What Is Form 10 Ic Of Income Tax What is Form 10 IC Form 10 IC is the official application for domestic companies that wish to pay tax at a concessional rate of 22 under Section 115BAA of the Income Tax Act 1961 It enables companies to

By filing Form 10 IC the company shall be entitled to pay tax at the rate of 22 plus a surcharge of 10 and cess 4 The effective tax rate will be 25 168 What Is Form 10 IC Who Needs To Fill Out Form 10 IC What Are The Key Details Required In Form 10 IC How To Download Form 10 IC Steps To File Form 10 IC

What Is Form 10 Ic Of Income Tax

What Is Form 10 Ic Of Income Tax

https://media.sailthru.com/composer/images/sailthru-prod-6i4/rupert.png

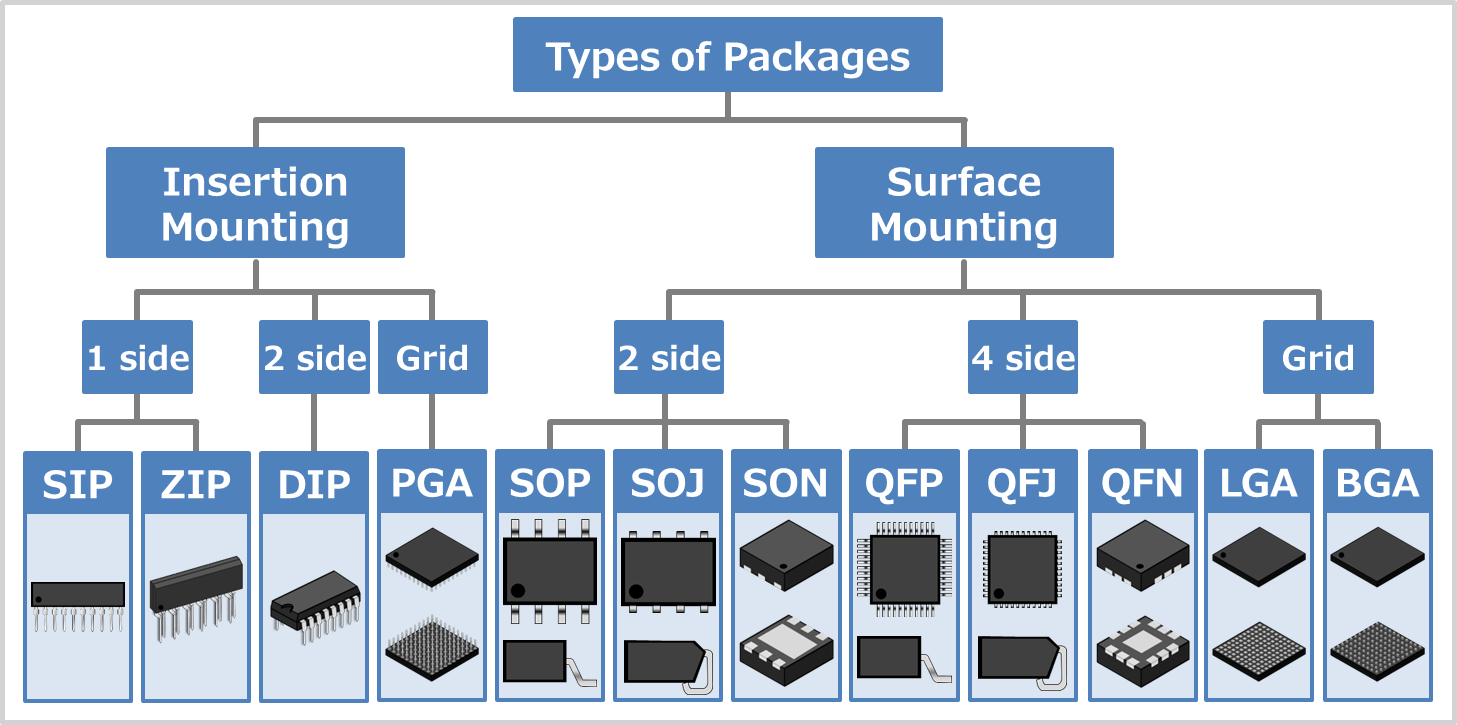

Package Types Shtampik

https://electrical-information.com/wp-content/uploads/2022/07/List-of-IC-Package-Types.png

What Is Form A DHL Freight Connections

https://dhl-freight-connections.com/wp-content/uploads/2025/02/RZ_DHL_Duo_Trailer_Header.jpg

Who is required to file Form 10 IC Form 10 IC has to be filed by a domestic company that wants to opt for a lower tax regime of Section 115BAA Section 115BAA allows a domestic company What is Form 10 IC All the companies that are incorporated and operating in India and paying the corporate tax under section 115BAB of the Income Tax Act are eligible for the filing of Form 10 IC The tax rate as

