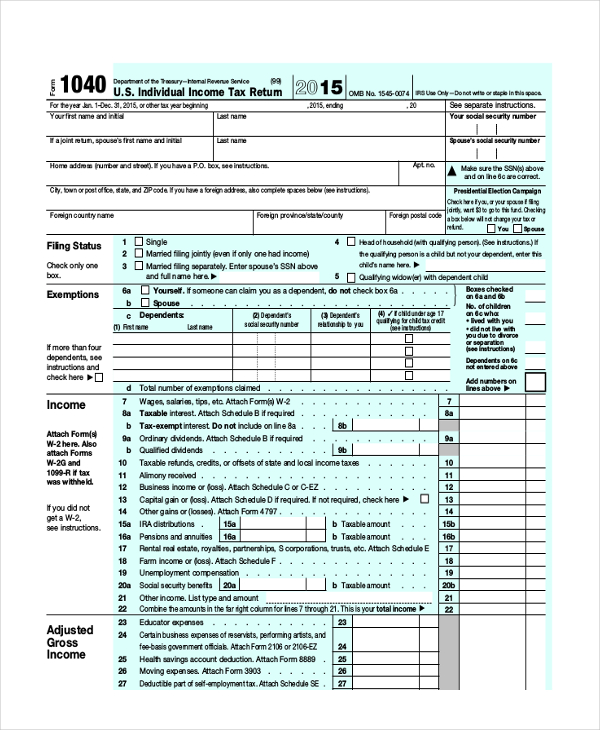

What Is Individual Income Tax Simple Definition An individual income tax or personal income tax is levied on the wages salaries investments or other forms of income an individual or household earns The U S imposes a progressive

What Is Income Tax Income tax in its simplest form is a legal obligation charged by governments on individuals and corporations financial incomes Predominantly it s applied to both earned income such as wages Income tax levy imposed on individuals or family units and corporations Individual income tax is computed on the basis of income received It is usually classified as a direct tax because the burden is presumably on the

