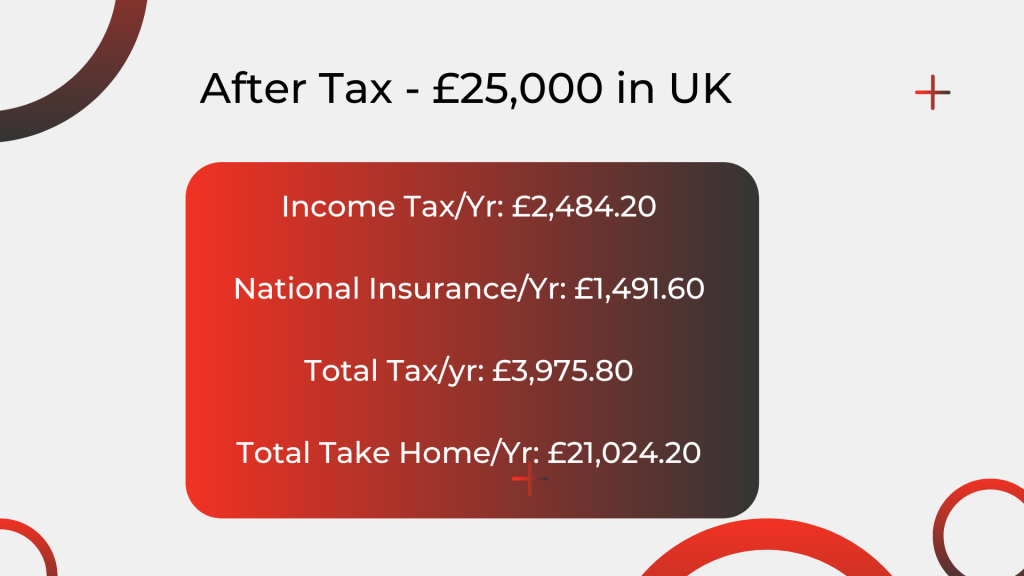

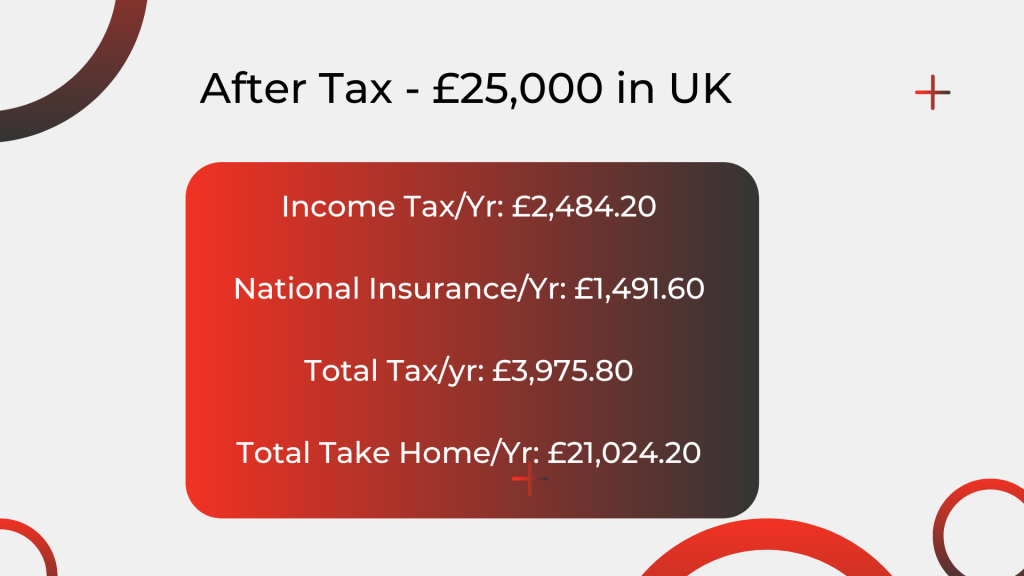

What Is 25 500 After Tax If your salary is 25 500 then after tax and national insurance you will be left with 21 362 This means that after tax you will take home 1 780 or 411 per week 82 20 per day and your hourly rate will be 10 28 if you re working 40 hours week

