What Is Income Tax Law And Practice The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was

How to determine your income When applying for the Guaranteed Income Supplement and the Allowance you or in the case of a couple you and your spouse or common law partner must Filing an income tax and benefit return can help you access benefit and credit payments like the GST HST credit up to 533 for an eligible individual the Canada child

What Is Income Tax Law And Practice

What Is Income Tax Law And Practice

https://i.ytimg.com/vi/i6diCuPglC8/maxresdefault.jpg

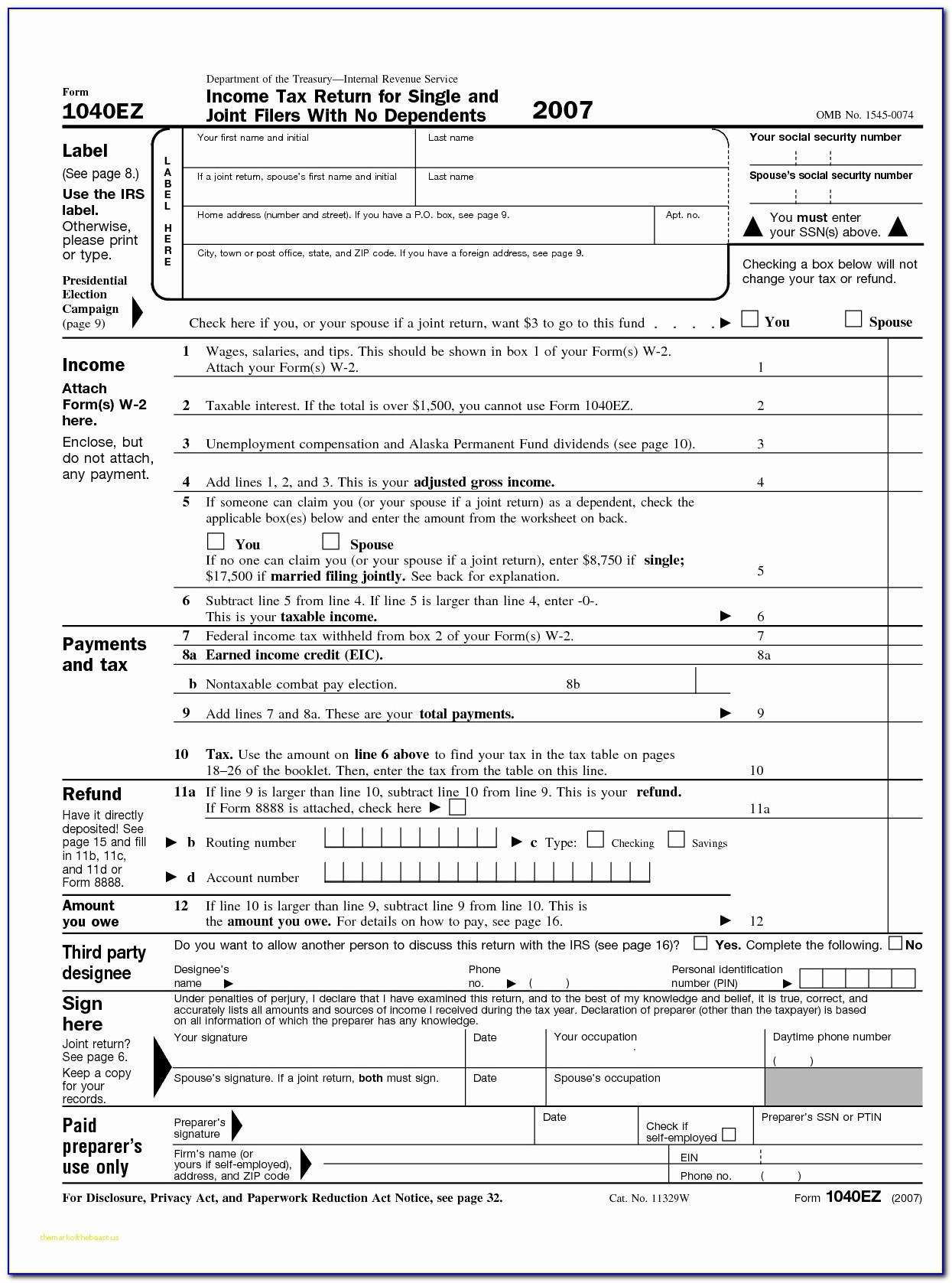

Income Tax Law And Practice Previous Year Question Paper 2022 23 Bcom

https://i.ytimg.com/vi/pQ3jRAqWlfg/maxresdefault.jpg

Income Tax Law And Practice B Com 3rd Year Super Model Paper 2020

https://i.ytimg.com/vi/OdQITEUTC0I/maxresdefault.jpg

February 24 2025 You can start filing your 2024 income tax and benefit return online April 30 2025 Deadline for most individuals to file their income tax and benefit return and pay any Enter net income or loss after income tax and extraordinary items at amount A page 1 of Schedule 1 Add the taxable items and the non allowable expenses listed on lines 101 to 199

