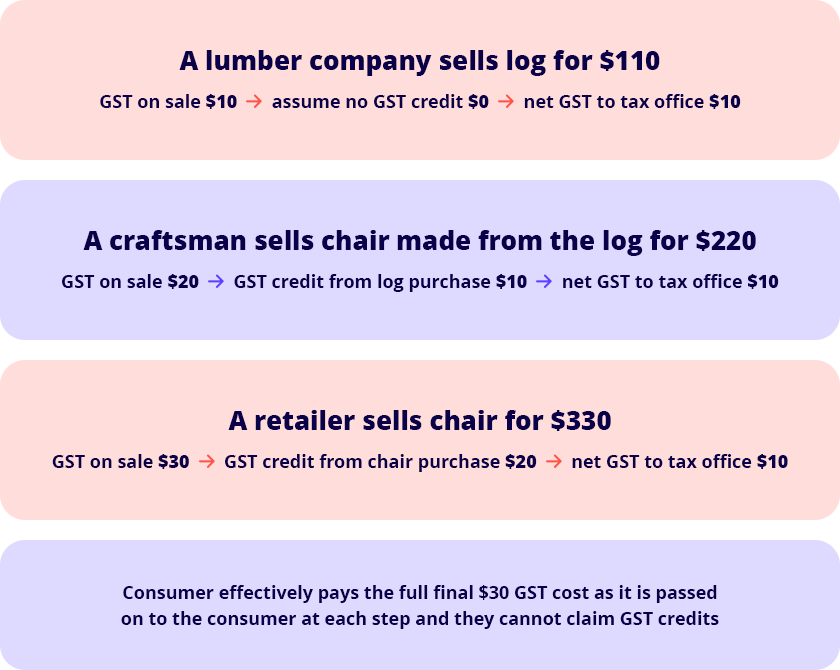

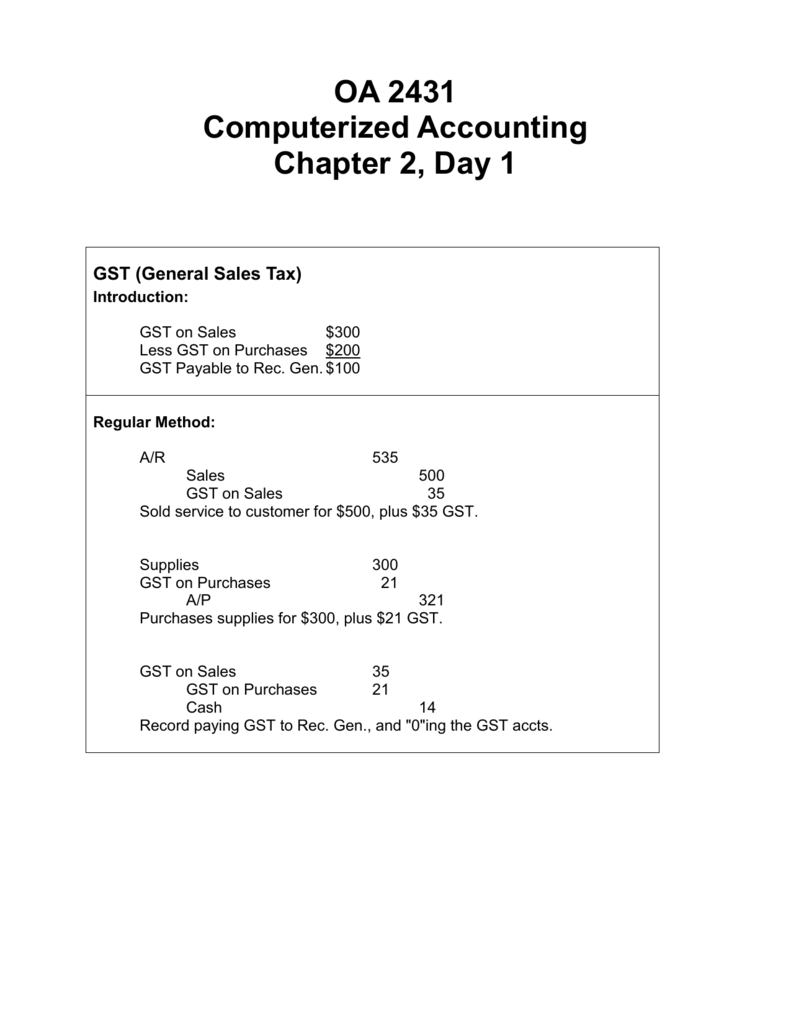

What Is Gst On Purchases Goods and services tax GST is the tax rendered on goods and services in many countries It s a value added tax VAT meaning it s applied at each stage of the supply

