Itc Reversal Form In Gst The last reporting period in which you can claim an ITC for the tax you were charged on the office furniture is the reporting period October 1 2026 to December 31 2026

ITC ICA 40 2025 27 May 2025 View details Apply LICA 10 Project Management Adviser Kigali Rwanda ITC ICA 39 2025 27 May 2025 View details Apply ITC eligibility for individuals corporations and partnerships ITC eligibility for public service bodies Footnote 3b including charities that have elected not to use the net tax

Itc Reversal Form In Gst

Itc Reversal Form In Gst

https://i.ytimg.com/vi/8Qtmh3S4RzM/maxresdefault.jpg

Input Tax Credit Under Goods And Services Tax Act RJA

https://carajput.com/blog/wp-content/uploads/2021/09/Compulsory-Reversal-of-GST-Credit-by-Buyers-for-Non-Payment-.jpg

GST ITC 180 REVERSAL EXCEL TRACKER GST ITC NOT PAID 180 DAYS REVERSAL

https://i.ytimg.com/vi/Q5aOL8MffkU/maxresdefault.jpg

L ITC fournit une multitude d informations et de ressources relatives au commerce aux entreprises des pays en d veloppement Les outils ci dessous dont certains sont des ITC thereby helps to build vibrant sustainable export sectors that provide entrepreneurial opportunities particularly for women youth and vulnerable communities As a subsidiary

ITC provides a wealth of information and resources on trade for businesses in developing countries The tools below some of them joint projects with other organisations El ITC proporciona una gran cantidad de informaci n y recursos sobre el comercio a las empresas radicadas en los pa ses en desarrollo Las herramientas que presentamos a

More picture related to Itc Reversal Form In Gst

ITC Full Form Mismatch And Reclaim Under GST Blog

https://www.gstrobo.com/blog/wp-content/uploads/2021/02/itc-full-form-mismatch-reversal-and-reclaim-under-gst.png

GST Declaration Format PDF

https://imgv2-2-f.scribdassets.com/img/document/568146865/original/ae742c1d84/1663468120?v=1

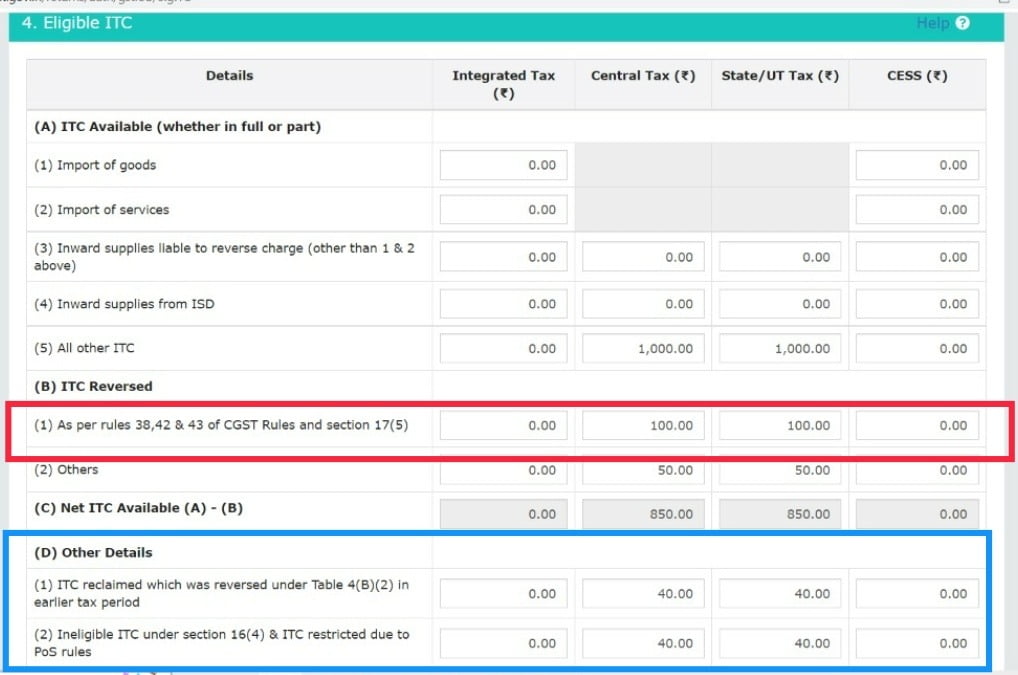

Changes In GSTR 3B For Correct Reporting Of ITC Availment Reversal And

https://taxreply.com/images/Z154304943047463-1206.jpg

ITC s market analyses provide real time data on trade dynamics market access conditions growth potential and policy choices possible business partners and business operations In an You can use ITC s Market Access Map to find ad valorem equivalents AVEs for non ad valorem duties in order to compare tariffs across countries The application includes

[desc-10] [desc-11]

