian property or from The personal income levels used to calculate your Manitoba tax have changed The basic personal amount has changed The maximum annual amount of eligible expenses for fertility

[desc-10] [desc-11]

Deduction Under Section 80C 80CCC 80CCD 1 And 80CCE Under Chapter VI

https://i.ytimg.com/vi/6uBM-gUyQWw/maxresdefault.jpg

Section 80CCD 2 Employer s Contribution To NPS NPS In New Tax

https://i.ytimg.com/vi/EpqXDIqNGX0/maxresdefault.jpg

https://www.canada.ca › ... › old-age-security › guaranteed-income-supp…

How to determine your income When applying for the Guaranteed Income Supplement and the Allowance you or in the case of a couple you and your spouse or common law partner must

https://www.canada.ca › en › revenue-agency › services › tax › individual…

The Government of Canada has tabled legislation proposing to reduce the lowest income tax rate effective July 1 2025 For more information Government tables a Motion to

Section 80CCC 80CCD 1 80CCD 2 80CCE Deductions Of Chapter VIA

Deduction Under Section 80C 80CCC 80CCD 1 And 80CCE Under Chapter VI

DT CAFinal Revision Of Deduction Under Chapter VIA Of Income Tax Act

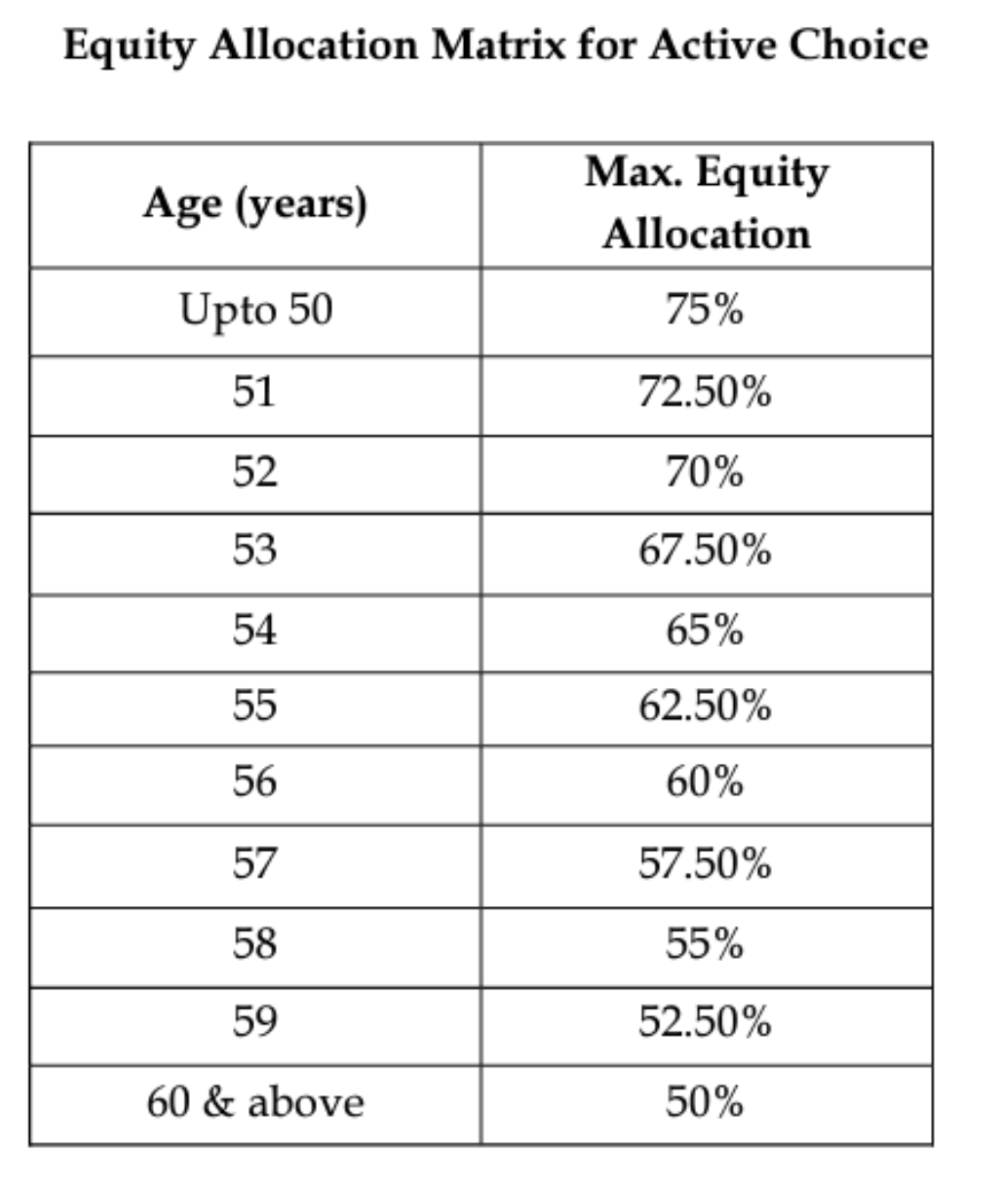

NPS Building Tomorrow s Stability Today Pension For A Secure

NPS Building Tomorrow s Stability Today Pension For A Secure

NPS Building Tomorrow s Stability Today Pension For A Secure

NPS Building Tomorrow s Stability Today Pension For A Secure

NPS Building Tomorrow s Stability Today Pension For A Secure

Under 1 5 Meaning

Income Tax Information NPS Tax Benefit Sec 80CCD 1 80CCD 1B And

Income Tax Act 80ccd 1 - Your income It is considered taxable income and is subject to a recovery tax if your individual net annual income is higher than the net world income threshold set for the year 86 912 for