Here is a full calculation for a 25 500 gross income after UK tax and national insurance deductions in the 2024 2025 tax year 25 500 After Tax If your salary is 25 500 then after tax and national insurance your take home net will be 21 879 60 This means that after tax your monthly take home will be 1 823 30 or 420 76 per week 84 15 per day and your hourly rate will be 10 52 if

What Is 25 500 After Tax

What Is 25 500 After Tax

https://www.storyofmathematics.com/wp-content/uploads/2022/09/of-.png

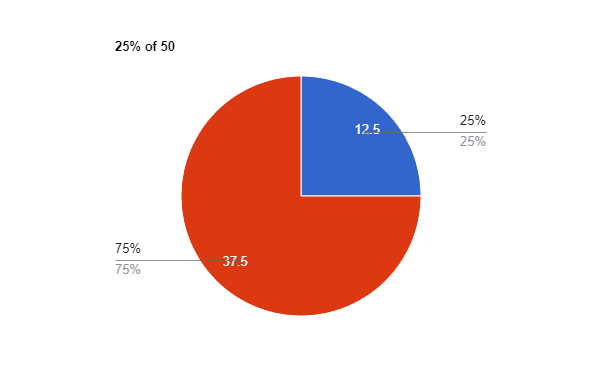

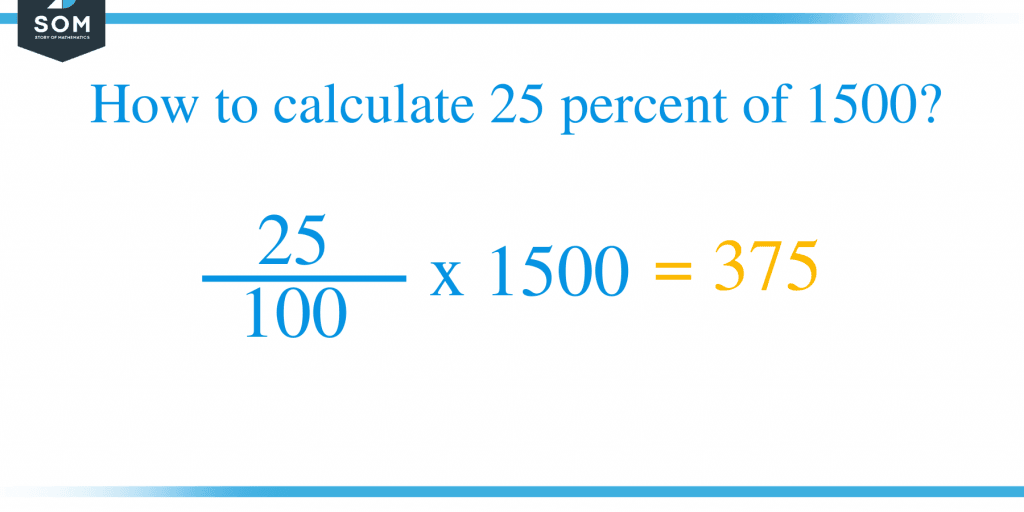

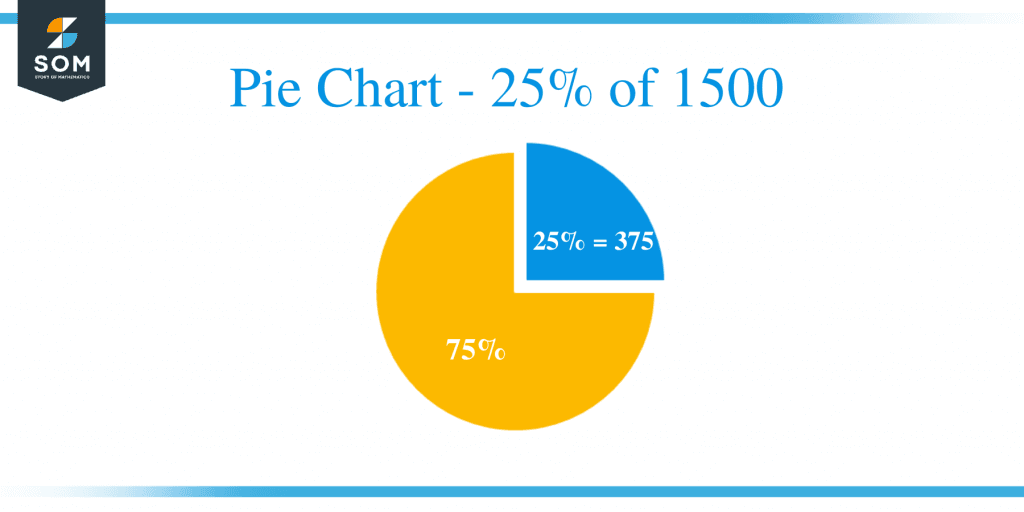

What Is 25 Percent Of 1500 Solution With Free Steps

https://www.storyofmathematics.com/wp-content/uploads/2022/12/Percent-formula-25-percent-of-1500-1024x512.png

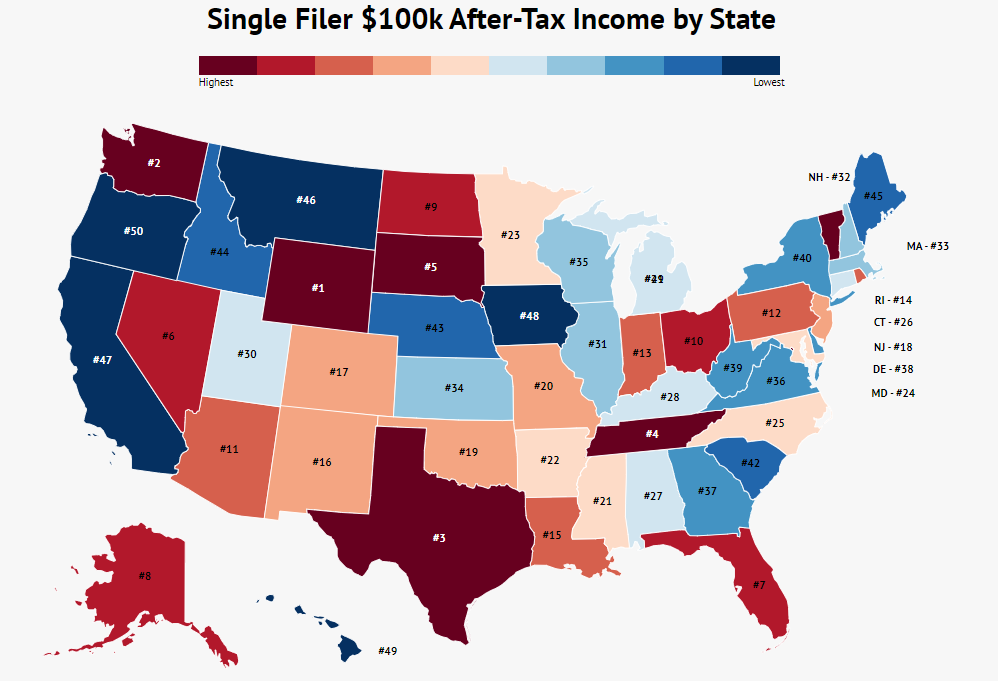

100k After Tax Income By State 2023 Zippia

https://www.zippia.com/wp-content/uploads/2023/03/single-filer-after-tax-income.png

What is the Take Home Pay With the Yearly Income of 25500 After Tax Your estimated Salary after tax 25500 for 2025 with 25 5k annual income is 21 881 40 a year Your yearly tax payments for the 25 5k annual income will be as below Income Tax to be paid per year 2 584 20 National Insurance to be paid per year 1 034 40 On a 25 500 salary in 2024 2025 you ll take home 21 880 paying 2 586 in Income Tax and 1 034 in National Insurance See your monthly 1 823 and weekly 421 earnings breakdown

Calculate your take home pay given income tax rates national insurance tax free personal allowances pensions contributions and more On a 25 500 salary your take home pay will be 21 621 after tax and National Insurance This equates to 1 801 75 per month and 415 79 per week If you work 5 days per week this is 83 16 per day or 10 39 per hour at 40 hours per week

More picture related to What Is 25 500 After Tax

Solved What Is The Price Consumers Pay After Tax Per Unit Chegg

https://media.cheggcdn.com/media/ea1/ea1ecf5a-4742-4527-b700-649270960a30/phptinO5F

How To Calculate After Tax Cost Of Debt

https://www.superfastcpa.com/wp-content/uploads/2023/06/How-to-Calculate-After-Tax-Cost-of-Debt.png

