What Is Tax Form For Hsa The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown

File non resident corporations income tax file non residents income tax get information on tax treaties country by country reporting Doing taxes for someone who died Report the date of Tax preparers use EFILE certified software to file your taxes online To find an EFILE certified tax preparer in your area try our postal code search Filing a paper return If online filing is not an

What Is Tax Form For Hsa

What Is Tax Form For Hsa

https://images.prismic.io/newfront/NmUwZDEzZDgtY2E4Ni00NDVlLTgwY2MtOThiNDgxZDUzZDM3_4_24_20_chart1.png?auto=compress,format&rect=0,0,779,580&w=779&h=580

How To Quickly And Tax Efficiently Draw Down HSA Assets

https://www.kitces.com/wp-content/uploads/2023/02/01-The-Two-Approaches-To-Managing-HSAs.png

There s Still Time To Get 2022 Tax Savings By Contributing To Your HSA Now

https://images.ctfassets.net/0rtn79ifmgv3/4GufKGbzoFDeI269pIb5f5/1062c52ae582e8e4b8a1ac4d39758ebe/TaxChecklistv3.jpg

The first R550 000 of your retirement lump sum is tax free as of 1 March 2024 Any previous withdrawals or retirement lump sums you ve taken will reduce your tax free amount The If you are signing in on behalf of someone else including friends and family members you must use Represent a Client in your CRA account to access their information Do not use autofill on

Tax free savings accounts registered savings plans pooled pension plans and plan administration Excise and specialty taxes Duties customs charges tax on underused The bulk of tax relief will go to those with incomes in the two lowest tax brackets i e those with taxable income under 114 750 in 2025 including nearly half to those in the

