What Is Income Tax Definition Income tax levy imposed on individuals or family units and corporations Individual income tax is computed on the basis of income received It is usually classified as a direct tax because the burden is presumably on the individuals who pay it

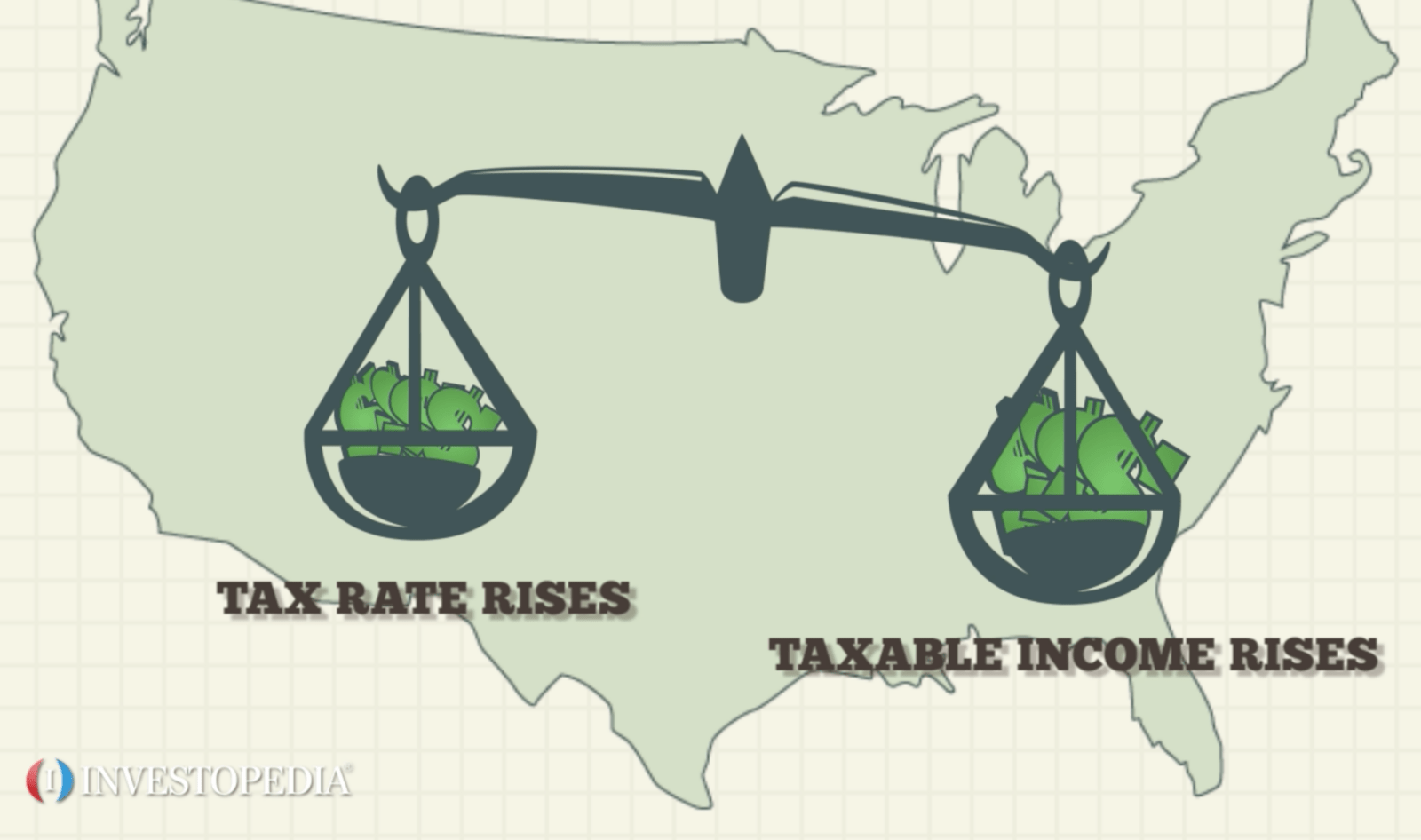

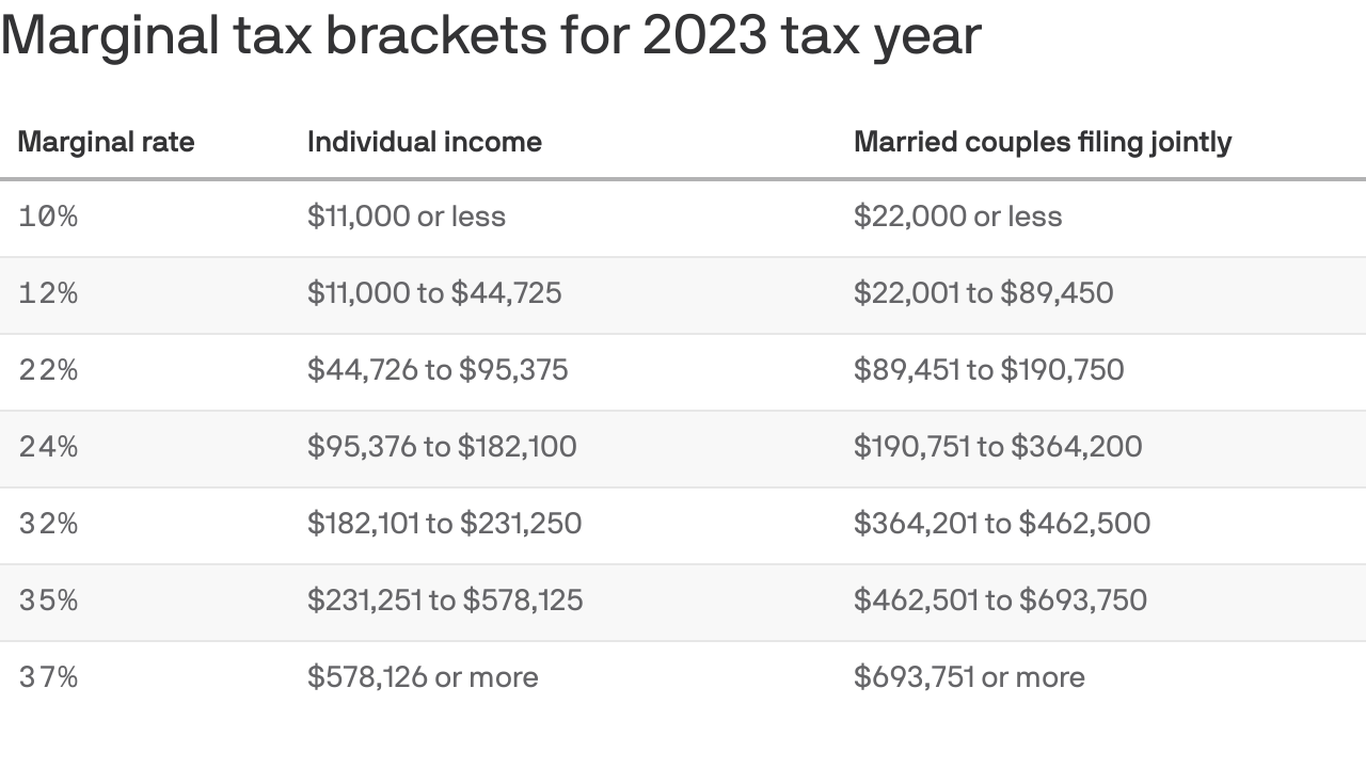

Income tax is revenue the government collects from generated wages or anyone who makes a profit from the business You might calculate your own tax payments by estimating your annual income and finding your tax bracket or by using a An income tax is a tax imposed on individuals or entities taxpayers in respect of the income or profits earned by them commonly called taxable income Income tax generally is computed as the product of a tax rate times the taxable income Taxation rates may vary by type or characteristics of the taxpayer and the type of income

What Is Income Tax Definition

:max_bytes(150000):strip_icc()/taxes-4188113-1-fb27402db4ac4638875e56eefb0ba00d.jpg)

What Is Income Tax Definition

https://www.investopedia.com/thmb/edghQFIGTDX96bQmdLg4XLIFf24=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/taxes-4188113-1-fb27402db4ac4638875e56eefb0ba00d.jpg