As per Section 115BAA of the Income Tax Act Domestic Companies have the option to pay tax at a concessional rate of 22 plus applicable surcharge and E Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries

More picture related to What Is Form 10 Ic Of Income Tax

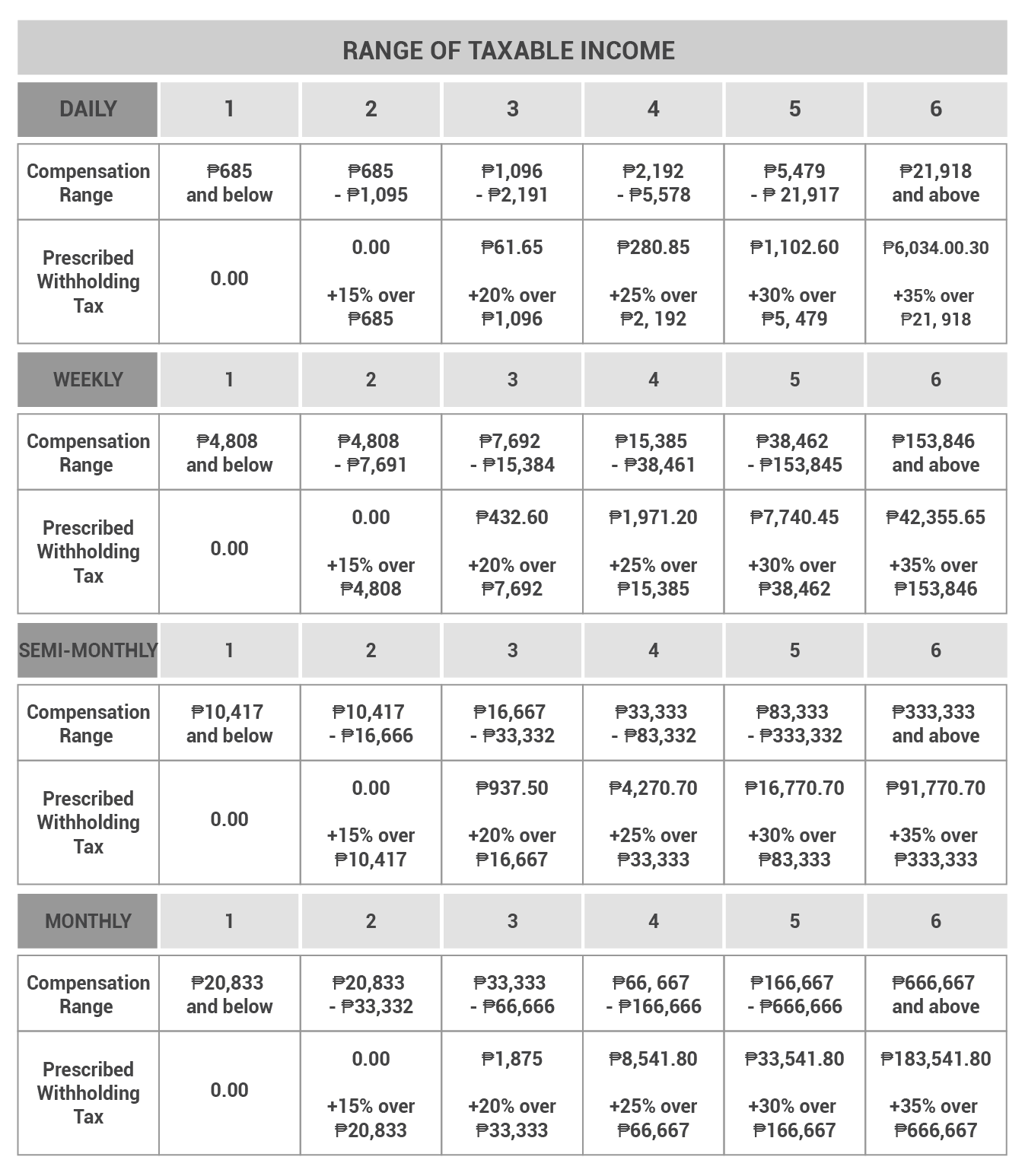

Individual Income Tax Rates 2024 Philippines Image To U

https://kittelsoncarpo.com/wp-content/uploads/2023/02/TAX-SSS-PHIC-UPDATES_TABLES-02-min.png

