What Is Income Tax Act 2007 Filing an income tax and benefit return can help you access benefit and credit payments like the GST HST credit up to 533 for an eligible individual the Canada child

File non resident corporations income tax file non residents income tax get information on tax treaties country by country reporting Doing taxes for someone who died Report the date of The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was

What Is Income Tax Act 2007

What Is Income Tax Act 2007

https://jananiservices.com/blog/wp-content/uploads/2022/08/image-2.png

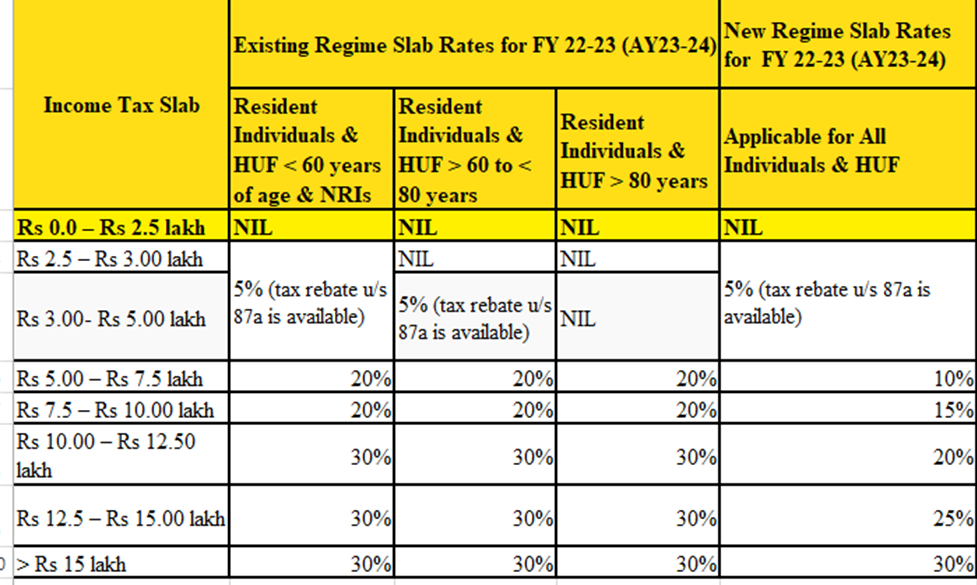

Income Tax Calculation And Effective Tax Saving Techniques

https://www.financeconductor.com/wp-content/uploads/2023/09/1500x900_413397-income-tax.png

Income Tax Act 2007 No 97 as At 02 February 2025 Public Act Subpart

https://www.legislation.govt.nz/act/public/2007/0097/latest/images/IncomefB2.JPG

How to determine your income When applying for the Guaranteed Income Supplement and the Allowance you or in the case of a couple you and your spouse or common law partner must 2 49 In broad terms the enhanced dividend gross up and dividend tax credit apply to dividends distributed to an individual from corporate income taxed at the general corporate income tax

The personal income levels used to calculate your Manitoba tax have changed The basic personal amount has changed The maximum annual amount of eligible expenses for fertility The Government of Canada has tabled legislation proposing to reduce the lowest income tax rate effective July 1 2025 For more information Government tables a Motion to

More picture related to What Is Income Tax Act 2007

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction.jpg

Tax Brackets 2025 Australia Ato Nashit Grace

https://images.axios.com/FeF3kXyZuSjEVWj-265DifJa2hw=/0x0:1280x720/1366x768/2022/10/19/1666195709283.png

Income Tax Worksheet 2023

https://i.pinimg.com/originals/aa/af/be/aaafbed0a4b639f5c32ede742b5dd17b.png

Formerly known as Climate action incentive payment Basic amount and rural supplement for residents of Alberta Manitoba New Brunswick Newfoundland and Labrador Nova Scotia If your net world income exceeds the threshold amount 86 912 for 2023 you have to repay part or your entire OAS pension Part or your entire OAS pension is reduced as a monthly recovery

[desc-10] [desc-11]

:max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg)

Simulador De Irs 2024 Image To U Paci ncia Spider Jogue 4 Naipes Gr tis

https://www.investopedia.com/thmb/vmecxtzh3YtlhkIY783GtuYo7Ds=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg

Wolters Kluwer NZ CCH Books New Zealand Income Tax Act 2007 2023

https://books.wolterskluwer.co.nz/images/covers/10078182-0014S

https://www.canada.ca › en › revenue-agency › news › tax-season-start…

Filing an income tax and benefit return can help you access benefit and credit payments like the GST HST credit up to 533 for an eligible individual the Canada child

https://www.canada.ca › en › services › taxes › income-tax

File non resident corporations income tax file non residents income tax get information on tax treaties country by country reporting Doing taxes for someone who died Report the date of

Income Tax Kya Hai All About Income

:max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg)

Simulador De Irs 2024 Image To U Paci ncia Spider Jogue 4 Naipes Gr tis

What Are The Tax Brackets For 2025 And 2025 Tax Year Summer T McCawley

Solved Philippine Tax System And Income Taxation BAMM6202A Course

Income Tax Act 2007 No 97 as At 19 December 2007 Public Act New

Income Tax Act 2007 No 97 as At 24 May 2013 Public Act New Zealand

Income Tax Act 2007 No 97 as At 24 May 2013 Public Act New Zealand

[img_title-14]

[img_title-15]

[img_title-16]

What Is Income Tax Act 2007 - [desc-12]