Is 5v Fast Charging Bonuses are considered supplemental income by the IRS and must be reported on your annual tax return When an employee receives a bonus it is typically included in their W 2 form

Can I include bonuses in my government rates It is important to know that your bonus policy should be explained in detail with the expected pay out of the bonus included in Workplace bonuses are often a source of contention between employers and employees Here s what you need to know about workplace bonuses including what to do if

Is 5v Fast Charging

Is 5v Fast Charging

https://news-cdn.softpedia.com/images/news2/everything-you-need-to-know-about-qi2-wireless-charging-536763-2.jpg

Universal Smart Battery Charger 4 Bay Fast Charger For Rechargeable

https://m.media-amazon.com/images/I/71u8VZ0TVcL._AC_SL1500_.jpg

![]()

About Us

https://www.ontime360.com/sample-site/images/icons/Fast_Delivery_Logo.png

Employee bonuses are any compensation paid in excess of an employee s base salary or hourly wage Learn how to structure and implement employee bonuses No employers are not required by law to provide bonuses unless specified by an employment contract collective bargaining agreement or state specific laws However employers often

Although your employees don t get the bonus in cash or check the bonus is completely non taxable to the employee until they withdraw the funds from their plan and you The key issue with bonuses regardless of the time of year when they are awarded is whether the bonus must be included in the regular rate when calculating

More picture related to Is 5v Fast Charging

Buy Ultraprolink Juice Up Slim 10000 MAh 22 5W Fast Charging Power Bank

https://media.croma.com/image/upload/v1703830231/Croma Assets/Communication/PowerBank/Images/303308_twpskh.png

25W Fast Wall Charger Fast Charging Black Kaizen

https://www.kaizen-products.com/wp-content/uploads/2023/03/KZ-WC25WB-25w-fast-wall-charger-fast-charging-black.png

Buy 5V Fast Charging Cable For Menhood Trimmer Keep Your Menhood

https://adapterkart.com/cdn/shop/collections/4_e50e0b12-5e8b-41e0-a291-2ca62061daf9.jpg?v=1680148309

In short you cannot use a 1099 to report an employee s or contractor s bonus The IRS considers all bonuses as general income which employers must report on the employee s W2 form You Employee bonuses are key for motivation and satisfaction but come with legal complexities This blog covers essential legal considerations including compliance with federal and state laws

[desc-10] [desc-11]

Buy Croma 10000 MAh 12W Fast Charging Power Bank 1 Micro USB Type B 1

https://media.croma.com/image/upload/v1675182295/Croma Assets/Communication/PowerBank/Images/250330_12_jlxhuy.png

DURACELL 10000 MAh 22 5W Fast Charging Power Bank 2 Type A And 1 Type

https://media.croma.com/image/upload/v1686222658/Croma Assets/Communication/PowerBank/Images/273756_ekty4i.png

https://majrresources.com › do-bonus-payments-need...

Bonuses are considered supplemental income by the IRS and must be reported on your annual tax return When an employee receives a bonus it is typically included in their W 2 form

https://boostllc.net › things-to-know-about-employee-bonuses

Can I include bonuses in my government rates It is important to know that your bonus policy should be explained in detail with the expected pay out of the bonus included in

Buy 5V 3 Pin ARGB To 12V 4 Pin RGB Converter 5V ADD RGB To 12V RGB

Buy Croma 10000 MAh 12W Fast Charging Power Bank 1 Micro USB Type B 1

Buy Lenovo 90 Watts 2 USB Ports Car Charging Adapter Intelligent Fast

25W Fast Wall Charger Fast Charging White Kaizen

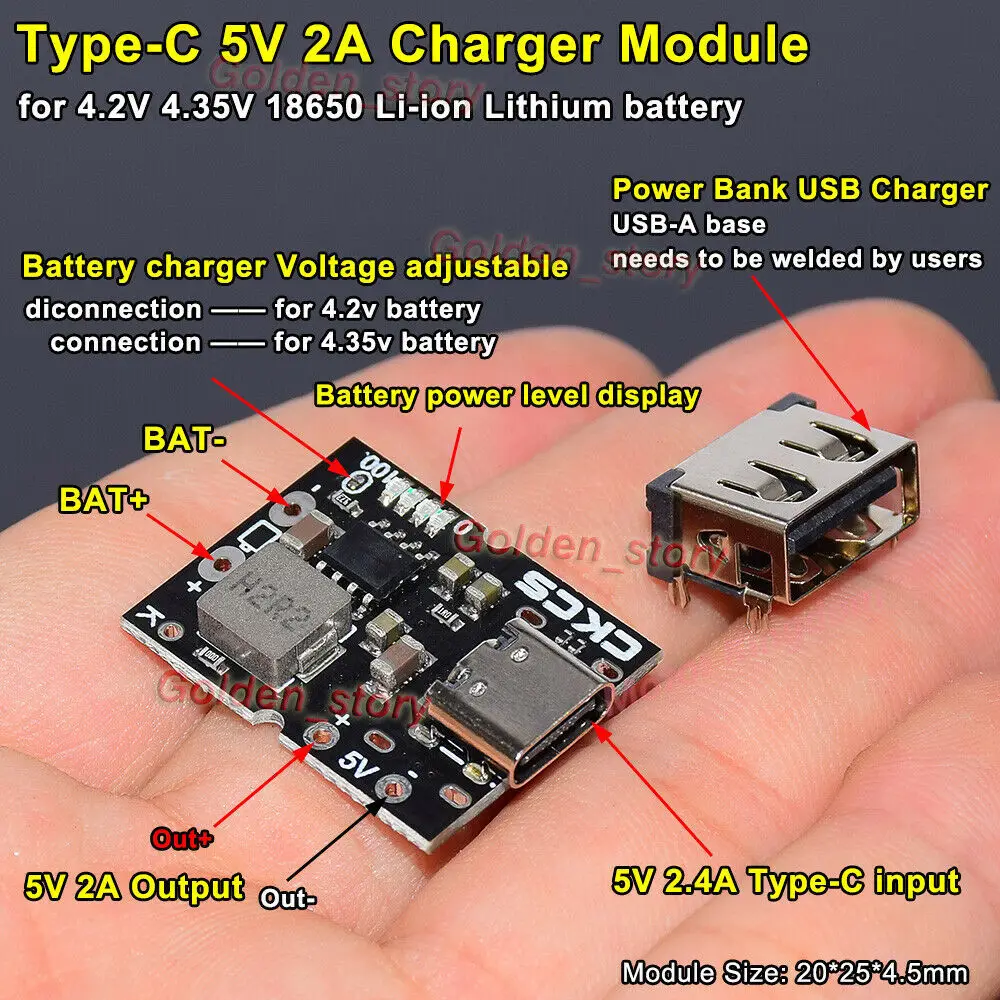

5V 2A Type C USB 3 7V 18650 Lithium Li ion Battery Charging Board DIY

Check Your Battery And Charge Your Apple Watch Apple Support PH

Check Your Battery And Charge Your Apple Watch Apple Support PH

Sojo 240 480kw Split Fast Charging System For Hybrid Vehicles Fast

Sojo Manufacturer Split Fast Charging System For Electric Cars Split

CA Power Up Pasadena Charger Rebate

Is 5v Fast Charging - Employee bonuses are any compensation paid in excess of an employee s base salary or hourly wage Learn how to structure and implement employee bonuses