USD ZAR Breaches 18 When Is It Best To Buy US Dollars Moneyweb

https://www.moneyweb.co.za/wp-content/uploads/2014/10/AdobeStock_218603303-1024x683.jpeg

The Salary Calculator tells you monthly take home or annual earnings considering UK Tax National Insurance and Student Loan The latest budget information from April 2025 is used to show you exactly what you need to know Wondering how much you really earn after tax Use our salary after tax calculator to quickly calculate how much you pay in taxes as well as your take home pay income tax and national insurance contributions made by your employer

Use our Bonus Tax Calculator to see the amount of tax paid on a bonus on top of regular salary How much of the bonus do you take home more options Adjust your details above and the calculation will automatically refresh How do you find the gross salary from the actual money you need to spend The answer is to use this tool our Reverse Tax Calculator Using an estimation system to take into consideration every option available on the regular tax calculator including self employment CIS options we can find the gross figure from a net figure provided

25000 After Tax Calculator How Much Is Salary After Tax 25k In UK

https://www.londonbusinessblog.co.uk/wp-content/uploads/2023/02/After-Tax-25000-in-UK-1024x576.png

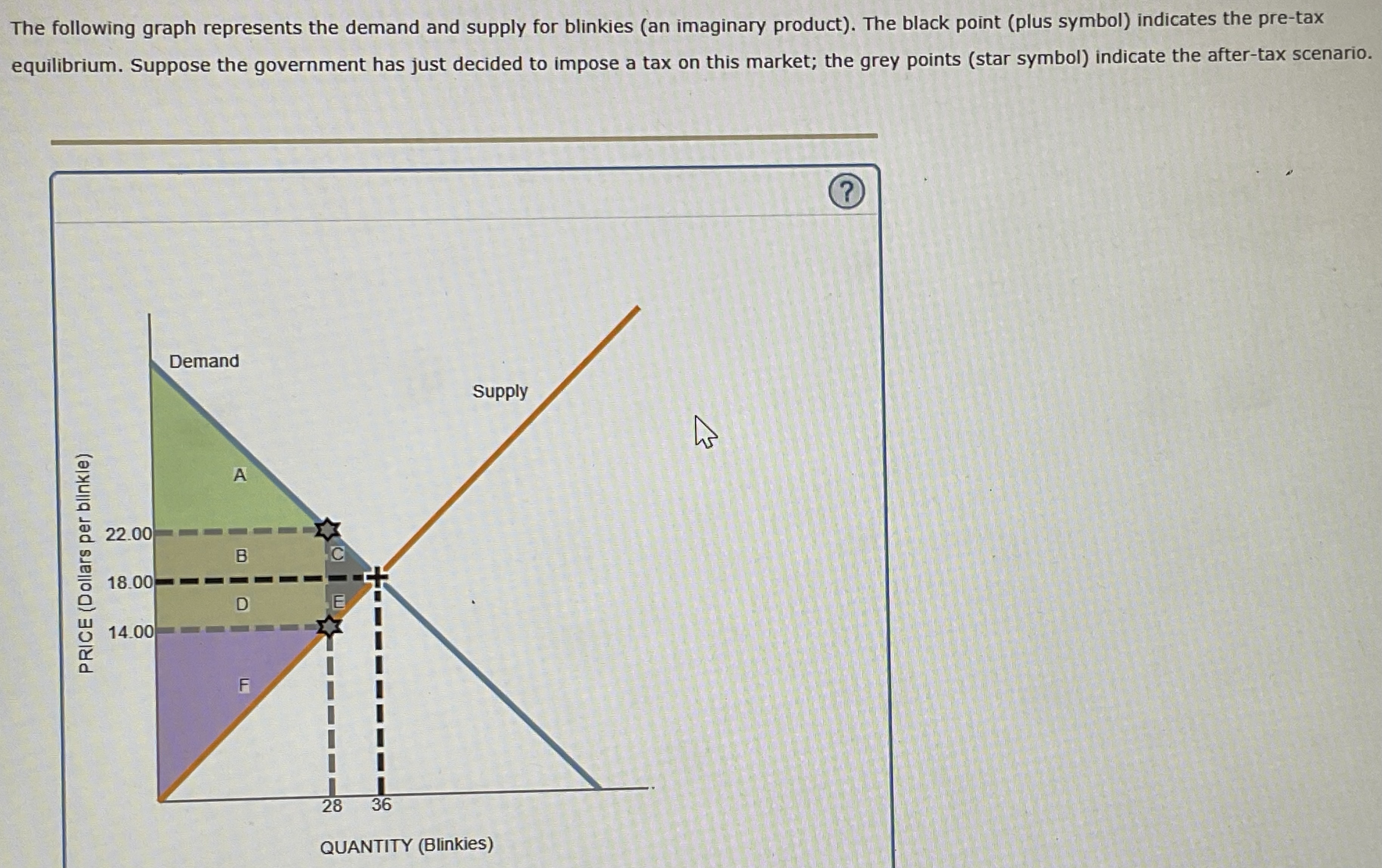

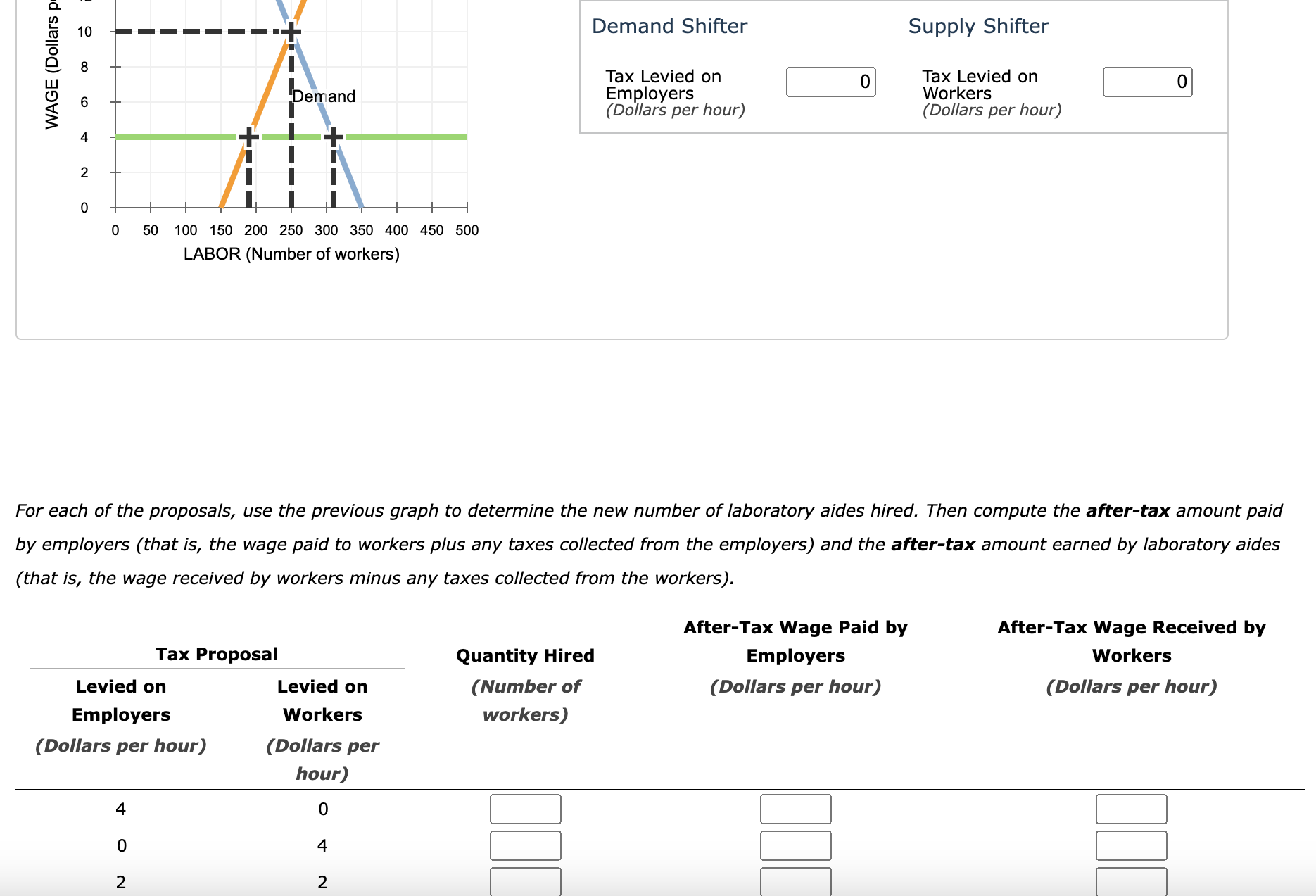

Solved 1 Understanding The Implications Of Taxes On Welfare Chegg

https://media.cheggcdn.com/media/959/959b2383-f836-4825-853a-b21edd909deb/phpeC69CK