Individual Federal Tax Rates 2024 Image To U

https://images.axios.com/FeF3kXyZuSjEVWj-265DifJa2hw=/0x0:1280x720/1366x768/2022/10/19/1666195709283.png

:max_bytes(150000):strip_icc()/Net-income-after-taxes-4192357-FINAL-fc5270d0948d44dfb5122ee178d0a61d.png)

Gov Tax On Salary Cheap Wholesale Www micoope gt

https://www.investopedia.com/thmb/lPZuwhPmQmQRxZi2zhT7oNxxWKs=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Net-income-after-taxes-4192357-FINAL-fc5270d0948d44dfb5122ee178d0a61d.png

People whose income falls above a specific range defined by the government have to pay tax on their income and it is called income tax The government sets the tax rates income brackets and rules which can change periodically What Is Income Tax Income tax in its simplest form is a legal obligation charged by governments on individuals and corporations financial incomes Predominantly it s applied to both earned income such as wages and salaries and

Income tax is a tax that governments put on income created by people and businesses within their jurisdiction Need a break Play the USA TODAY Daily Crossword Puzzle The government levied income tax on an individual s or an entity s income earned within a financial year The income can be in the form of salaries wages profits gains from business or profession rental income capital gains and any other sources of income

More picture related to What Is Income Tax Definition

Definition And Different Types Of Income Tax

https://lh3.googleusercontent.com/0qI7epLNCcvySgQkBiKpJw6gxZ1usUXcICOOiPOHzjq_CR--5alEz523csWCdS12cjc02Yzgh6bRL8fZMCsFvevXIhGnK5gjhSW5SMCTA1SbPt-xtSrZcy9Sk43QQg

WHAT IS INCOME TAX SHOULD YOU PAY

https://static.wixstatic.com/media/31c268_e005c6de2e0648f097387aa64ef37bcc~mv2.jpg/v1/fill/w_980,h_611,al_c,q_85,usm_0.66_1.00_0.01,enc_auto/31c268_e005c6de2e0648f097387aa64ef37bcc~mv2.jpg

:max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg)

Income Tax

https://www.investopedia.com/thmb/vmecxtzh3YtlhkIY783GtuYo7Ds=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg

Income tax is a direct tax collected by the government from individuals businesses and other entities It is governed by the Income Tax Act 1961 and managed by the Income Tax Department of India Salary Wages Income from employment Business Profession Profits earned by self employed individuals and businesses Income tax is a mandatory payment levied on individuals and corporations by a government as a source of revenue It is typically calculated based on a taxpayer s income salary or business profits Types of Income Tax Progressive tax A tax system in which higher incomes are taxed at a higher rate

[desc-10] [desc-11]

Income Tax Definition And Examples Market Business News

http://marketbusinessnews.com/wp-content/uploads/2018/03/Income-Tax.jpg

The Definition And Calculation Of Federal Income Tax Personal Accounting

https://personal-accounting.org/wp-content/uploads/2020/02/income_tax.png

:max_bytes(150000):strip_icc()/taxes-4188113-1-fb27402db4ac4638875e56eefb0ba00d.jpg?w=186)

https://www.britannica.com › money › income-tax

Income tax levy imposed on individuals or family units and corporations Individual income tax is computed on the basis of income received It is usually classified as a direct tax because the burden is presumably on the individuals who pay it

https://au.indeed.com › career-advice › pay-salary › what-is-income-tax

Income tax is revenue the government collects from generated wages or anyone who makes a profit from the business You might calculate your own tax payments by estimating your annual income and finding your tax bracket or by using a

Direct Tax Definition Explained Types Features Examples

Income Tax Definition And Examples Market Business News

2025 Income Tax Brackets Calculator Ny Sara Silas

Income Tax Calculation And Effective Tax Saving Techniques

Income Tax Word Cloud Stock Illustration Illustration Of Design 9958632

Progressive Tax Definition TaxEDU Tax Foundation

Progressive Tax Definition TaxEDU Tax Foundation

Tax Brackets 2025 Australia Ato Nashit Grace

Income Tax Worksheet 2023

How To Find Net Income For Beginners Pareto Labs

What Is Income Tax Definition - [desc-12]