More picture related to What Is Tax Form For Hsa

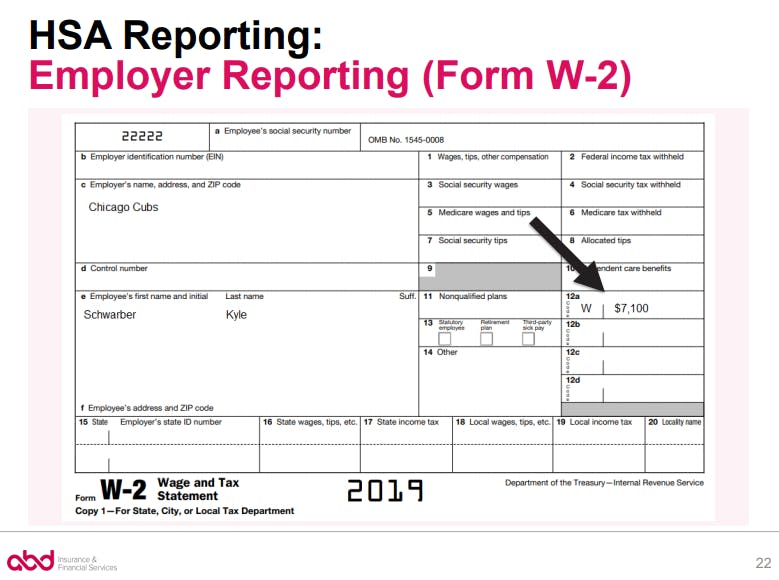

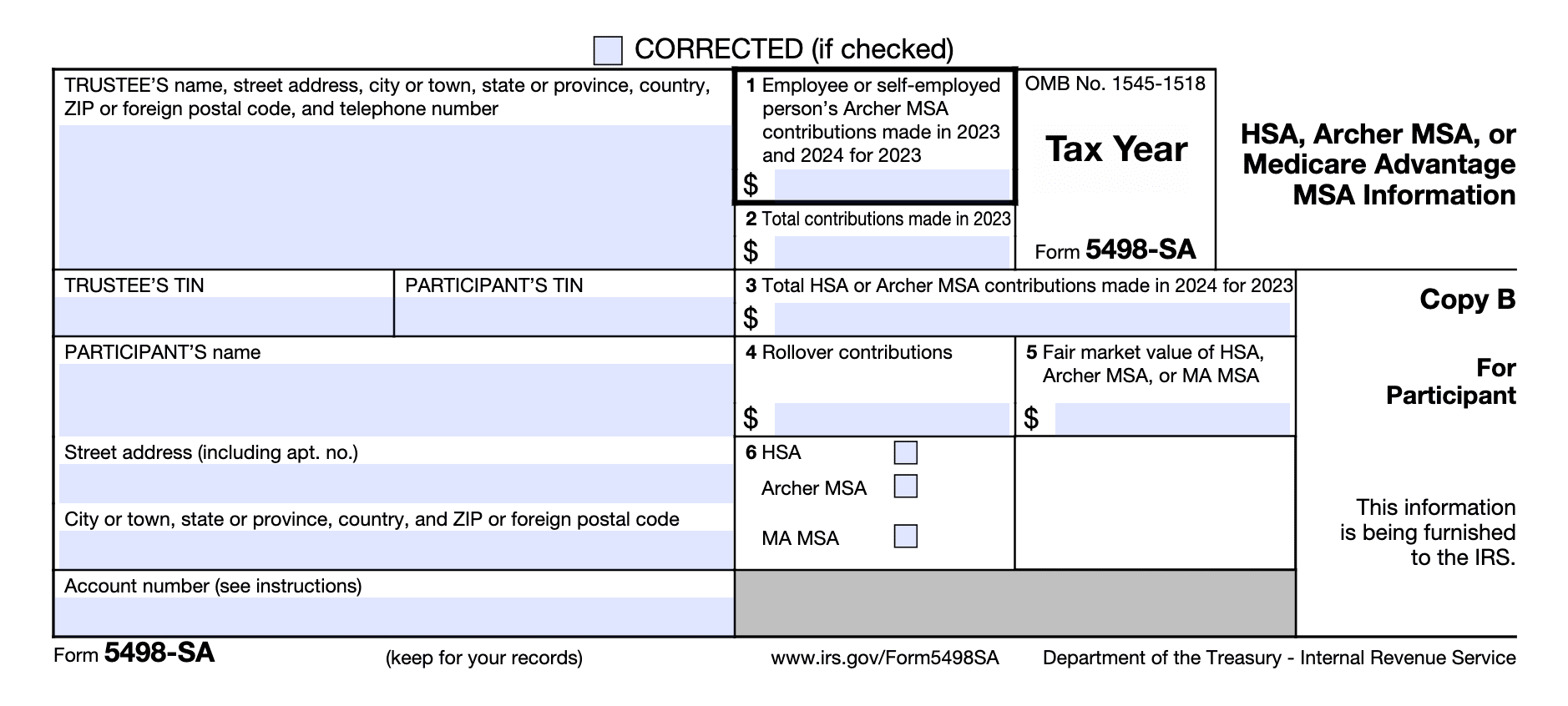

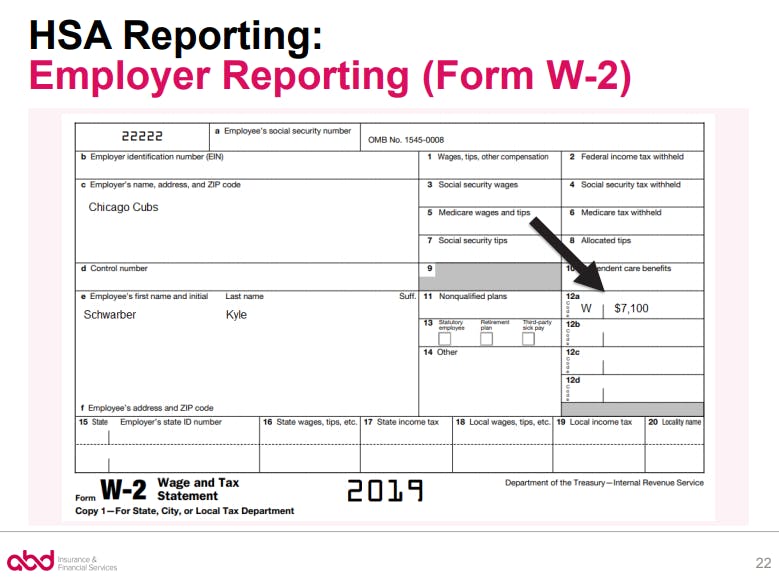

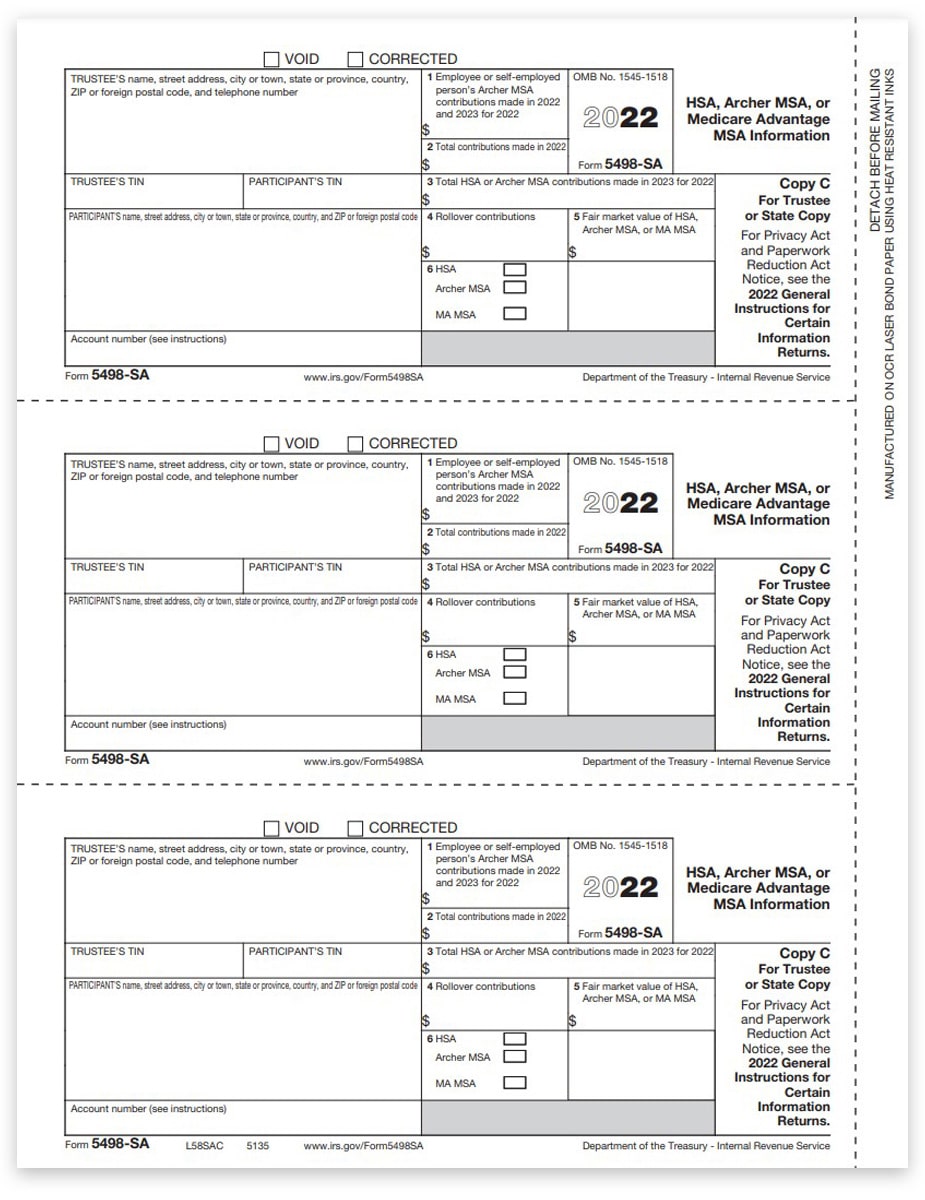

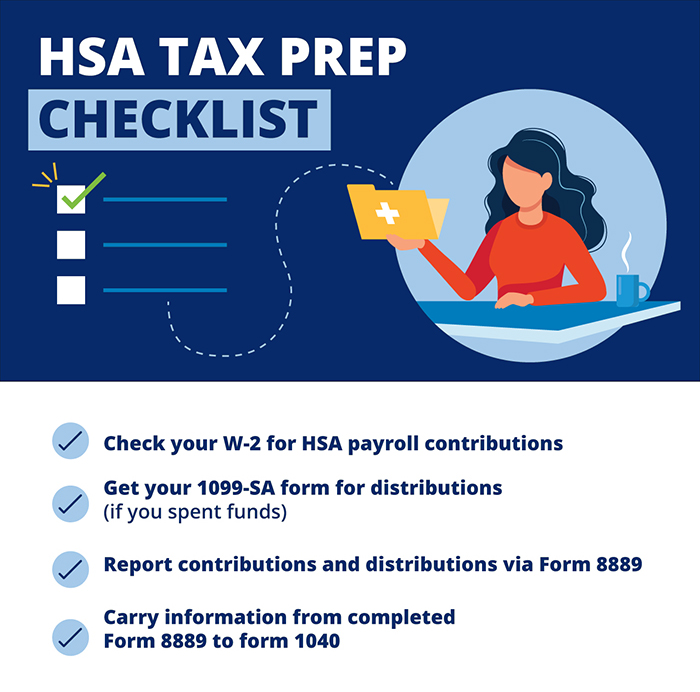

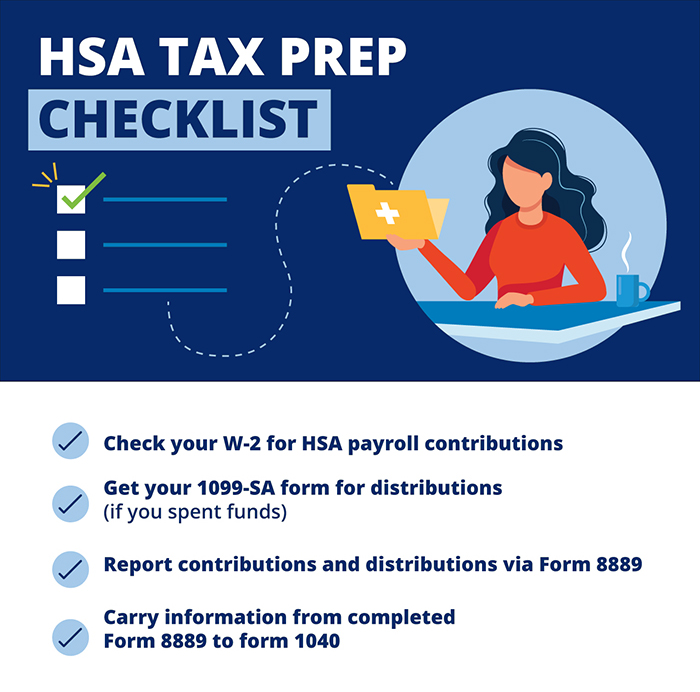

How HSA Distributions And Contributions Affect Your Tax Return

https://www.efile.com/image/hsa-contributions-form-5498-sa.png

HSA Demystifying Tax Form 5498 SA Bigger Insights

https://biggerinsights.com/wp-content/uploads/2023/04/Tax-Tax-Form-Health-Savings-Account-HSA-5498-SA.png

Tax Laws Amendments Revision Notes 1 BASIC CONCEPT OF TAX WHAT IS

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/ec7c45ef33717ee9e42a8a874a10b818/thumb_1200_1553.png

