What Is Tax Credit For Solar Panels The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown

File non resident corporations income tax file non residents income tax get information on tax treaties country by country reporting Doing taxes for someone who died Report the date of If you are signing in on behalf of someone else including friends and family members you must use Represent a Client in your CRA account to access their information Do not use autofill on

What Is Tax Credit For Solar Panels

What Is Tax Credit For Solar Panels

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg

Renaldo Cano

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

30 Federal Solar Investment Tax Credit Sol Luna Solar

https://sollunasolar.com/wp-content/uploads/2017/05/taxcredits.png

Tax free savings accounts registered savings plans pooled pension plans and plan administration Excise and specialty taxes Duties customs charges tax on underused The bulk of tax relief will go to those with incomes in the two lowest tax brackets i e those with taxable income under 114 750 in 2025 including nearly half to those in the

The goods and services tax harmonized sales tax GST HST credit is a tax free payment that eligible individuals receive every 3 months It helps individuals and families with low or modest Throughout the following text for purposes of the tax exemption under section 87 of the Indian Act the Canada Revenue Agency CRA uses the term Indian because it has a legal

More picture related to What Is Tax Credit For Solar Panels

Federal Solar Tax Credit Ecohouse Solar LLC

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Graphic-06.png

Car Rebates 2025 Kasey Matelda

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

2024 Energy Credits Tova Ainsley

https://www.revisionenergy.com/application/files/9816/7416/5521/Residential_Clean_Energy_Tax_Credit_Graphic.png

Personal information is collected pursuant to the Income Tax Act and Excise Tax Act Personal information is described in program specific Personal Information Banks which can be found The 25 Part XIII tax also applies to payees in countries with which Canada has a tax treaty that is not yet in effect A Part XIII tax rate of 23 applies to the gross amounts paid credited or

[desc-10] [desc-11]

