What Is 384 Divided By 8 GAMMA OPTIONS is a DeFi protocol built on the Ethereum blockchain used for Amplify your gains when trading hedging or providing liquidity to AMMs React Redux MaterialUI etc

Delta and Gamma D G are important option that defines the sensitivity of an options trading instrument Investors can quickly determine the value of an options trading Hedging Cryptocurrency Options Jovanka Matic Natalie Packham Wolfgang Karl H rdle November 2021 Abstract The cryptocurrency CC market is volatile non stationary and non

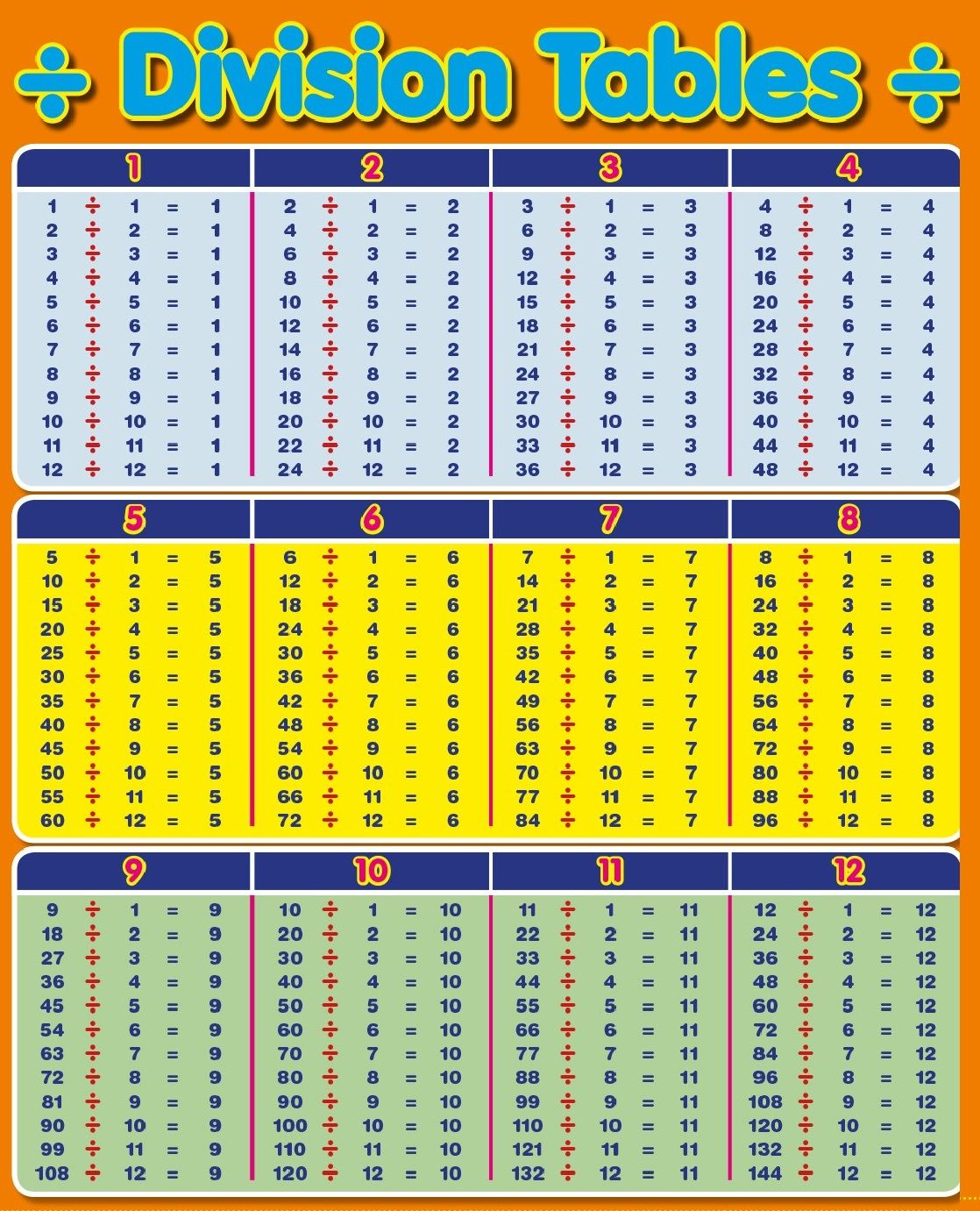

What Is 384 Divided By 8

What Is 384 Divided By 8

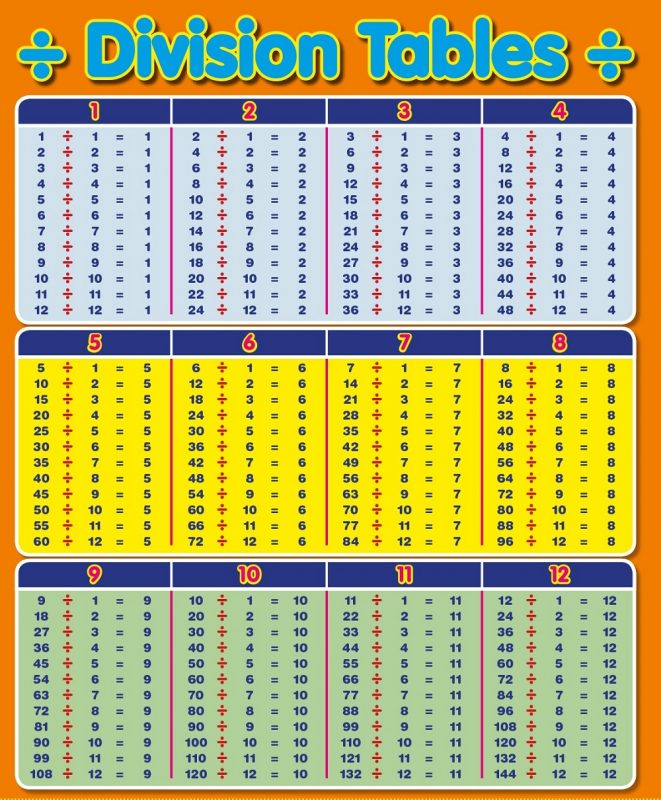

https://www.learningprintable.com/wp-content/uploads/2017/11/division-table-for-kids-661x800.jpg