In this article we will tell you how you can take the benefit of GST paid on your purchases and set it off with your GST liability What is Input tax credit Input tax credit means There are two types of taxation systems These are Indirect taxes The indirect taxes are to be paid by the customers and are generally implied on the goods and services

What Is Gst On Purchases

What Is Gst On Purchases

https://www.betterplace.co.in/blog/wp-content/uploads/2020/03/GST-Return-1.jpg

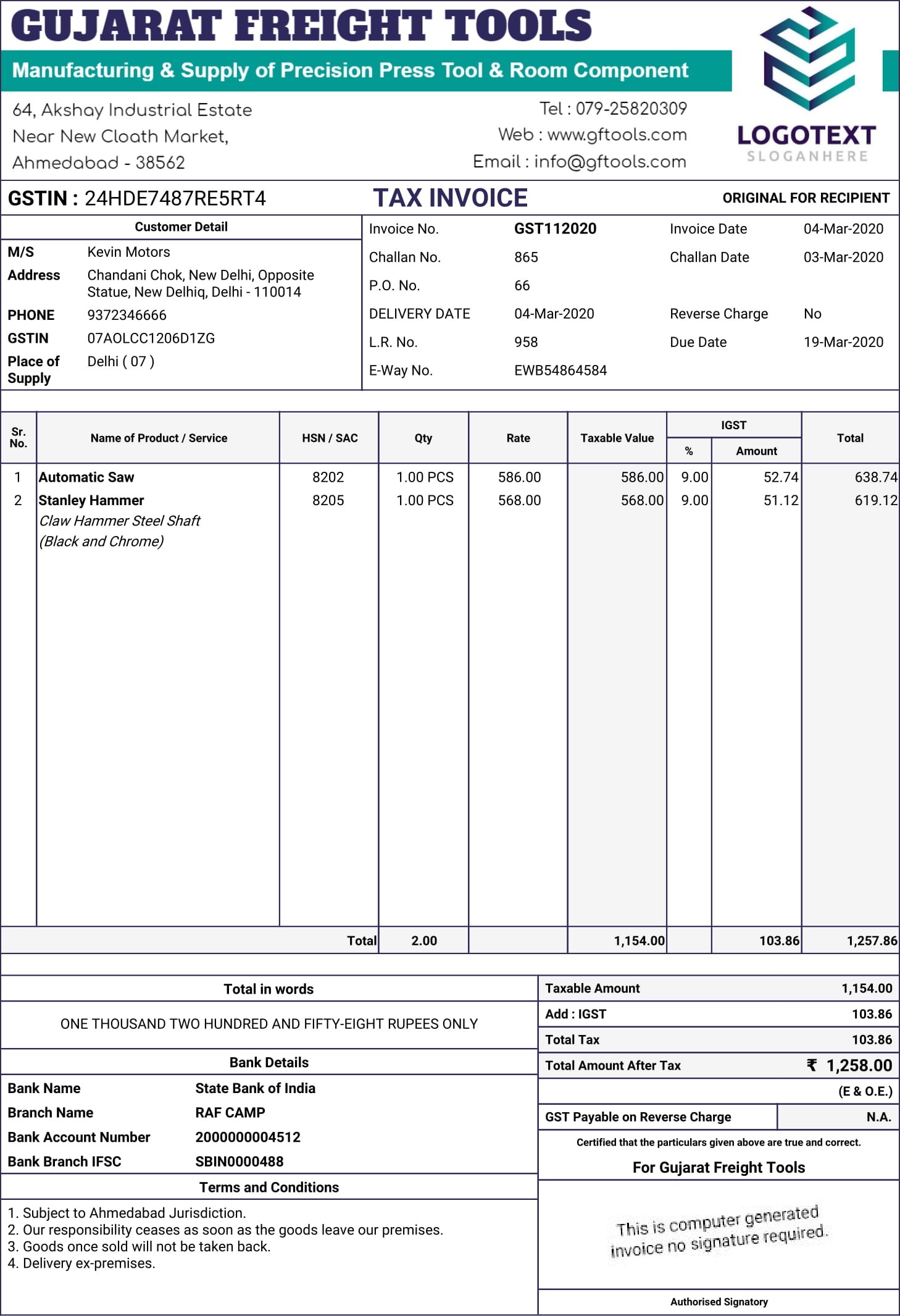

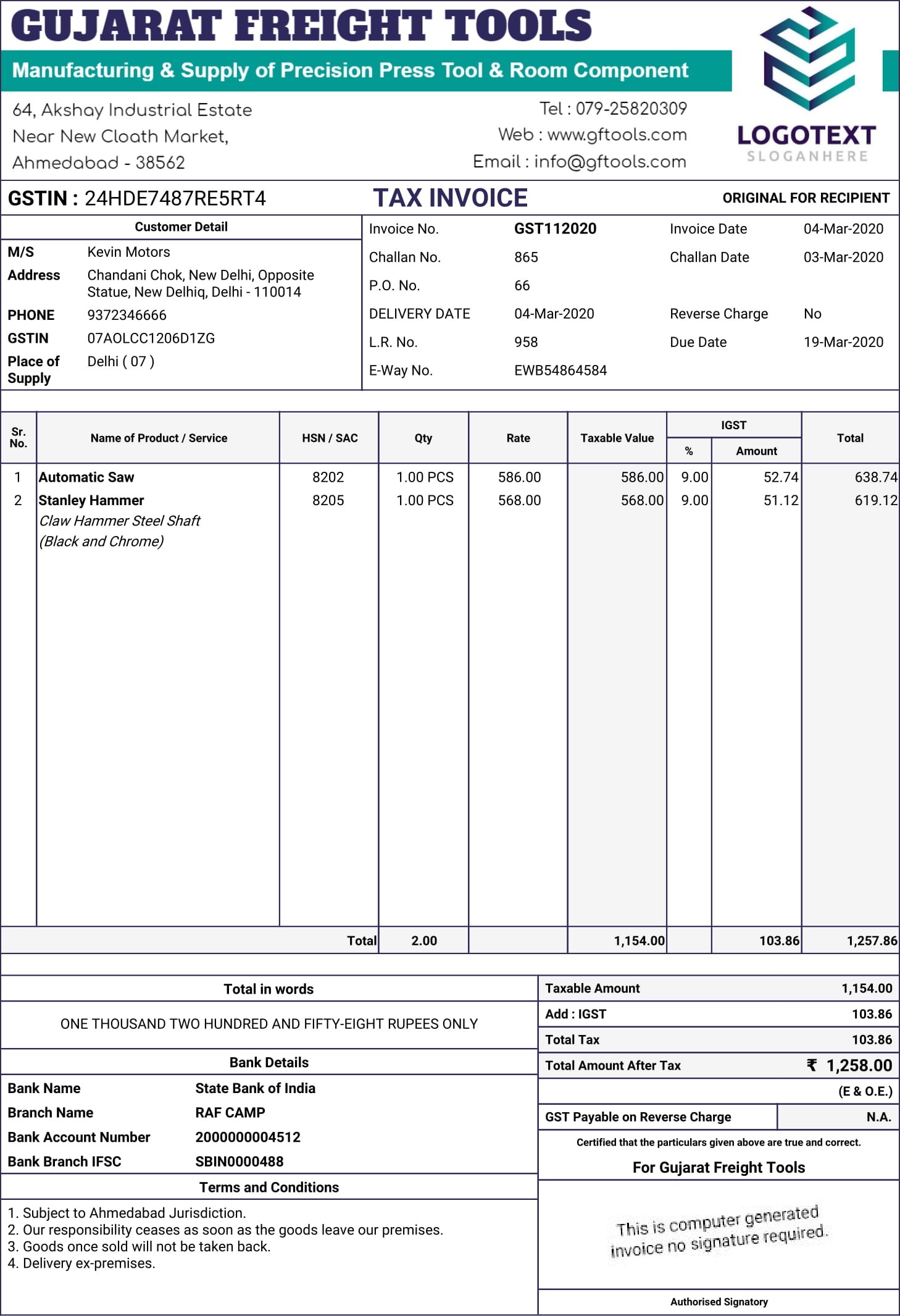

Beautiful Gst Tax Invoice Template Excel Sample Network Diagram In

https://i.pinimg.com/originals/a2/61/8c/a2618c3520ae70e2ddc425517848892c.jpg

Summary Of Changes 37th GST Council Meet SBSandco

https://www.sbsandco.com/images/2019/10/14/gst-council-meet.jpg

What is the goods and services tax GST Goods and services tax GST is a general tax which is added to most products and services sold or consumed in Australia Two accounts must be debited in order to create an entry for a purchase containing GST Debit the expense or asset account first for the purchase s net cost The GST amount

Understand what GST is how it works when to pay it and tips to stay organised Make GST stress free with expert advice Learn all about GST in Australia with our simple GST full form is Goods and Services Tax which is a comprehensive tax levied on the supply of goods and services in India It was introduced to streamline and simplify the country s indirect

More picture related to What Is Gst On Purchases

Share 88 About Gst Refund Australia Latest NEC

https://www.reckon.com/au/wp-content/uploads/2022/10/JOB2003014-2020-Website-PNG-GST-for-small-business.png

Implementation Of GST And Act Of GST Example TutorsTips

https://tutorstips.com/wp-content/uploads/2018/01/GST-Rate-1.png

Journal Entry Capital Drawings Expenses Income Goods GeeksforGeeks

https://media.geeksforgeeks.org/wp-content/uploads/20220408121821/Purchasessol-660x469.PNG

We ve covered everything you need to know about GST registration requirements calculation methods overseas purchases error corrections and those special cases that GST or Goods and Services Tax is a type of consumption tax levied in some countries on products that are sold domestically and to buyers in other countries

[desc-10] [desc-11]