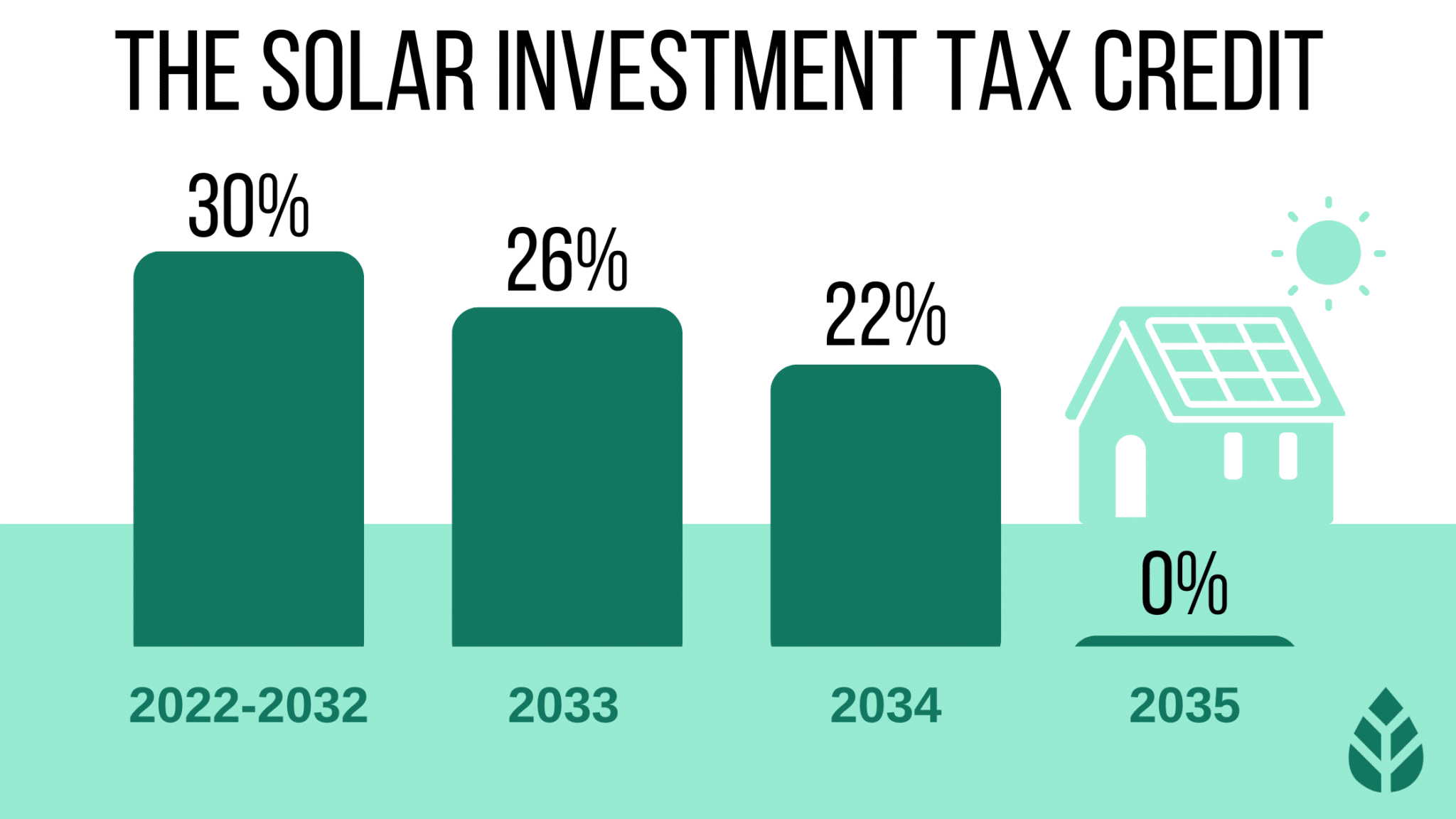

Solar Tax Credits 2025 Mia Ann

https://www.energy.gov/sites/default/files/2022-10/Summary-ITC-and-PTC-Values-Table.png

2024 Government Solar Incentives Tiff Shandra

https://www.ecowatch.com/wp-content/uploads/2022/12/Solar-Investment-Tax-Credit-5-1-3.png

https://www.canada.ca › en › department-finance › news › delivering-a-…

The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown

https://www.canada.ca › en › services › taxes › income-tax

File non resident corporations income tax file non residents income tax get information on tax treaties country by country reporting Doing taxes for someone who died Report the date of

