Is Rice Exempted From Vat Some of the most common VAT exempt goods in Kenya include milk eggs meat rice maize bread beans unprocessed vegetables tubers infant food formula medicines fertilizers sanitary towels pharmaceuticals just to name a few

GOODS SERVICES LISTED IN FIRST AND SECOND SCHEDULE OF THE VAT ACT 0001 11 00 Bovine Semen of tariff number 05111000 Exempted 0002 11 00 Fish eggs and roes of tariff number 05119110 Exempted 0039 11 10 Semi milled or wholly milled rice whether or not polished or glazed 10063000 Exempted The normal rate of VAT is 16 However the Items exempted from VAT as provided by the VAT Act of 2013 attract a rate of 0 An import declaration fees of 3 5 and Railway development Levy of 2 are levied on value of imports as provided by the miscellaneous Fees and Levies Act of

Is Rice Exempted From Vat

Is Rice Exempted From Vat

https://businesspost.ng/wp-content/uploads/2019/08/value-added-tax-VAT.jpg

Is White Rice Keto And Carbs In White Rice Keto White Rice

https://izzycooking.com/wp-content/uploads/2023/04/White-Rice-01.jpg

How To Compute VAT Payable Business Taxes Can Be Either A Percentage

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/83ef57b4f926837907f3b5bc4063a6c0/thumb_1200_1553.png

Section b exempt goods on transition The following Imports shall be exempt for a period of three years from the commencement of this Act unless the exempt status of the supplies is earlier revoked Exempt Supplies SECTION A The supply or importation of the following goods shall be exempt supplies 1 Bovine semen of tariff No 0511 10 00 2 Fish eggs and roes of tariff No 0511 91 10 3 Animal semen other than bovine of tariff No 0511 99 10 4 Soya beans whether or not broken of tariff Nos 1201 10 00 and 1201 90 00 5

In Kenya supplies are either taxable or exempt from VAT 0 for zero rated supplies Zero rating of goods and services means that such supplies are actually taxable but at the rate of 0 Exemption from VAT means such supplies are not taxable PART I GOODS exempt supplies SECTION A The supply or importation of the following goods shall be exempt supplies

More picture related to Is Rice Exempted From Vat

What Is VAT Main Types Advantages And Disadvantages For

https://i.ytimg.com/vi/E-B4m-tfoFs/maxresdefault.jpg

Subsidy For Rice Retailers Exempted From Election Ban ABS CBN News

https://news-image-api.abs-cbn.com/Prod/2023121916128/7660812b76bce2dbeb8f4bb7a973901e74cb7278d48459b390cc26b7e3ed6774.jpg

Rye Low GI Bread To Be Removed From VAT Exempted Goods Northglen News

https://northglennews.co.za/wp-content/uploads/sites/51/2018/02/100_Rye_Bread_5752657009-Large-2.jpg

Under the provisions of the Finance Act cooking gas was granted exemption from various forms of taxation which encompassed an 8 per cent Value Added Tax VAT a 3 5 per cent Import Declaration Fee and a 2 per cent Railway Development Levy There shouldnt be any VAT to be deducted at all Vat exempted eh

[desc-10] [desc-11]

VAT Exemption Declaration Form

https://s3.studylib.net/store/data/005865607_1-5b279a0808c1f4bd31d5769ee6bc7eac-768x994.png