https://www.income-tax.co.uk › after-tax

If your salary is 25 500 then after tax and national insurance you will be left with 21 362 This means that after tax you will take home 1 780 or 411 per week 82 20 per day and your hourly rate will be 10 28 if you re working 40 hours week

https://www.uktaxcalculators.co.uk

Here is a full calculation for a 25 500 gross income after UK tax and national insurance deductions in the 2024 2025 tax year

What Is 25 Percent Of 2000 Calculatio

25000 After Tax Calculator How Much Is Salary After Tax 25k In UK

30000 After Tax Calculator How Much Is Salary After Tax 30k In UK

What Is 20 Percent Of 500 Calculatio

Legal Tech Startup Ex Parte Raises 7 5M In Funding To Predict

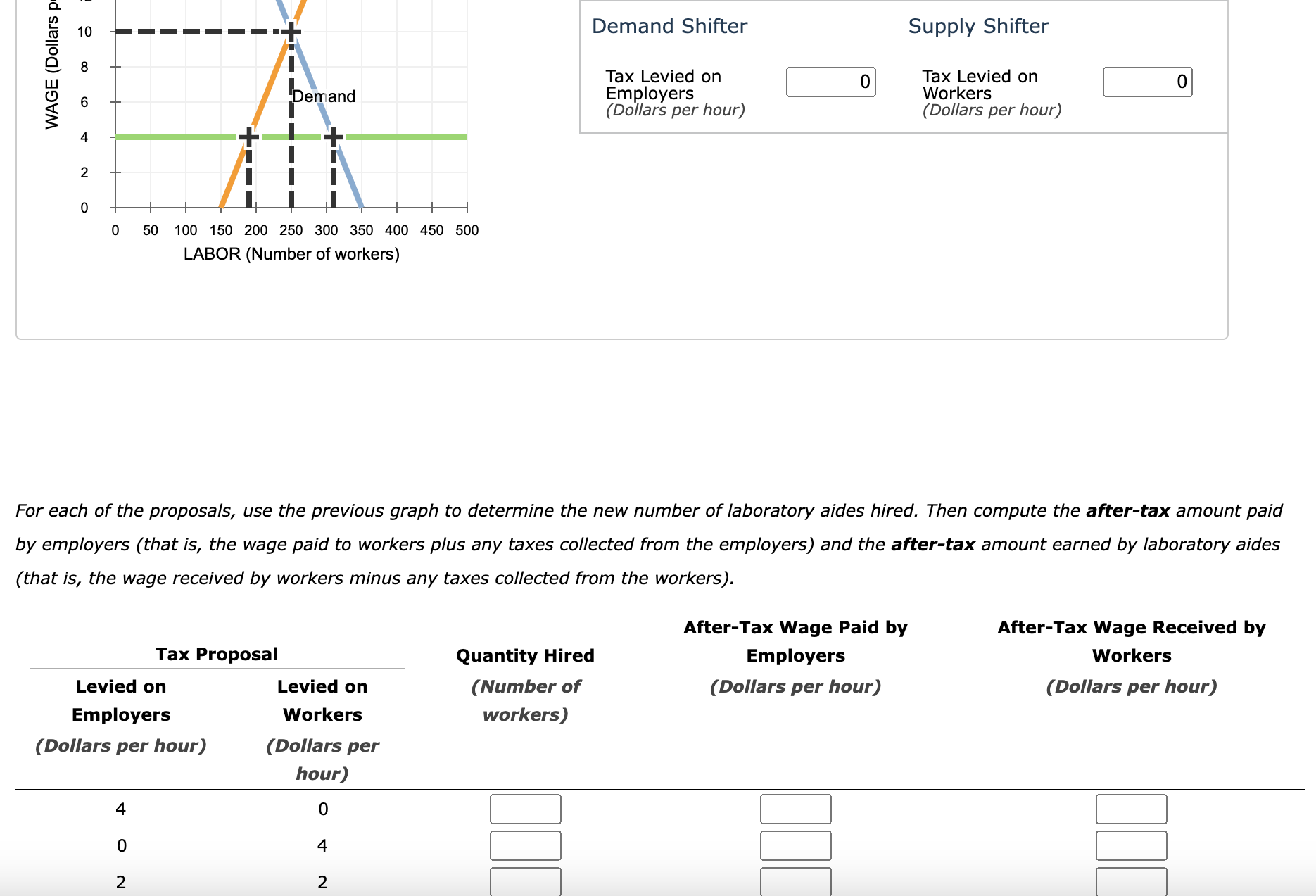

Solved 6 Who Should Pay The Tax The Following Graph Gives Chegg

Solved 6 Who Should Pay The Tax The Following Graph Gives Chegg

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

What Is 25 Percent Of 1500 Solution With Free Steps

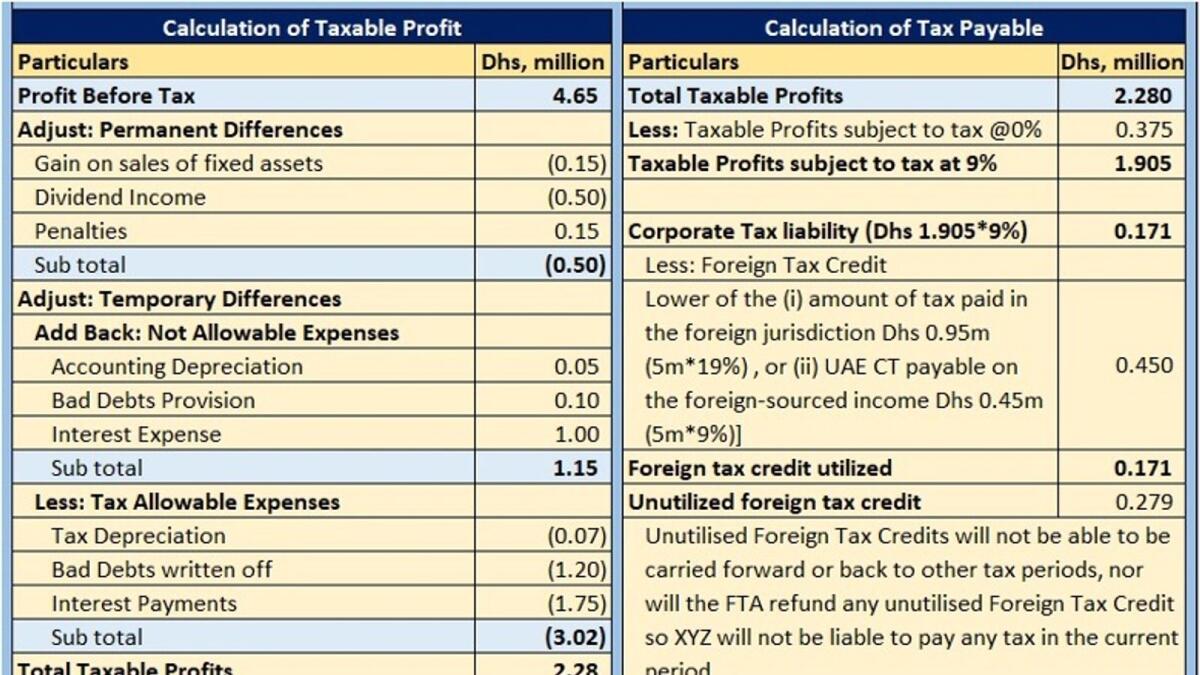

How To Calculate Corporate Tax Payable And Adjust Foreign Tax Credit

What Is 25 500 After Tax - Calcuate the UK Income Tax National Insurance contributions and Student Loan repayments on your salary See your annual monthly and weekly take home pay and taxes for the 2025 26 tax year 25 00 436 800 Invested annual pension 0 Invested annual surplus 2 201 Inflation of 2 5 year Assumes New State Pension payments