Is Gst Applicable On Rice GST HST NETFILE Find out how to use this service and file your return GST HST Access code You can change your access code to a number of your choice by using GST HST Access

The Canada Revenue Agency usually send the GST HST credit payments on the fifth day of July October January and April If you do not receive your GST HST credit payment on the All GST HST registrants with the exception of charities and selected listed financial institutions SLFIs are required to file returns electronically This applies to all GST HST returns for

Is Gst Applicable On Rice

Is Gst Applicable On Rice

https://i.ytimg.com/vi/z8se7Cpfuhs/maxresdefault.jpg

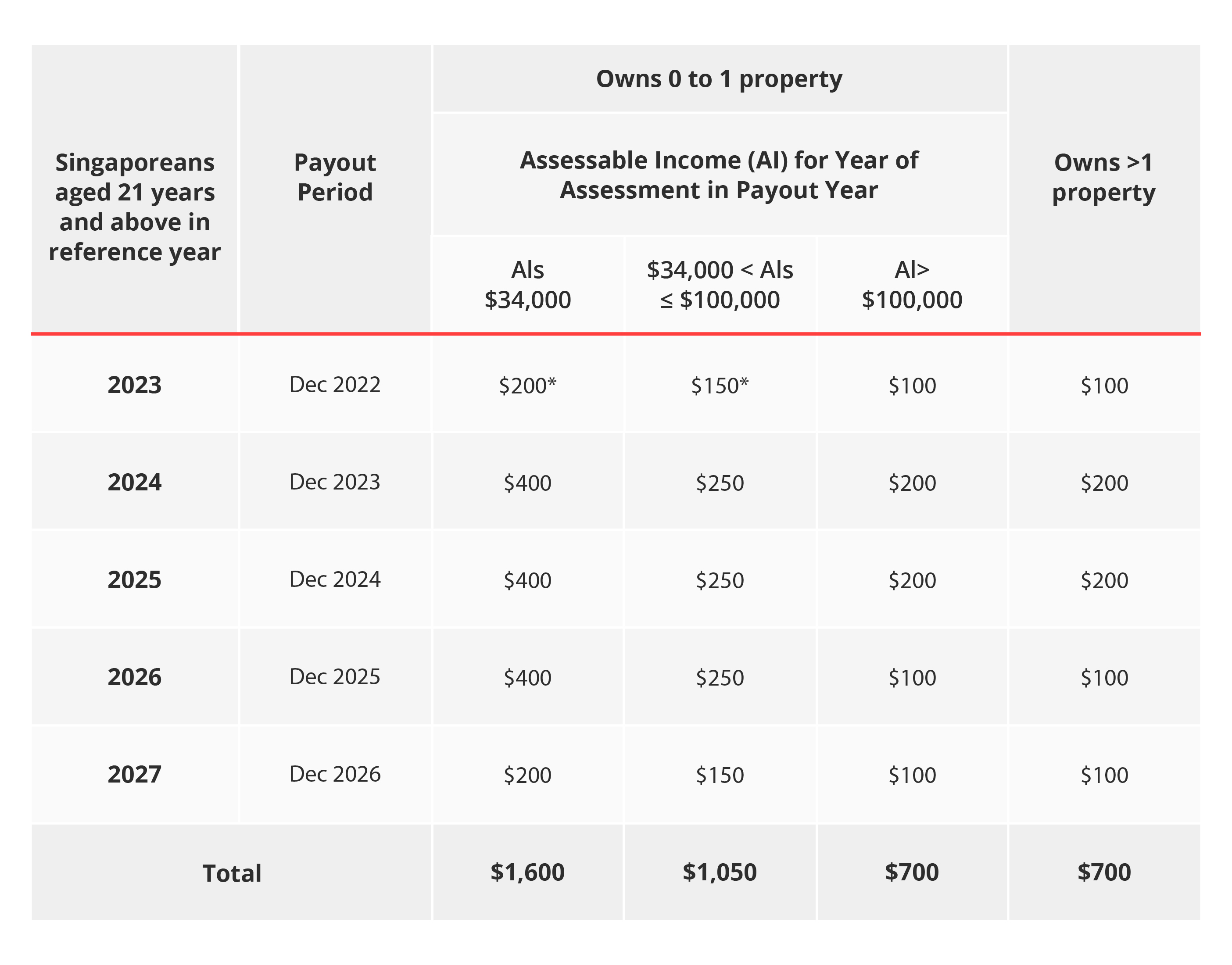

GST 5 GST On Rice Tamil Nadu Rice

https://i.ytimg.com/vi/mdiEfWB80VQ/maxresdefault.jpg

Helping Taxpayers Make Sense Of GST Regulation Hindustan Times

https://www.hindustantimes.com/ht-img/img/2023/06/29/1600x900/GST_1688043433710_1688043433973.jpeg