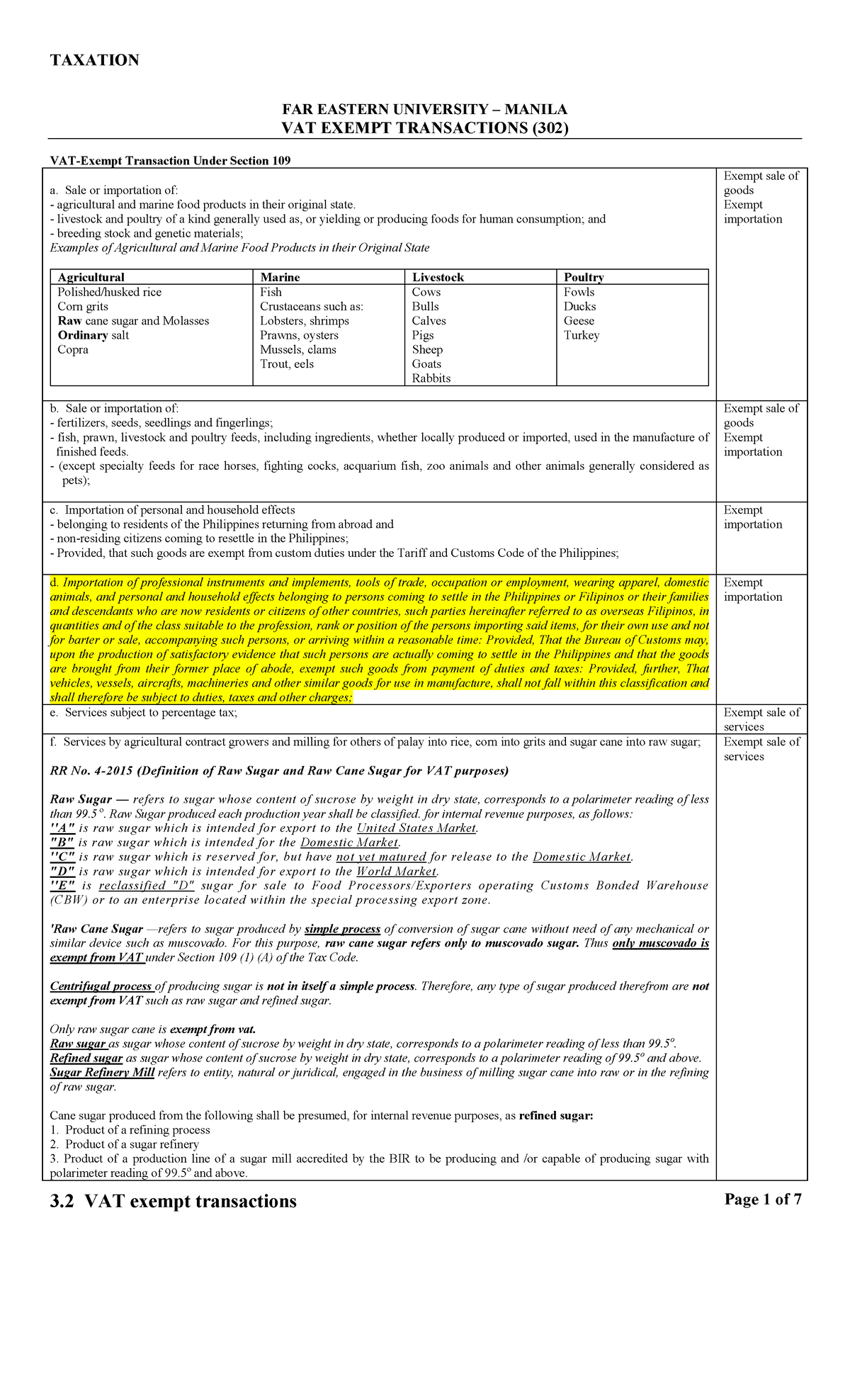

3 2 VAT Exempt Transactions TAXATION FAR EASTERN UNIVERSITY MANILA

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/1da125cba5bac4fecc5ea577d79c60e7/thumb_1200_1976.png

https://www.tuko.co.ke/288529-list-vat-exempt-goods-kenya.html

Some of the most common VAT exempt goods in Kenya include milk eggs meat rice maize bread beans unprocessed vegetables tubers infant food formula medicines fertilizers sanitary towels pharmaceuticals just to name a few

https://www.kra.go.ke/images/publications/Goods...

GOODS SERVICES LISTED IN FIRST AND SECOND SCHEDULE OF THE VAT ACT 0001 11 00 Bovine Semen of tariff number 05111000 Exempted 0002 11 00 Fish eggs and roes of tariff number 05119110 Exempted 0039 11 10 Semi milled or wholly milled rice whether or not polished or glazed 10063000 Exempted

Subsidy For Rice Retailers Exempted From Election Ban Philstar

VAT Exemption Declaration Form

VAT Exempt In The Philippines Manager Forum

6 Tax INTRODUCTION TO THE VALUE ADDED TAX THE VALUE ADDED TAX The

Zero rated And Exempt Supplies

COOKED FOOD EXEMPTED FROM PAYMENT OF VAT IN EXCESS OF 5 RHC

COOKED FOOD EXEMPTED FROM PAYMENT OF VAT IN EXCESS OF 5 RHC

TAX SC PWD Wqewre 2021 Senior Citizens SCs Persons With

VAT Exempt Sales VAT EXEMPT SALES A Section 109 1 A Sale Or

Subsidiya Para Sa Rice Retailers Exempted Mula Sa Spending Ban Sa BSKE

Is Rice Exempted From Vat - In Kenya supplies are either taxable or exempt from VAT 0 for zero rated supplies Zero rating of goods and services means that such supplies are actually taxable but at the rate of 0 Exemption from VAT means such supplies are not taxable