GST Returns

https://www.acclaimsoftware.com/wp-content/uploads/2018/05/gst-return.jpg

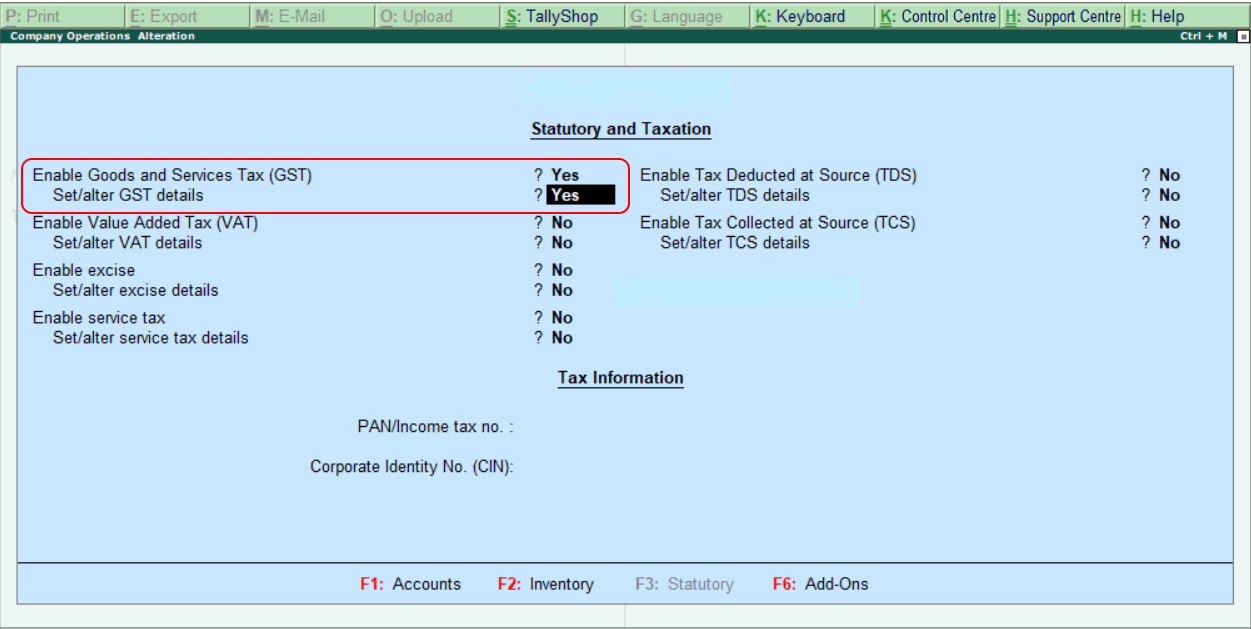

How To Activate GST In Tally Javatpoint

https://static.javatpoint.com/tutorial/tally/images/how-to-activate-gst-in-tally3.png

https://stripe.com › resources › more › how-to-calculate...

Goods and services tax GST is the tax rendered on goods and services in many countries It s a value added tax VAT meaning it s applied at each stage of the supply

https://www.charteredclub.com › claim-gst-benefit

In this article we will tell you how you can take the benefit of GST paid on your purchases and set it off with your GST liability What is Input tax credit Input tax credit means