What Is Individual Income Tax Simple Definition

What Is Individual Income Tax Simple Definition

https://i.ytimg.com/vi/ubbjgC1yb5o/maxresdefault.jpg

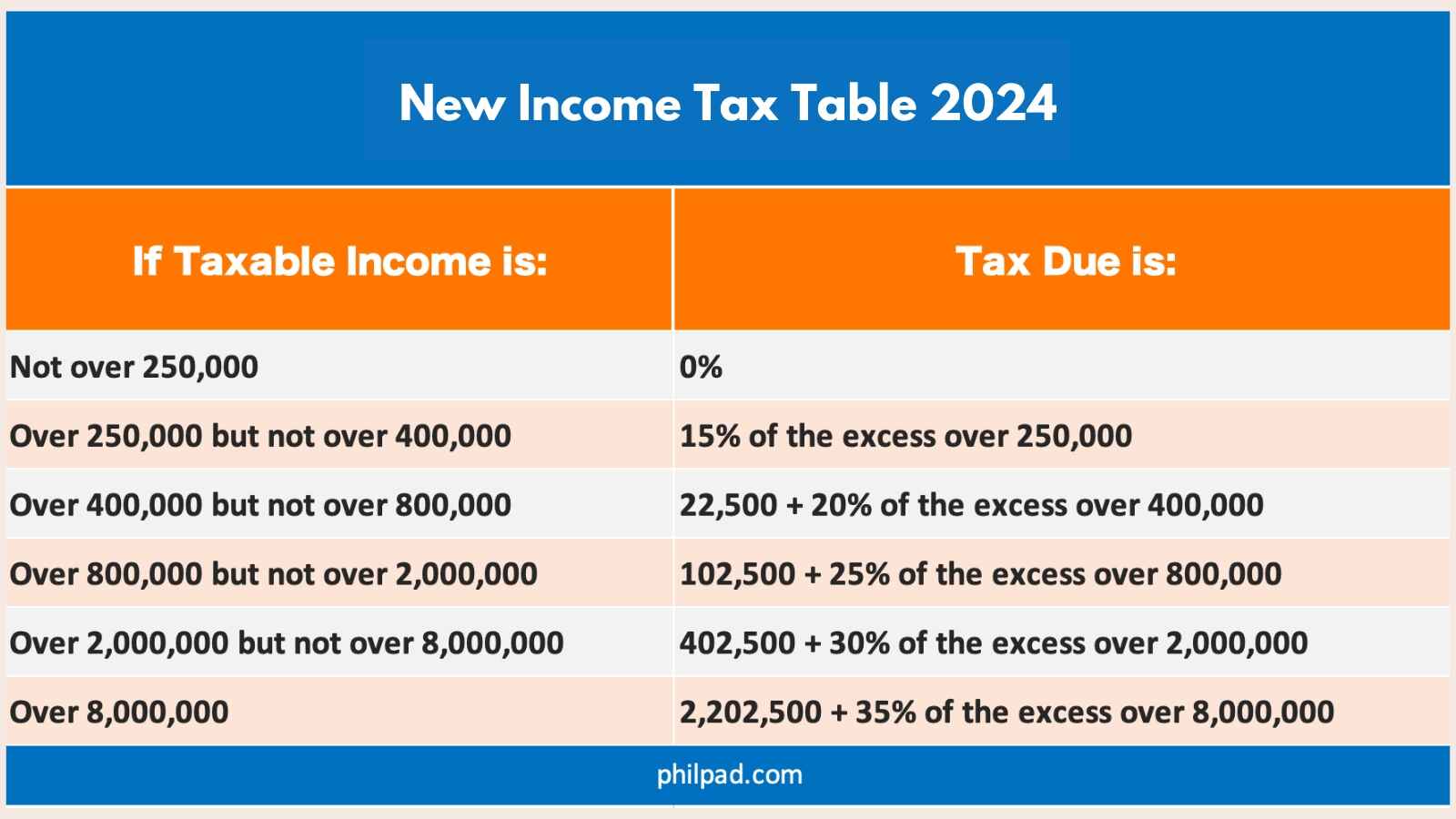

Tax Bracket 2025 Philippines Nashit Zara

https://governmentph.com/wp-content/uploads/2017/12/Personal-Income-Tax-2023.png

:max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg)

Income Tax

https://www.investopedia.com/thmb/vmecxtzh3YtlhkIY783GtuYo7Ds=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg

Individual income tax also called personal income tax is placed on a person s wages salary and other forms of income This particular tax is INDIVIDUAL INCOME TAX meaning a tax paid by people on the money they earn not a tax that a company pays on its profits Learn more

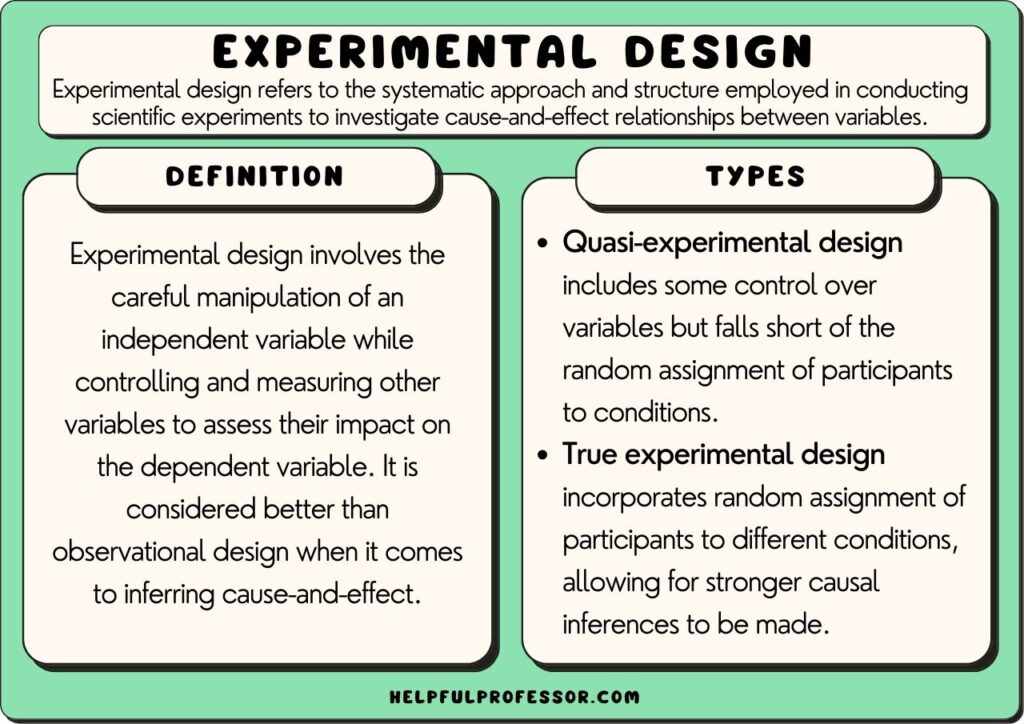

In this blog post we will cover everything you need to know about individual income tax including taxable income tax brackets and rates deductions and credits and filing and payment procedures We will also discuss common Individual federal income taxes are taxes imposed by the government on individuals based on the income they have earned during a given year These taxes are calculated based on factors such as total income filing

