What Is Gstr 5 6 7 8 GSTR 2 is a monthly inward supply report which can also include reverse charge transactions It is used to do buyer seller reconciliation also known as invoice matching by the government

Learn how to download GSTR1 for the entire year via GST portal for compliance reconciliation audits and business analysis Follow our step by step guide Understanding the GSTR 1 is essential for businesses to comply with GST regulations effectively and efficiently Let s delve into the essential aspects of this return filing

What Is Gstr 5 6 7 8

What Is Gstr 5 6 7 8

http://mybillbook.in/blog/wp-content/uploads/2021/06/gstr-6.png

What Is The Difference Between GSTR 1 And GSTR 3B Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/12/Difference-between-GSTR-1-and-GSTR-3B.jpg

Filing GST Return GSTR 5 Enterslice

https://enterslice.com/learning/wp-content/uploads/2017/06/Filing-GST-Return-GSTR-5.png

Learn how to file GSTR 1 and understand its format and due dates Discover a step by step guide for GSTR 1 filing and how TallyPrime simplifies it Learn about GSTR 1 Filing due dates format late fees eligibility rules and quarterly return details for GST compliance Every GST registered business shall submit sales

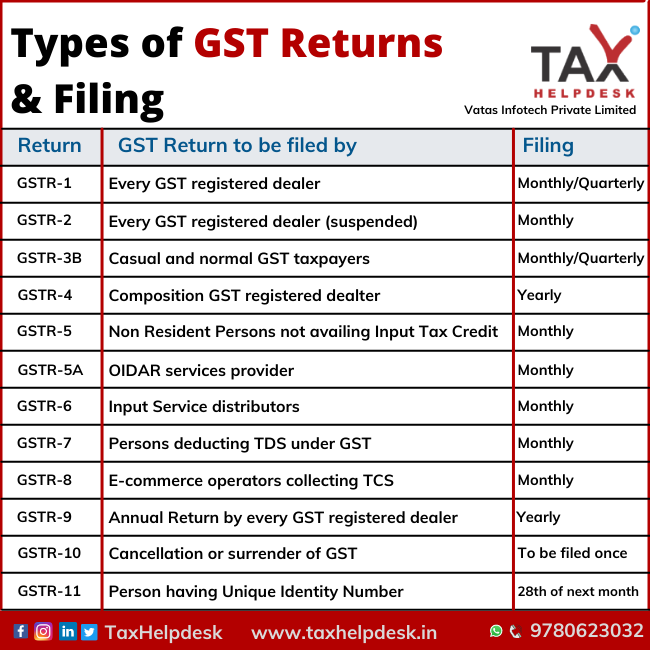

What is GSTR A GSTR i e Goods Service Tax Return is a document that every GST registered business has to submit to the government It includes all details of the Understand the key differences between GSTR 1 GSTR 3B and GSTR 9 to ensure GST compliance Learn their purposes filing requirements and more with our detailed

More picture related to What Is Gstr 5 6 7 8

GSTR 1 Explained Everything You Need To Know

https://www.refrens.com/grow/wp-content/uploads/2023/08/GSTR-1-Explained-1024x576.png?is-pending-load=1

What Is GSTR 5 And How To File It On GST Portal

https://www.gsthelplineindia.com/blog/wp-content/uploads/2017/07/GSTR-5.png

GSTR 6 What Is GSTR 6 Computerguidehindi India s No 1

https://1.bp.blogspot.com/-ICjph6aJYaU/YDjqNGR7MVI/AAAAAAAAb4g/nENK54Dk5SYufl2EscOvdiFSGVX2ALnzwCLcBGAsYHQ/s1280/What%2Bis%2BGSTR-6%2BIN%2BHINDI.jpg

Reconcile and Validate Data Early Since GSTR 3B will pull data directly from GSTR 1 ensure all invoice uploads and outward supply declarations are correct before the GSTR 1 is a GST returns form that every registered GST business must file if eligible It can be filed on a monthly or quarterly basis as the case may be and contains

[desc-10] [desc-11]

What Is GSTR 1 A Detail Guide To The Mandatory GST Return

https://www.captainbiz.com/blogs/wp-content/uploads/2023/08/gstr-1-details-scaled.jpg

Difference Between GSTR 5 And GSTR 10

https://howtoexportimport.com/UserFiles/Windows-Live-Writer/Difference-between-GSTR-5-and-GSTR-10_8DDB/Difference between GSTR 5 and GSTR 10_2.jpg

https://zetran.com

GSTR 2 is a monthly inward supply report which can also include reverse charge transactions It is used to do buyer seller reconciliation also known as invoice matching by the government

https://thegstco.com › blogs › ecommerce › how-to...

