Income Tax Lien Definition Income is reported and tax is calculated on an annual basis To reflect a one percentage point cut in the lowest tax rate coming into effect halfway through the year the full

Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by Canada Disability Benefit The Canada Disability Benefit provides direct financial support to people with disabilities who are between 18 and 64 years old The program is

Income Tax Lien Definition

Income Tax Lien Definition

https://i.ytimg.com/vi/4gDuLskLkYI/maxresdefault.jpg

Tax Brackets 2024

https://districtcapitalmanagement.com/wp-content/uploads/Tax-Bracket-scaled.jpg

Federal Buyout 2025 Will You Get One Prepare Now

https://vc-scoop.com/wp-content/uploads/2024/07/logo.jpg

Guaranteed Income Supplement provides monthly payments to seniors who are receiving Old Age Security Pension OAS and have an annual income lower than the maximum annual The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was

The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income Income tax calculator Updated for 2024 25 tax year how much tax will you pay on your salary in South Africa find out with the SARS income tax calculator updated for 2024 25 tax year

More picture related to Income Tax Lien Definition

Lien Meaning Explained Example Vs Collateral Mortgage

https://wallstreetmojo.com/wp-content/uploads/2023/01/What-does-lien-mean-1024x576.png

Tax Liens An Overview CheckBook IRA LLC

https://www.checkbookira.com/wp-content/uploads/2014/08/Tax.jpg

What Is A Tax Lien The Leinlord

https://leinlord.com/wp-content/uploads/2024/03/word-image-868-5.jpeg

Information on T4 slips for employers how and when to complete and distribute the slips box 45 how to amend cancel add or replace T4 slips how to correct CPP EI and Find out if this guide is for you If you make certain investment income payments to a resident of Canada or if you receive certain investment income payments as a nominee or agent for a

[desc-10] [desc-11]

Miscellaneous Charge Huntington Bank 34

https://assets-global.website-files.com/63e56114746188c54e2936e0/641181fb84bd9957d62c524c_img-purchase-order-template.jpeg

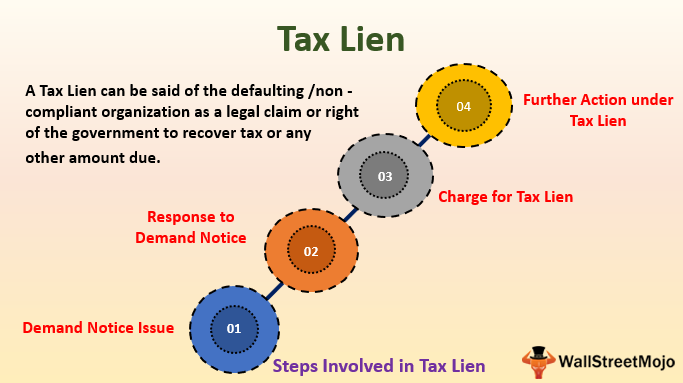

Tax Lien How Does Tax Lien Work With Example And Impact

https://cdn.educba.com/academy/wp-content/uploads/2020/11/Tax-Lien.jpg

https://www.canada.ca › en › department-finance › news › delivering-a-…

Income is reported and tax is calculated on an annual basis To reflect a one percentage point cut in the lowest tax rate coming into effect halfway through the year the full

https://www.canada.ca › en › revenue-agency › news › tax-season-start…

Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by

Brawl Stars Inferno HD Wallpaper By ChenChen Zi

Miscellaneous Charge Huntington Bank 34

Voluntary Lien What Is It Examples Vs Involuntary Lien

Tax Lien Definition Steps How Does Tax Lien Work

/tax-lien-497446038-c58c6c685be6482786f29fc2c9ade07b.jpg)