If your net world income exceeds the threshold amount 86 912 for 2023 you have to repay part or your entire OAS pension Part or your entire OAS pension is reduced as a monthly recovery Do not report tax exempt employment income you paid to your employee who is registered or entitled to be registered under the Indian Act using box 14 use code 71 or for a

More picture related to What Is Income Tax Law And Practice

Overview Of Components Of Income Tax Law Income Tax Video Lectures

https://i.ytimg.com/vi/jqk6IsoxSic/maxresdefault.jpg

Individual Federal Tax Rates 2024 Image To U

https://images.axios.com/FeF3kXyZuSjEVWj-265DifJa2hw=/0x0:1280x720/1366x768/2022/10/19/1666195709283.png

Income Tax Law And Practice Ryan Publishers

https://ryanpublishers.co.in/wp-content/uploads/2020/07/Income-Tax-Law-and-Practice.jpg

The personal income levels used to calculate your Manitoba tax have changed The basic personal amount has changed The maximum annual amount of eligible expenses for fertility 2 49 In broad terms the enhanced dividend gross up and dividend tax credit apply to dividends distributed to an individual from corporate income taxed at the general corporate income tax

[desc-10] [desc-11]

Income Tax Thresholds 2025 26 Trish Micheline

https://www.thechichesteraccountants.com/wp-content/uploads/2023/01/tax-2-2-1024x633.png

2025 Tax Brackets Australia Calculator Lilian D Broughton

https://taxedright.com/wp-content/uploads/2023/10/2024-Tax-Brackets.png

https://www.canada.ca › ... › general-income-tax-benefit-package › ontario

The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was

https://www.canada.ca › ... › old-age-security › guaranteed-income-supp…

How to determine your income When applying for the Guaranteed Income Supplement and the Allowance you or in the case of a couple you and your spouse or common law partner must

:max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg)