Two Division

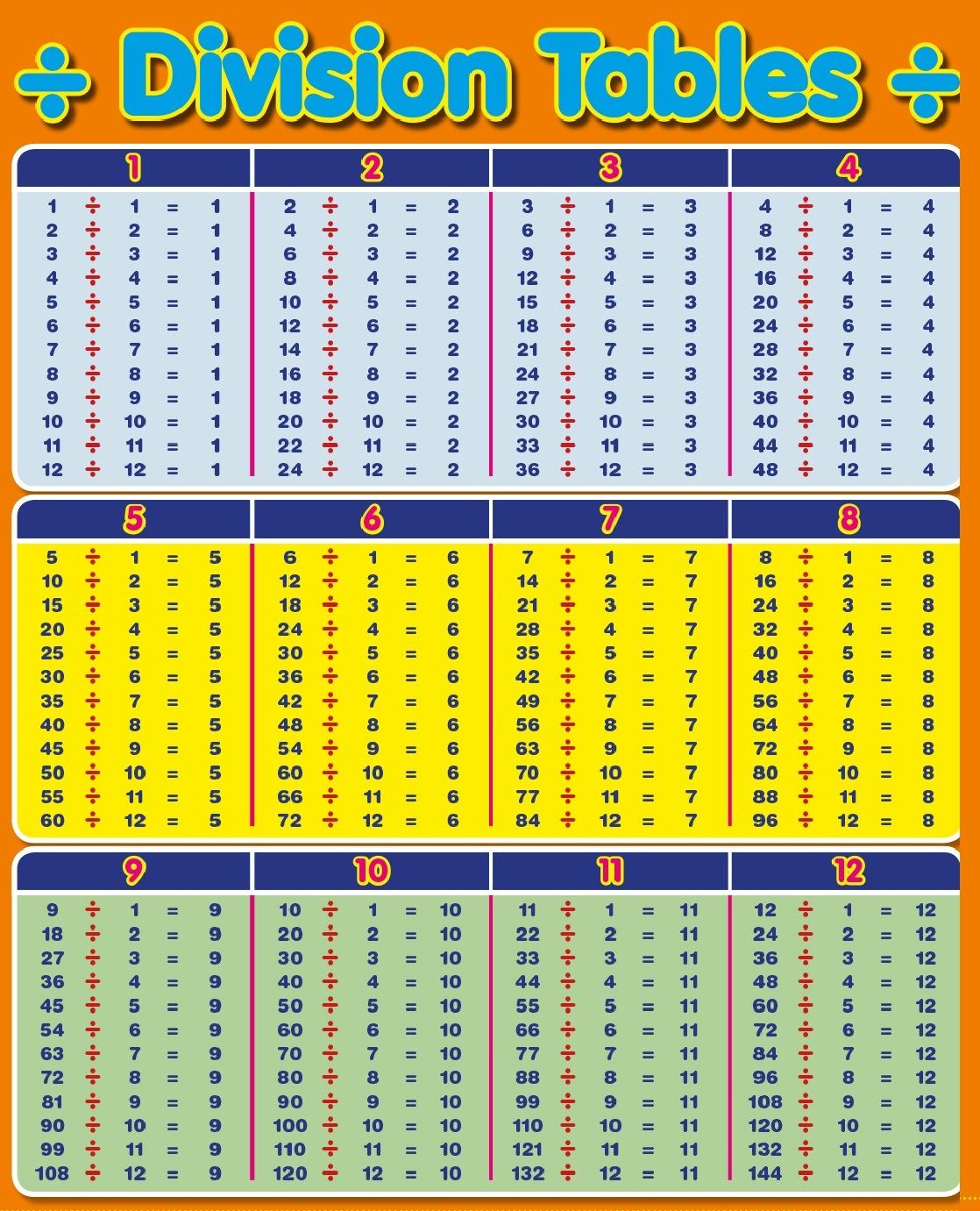

https://www.printablemultiplication.com/wp-content/uploads/2020/11/division-table-1-100-chart-for-kids-in-2020-printable.jpg

Division With 2 Digit Divisors

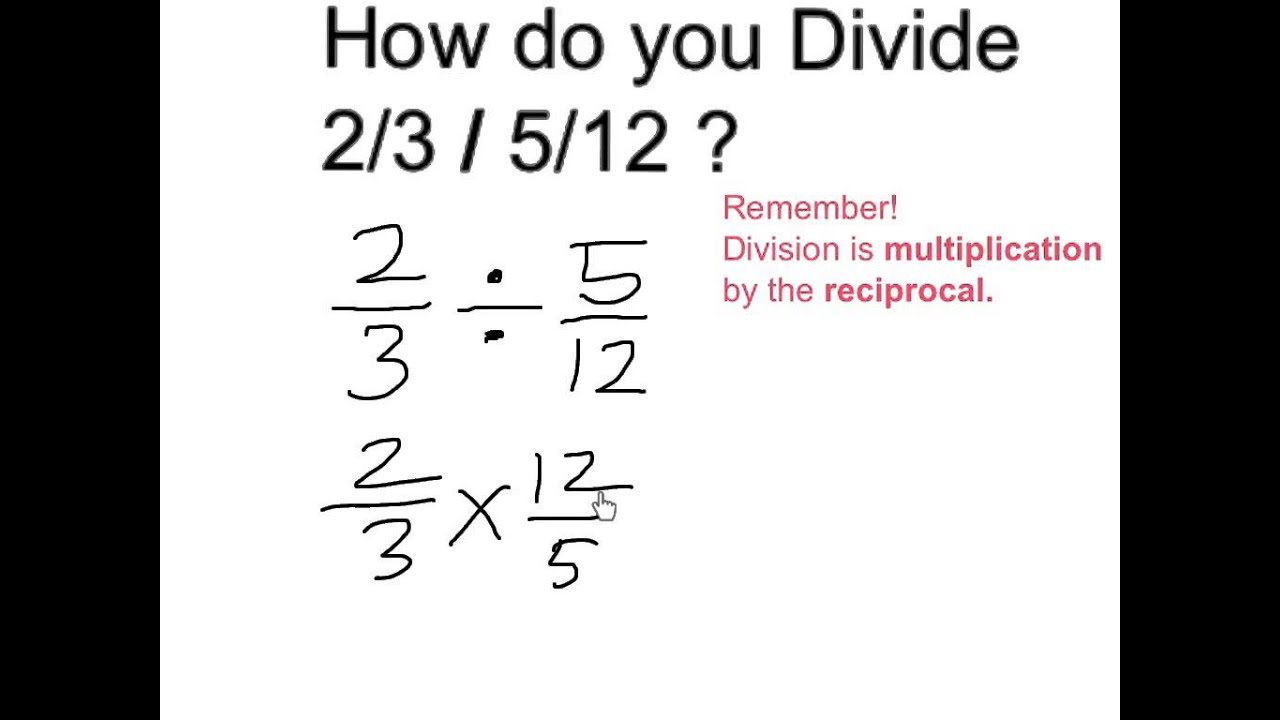

https://i.pinimg.com/originals/5b/5e/bb/5b5ebbb7f4fbe60e44d9926e0ad0c236.jpg

Gamma is everyone s favorite option Greek nowadays and much of the mainstream options trading world has shifted towards trying to exploit market dynamics related In all three settings options are dynamically hedged with Delta Delta Gamma Delta Vega and Minimum Variance strategies Including a wide range of market models allows