Solar Credits 2024 Kaye Savina

Solar Tax Credits 2025 Mia Ann

2024 Tax Credits For Solar Rici Demetra

2024 Tax Credits For Solar Energy Ranee Casandra

Federal Tax Credit For Installing Solar Panels Tax Walls

2024 Tax Credits For Solar Projects Datha Steffie

2024 Tax Credits For Solar Projects Datha Steffie

The Federal Solar Tax Credit Explained Sunshine Plus Solar

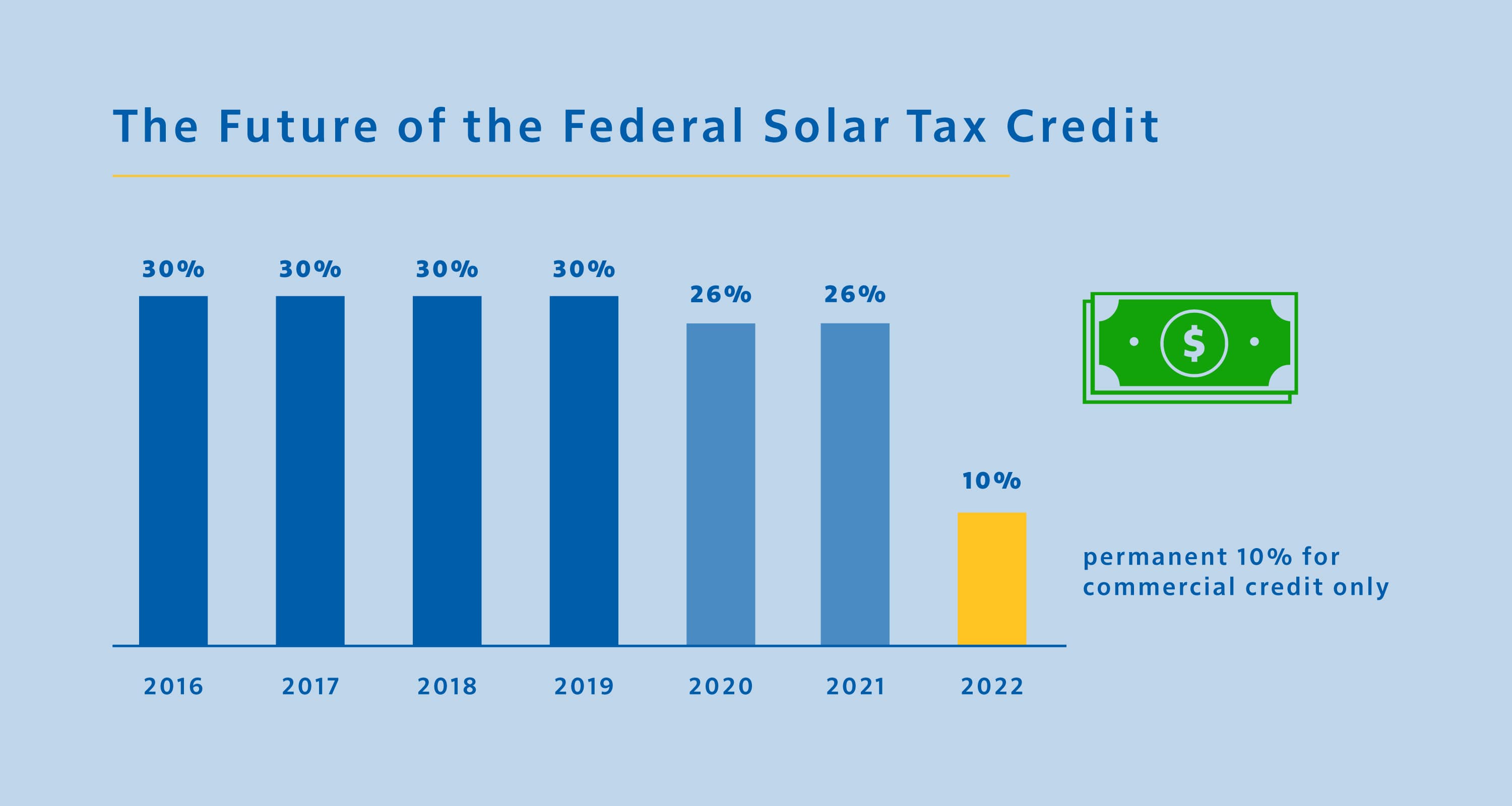

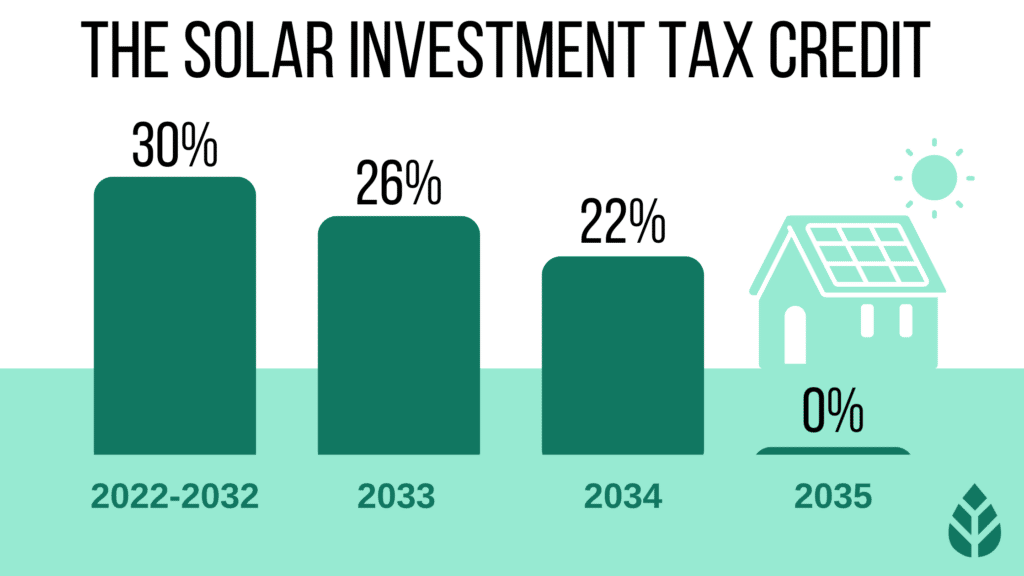

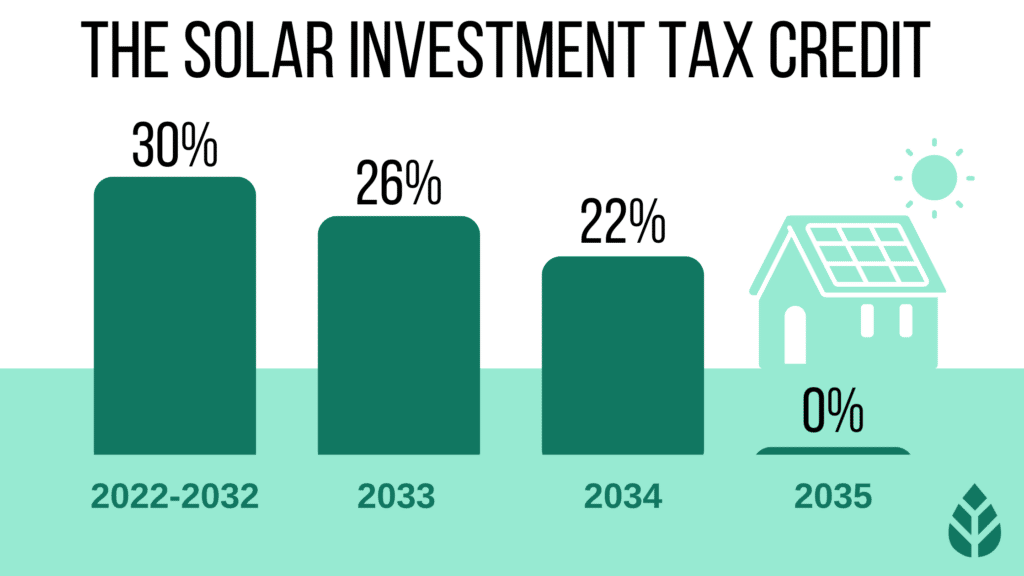

Why The Solar Tax Credit Extension Is A Big Deal In 2020 EnergySage

Solar 2021 Updates 26 Federal Tax Credit Extended Until 2023

What Is Tax Credit For Solar Panels - The goods and services tax harmonized sales tax GST HST credit is a tax free payment that eligible individuals receive every 3 months It helps individuals and families with low or modest