More picture related to What Is Individual Income Tax Simple Definition

Iowa Tax Changes Effective January 1 2023 ITR Foundation

https://itrfoundation.org/wp-content/uploads/2023/01/2023-Income-Tax-Changes.png

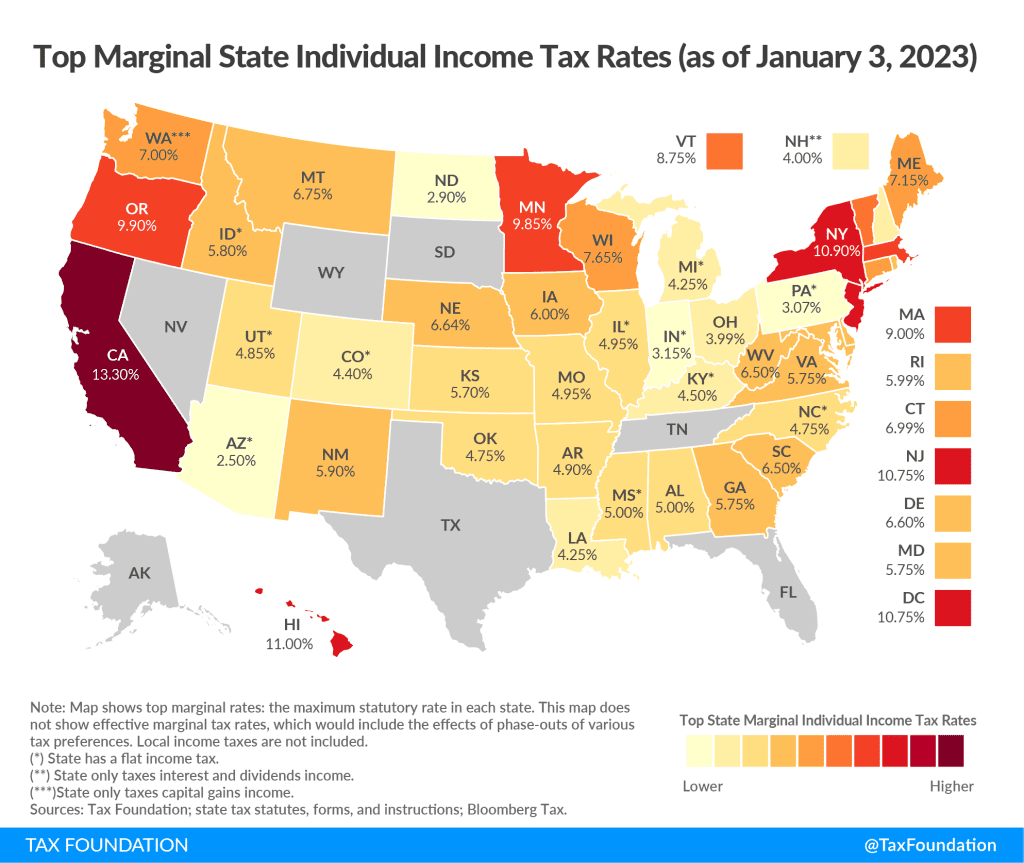

Arizona Tax Rates Rankings Arizona State Taxes

https://taxfoundation.org/wp-content/uploads/2023/02/2023-state-individual-income-tax-rates-2023-state-income-taxes-by-state-1024x863.png

:max_bytes(150000):strip_icc()/Term-Definitions_ExciseTax_V1_CT-b9400e392640438cacee433b84fb89f8.jpg)

Gas Things Examples

https://www.investopedia.com/thmb/VUOooSP_YQAw0q7-6Ir9vYmdiRU=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Term-Definitions_ExciseTax_V1_CT-b9400e392640438cacee433b84fb89f8.jpg

Find out how income tax is calculated what it applies to and when you ll need to pay Browse Investopedia s expert written library to learn more Income tax is a government levy on the earnings of individuals and businesses The collected money contributes to public services and infrastructure Individuals and businesses submit

Income tax is a direct tax collected by the government from individuals businesses and other entities It is governed by the Income Tax Act 1961 and managed by the Income Tax Individual income tax is a government imposed levy on an individual s earnings including wages salaries dividends interest and other income sources This tax is generally progressive

