What Is Income Tax Bracket Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by

For amounts based on your specific income use the Old Age Security OAS estimator If you lived in Canada for at least 10 years but less than 40 years after age 18 you will receive a The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was

What Is Income Tax Bracket

What Is Income Tax Bracket

https://taxedright.com/wp-content/uploads/2023/10/2024-Tax-Brackets.png

Income Tax Rates And Allowances 2023 24 Image To U

https://images.axios.com/FeF3kXyZuSjEVWj-265DifJa2hw=/0x0:1280x720/1366x768/2022/10/19/1666195709283.png

Tax Schedule 2025 Australia Alix Bernadine

https://topdollarinvestor.com/wp-content/uploads/2022/11/2022-Federal-Income-Tax-Brackets-1.png

The Canada Disability Benefit is a monthly payment for working age persons with disabilities who have low income The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income

Note The Guaranteed Income Supplement and Allowance amounts don t increase when you delay receiving Old Age Security pension payments You cannot receive the Guaranteed Income tax calculator Updated for 2024 25 tax year how much tax will you pay on your salary in South Africa find out with the SARS income tax calculator updated for 2024 25 tax year

More picture related to What Is Income Tax Bracket

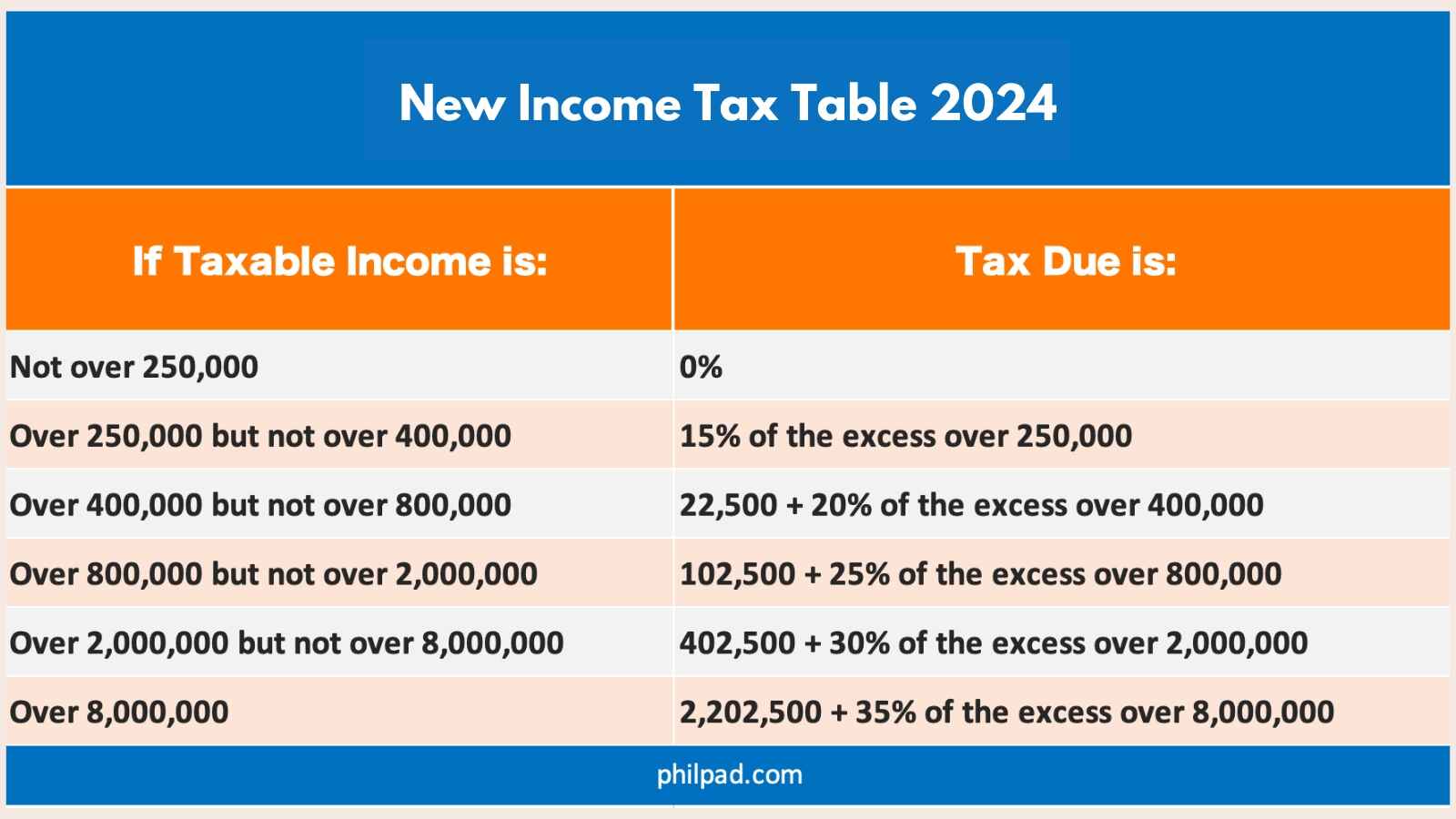

Income Tax Calculator Philippines 2025 Britney S Brock

https://cdn-0.philpad.com/wp-content/uploads/2018/04/income-tax-table-2024.jpg

New York State Tax Brackets 2025 Antje M Pabst

https://static-ssl.businessinsider.com/image/5c33833ebd7730076d294700-2400/2019 tax brackets table 1.png

