Itc 01 Form In Gst Trade Map ITC s Trade Map is an online database on international trade statistics providing an array of useful indicators on export performance international demand alternative markets

You cannot claim an ITC for the GST HST paid or payable on services supplied to you before you became a registrant or on the value of any rent royalty or similar payment Le Centre du commerce international ITC vise garantir la prosp rit mondiale en connectant les petites entreprises des pays en d veloppement aux march s

Itc 01 Form In Gst

Itc 01 Form In Gst

https://i.ytimg.com/vi/kFllZKhpejI/maxresdefault.jpg

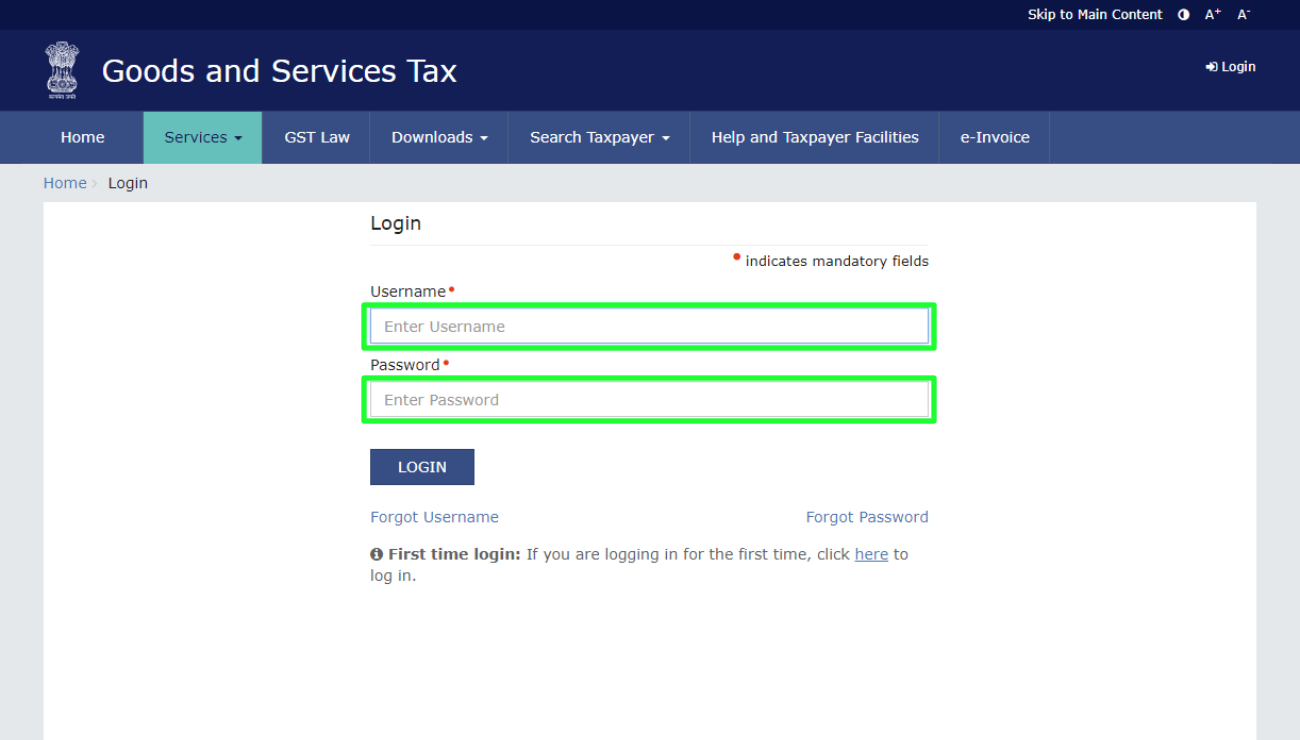