Reversal Of ITC In Case Of Non payment Of Consideration Within 180 Days

https://taxguru.in/wp-content/uploads/2022/10/Reversal-of-ITC-in-case-of-non-payment-of-consideration-within-180-days-w.e.f.-01.10.2022.jpg

Request Letter To Bank For Reversal Of Minimum Balance Charges

https://www.lettersinenglish.com/wp-content/uploads/Request-Letter-to-Bank-for-Reversal-of-Minimum-Balance-Charges.jpg

https://www.canada.ca › en › revenue-agency › services › tax › business…

The last reporting period in which you can claim an ITC for the tax you were charged on the office furniture is the reporting period October 1 2026 to December 31 2026

https://www.intracen.org › about-us › careers › job-opportunities

ITC ICA 40 2025 27 May 2025 View details Apply LICA 10 Project Management Adviser Kigali Rwanda ITC ICA 39 2025 27 May 2025 View details Apply

Decoding Input Tax Credit ITC Under GST

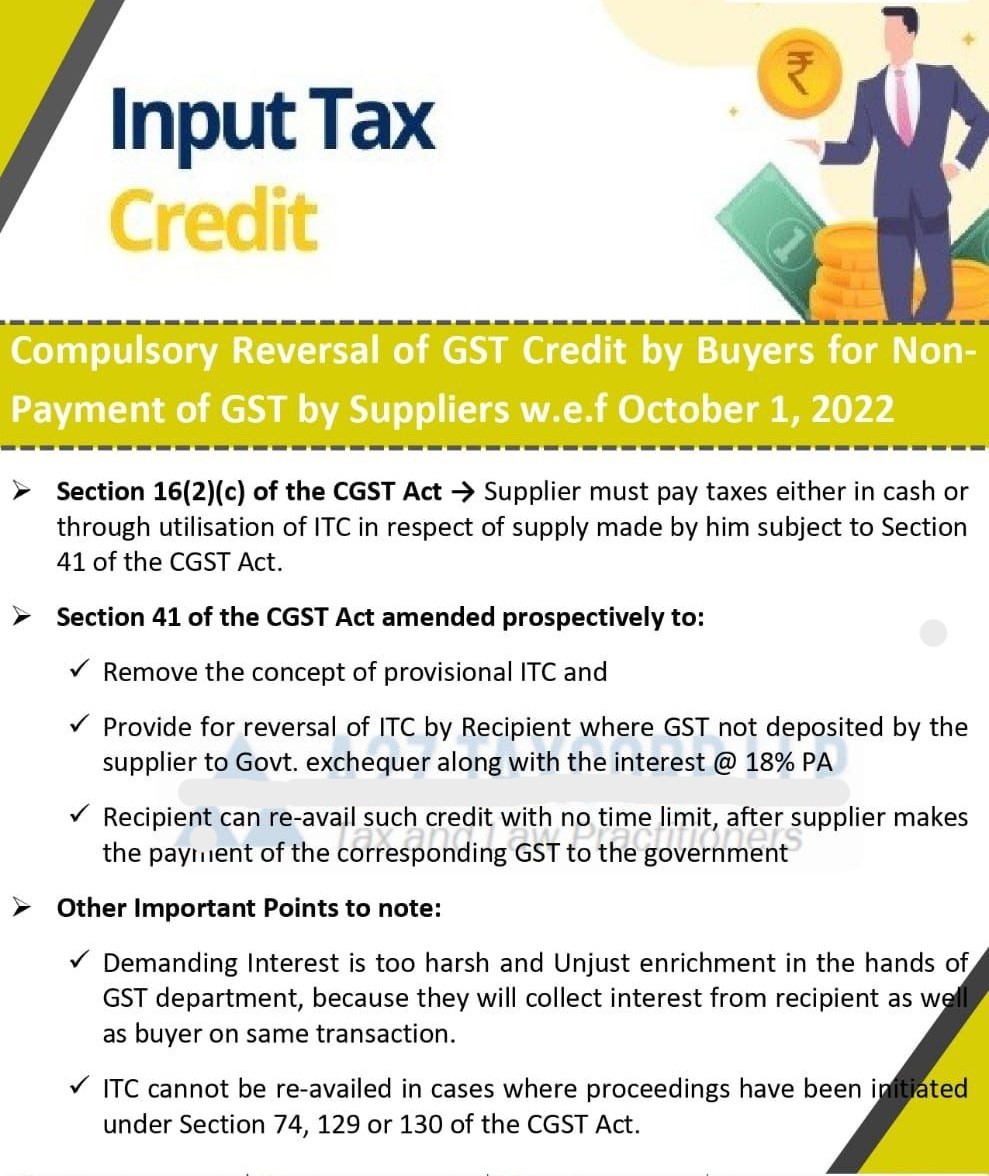

Reversal Of ITC In Case Of Non payment Of Consideration Within 180 Days

ITC Reversal On Failure To Pay Within 180 Days Amendments Issues

Analyzing The Mismatch In ITC Claims Between GSTR 3B And GSTR 2A

Reversal Of ITC Overview Of Amendment In Rule 37 Of CGST Rules

Reversal Of Input Tax Credit ITC Under GST Calculation With Example

Reversal Of Input Tax Credit ITC Under GST Calculation With Example

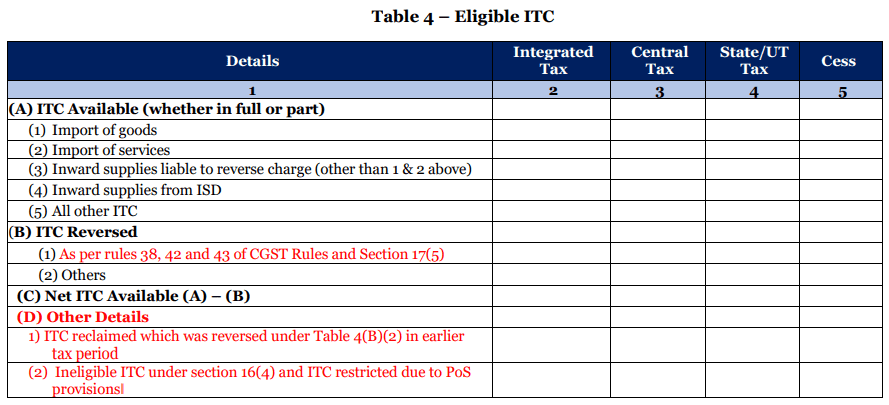

GSTN Enables Changes In Table 4 Of GSTR 3B Related To The Claim Of ITC

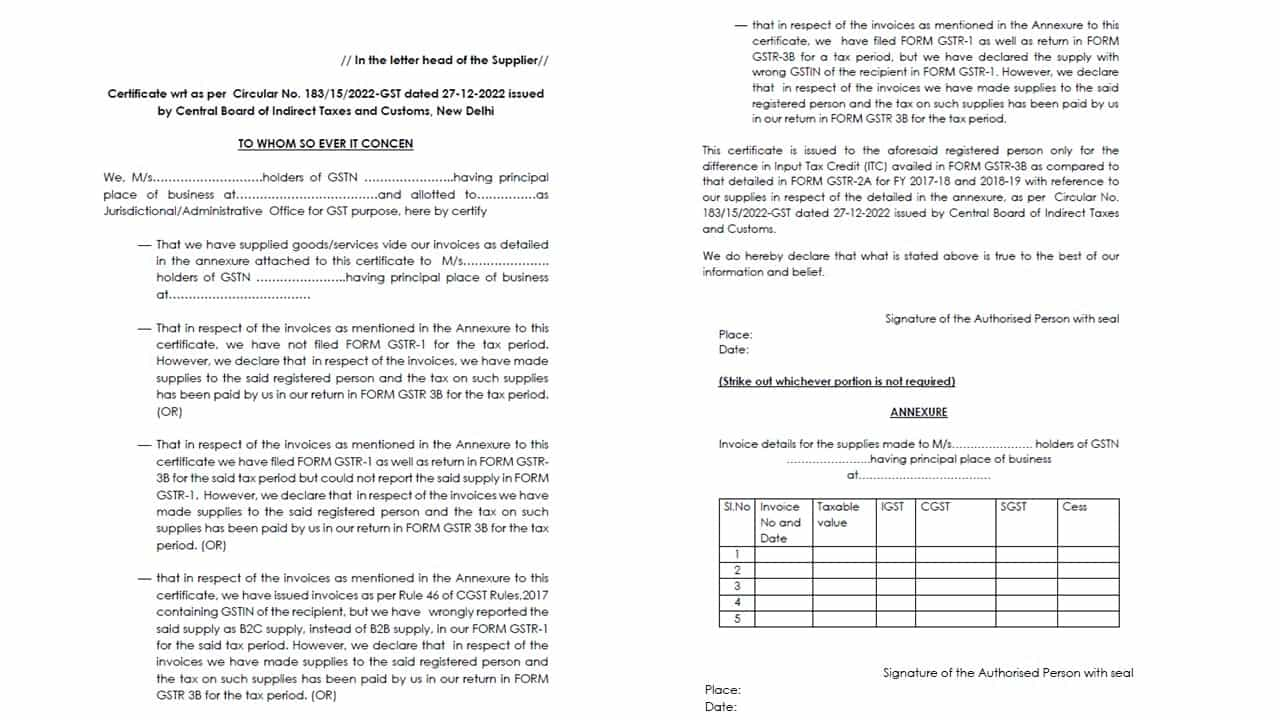

ITC Mismatch GSTR 3B And GSTR 2A Format Of Certificate

GST Reporting Of ITC Reversal Opening Balance Reclaimed Statement

Itc Reversal Form In Gst - [desc-12]