Learn how to download GSTR1 for the entire year via GST portal for compliance reconciliation audits and business analysis Follow our step by step guide

What Is GSTR 5

What Is GSTR 1 A Detail Guide To The Mandatory GST Return

Types Of GST Returns Filing Period And Due Dates

GSTR 5 What Is GSTR 5

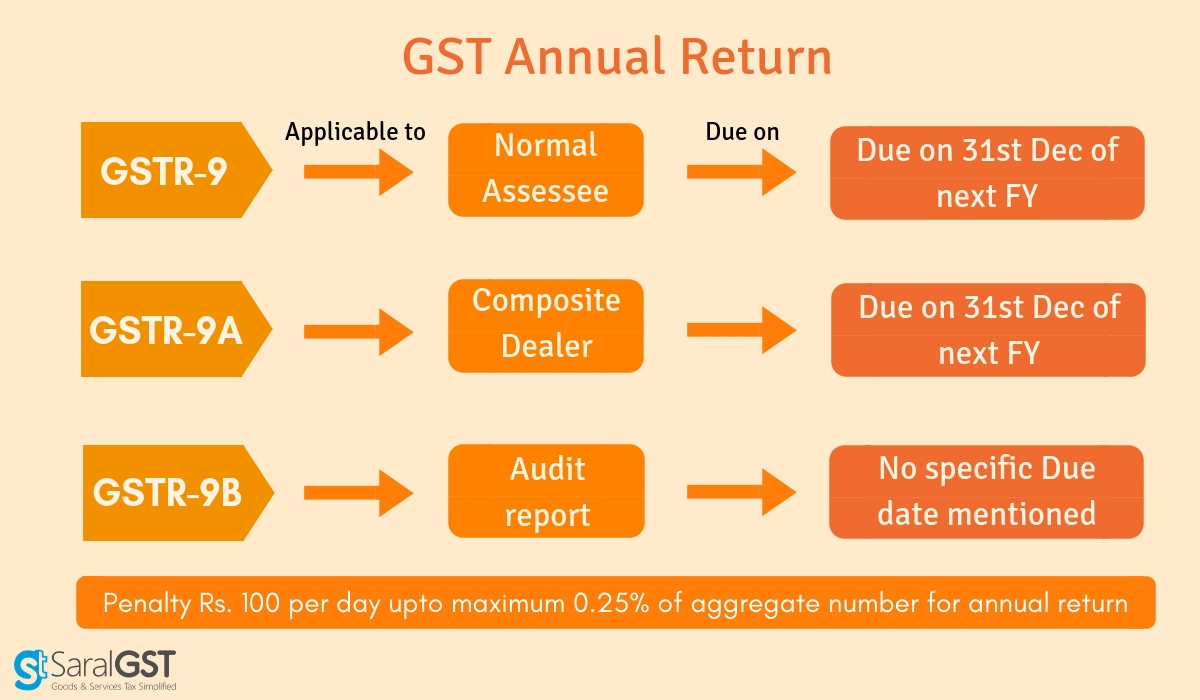

GSTR 9 Meaning Due Date And Details In GST Annual Return

GSTR 8 What Is GSTR 8 Computerguidehindi India s No 1

GSTR 8 What Is GSTR 8 Computerguidehindi India s No 1

GSTR 5 Filing Due Date Penalty For Late Filing IndiaFilings

GSTR 5 Return Due Date Extended IndiaFilings

What Is GSTR 1 Format How To File GSTR 1 Tally Solutions

What Is Gstr 5 6 7 8 - Understand the key differences between GSTR 1 GSTR 3B and GSTR 9 to ensure GST compliance Learn their purposes filing requirements and more with our detailed