When it comes to gamma hedging understanding the tools and techniques for calculating gamma is crucial Gamma a measure of an option s sensitivity to changes in the When trading crypto options This can be particularly handy when planning options hedging strategies and mitigating one s overall exposure A possible application of

More picture related to What Is 384 Divided By 8

10 Divided By 1 Over 20

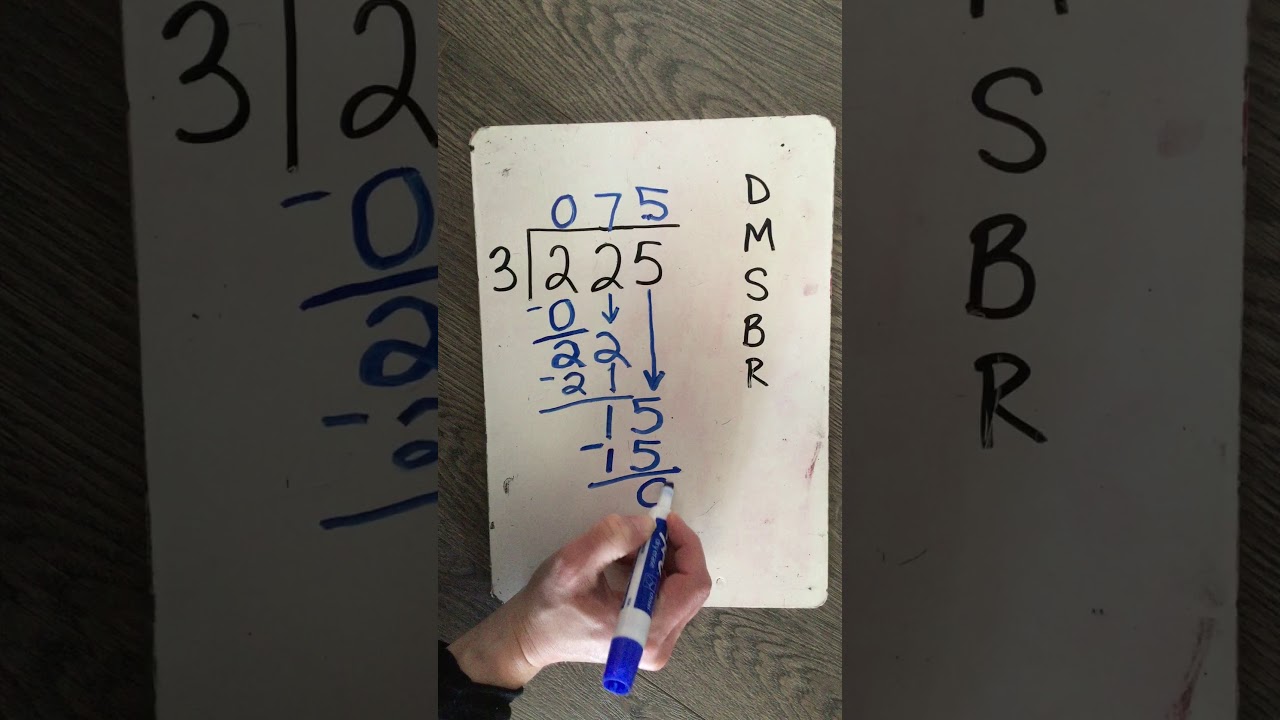

https://i.ytimg.com/vi/_5UIkbRmX4k/maxresdefault.jpg

14 Divided By 55

https://i.ytimg.com/vi/TzYe1O6DAFY/maxresdefault.jpg

[img_title-6]

[img-6]

Learn about gamma in options including what gamma is and how to use it in options trading In that regard gamma hedging isn t usually executed as a standalone strategy Instead it s The cryptocurrency market is volatile non stationary and non continuous Together with liquid derivatives markets this poses a unique opportunity to study risk

[desc-10] [desc-11]

[img_title-7]

[img-7]

[img_title-8]

[img-8]

https://gammaoptions.com

GAMMA OPTIONS is a DeFi protocol built on the Ethereum blockchain used for Amplify your gains when trading hedging or providing liquidity to AMMs React Redux MaterialUI etc

https://investgrail.com › crypto-options-trading-delta-and-gamma

Delta and Gamma D G are important option that defines the sensitivity of an options trading instrument Investors can quickly determine the value of an options trading

[img_title-9]

[img_title-7]

[img_title-10]

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

What Is 384 Divided By 8 - In all three settings options are dynamically hedged with Delta Delta Gamma Delta Vega and Minimum Variance strategies Including a wide range of market models allows