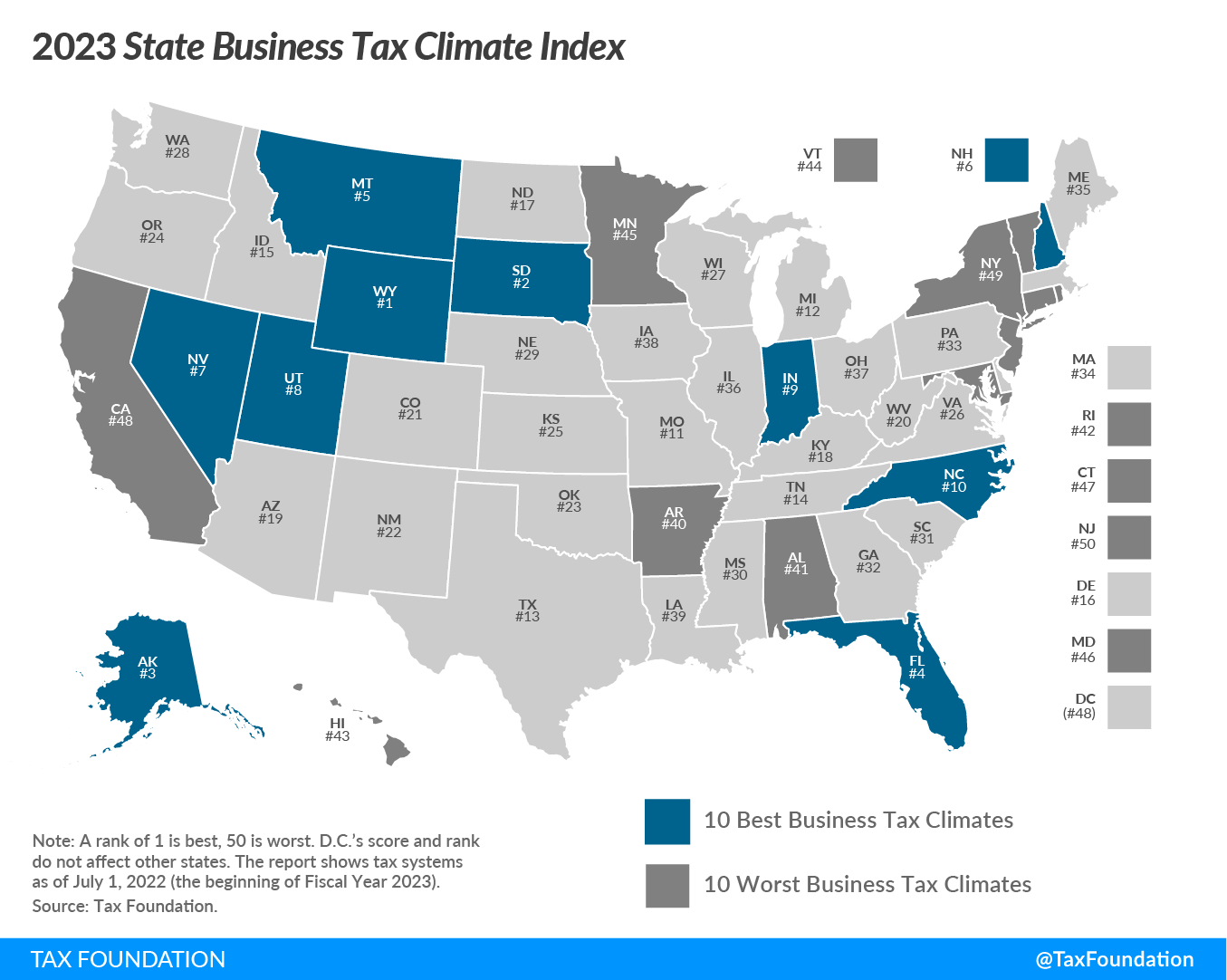

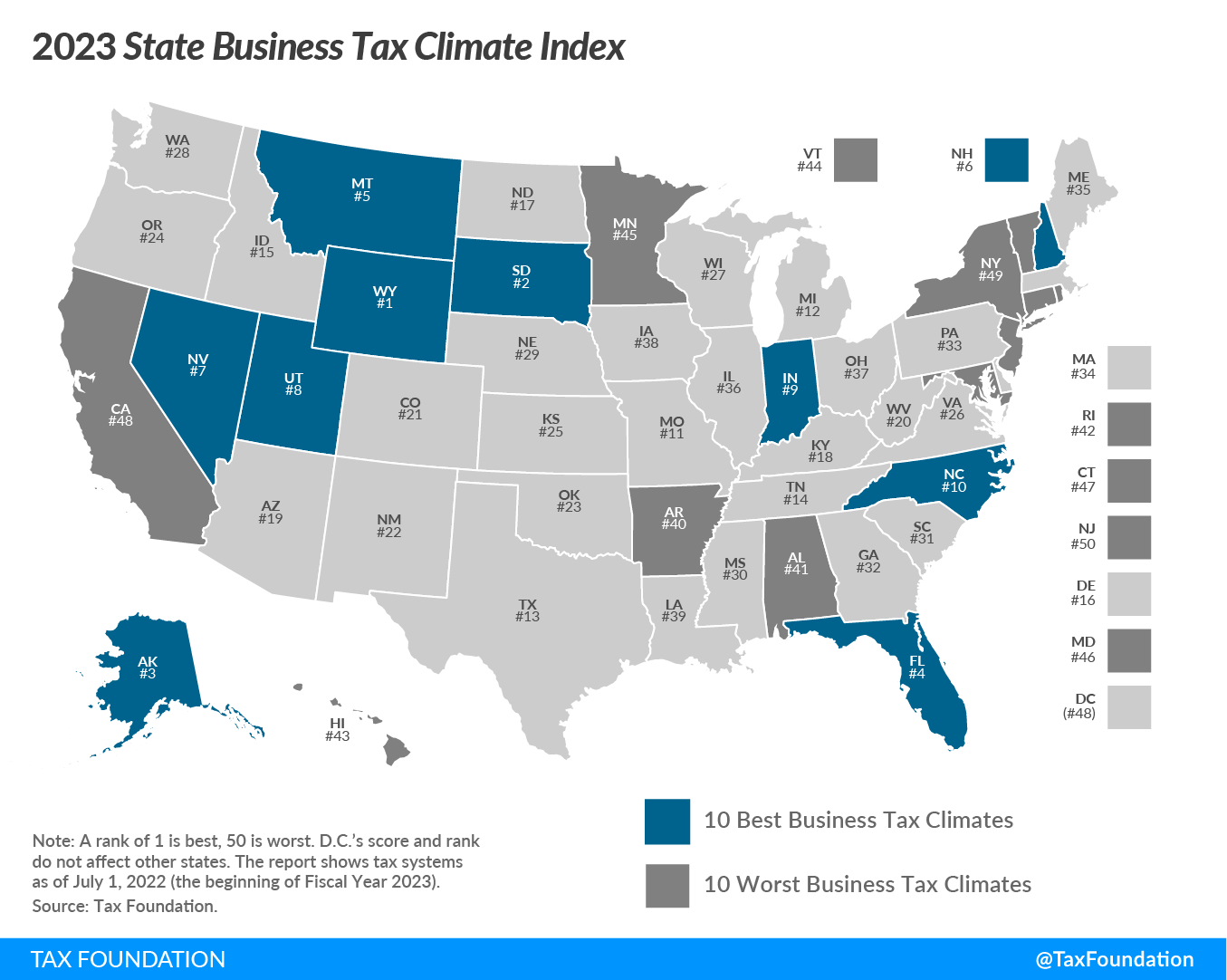

2024 Top Tax Rate Dasha Emmalee

https://files.taxfoundation.org/20221025113015/2023-State-Business-Tax-Climate-Index1.png

Income Tax 2022 2023 Image To U

https://i0.wp.com/blog.fundingsocieties.com.my/wp-content/uploads/2023/03/Personal-Income-Tax-Relief-Malaysia-2023-YA-2022.png?fit=1200%2C628&ssl=1

https://taxfoundation.org › taxedu › glossary › individual-income-tax

An individual income tax or personal income tax is levied on the wages salaries investments or other forms of income an individual or household earns The U S imposes a progressive

https://www.financestrategists.com › tax › income-tax

What Is Income Tax Income tax in its simplest form is a legal obligation charged by governments on individuals and corporations financial incomes Predominantly it s applied to both earned income such as wages

Income Tax Calculator Philippines 2025 Britney S Brock

2024 Top Tax Rate Dasha Emmalee

Income Tax Brackets 2025 Julieta Rose

South Carolina Tax Deadline 2025 Emily Dias

The 3 Types Of Experimental Design 2025

Selling A Home AFSG Consulting

Selling A Home AFSG Consulting

New York State Itemized Deductions 2025 Hana Llevi

PDF Federal Income Tax PDF T l charger Download

Income Tax Calculation And Effective Tax Saving Techniques

What Is Individual Income Tax Simple Definition - Individual income taxes are imposed on a person s taxable income which includes both earned and unearned income Earned income includes wages salaries and