What Tax Year Is 24 25 Fafsa Based On The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income

Sign in or register for My Account My Business Account or Represent a Client with the CRA and get help with using the CRA sign in services Information on taxes including filing taxes and get tax information for individuals businesses charities and trusts Income tax

What Tax Year Is 24 25 Fafsa Based On

What Tax Year Is 24 25 Fafsa Based On

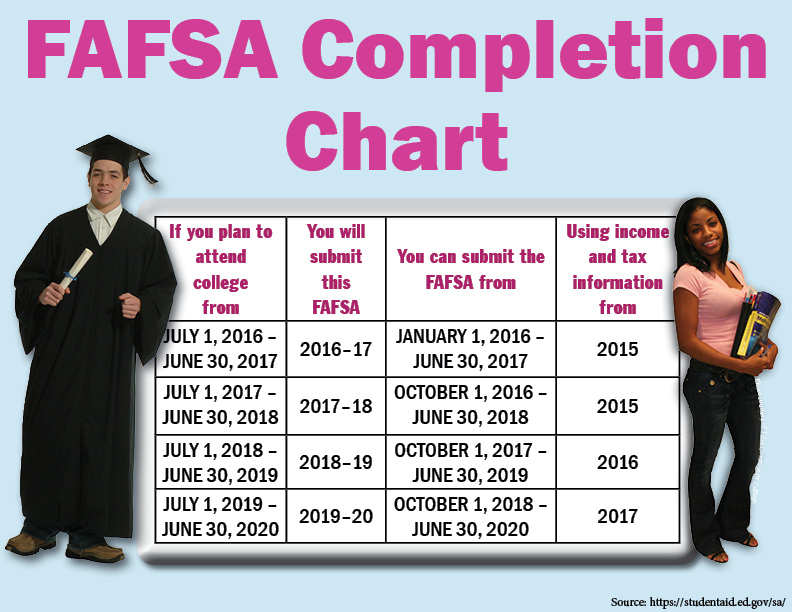

https://www.startwithfafsa.org/wp-content/uploads/2016/08/FAFSA-Completion-Chart.jpg