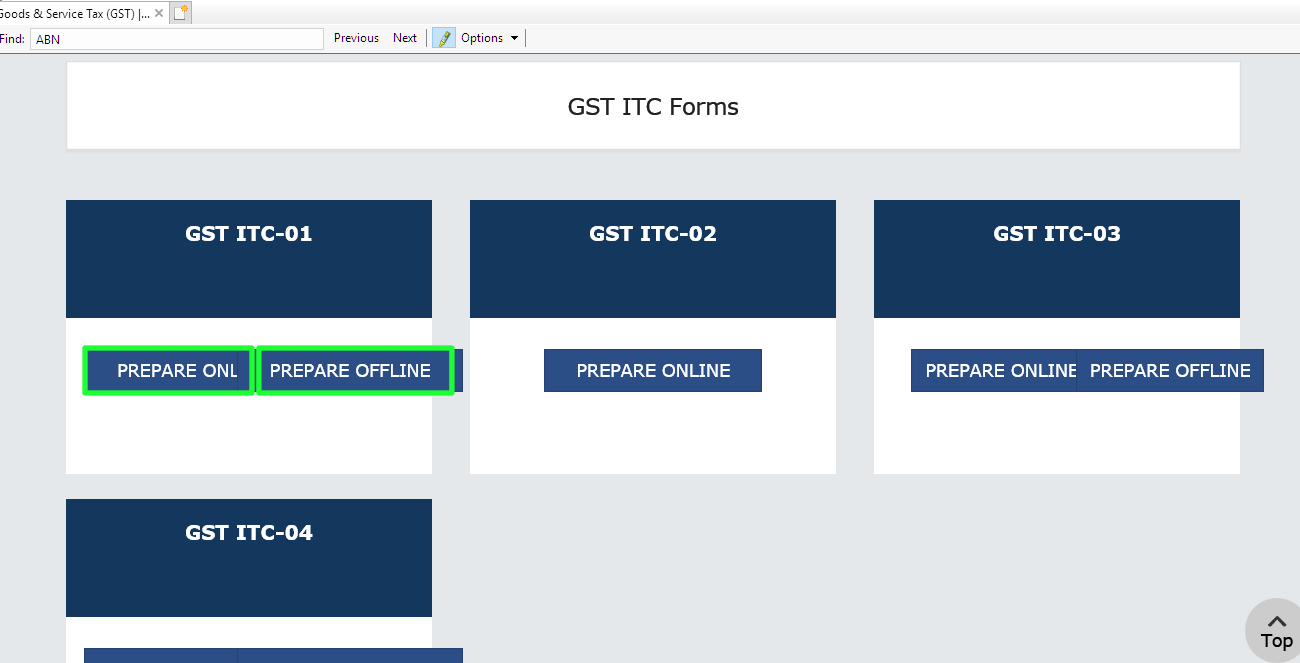

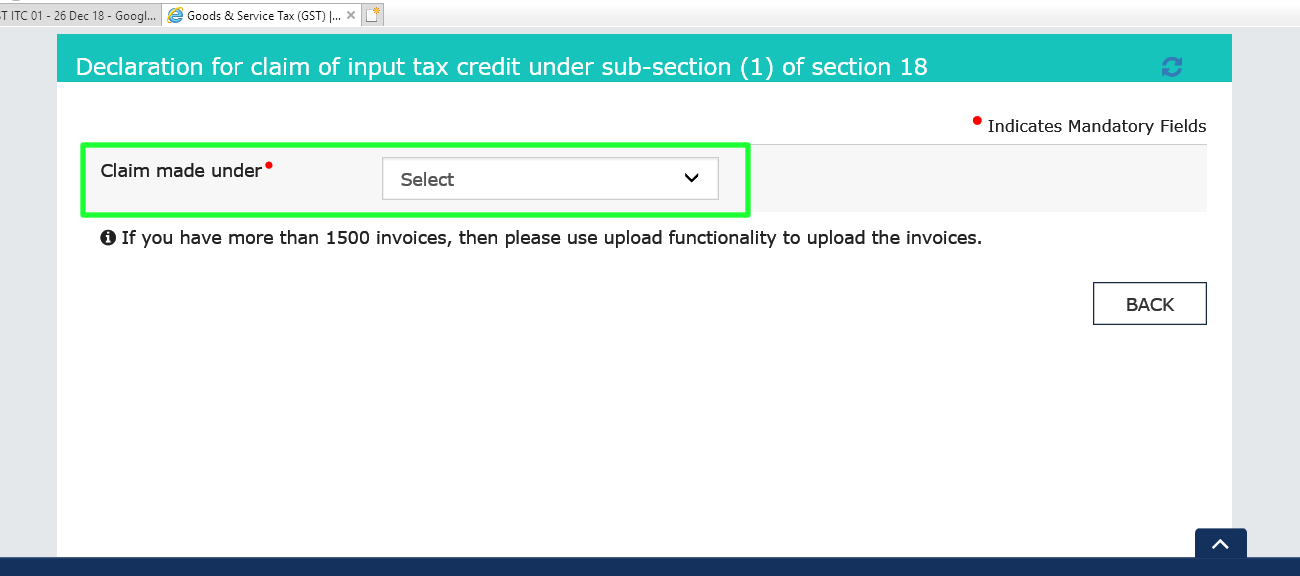

Live Demo GST ITC 01 Form Claim ITC On Stock For New Taxpayers

https://i.ytimg.com/vi/wuGK837yc40/maxresdefault.jpg

GST ITC 01 Form To Claim ITC On Stock For New Taxpayers Form ITC 01

https://i.ytimg.com/vi/K3h9eJwHss0/maxresdefault.jpg

Market Analysis Tools Portal The International Trade Centre has developed a suite of online tools to make global trade more transparent and to facilitate access to markets These tools enable ACP Business friendly Supporting value chains through inclusive policies investment promotion alliances and access to finance