If you are a GST HST registrant with a reporting period that begins in 2024 or later you must file your returns electronically except for charities and selected listed financial institutions If you For the GST HST rates applicable before April 1 2013 go to GST HST Statistics Tables For the PST rates of previous years go to the respective province s website Other

If you do not have a CRA account you can file your GST HST return and eligible rebates directly with the Canada Revenue Agency CRA using an online form with an access code If you You recovered 100 GST as a tax adjustment on line 107 of your GST HST return or line 108 if you used GST HST TELEFILE Later that year you receive a payment of 400

More picture related to Is Gst Applicable On Rice

What Is GST Return And The Types Of GST Returns

https://www.pegatraining.in/wp-content/uploads/2022/10/Types-of-GST-Returns.png

Benefits Of GST In India

https://www.deskera.com/blog/content/images/size/w2000/2021/09/gstblog2.jpg

GST Calculation Both Inclusive And Exclusive Tax YouTube

https://i.ytimg.com/vi/7LlfYE45QmU/maxresdefault.jpg

The deadline to remit your balance of GST HST depends on your GST HST filing period Most GST HST payments are due at the same time as your GST HST returns Your payment The FTHB GST Rebate would allow an individual to recover up to 50 000 of the GST or the federal part of the HST paid in respect of a new home purchased from a builder

[desc-10] [desc-11]