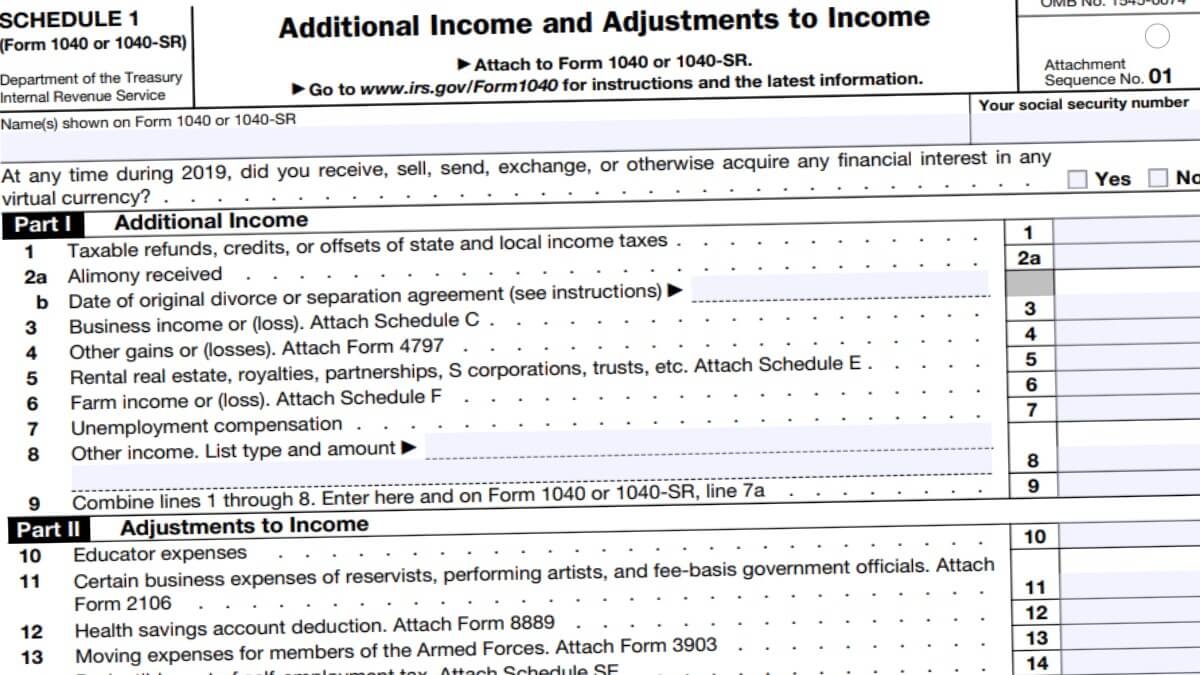

Irs 2025 Schedule 1 Fadi Radical

https://www.taxuni.com/wp-content/uploads/2020/12/1040-Schedule-1-2021.jpg

What Is Form A DHL Freight Connections

https://dhl-freight-connections.com/wp-content/uploads/2025/01/DHL_Malmoe_Header-2048x1152.jpg

All the companies that are incorporated and operating in India and paying the corporate tax under section 115BAB of the Income Tax Act are eligible for the filing of Form 10 IC The tax rate as amended by the government is Get to know CBDT form 10 IC and 10ID for concessional corporate taxation The forms will file as per the eligibility condition of section 115BAA and 115BAB of the IT Act

Form 10 ic 1 What is Form 10 IC Form 10 IC shall be filed by all the companies that are incorporated and operating in India and paying the corporate tax under section Form 10 IC of Income Tax Act From April 2020 a domestic company can opt to pay income tax at a concessional tax rate of 22 p a under Section 115BAA of the IT Act 1961 To avail of

New York State Tax Brackets 2025 Antje M Pabst

https://static-ssl.businessinsider.com/image/5c33833ebd7730076d294700-2400/2019 tax brackets table 1.png

Income Tax Brackets 2025 Julieta Rose

https://topdollarinvestor.com/wp-content/uploads/2022/11/2022-Federal-Income-Tax-Brackets-1.png

https://cleartax.in

What is Form 10 IC Form 10 IC is the official application for domestic companies that wish to pay tax at a concessional rate of 22 under Section 115BAA of the Income Tax Act 1961 It enables companies to

https://www.taxwink.com › blog

By filing Form 10 IC the company shall be entitled to pay tax at the rate of 22 plus a surcharge of 10 and cess 4 The effective tax rate will be 25 168

2025 2025 Es Form Printable Renata Grace

New York State Tax Brackets 2025 Antje M Pabst

2025 Tax Brackets Mfj James McLaughlin

Individual Tax Rates 2025 Nz Kareem Avery

Free Federal Itemized Deductions Worksheet Download Free Federal

Schedule C Form 1040 For 2025 Michael Harris

Schedule C Form 1040 For 2025 Michael Harris

GST Changes From Budget 2025 CA GuruJi

2025 Tax Brackets Single Filer Ronald L Ellis

Income Tax Standard Deduction 2025 Married Jointly Celeste E Johnson

What Is Form 10 Ic Of Income Tax - FAQs On Form 10IC FAQ 1 While filing Form 10IC I had selected Yes for Whether option under sub section 4 of section 115BA has been exercised in Form 10 IB