Fafsa 2025 Elizabeth Smith

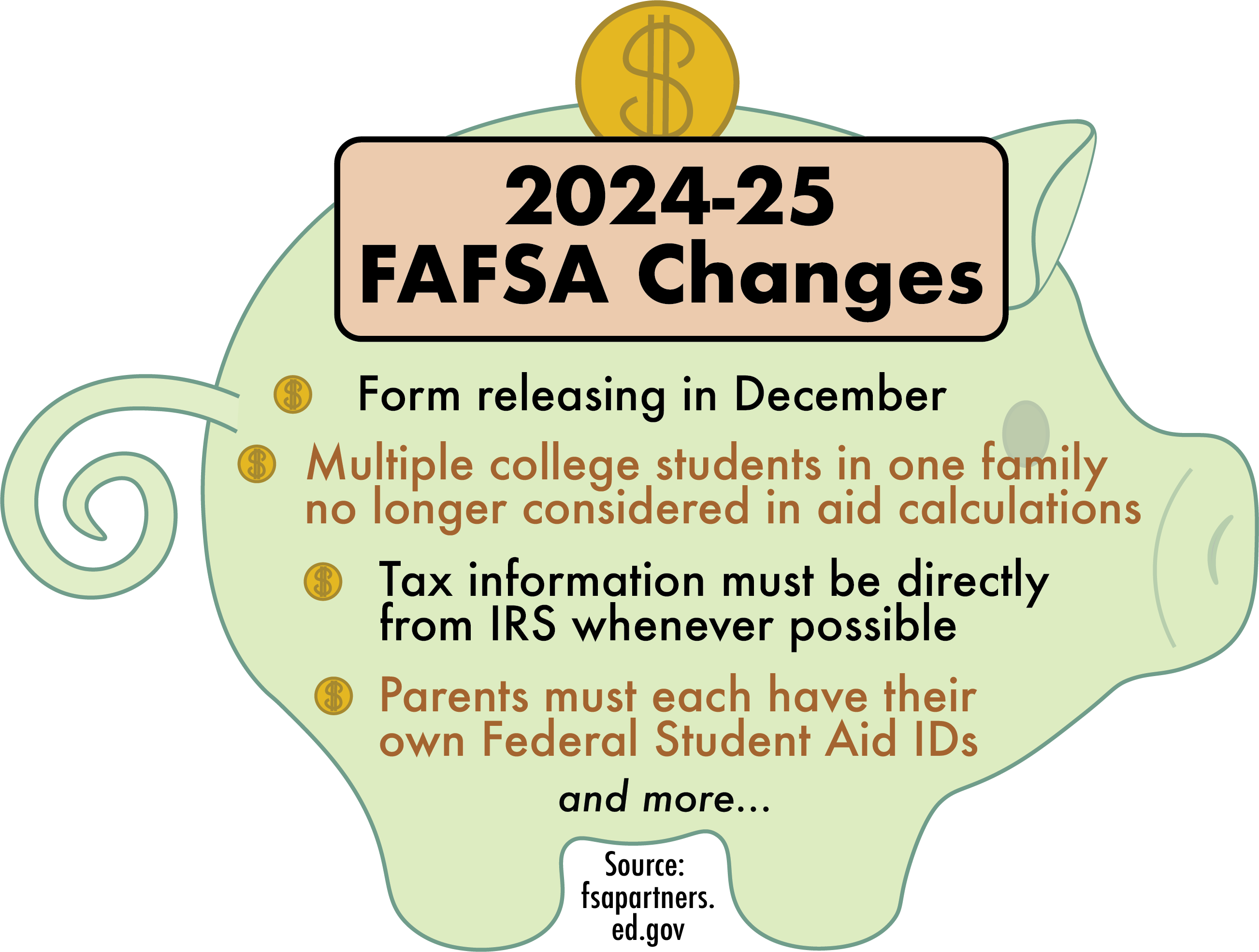

https://reflector.uindy.edu/wp-content/uploads/2023/11/FAFSAInfo_FINAL.png

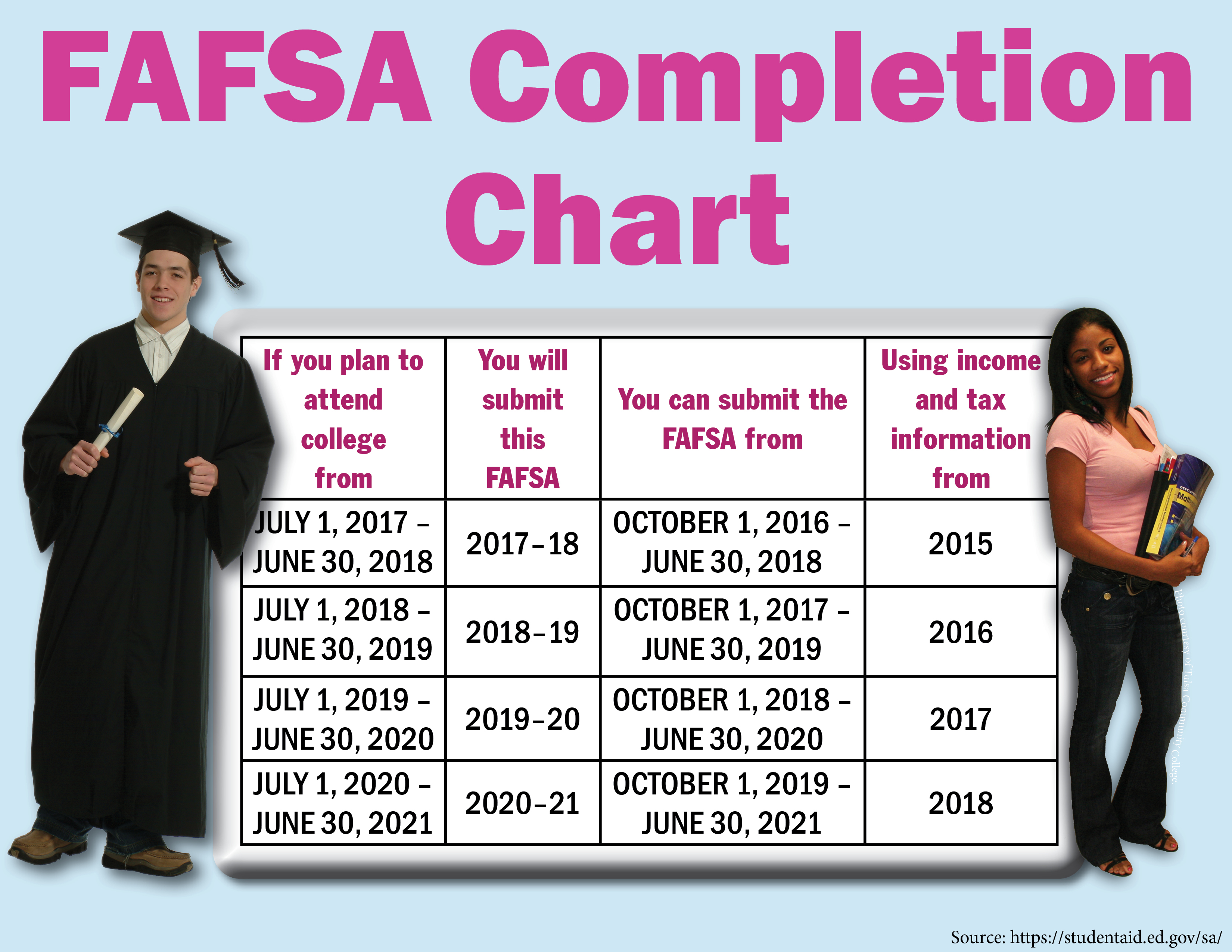

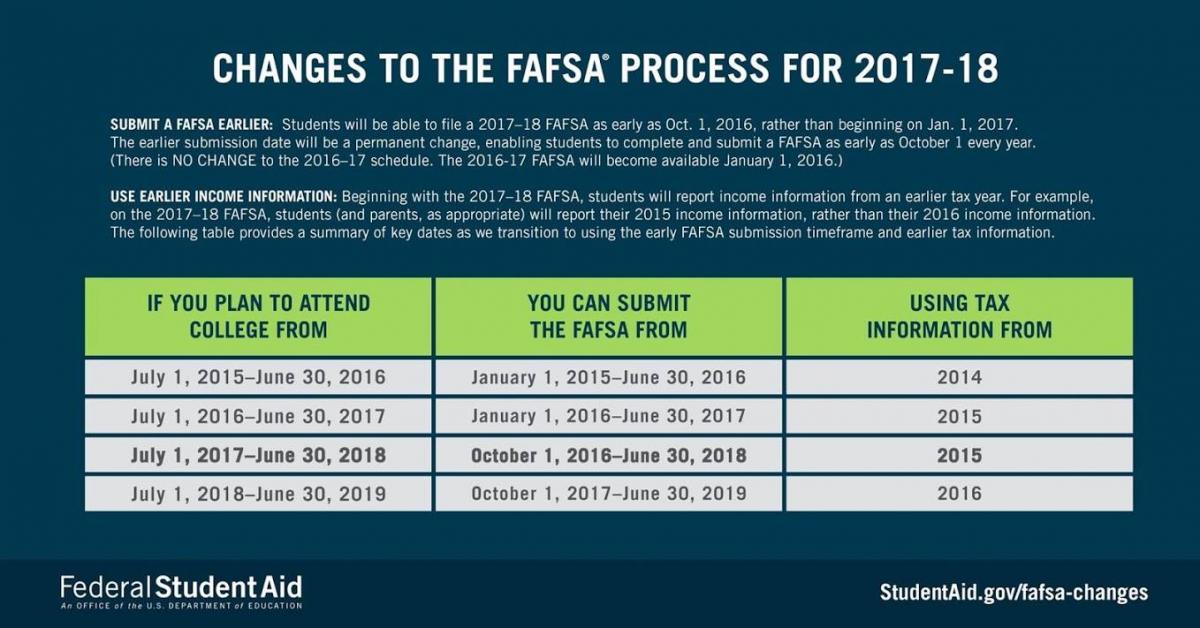

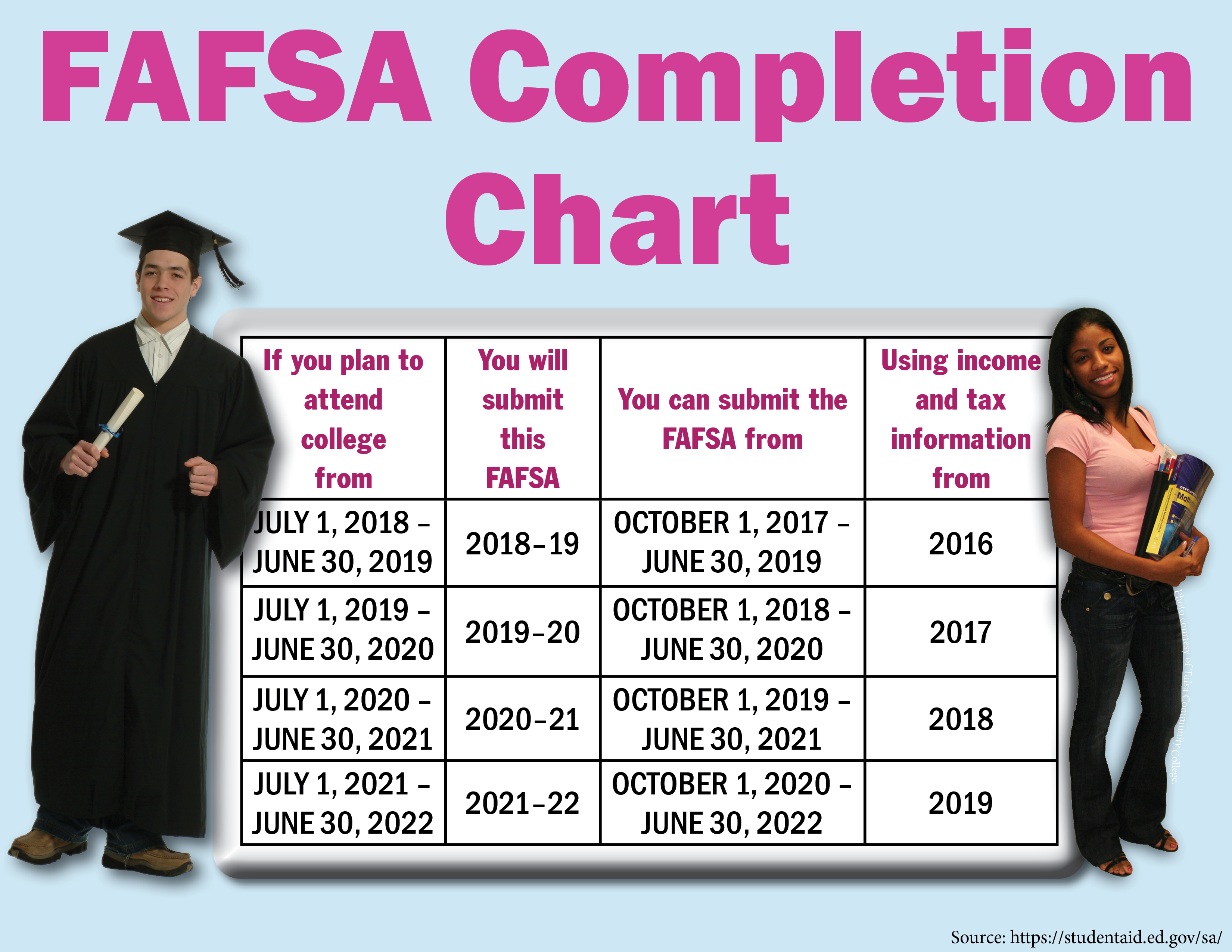

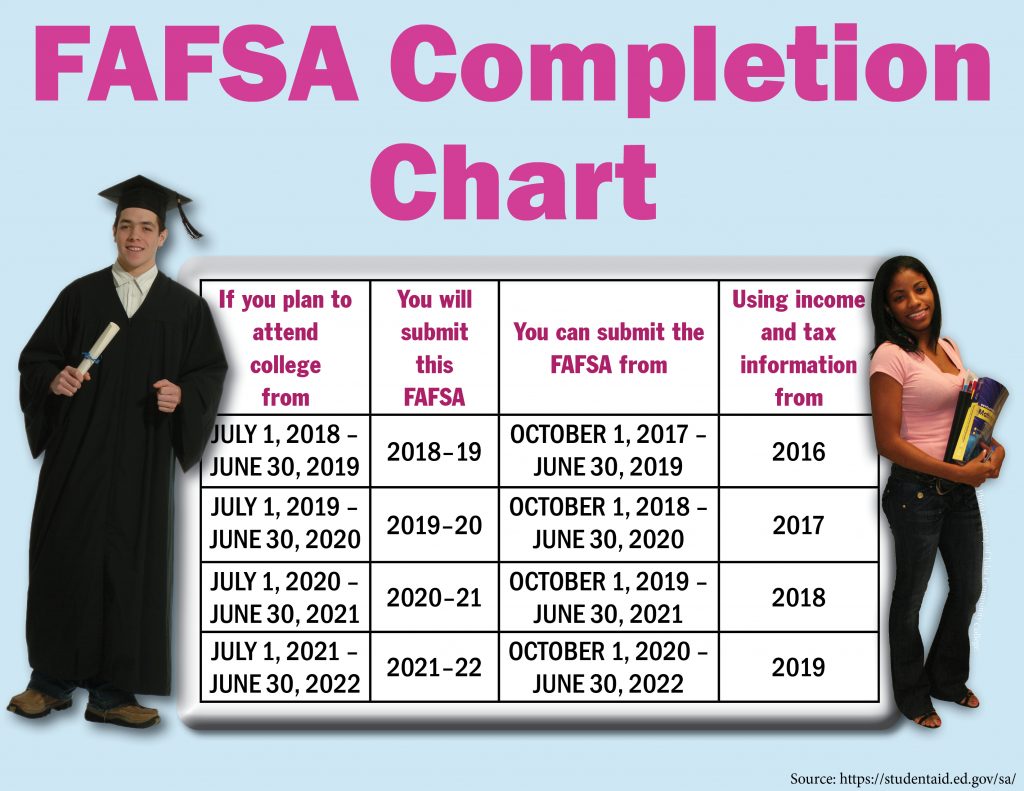