Tax Lien Definition

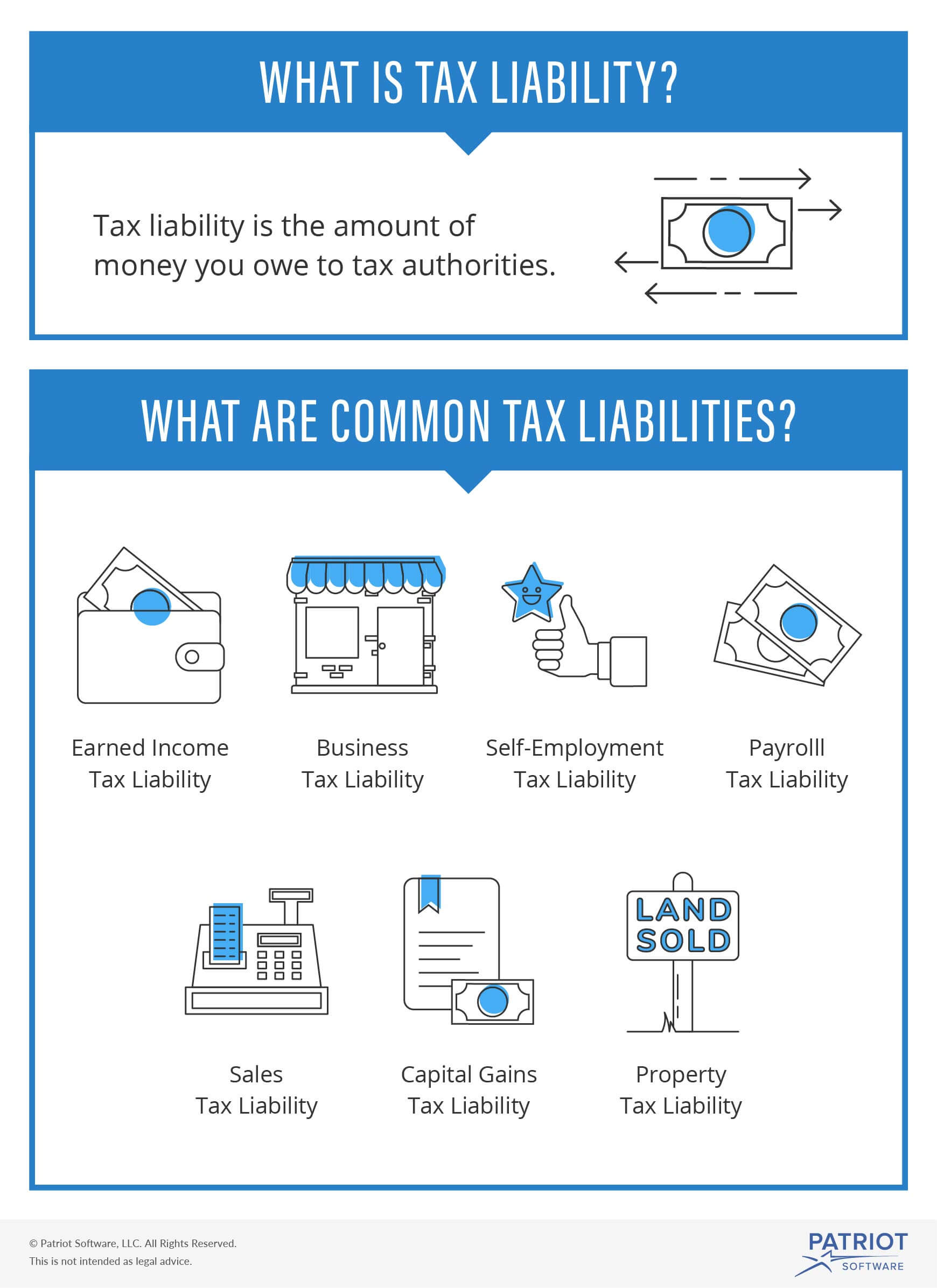

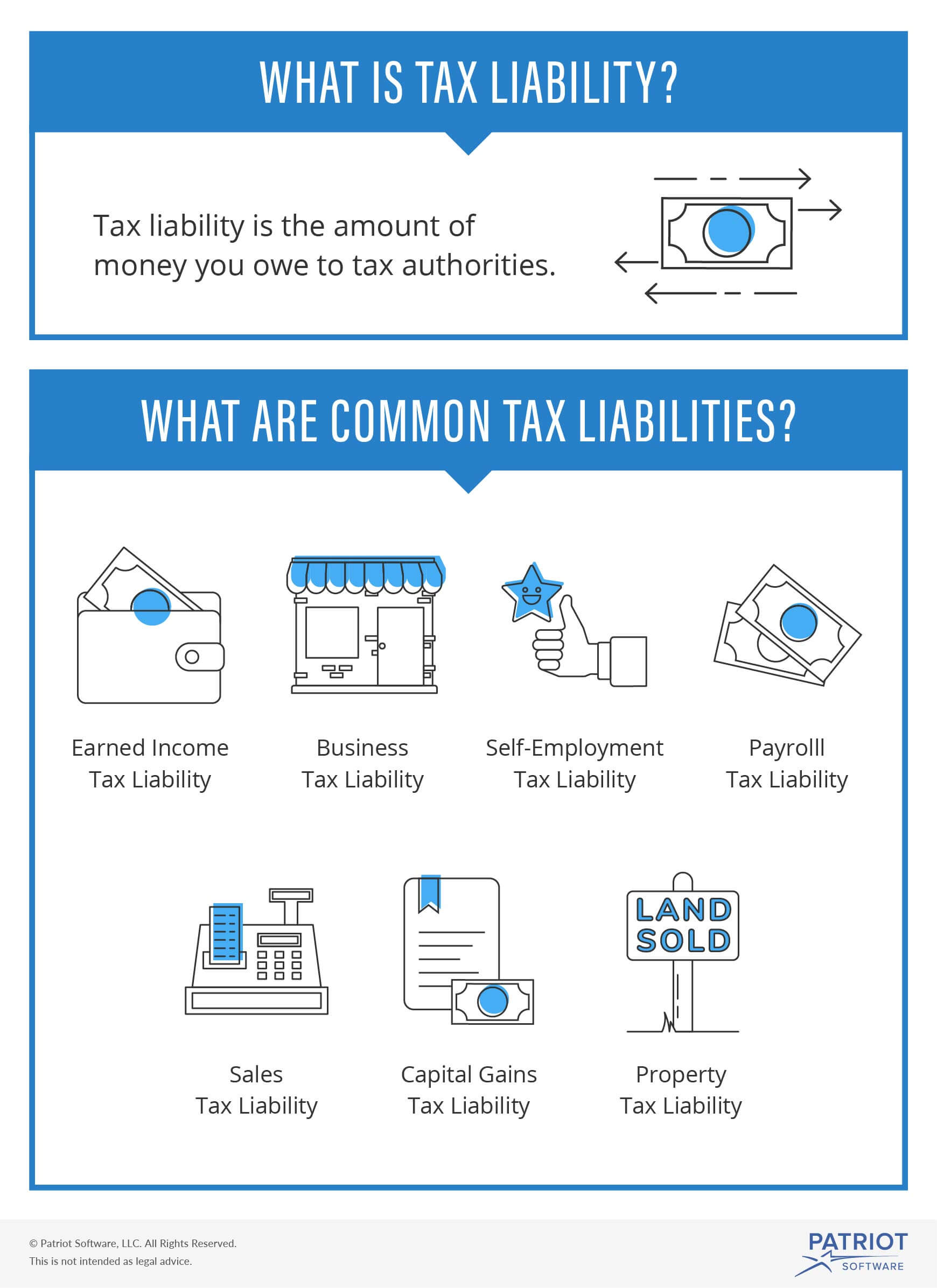

What Is Tax Liability Definition Examples More

What Is Tax Liability Definition Examples More

SOP Penyusunan Laporan Keuangan Perusahaan

Right Of Lien Conditions Types IndiaFilings

Tax Brackets 2025 Federal Robert P Murray

Income Tax Lien Definition - The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income