Income Tax

Income Tax Thresholds 2025 26 Trish Micheline

Irs W9 Form 2025 Oliver N Lumholtz

2025 Income Tax Calculator Jamie Luna

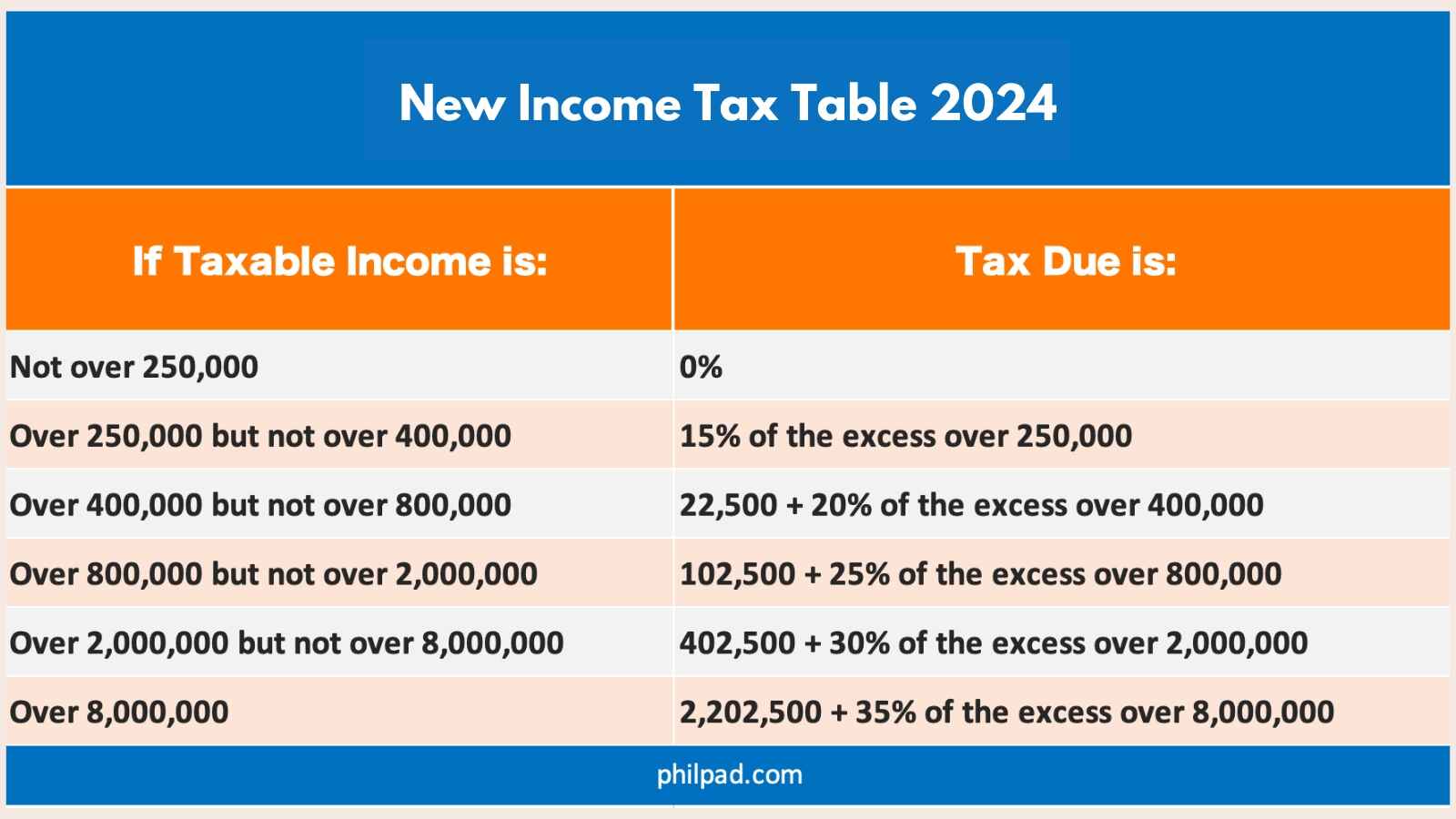

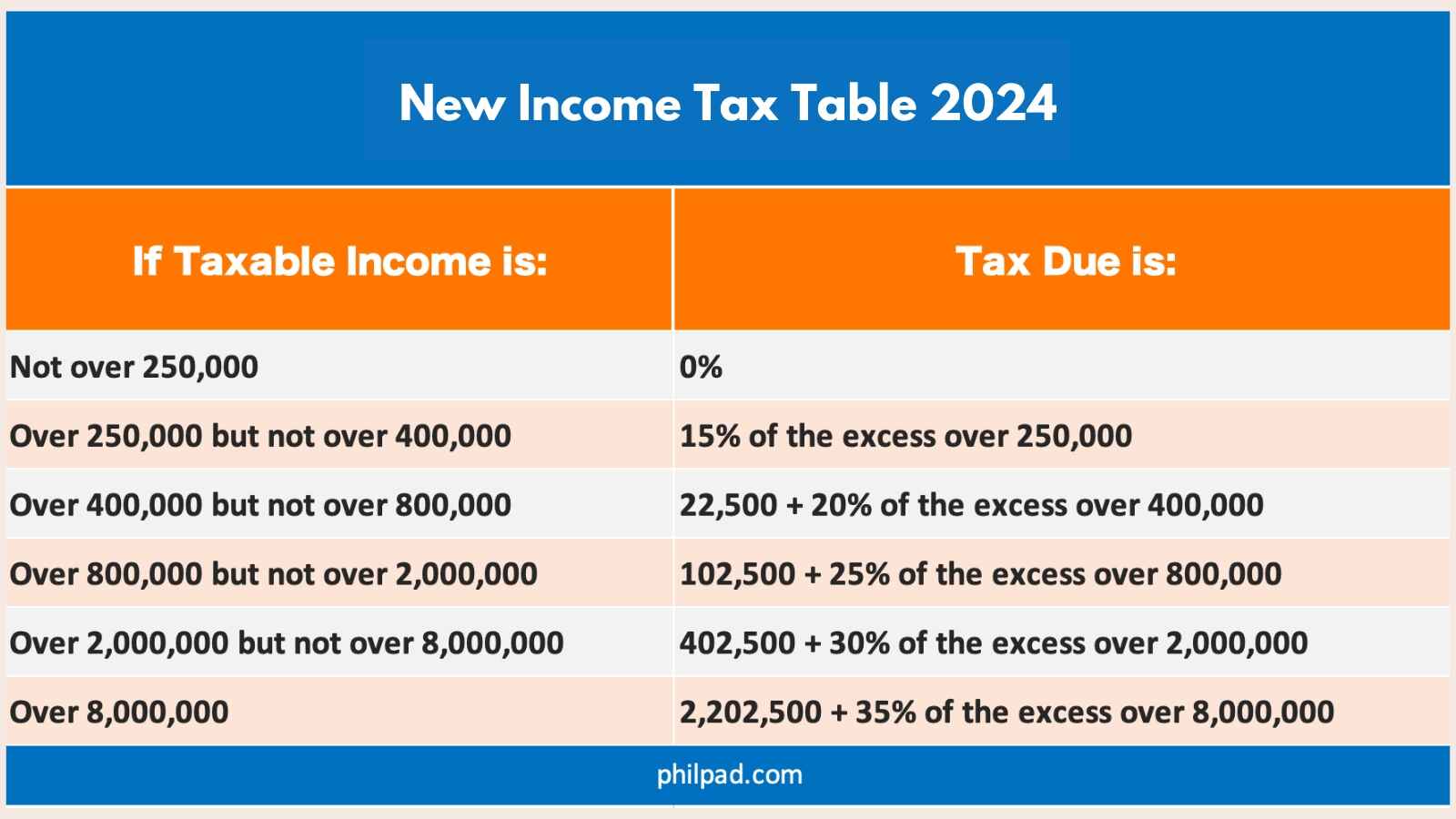

Tax Bracket 2025 Philippines Ruby Amira

Income Tax Calculator Philippines 2025 Britney S Brock

Income Tax Calculator Philippines 2025 Britney S Brock

Individual Income Tax Rates 2024 Singapore Image To U

South Carolina Tax Deadline 2025 Emily Dias

Individual Tax Rates 2025 Nz Kareem Avery

What Is Income Tax Law And Practice - [desc-13]