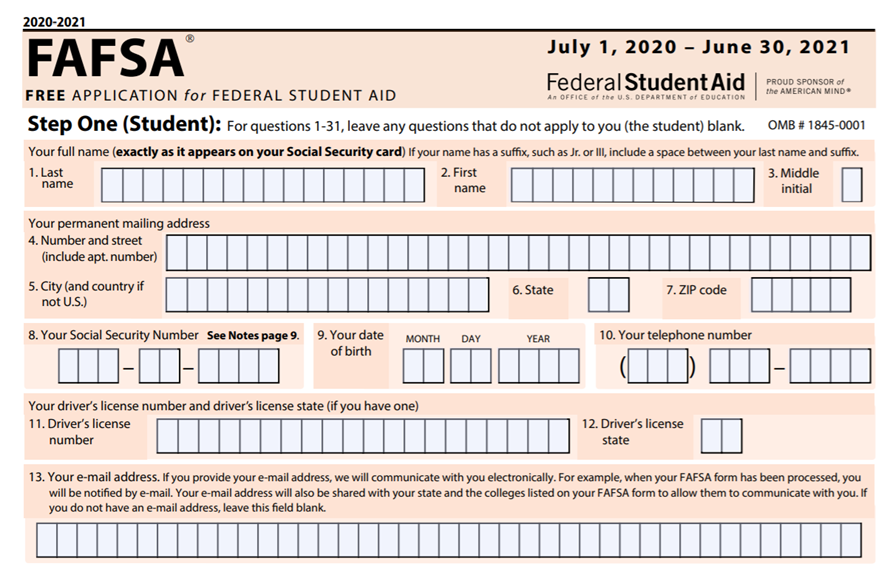

COMPLETING THE 2018 19 FAFSA Startwithfafsa

http://www.startwithfafsa.org/wp-content/uploads/2017/09/Infograph_FAFSA_0917.jpg

The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown This tax season the Canada Revenue Agency CRA has simplified its sign in process making it easier to access the My Account My Business Account and Represent a

To support those negotiations the Minister of Finance and National Revenue the Honourable Fran ois Philippe Champagne announced today that Canada would rescind the For more information go to Change from paper to online mail for some benefit recipients Who should file a tax return how to get ready for taxes filing and payment due

More picture related to What Tax Year Is 24 25 Fafsa Based On

Nhl Stats 2024 25 Fafsa Dode Nadean

https://www.taxuni.com/wp-content/uploads/2022/10/FAFSA-Application-Form-TaxUni-Cover-1-1536x864.jpg