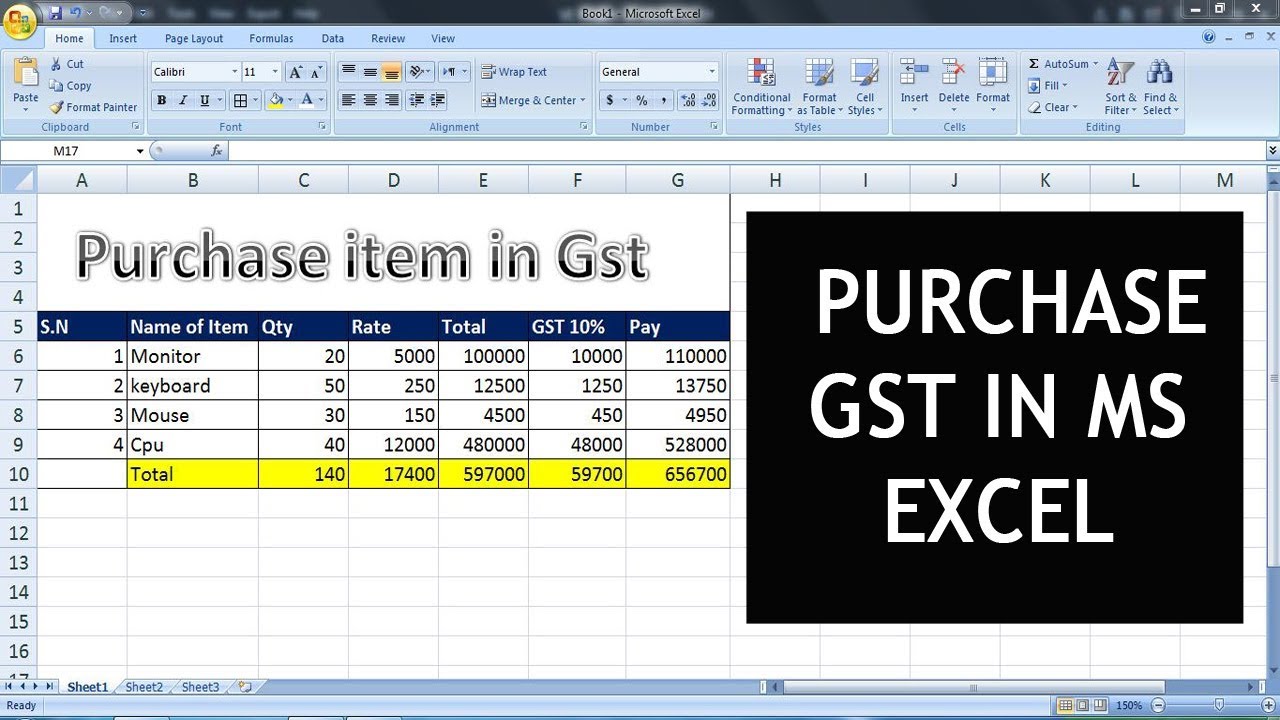

GST Formula In Ms Excel Purchase GST In Ms Excel YouTube

GST Returns

GST Advantages With Examples Here Are Some Important Points For You

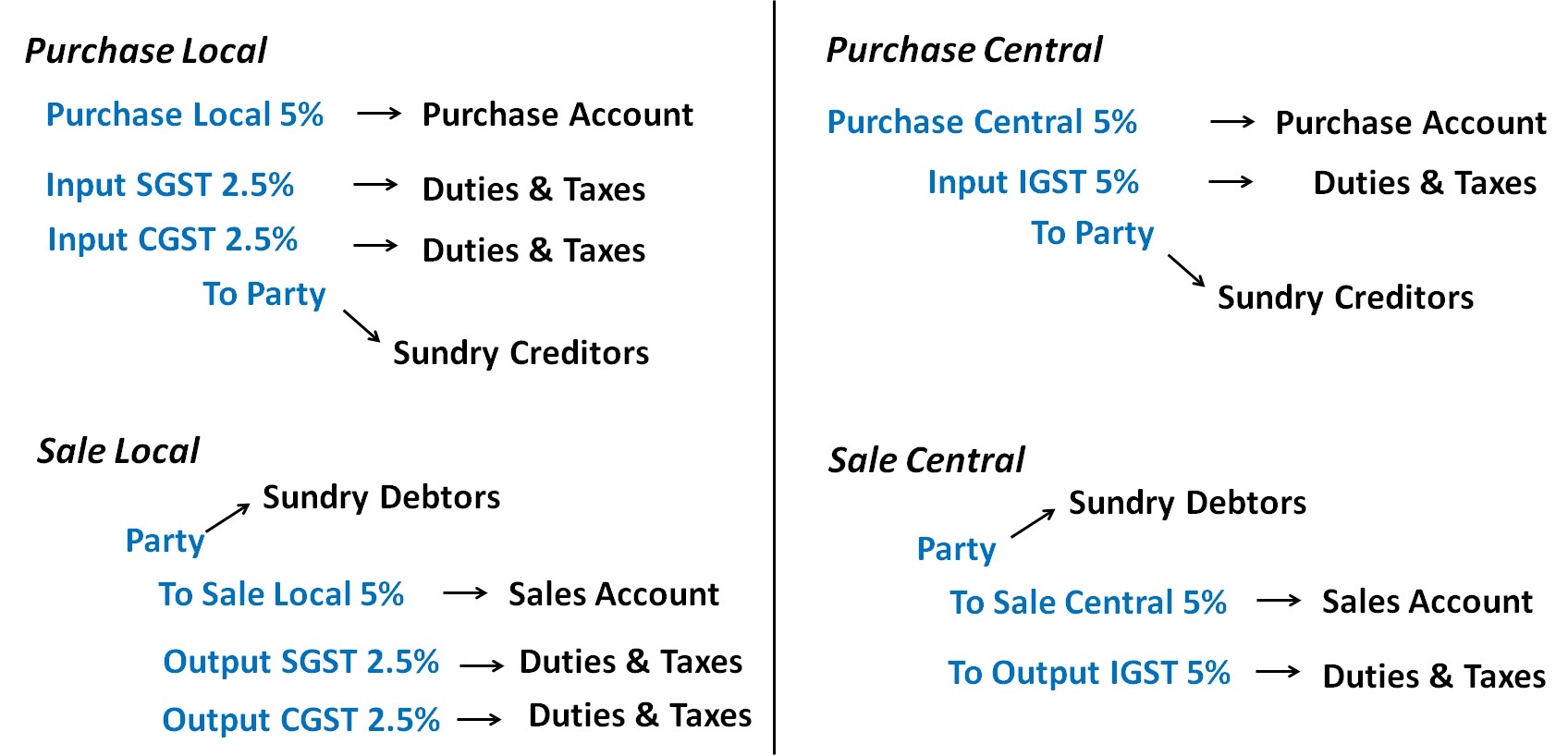