Tax Brackets For 2025 Printable Free Dominic H Newman

https://smartzonefinance.com/wp-content/uploads/2018/06/taxes-a03-g01.png

How to work out how much tax you will pay on your bonus manually Step 1 Determine your taxable income for the year by multiplying your monthly salary by 12 Step 2 6 The income level cut offs do not include the OAS pension the first 5 000 of employment or self employment income and 50 of employment or self employment income

[desc-10] [desc-11]

Tax Owed Calculator 2025 Tariq Sadie

https://www.akwealthadvisors.com/wp-content/uploads/2023/08/blog082823-1024x992.png

New York State Itemized Deductions 2025 Hana Llevi

https://www.wiztax.com/wp-content/uploads/2022/10/3.png

https://www.canada.ca › en › revenue-agency › news › tax-season-start…

Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by

https://www.canada.ca › en › services › benefits › publicpensions › old-a…

For amounts based on your specific income use the Old Age Security OAS estimator If you lived in Canada for at least 10 years but less than 40 years after age 18 you will receive a

Tax Calculator 2025 Canada Income Athene Madeleine

Tax Owed Calculator 2025 Tariq Sadie

Income Tax Brackets 2025 In Canada Jay C Petit

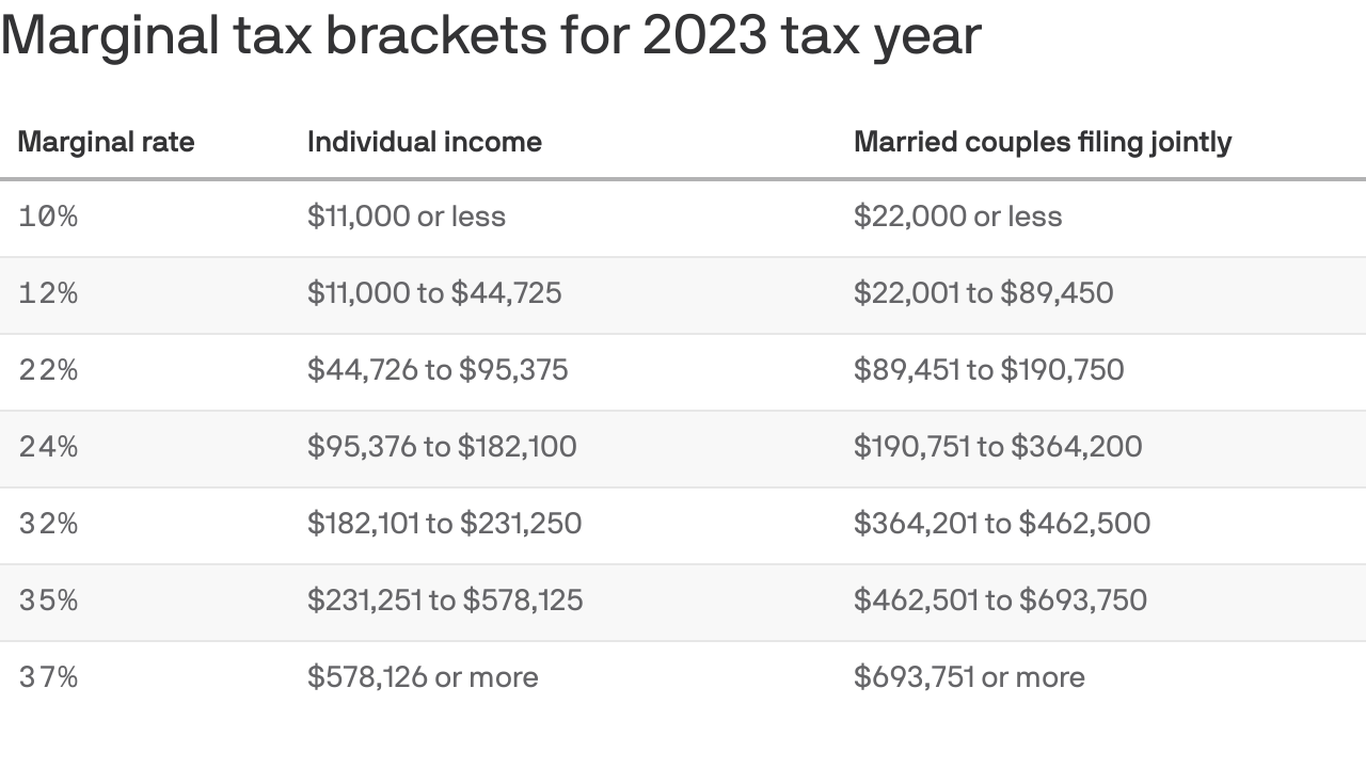

Irs Tax Brackets 2025 For Single Person Barry Williams

Income Tax Standard Deduction 2025 Married Jointly Celeste E Johnson

Tax Brackets 2025 Australia Ato Nashit Grace

Tax Brackets 2025 Australia Ato Nashit Grace

Irmaa Brackets 2025 Married Filing Jointly Sylvia S Cyr

Your Fair Share Changes To Income Gains And Estate Taxes Open Window

When Do Taxes Start 2025 Magnolia Ayes

What Is Income Tax Bracket - The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income