New FAFSA Application Timeline

https://www.theplanningcenter.com/wp-content/uploads/2016/10/EarlyFAFSA2016.jpg

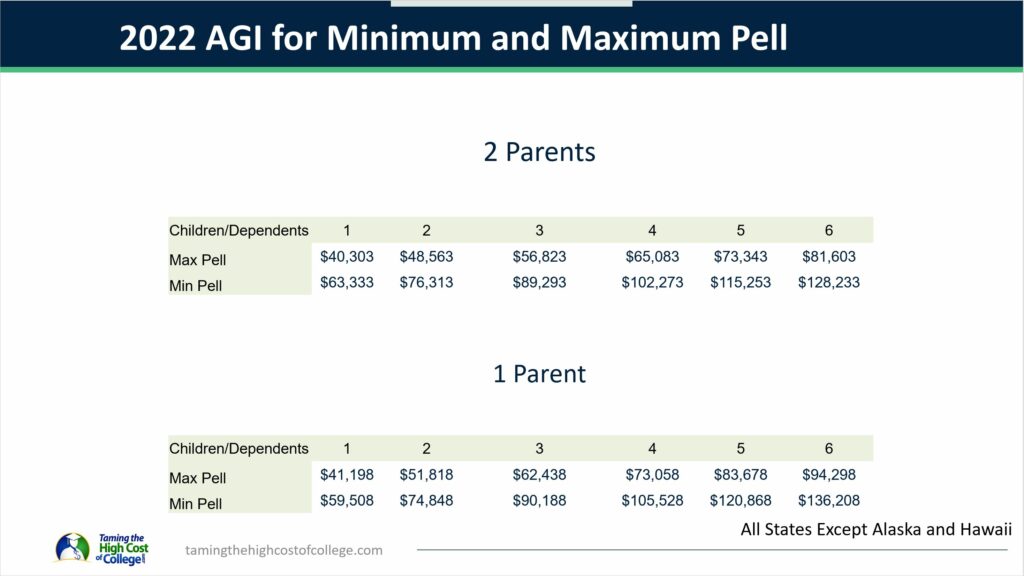

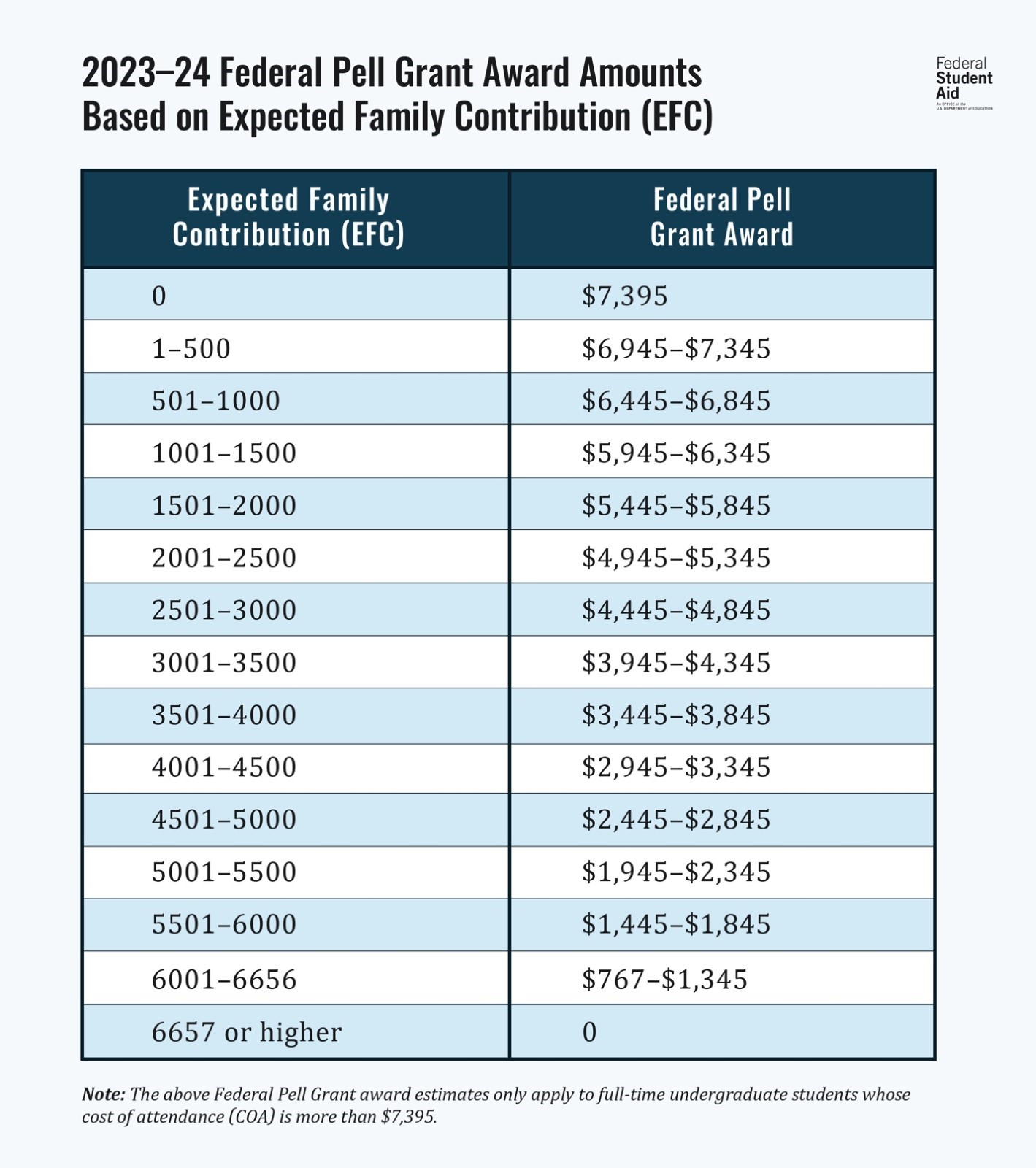

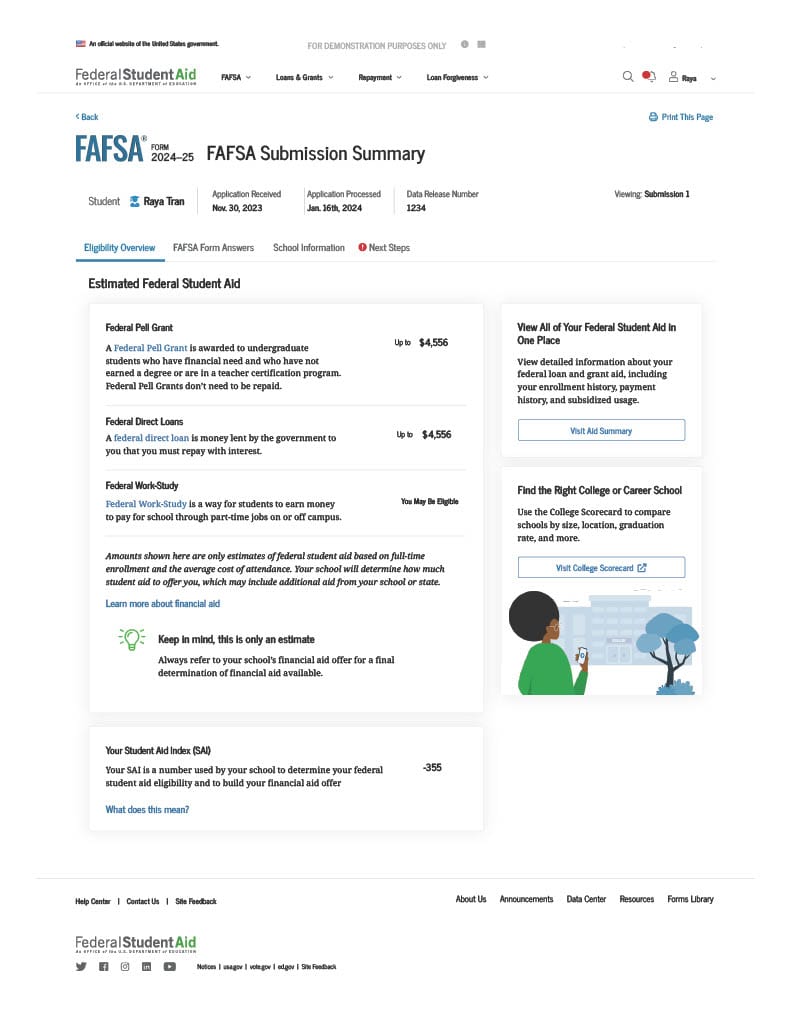

Pell Grant 2025 25 Fafsa Liam Dowd

https://tamingthehighcostofcollege.com/wp-content/uploads/Pell-Grant-Tables-1-1024x576.jpg

How much tax will I pay on my retirement lump sum withdrawals From age 55 you can take up to one third of your retirement fund Retirement Annuity Company Pension Fund The Canada Revenue Agency CRA understands that life can move fast and tasks like filing your income tax and benefit return can slip through the cracks The deadline to