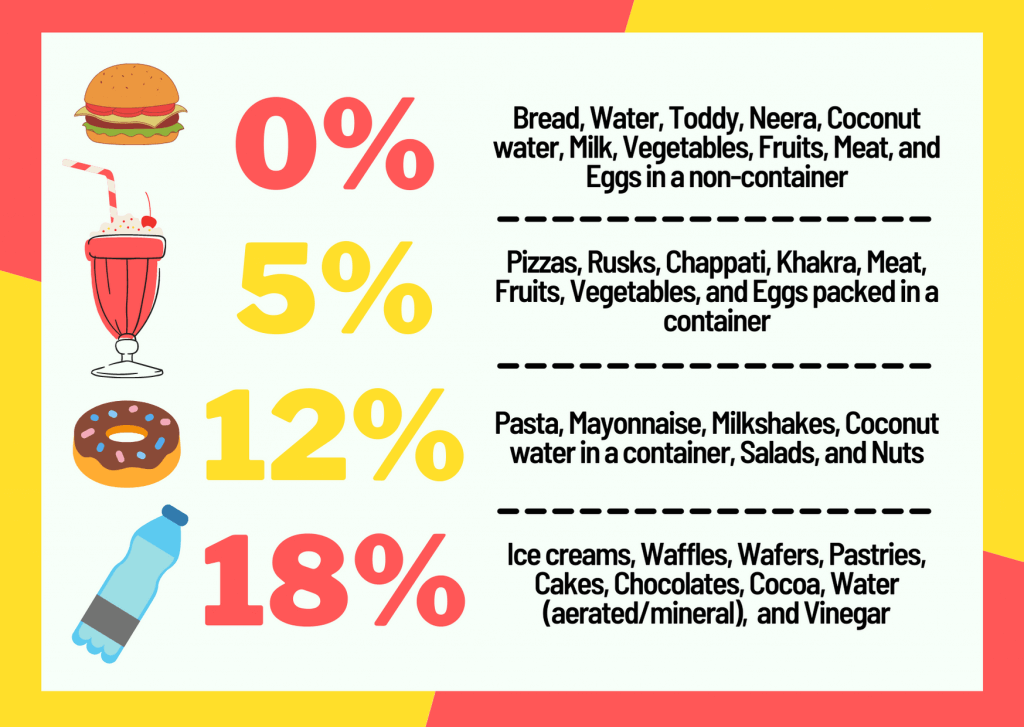

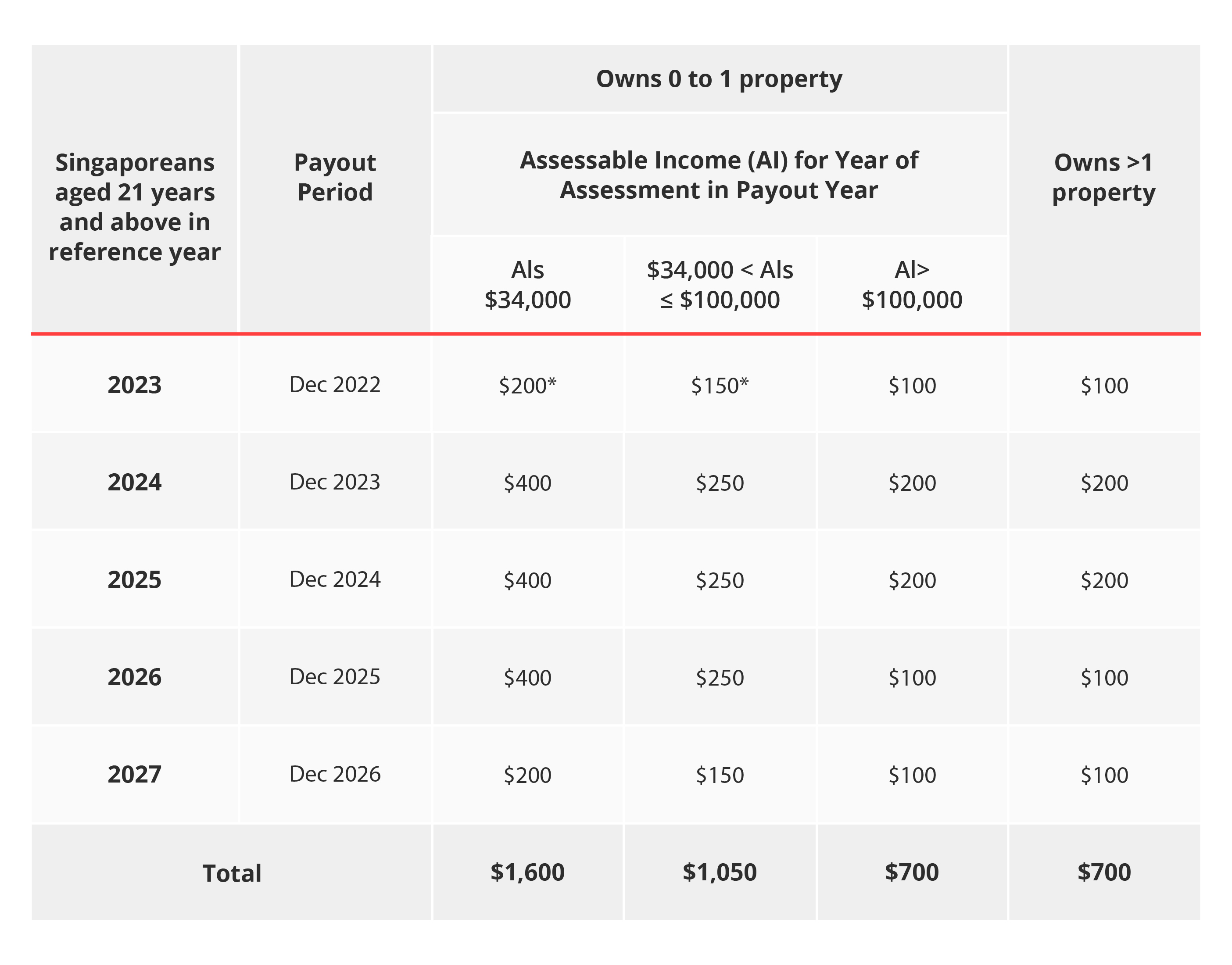

The DBS Guide To Singapore s GST Rate Changes

https://www.dbs.com.sg/iwov-resources/media/images/nav/preparing-for-GST-rate-changes/preparing-for-GST-rate-changes-img1.jpg

Applicable GST Rates For Restaurants Services IFCCL

https://www.caindelhiindia.com/blog/wp-content/uploads/2023/04/Red-Blue.png

https://www.canada.ca › en › services › taxes › resources-for-small-and-…

GST HST NETFILE Find out how to use this service and file your return GST HST Access code You can change your access code to a number of your choice by using GST HST Access

https://www.canada.ca › en › revenue-agency › services › child-family-b…

The Canada Revenue Agency usually send the GST HST credit payments on the fifth day of July October January and April If you do not receive your GST HST credit payment on the

IS GST Applicable On Transfer Of Business Assets Without Consideration

The DBS Guide To Singapore s GST Rate Changes

GST CHANGES IN REVERSE CHARGE APPLICABLE FROM 18TH JULY 2022 YouTube

Unlock GST inclusive Vs GST exclusive Prices In Australia 2024 My

How To Export Salt From India Complete Procedure About Salt Export

Is GST Applicable On The Income Earned From Commission

Is GST Applicable On The Income Earned From Commission

Applicability Of GST On Toll Charges FinancePost

What Is The GST On Transportation Of Household Goods NoBroker

Is Gst Applicable On Free Samples Legaltax

Is Gst Applicable On Rice - You recovered 100 GST as a tax adjustment on line 107 of your GST HST return or line 108 if you used GST HST TELEFILE Later that year you receive a payment of 400