Throughout the following text for purposes of the tax exemption under section 87 of the Indian Act the Canada Revenue Agency CRA uses the term Indian because it has a legal Personal information is collected pursuant to the Income Tax Act and Excise Tax Act Personal information is described in program specific Personal Information Banks which can be found

[desc-10] [desc-11]

How To Fill Out Form 1040 For 2022 Taxes 2023 Money Instructor

https://i.ytimg.com/vi/dXjHkaNOFBo/maxresdefault.jpg

Health Savings Accounts HSA Grant Smith Health Insurance Agency

http://grantsmith.com/wp-content/uploads/HSA-Graph-2019-.png

https://www.canada.ca › en › department-finance › news › delivering-a-…

The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown

https://www.canada.ca › en › services › taxes › income-tax

File non resident corporations income tax file non residents income tax get information on tax treaties country by country reporting Doing taxes for someone who died Report the date of

Form 8889 2023 Printable Forms Free Online

How To Fill Out Form 1040 For 2022 Taxes 2023 Money Instructor

2023 Hsa Form Printable Forms Free Online

:max_bytes(150000):strip_icc()/Form1040copy-7af98beb63114d4ab3f7a999ba1f3608.jpg)

2023 Irs Tax Form 1040 Printable Forms Free Online

How To Submit FSA HSA Reimbursement Claim For Purchase That You Already

Your HSA And Your Tax Return 4 Tips For Filing First American Bank

Your HSA And Your Tax Return 4 Tips For Filing First American Bank

Usa Tax Form 1040 Us Individual Stock Photo 1950293758 Shutterstock

How To Apply For IRS Form 6166 Certification Of U S Tax Residency

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)

Above mentioned Haltungen Become Remote From The Bench Normal Included

What Is Tax Form For Hsa - [desc-14]