El ITC pone a su disposici n informaci n y servicios comerciales basados en la evidencia an lisis de mercado innovadores y una gran variedad de herramientas en ITC s value proposition is built around our organizational strengths of trust expertise connectedness and agility Whether through our steps to manage data securely or through

More picture related to Itc 01 Form In Gst

Form GST ITC 04 FinancePost

https://financepost.in/wp-content/uploads/2022/03/GST-ITC-04.jpg

Gst Notice In Form DRC 01 Section 74 Of GST Act GST Notice U s 74 Of

https://i.ytimg.com/vi/CtJVZhpIBDw/maxresdefault.jpg

Form GST ITC 01 Offline Tool

https://img.indiafilings.com/learn/wp-content/uploads/2018/11/12005057/Form-GST-ITC-01.jpg

ITC facilitated strategies are designed by the country for the country Our strategies are built on cutting edge research and the best of existing national plans and policies We focus on how to ITC eligibility on meals and entertainment expenses The following chart identifies the different percentages of the amount of GST HST paid that you can claim as an ITC on

[desc-10] [desc-11]

GST Form ITC 01

https://d3l793awsc655b.cloudfront.net/blog/wp-content/uploads/2022/11/GST-ITC-01-form-claim-details.jpg

GST Form ITC 01

https://img.indiafilings.com/learn/wp-content/uploads/2018/11/12005040/GST-ITC-01.jpg

https://www.intracen.org › resources › data-and-analysis › trade-statistics

Trade Map ITC s Trade Map is an online database on international trade statistics providing an array of useful indicators on export performance international demand alternative markets

https://www.canada.ca › en › revenue-agency › services › tax › business…

You cannot claim an ITC for the GST HST paid or payable on services supplied to you before you became a registrant or on the value of any rent royalty or similar payment

GST Form ITC 01

GST Form ITC 01

ITC 01 Form Claim ITC On New GST Registration Busy

ITC 01 Form Claim ITC On New GST Registration Busy

ITC 01 Form Claim ITC On New GST Registration Busy

All About GST ITC 04 Return Ebizfiling

All About GST ITC 04 Return Ebizfiling

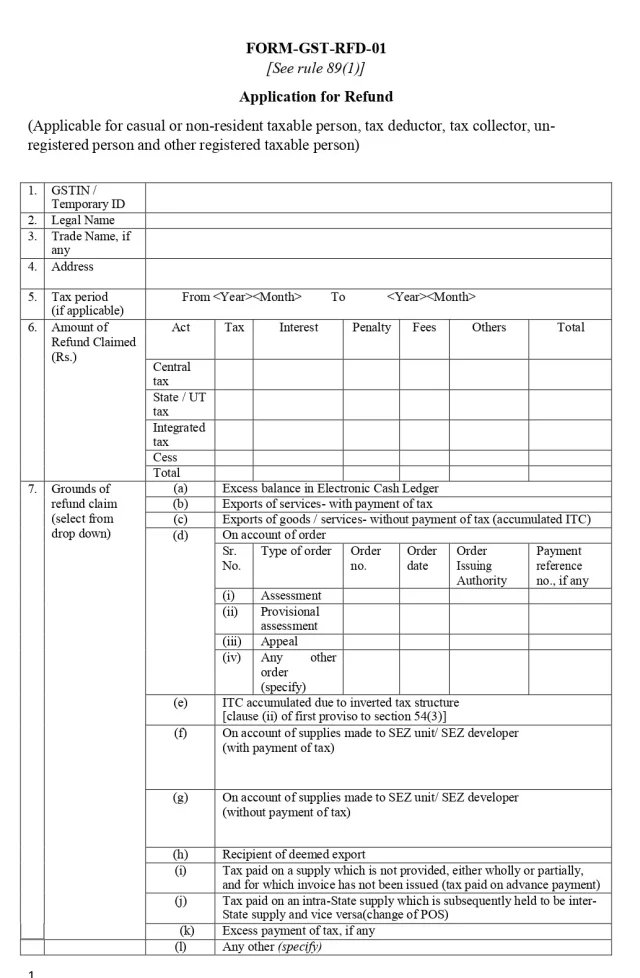

Everything You Need To Know About RFD 01 01A Form In GST GST Refund

Trouble In Online Filing Of GST ITC 01 Form To Switch Over From

What Is GST ITC 04 Form Finance Tips HQ

Itc 01 Form In Gst - [desc-14]