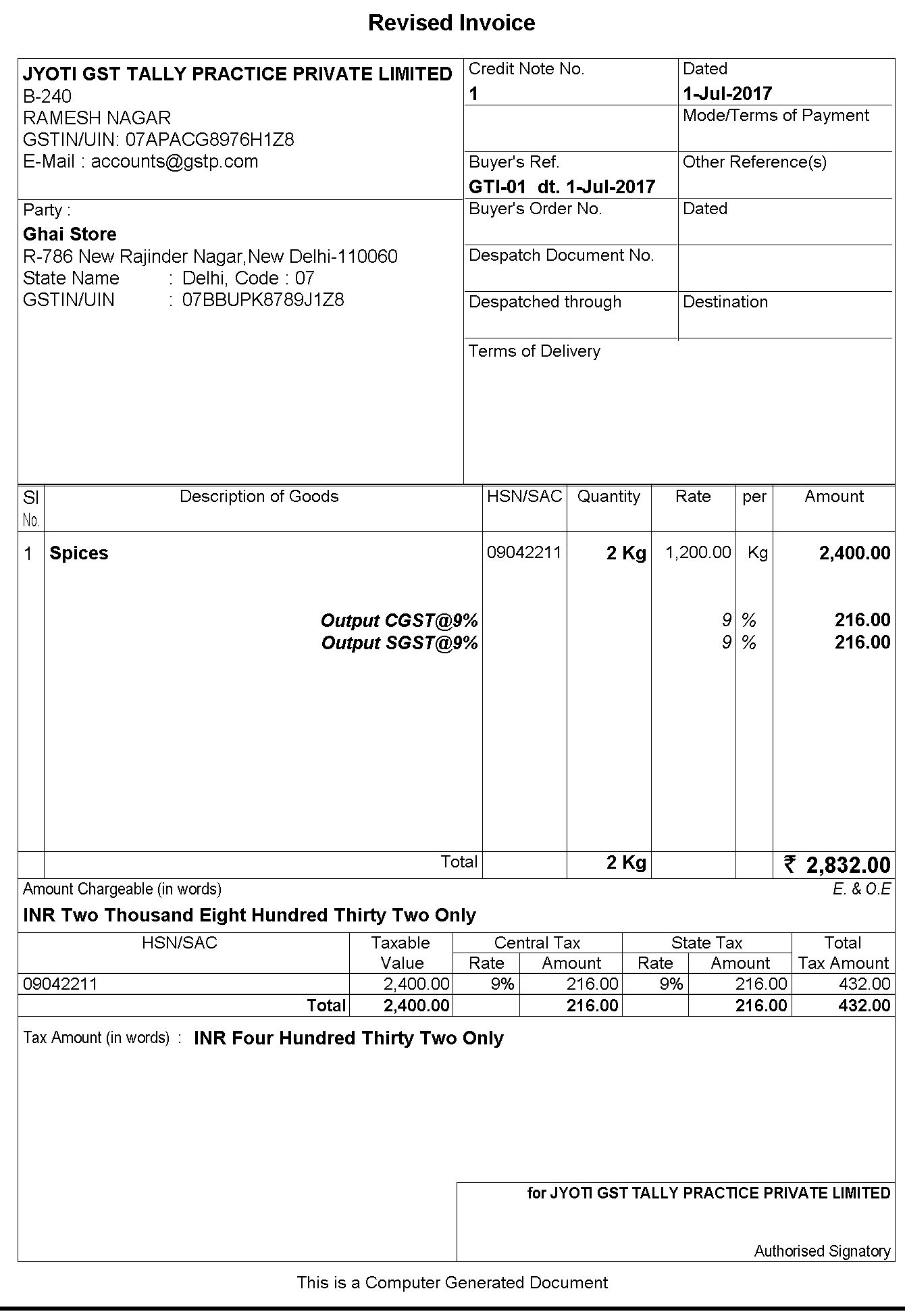

Entries For Sales And Purchase In GST Accounting Entries In GST

GST PST Journal Entries

Sample Image For Gst Bill Invoice Template Ideas Riset

Sample Image For Gst Bill Invoice Template Ideas Riset

File GST Return Know All About GST Return Complete Guide

GST Return Filing Online Know GST Return Filing Procedure

Tax Invoice Format Under Gst Invoice Template Ideas

What Is Gst On Purchases - [desc-13]