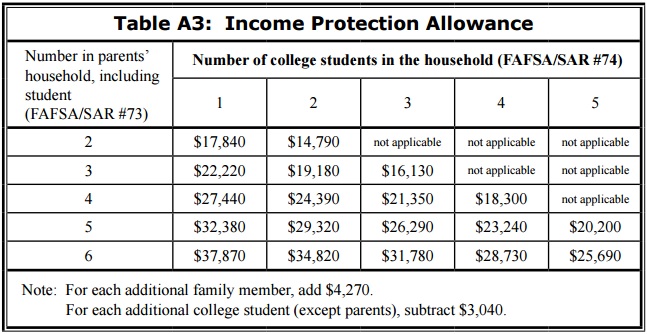

[desc-10] [desc-11]

Standard Tax Deduction 2025 Married William J Sheffield

https://thecollegeinvestor.com/wp-content/uploads/2022/10/TCI_-_2023_Federal_Tax_Brackets_1600x974.png

Pell Grant Income Limits 2024 Calculator Aubry Claribel

https://pbs.twimg.com/media/Fs6Ci1OXgAUV4lJ.jpg:large

https://www.canada.ca › en › revenue-agency › services › tax › individual…

The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income

https://www.canada.ca › en › revenue-agency › services › e-services › cr…

Sign in or register for My Account My Business Account or Represent a Client with the CRA and get help with using the CRA sign in services

Income Max For Pell Grant Intelhub

Standard Tax Deduction 2025 Married William J Sheffield

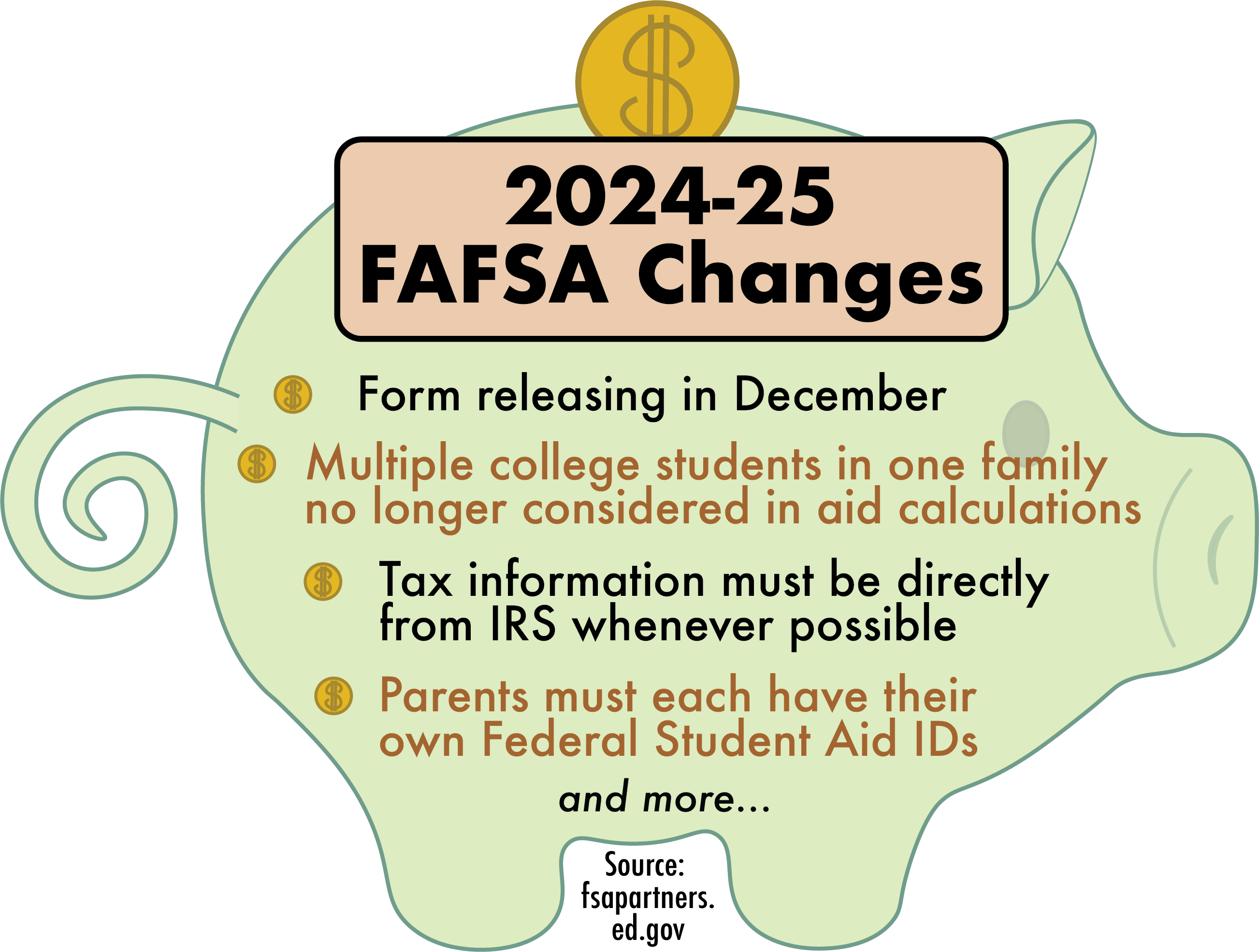

What Does Fafsa 2024 25 Cover Barbi Carlota

Save Your Tax Documents For A Future FAFSA Startwithfafsa

What Time Does Fafsa Open 2025 Roosevelt Peacock

Fafsa Application 2025 24 Eligibility Hudson Reed

Fafsa Application 2025 24 Eligibility Hudson Reed

Fafsa Deadline 2025 25 Academic Yearbook Daniela Wren

Printable Fafsa Form 2023 24 Printable Forms Free Online

How Do I Add Schools To My 2024 2025 FAFSA Citrus College Student Support

What Tax Year Is 24 25 Fafsa Based On - [desc-13]